Key points:

- The PBO’s legislation requires that, for each major party, the Election commitments report contains costings of all election commitments that, in the Parliamentary Budget Officer’s best professional judgement, would have a material impact on the budget. The report must also include the total combined impact of those commitments.

- To fulfil these requirements, the PBO must first identify all relevant commitments, and then cost and aggregate them accurately and robustly.

- This appendix summarises the legislative requirements for the Election commitments report, additional features included in this edition, and the approaches used to identify, cost and aggregate commitments.

Legislative requirements and additional features for 2022

Timing, parties and scope

The election commitments report must be published after each general election. The deadline for publishing this report is the later of 30 days after the end of the caretaker period, or 7 days prior to the first sitting of the new Parliament.1

This report must include estimates of the fiscal impacts of the election commitments made by major parliamentary parties and may include estimates for minor parties and independent parliamentarians if they choose to be included. A ‘designated’ or major parliamentary party for the report is a political party with at least 5 members in the Australian Parliament immediately before the caretaker period. The major parliamentary parties of the 46th Parliament of Australia required to be included in the report are:

- the Liberal Party of Australia, Country Liberal Party, Liberal National Party of Queensland and National Party of Australia, treated as a single party (the Coalition), with 75 members of the House of Representatives and 35 senators.2

- the Australian Labor Party (Labor), with 68 members of the House of Representatives and 26 senators.

- the Australian Greens (the Greens), with 1 member of the House of Representatives and 9 senators.

In the lead-up to this general election, the PBO provided minor parties and independent parliamentarians with the option to be included and issued guidance on the approach for those opting in.3 One independent member of parliament, the independent member for Indi, Dr Helen Haines MP, chose to be included. Her commitments are published in the inaugural Minor parties and independents section of the report.

For each parliamentary party that is included in this report, the election commitments report must include:

- the financial impact of all the election commitments that the Parliamentary Budget Officer reasonably believes would have a material impact on the Australian Government budget over the 2022–23 Budget forward estimates period (the budget year and the next 3 years)

- the total combined impact of each party’s election commitments on the budget estimates over the 2022–23 Budget forward estimates period.

The report may include other information in addition to these statutory requirements.

Consultation with parties and independents

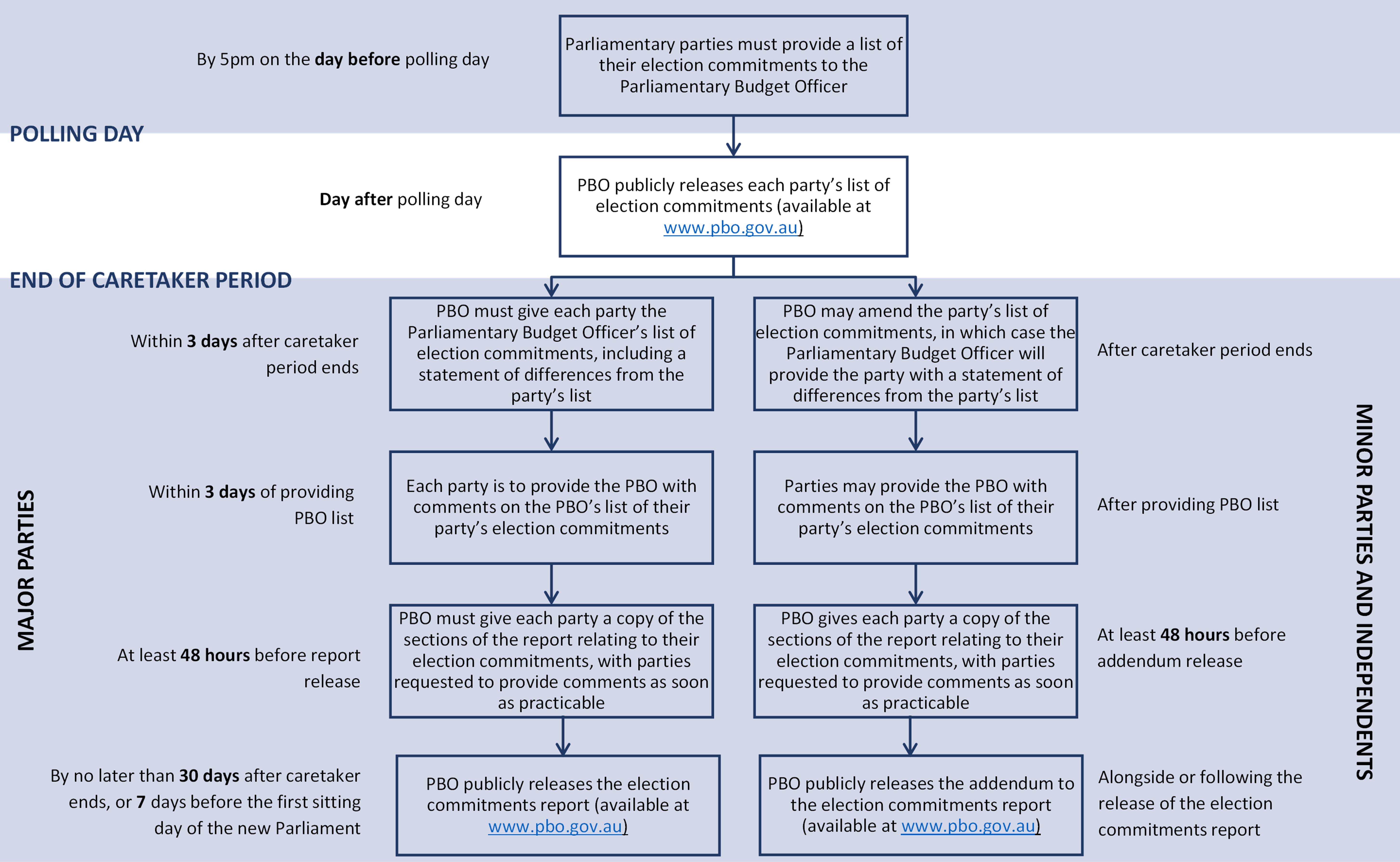

The PBO’s legislation sets out how the Parliamentary Budget Officer must seek and may take into account feedback from parliamentary parties when preparing the report. We follow a similar approach for minor parties or independents choosing to opt in. These processes are summarised in Figure I‒1 below.

- Parliamentary parties must submit a list of their election commitments to the PBO on the day before polling day and the PBO must publish these on the day after polling day.

- The PBO separately tracks and identifies election commitments made by parties during the campaign and must provide its list to each party within 3 days after the end of the caretaker period.

- Each party may comment on their list and on the draft of their section of the report.

Financial impacts included in this report

The appendices to the report provide the financial impacts:

- both in terms of their net impact on the budget aggregates and the resulting final levels of the budget aggregates

- on several budget bases (including a fiscal, underlying cash and headline cash balance basis)

- broken down by their individual components and by different sources of receipts and payments (and their accrual equivalents)

- in nominal dollars and as a proportion of gross domestic product (GDP) to the end of the medium term.

Individual costing documents are provided for all commitments included in the report other than those that involve specified (or capped) amounts of funding. The detailed costing documents are included at Appendices E (the Coalition), F (Labor), G (the Greens) and H (independent member for Indi).

A consolidated table showing all capped costings for each party, including a breakdown of the figures into their administrative and departmental components, is provided at the end of the appendices.

In a small number of cases a capped funding proposal is presented in an individual costing document rather than in the consolidated capped costing document for the party. This occurs, for example, where the capped funding relates to a substantial infrastructure program involving the use of both new funding and funding redirected from an existing program, or where the PBO has had to make an assumption about the profile of uncommitted funding in the capped funding.

Additional features for the 2022 Election commitments report

The 2022 report includes, for the first time:

- information on all individual election commitments, in addition to each party’s combined policy platform over the medium term (the budget year and the next 10 years). The inclusion of medium-term impacts for all costings follows their inclusion for a subset of costings in the 2019 report.

- information on the distributional impacts of policies, on an opt-in basis. Parties which previously requested distributional impacts as part of a PBO costing outside of the caretaker period could elect to retain some or all of that information in this report.

- additional data and graphs on commitments and a more comprehensive set of budget balance information, including both the net impact on and final level of the headline cash balance.

- An A3 summary of the report, and quick guides to reading costings and the Election commitments report.4

Figure I‒1: Process for consultation with parliamentary parties and independents

Identifying election commitments

The election commitments in this report include all election commitments that have been identified by the PBO as policies that parties would seek to implement after the election and which would be expected to have a material impact on the budget.

The PBO determined the commitments that are included in this report, and the detailed specifications for these commitments, based on:

- the lists of election commitments that the parties provided to the PBO on the day before the election

- our tracking of election commitments and announcements before and during the caretaker period

- our assessment of the fiscal impact of commitments

- consultation with parties.

The rest of this section describes the criteria for election commitments, and the PBO’s approach to identifying commitments meeting these criteria.

What makes a commitment for the purposes of this report?

The Parliamentary Budget Officer decides which commitments should be included in the election commitments report, based on announcements made by the parties prior to polling day and any associated fiscal impact. Election commitments included in the report must be public, specific, and material. That is, for an announcement to be included as an election commitment in the report, it must at least satisfy the following:

- The commitment must have been publicly announced. This may include announcements made before and during the caretaker period. The PBO’s legislation provides for the Parliamentary Budget Officer to seek additional information about election commitments as required, including from people outside the relevant parliamentary party if they have been involved in the development of an election commitment.5

- The announcement must have been made by a candidate for or member of the parliamentary party. This may include current sitting parliamentarians who are not contesting the election (for example, current members who are retiring or senators who are partway through their term).

- The announcement must be specific enough to cost. Where no firm commitment is made as to the policy mechanism or details that would deliver on the announcement, it may be considered aspirational in nature. Where an announcement involves detailed actions to achieve an aspirational target, the PBO would include the commitment in the report.

- The commitment must have a material impact on the Australian Government budget. This includes commitments for additional expenditure that would be material but have a net zero impact because the party specifies that they would be offset by savings. As discussed in the next section, an announcement or commitment might appear material, and even include specific amounts of spending, but not have an impact on the budget.

While a commitment must at least satisfy the above, there may still be judgement involved when determining whether announcements made during the election campaign and not included on the list provided by the party constitute election commitments for the purposes of the report. In forming this judgement, the Parliamentary Budget Officer may consider other factors such as which party member made the statement and the nature of the commitment made.

The PBO’s legislation requires the Parliamentary Budget Officer to take account of statements made before and during the caretaker period when determining election commitments for the purposes of the report. For the 2022 election, the caretaker period ended on the Monday after polling day. This report covers commitments made up to polling day. In the event of an extended caretaker period, the PBO would consider announcements made during caretaker after polling day.

What makes a commitment material?

There are 4 main reasons that an announcement, meeting the other criteria for being a commitment, might not be a material commitment for the purposes of the report.

- The commitment is a regulation. The direct fiscal impact of regulatory commitments is generally small, and often zero, if they can be administered using the current regulatory arrangements. Regulatory changes would, however, be expected to have impacts outside the government sector, often having offsetting impacts on different sectors. As discussed in ’Costing election commitments’ below, the flow-on effects of these impacts on the budget are generally not included in costings.

- The commitment involves only an increase in departmental expenses and this increase could reasonably be expected to be absorbed, or is already provided for, in existing agency budgets. Examples include modest changes to the administration of existing programs.

‒ In some cases, a party will specify in the commitment that the affected agency would absorb any costs associated with implementing the commitment. In this case, the PBO considers whether those expenses would be material.

‒ Expenses judged to be material, but required to be offset under the commitment, are presented along with the offset in the individual report costing minute or (for capped costings) mentioned in the footnotes to the omnibus capped costing minute for that party.

- The commitment is in the Pre-election Economic and Fiscal Outlook (PEFO) baseline because the announcement is a ‘decision of government’. That is, the decision to implement the proposal was appropriately authorised by the government prior to the start of the caretaker period. This could be in the 2022–23 Budget prior to the election, or between the budget and the start of the caretaker period.

‒ While policies may not be explicitly announced in the budget as a ‘measure’ in Budget Paper 2, they may still be factored into the budget baseline, including through the line item Decisions Taken But Not Yet Announced and Not for Publication (DTBNYANFP).

‒ The PBO seeks advice from all parties on the source of funding for announcements made during the election campaign. Where the party in government advises that an announcement was a decision of government, the PBO verifies this with the relevant government agency.

- The commitment would have no material impact because it reallocates funds which are in the PEFO baseline, but not yet contractually committed to a particular project or funding recipient.

‒ For example, if there is a $500 million grant program already in the PEFO baseline, but only $100 million of grants have been contractually committed prior to the start of the caretaker period, $400 million is available to any party contesting the election to commit to new projects under the program at no additional cost to the budget.

‒ Alternatively, a party could announce that uncommitted funds in the program would be returned to the budget and allocated to a different priority, at no additional cost to the budget.

How does the PBO identify potential commitments?

During the caretaker period, the PBO identified almost 2,000 potential election commitments by participants in the election commitments report. Box 1 outlines the sources reviewed by the PBO with the aim of identifying all election commitments with a material impact on the budget. The PBO considered the criteria discussed above to identify which of these potential commitments were election commitments for the purposes of the report.

As discussed in the party sections of the report, this independent tracking of election commitments led to some additional election commitments being included beyond those identified by parties just before the election. It also led to changes in the specifications of some election commitments, where announcements were judged to add components to or otherwise modify a commitment.

Box 1: The PBO’s prioritisation framework for election commitment tracking

Announcements about election commitments are made by many parliamentary party members and candidates for designated parties, in forums ranging from Press Club speeches and party websites to hardcopy material dropped in letterboxes. Particularly given the rise of social media, the PBO cannot monitor all sources of election commitments exhaustively, so we prioritise sources of election commitments for monitoring. The PBO prioritises sources as follows:

Tranche 1

- Platform documents published on party websites: monitored exhaustively

- Consolidated party fiscal plan documents (if released): monitored exhaustively

- All material mentioning commitments costed by the PBO: monitored exhaustively

- Speeches, transcripts and press releases by ministers and opposition shadow ministers (which may be on individual rather than party websites): monitored closely with a focus on speeches, press releases and appearances covering new policy announcements

- Announcements and transcripts where candidates (particularly for marginal seats) appear with major ministers and opposition shadow ministers: monitored closely.

Tranche 2

- Major (high circulation) mainstream print and online media: monitored regularly, prioritising material which may add to, rather than duplicate, tranche 1 material.

- Social media: monitored as time permits, prioritising ministerial, shadow ministerial and marginal seat candidates’ material which may add to, rather than duplicate, tranche 1 material.

Tranche 3

- Other sources, such as hardcopy material distributed to electors, and smaller media outlets: not actively monitored, but may be used as additional evidence for commitments identified through other sources.

Costing election commitments

For every election commitment included in this report, estimates of the financial impacts of the commitment are provided over the 2022–23 Budget forward estimates period (2022–23 to 2025–26) and medium term (2022–23 to 2032–33).

The individual costings in this report use the same budget rules and costing conventions, and comparable models and data, as the government uses in preparing the budget.

The baseline for the costings included in this report, and the economic parameters underpinning the analysis, were set out in the Pre-election Economic and Fiscal Outlook (PEFO) released on 20 April 2022 by the Secretary to the Treasury and the Secretary of the Department of Finance (the secretaries).

The estimated cost of a policy can change over time as economic conditions change and new data become available. Some individual costings are only slightly affected by changes in economic parameters, while others are very sensitive to parameter changes. Each individual PBO costing minute in the Election commitments report contains a discussion of the drivers of the results and how sensitive the estimates are to variations in those drivers.

The costings included in this report have been prepared by either the Parliamentary Budget Officer or by the Secretary of the Department of Finance or the Treasury, in keeping with the Charter of Budget Honesty Policy Costing Guidelines.6 Where costings have been prepared by one of the secretaries during the caretaker period, the Parliamentary Budget Officer has taken all reasonable steps necessary to determine that the costings are valid and appropriate for inclusion in the report.

Where a policy costing prepared by the Treasury or the Department of Finance during the caretaker period does not include the financial impacts over the medium term, the PBO has prepared a supplementary costing that includes these.

What is (and isn’t) in a costing

PBO costings are an assessment of the financial impact of a proposed election commitment on the budget. They estimate how much an election commitment, if implemented, would change the budget surplus or deficit as presented in PEFO. These costings take into account the expected direct behavioural responses to the proposed policy change by people (or other entities) who are directly affected by the policy wherever those responses are likely to have a significant impact on the cost of a proposal.7

The costings do not include impacts that could arise due to the effects of a policy proposal on the wider economy, for instance through a change in prices, wages, investment or productivity that can change the rate of growth of the economy, although the costing documents do include a qualitative statement where the potential for these effects is judged to be significant. This approach is consistent with the approach taken in the budget and in other jurisdictions.8 These impacts are sometimes referred to as ‘broader economic’, ‘second round’, or ‘indirect’ effects.

Broader economic impacts are generally not included in costings because their magnitude and timing are highly uncertain. In some cases it is not even clear what direction the broader economic effects would have, as it depends on additional details such as how the proposal would be funded. The broader economic effects may also already be included implicitly in the baseline budget projections. For example, the medium-term budget projections assume that there would be ongoing productivity growth at around the average level of the past 30 years. This implicitly assumes that there would be ongoing reforms to deliver such an outcome. Including productivity growth impacts for a particular proposal on top of these background assumptions risks overstating the likely level of productivity growth.

Costings prepared by the PBO are based on the best information available, including known details of items already included in the budget. Unlike other budget updates, for PEFO the PBO has access to the details of provisions for individual items included in the Contingency Reserve, except where decisions are commercial in confidence or are not disclosed for national security reasons.9

Conventions: agency names and rounding

Agency and portfolio names in the report are as at the 2022 general election. They do not reflect recent Machinery of Government changes.

The PBO rounds its estimates of the financial implications of policy proposals to simplify the presentation and acknowledges that the figures presented are estimates and not exact numbers. All estimates are rounded to 3 significant figures. The PBO rounds by applying a set of rules that are simple to implement and apply consistently across all costings. Our default rounding convention may be modified on occasion where it fails to clearly present a costing’s financial implications (for instance, where an estimate is particularly uncertain in which case we may present less than three significant digits, or where a proposal specifies an exact amount to be spent, in which case the figures presented would not be rounded at all).10

Commitments are assumed to be ongoing unless parties publicly state otherwise

Where the PBO could not determine from the policy announcement and related public material whether a commitment was ongoing or terminating, we adopt the approach set out in our election guidance – namely, we assume the proposal is ongoing for the purpose of estimating its medium term impacts.11 This assumption does not apply to discrete ‘projects’ such as the construction of a specific piece of infrastructure, which are all assumed to be terminating. Table 1 in each of Appendices A to D shows whether a commitment has been assumed ongoing, and from which year.

Box 2 in the Summary of major party budget impacts section includes a sensitivity analysis on the impacts of relaxing this assumption. When estimating the impacts for this sensitivity analysis, the PBO calculated the financial impacts of each party’s election platform under 2 scenarios: one where the policies without a specified end date were assumed to be ongoing, and one where they were assumed to terminate. Where a commitment included only a small component which was assumed to be ongoing, that commitment as a whole was not included in the sensitivity analysis, to avoid overestimating the impact of the PBO’s assumption. The year from which policies were assumed to be ongoing was determined based on public announcements (including estimates in each party’s fiscal plan) and advice from parties on the profile of announced funding. For capped costings which were assumed to be ongoing, the last announced cost was carried forward using an indexation factor (in most cases the indexation factor used was the consumer price index). The difference between the underlying cash balance in each scenario was then calculated and adjusted for the public debt interest (PDI) impact to determine the total impact on each party’s platform of the PBO’s assumption that commitments were ongoing.

Under the alternative scenario – that policies terminate in the absence of a statement otherwise – this sensitivity analysis assumes that the financial impact of the policies is zero, except for the continuing impact on public debt interest. Some programs would, however, have a financial impact beyond the point that the policy terminates (or will have a different impact before termination due to different behavioural responses if the policy were terminating rather than ongoing). For example, an education loan scheme might close to new entrants, but the repayment of loans would continue. These ongoing impacts of terminating programs are not accounted for in this sensitivity analysis but would reduce over the medium term to be relatively small by 2032–33.

Aggregating election commitments

Once individual election commitments were identified and costed, the costs were aggregated to determine the combined impact of each party’s election commitments on the budget. This was done by:

- adding together the direct budget impacts of the individual election commitments

- adjusting for material interactions between commitments

- applying any overarching commitments, such as a tax cap

- adjusting for an estimate of the PDI impact of the entire platform.

Adding together the direct budget impacts of the individual election commitments

The aggregate budget impact includes all quantifiable election commitments for each party. In some cases, the PBO may judge that a commitment would have a material impact on the Australian Government budget, and therefore be included in the report, but judge that the impact on the budget cannot be reliably quantified.

Adjusting for material interactions between commitments

The PBO estimates material interactions between commitments for each party.

An interaction arises when 2 or more proposals (or individual components of a proposal) would have different budgetary implications when implemented together, compared to the sum of the budgetary implications of implementing the proposals (or individual components of a proposal) in isolation.

For example, a policy to increase the age pension payment rate and a policy to reduce the income test for eligibility for the age pension would have a different (and larger) impact when implemented together, because the second policy would increase the number of pensioners receiving the higher payment.

Applying any overarching commitments, such as the tax cap

As part of their medium-term fiscal strategies, successive governments have committed to maintaining tax receipts as a share of GDP at or below a stated ‘cap’. In the 2022–23 Budget this cap was 23.9% of GDP. Consistent with the approach in budget documents, the tax cap is applied by calculating the total impact of all individual election commitments on tax receipts, after adjusting for interactions. The total impact of election commitments is then added to an unconstrained PEFO baseline and converted to a share of GDP. This final unconstrained tax impact is compared to the target cap for the tax-to-GDP ratio and where tax receipts are above the target the excess is deducted to ensure tax receipts stay at the target level. A net difference between the tax cap contained within the PEFO baseline and the newly derived tax cap is then calculated. No adjustments are made where tax receipts remain below the target cap. Where parties have stated the policy to not have a tax cap, the impact of the tax cap factored into the PEFO baseline is reversed. The impact of the tax cap is assumed to affect tax receipts (cash) and revenue (accrual) equally.

Adjusting for an estimate of the PDI impact of the entire platform

The total impact of each party’s platform includes an estimate of the total PDI impact. This total PDI impact takes into account the PDI impacts already included in a small number of individual policy costings. While the PDI impacts of policies are always presented in individual PBO costing documents, they are only included in the costs of the policy if it is an explicit policy objective to impact the level of interest payments or the policy involves transactions of financial assets (such as loan schemes, equity investments or guarantees). In these cases, the PDI impact is included in the budget aggregates in Table 1 and Attachment A of the costing. In all other cases, PDI is included in the costing minute as a separate memorandum item in Attachment A. The aggregate impacts for each party in the election commitments report include the PDI impacts for all individual costings.

Why might the PBO’s budget aggregates differ from those presented by parties before the election?

There are 4 key reasons why the budget aggregates presented in this report may differ from those presented by parties in their election commitment documents.

- The PBO’s list of individual election commitments may differ from those presented by parties.

- There may be differences between the PBO’s and party’s costings for individual commitments, including assessments of the impact of interactions between commitments.

- The PBO’s estimates of the impact of any overarching commitments to cap taxes as a share of GDP may differ from those presented by parties.

- The PBO’s estimates of the overall impact of party commitments on PDI payments may be different.

Any differences arising from the first 2 sources are discussed in the Summary of major party budget impacts and party sections of the report.

The latter 2 calculations are complex, with the tax cap calculation depending on estimates of the expenditure and revenue components for each election commitment and an assessment of whether the revenue measures are classified as tax or non-tax revenue in the budget. Furthermore, each of these calculations depends on the final election platform announced by parties which is generally determined during the caretaker period after final costings for individual components against the PEFO baseline have been provided. The PBO’s legislation does not permit parties to submit confidential costing requests during the caretaker period.

Footnotes

- The specific deadline implied by this requirement is determined by applying the conventions around dates (such as accounting for public holidays) in the Acts interpretation Act 1901. The requirements for the Election commitments report are set out in the Parliamentary Services Act 1999 Sections 64MA, 64MAA, 64MB and 64MC.

- The Parliamentary Budget Officer may treat two or more parties as a single party for the purpose of preparing the Election commitments report. (See Section 7 of the Parliamentary Service Act 1999.)

- PBO general election guidance 1 of 4, 2021 How minor parties and independents can opt in to the PBO's election commitments report, available on the 2022 General election page of the PBO website.

- Both guides are available on the Guide to the budget page of the PBO website.

- Parliamentary Service Act 1999 section 64MB(1).

- The latest Charter of Budget Honesty - Policy Costing Guidelines were issued by the secretaries on 20 September 2021.

- The PBO’s Guide to Reading PBO Costings contains more information on how policies, including election commitments, are costed. The PBO has also issued several information papers that explain in more detail what a costing is, what factors determine the reliability of costings, behavioural assumptions, and the costing process, available on the Information papers page of the PBO website.

- For further discussion on the treatment of broader economic effects in costings, see the PBO information paper Including broader economic effects in policy costings.

- For more information on the Contingency Reserve and its major components, see the PBO explainer piece The Contingency Reserve.

- The Costings and budget information page of the PBO website presents more detailed information on the PBO’s rounding rules.

- PBO general election guidance 2 of 4, 2021 The election commitments report: Summary of major party budget impacts, available on the 2022 General election page of the PBO website.