Why read this Budget Explainer?

Franking credits are a key part of how company profits are taxed in Australia through a system called ‘dividend imputation’. But what are franking credits and how do they work?

This Budget Explainer details how for Australian shareholders, company income tax is not really a tax on companies but a pre-payment of the tax which will eventually be owed by those shareholders. This is because the shareholders are the owners of the companies who receive income through the dividends paid out of company profits.

Franking credits are the way in which the pre-payment of tax by companies is recorded and later credited to the shareholders when they submit their own personal income tax returns.

In this paper, we step through what the dividend imputation system means for different Australian shareholders and also cover how the company income tax system operates for foreign owners of Australian companies, who cannot access franking credits.

Overview

This Parliamentary Budget Office (PBO) explainer provides an in-depth walk through of the dividend imputation part of the tax system, and the franking credits that underpin it. The explainer first provides an intuitive approach to understanding imputation, including using ‘pay-as-you-go’ (PAYG) withholding tax as an analogy, before introducing the complexities of the system.

- Chapter 1 sets out the core concepts of how corporate business income is taxed in Australia in the most common case of company profits being distributed to Australian shareholders as dividends.

- Chapter 2 covers the taxation of company profits which are paid to foreign shareholders or retained by the company.

- Chapter 3 discusses practical outcomes of the dividend imputation system.

- The 3 appendices included provide some historical background and data.

Note to the reader

The taxation of corporate income is arguably the most complex and contested area of tax policy, partly because of the balance between domestic and international considerations.

This explainer introduces imputation from the perspective of Australian shareholders, to show how the dividend imputation system operates and how it relates to other income tax in Australia (an important consideration for the PBO’s costings of company tax proposals).

Our discussion of corporate tax for foreigners also mainly focusses on mechanisms rather than the economic impacts of imputation or comparisons to alternative tax systems, topics of robust debate among experts.

For readers wishing to delve deeper into the literature on the taxation of corporate income, we suggest as a starting point the Tax and Transfer Policy Institute’s (TTPI) Corporate income taxation in Australia: Theory, current practice and future policy directions, a detailed discussion of Australia’s corporate tax system, including analysis of impacts on foreign and domestic shareholders, the benefits and shortcomings of imputation compared with alternatives, and current policy debates.

1. Dividend imputation concepts

1.1 The basics

Australia’s income tax system recognises that while all taxable income is ultimately earned by individuals, in practice most income flows through a business, typically as wages for employees or profits and capital gains for owners. Accordingly, income tax in Australia is largely paid to the Australian Tax Office (ATO) by businesses on behalf of individuals (the goods and services tax - GST - and excise are also paid by businesses and passed onto consumers through prices).

Businesses ‘withhold’ tax from employees’ wages as a pre-payment of tax on their behalf. Similarly, income tax paid by companies is a pre-payment of tax on behalf of the owners, the shareholders.

When a company pays income tax the ATO provides the company with a credit of the same value, known as an ‘imputation credit’ or ‘franking credit’. Later, this tax credit can be passed on to shareholders when they receive dividends from the company. Franking credits work somewhat like a voucher that was purchased by the company from the ATO, passed on to the shareholder, and accepted by the ATO as payment of tax.

When a shareholder (owner) of a company lodges their own tax return, these franking credits are recognised by the ATO as tax already paid on the owner’s behalf. This may result in a tax refund to the shareholder if the tax already paid is higher than their tax liability, or the shareholder may need to pay an additional amount of tax if their tax liability is greater than the tax already paid.

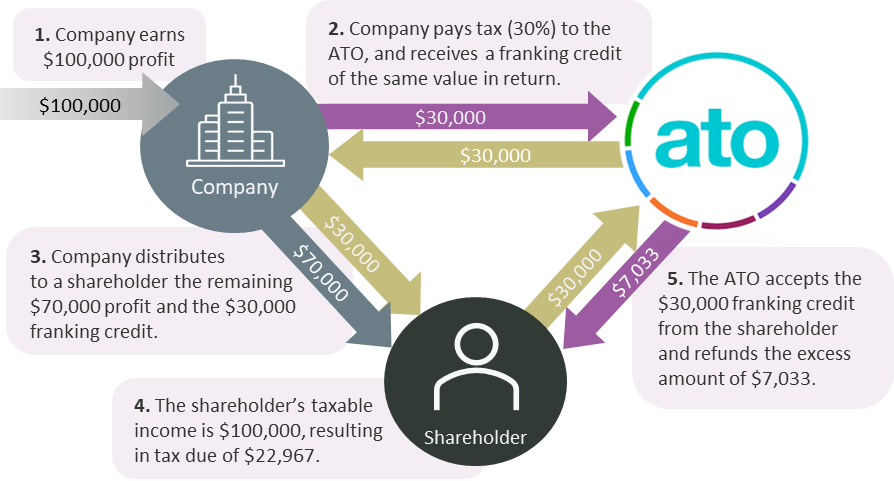

The diagram shows the various flows for a simple case of a company with one shareholder, whose only income is $100,000 of dividends. The flows of tax (and refunds) are shown by the purple arrows (figure 1). The flows of franking credits are shown by the gold arrows.

Figure 1 – Flows of tax and franking credits

In the example, the shareholder receives $100,000 of income, being $70,000 of cash dividends and $30,000 of tax credits paid by the company on the shareholder’s behalf, at the company tax rate of 30%. The shareholder’s tax assessment1 for the income is around $23,000, so the over-payment of tax of around $7,000 is refunded to the shareholder. The refund is for the tax that, in retrospect, should never have been paid because it is the shareholder who ultimately earns the income and pays the associated tax, with the company acting as a conduit.

The example illustrates that, while the tax payments system results in flows of tax to and from the ATO, the end result is that the tax on the profits earned by the company is based only on the shareholder’s individual tax rate.

Most of Australia’s income tax system works like this, with a notional amount of tax being paid close to when the economic activity occurs, followed by a reconciliation later on. The most well-known of these payment mechanisms is PAYG tax, where a business will ‘withhold’ some of its employees’ wages to send to the ATO. These amounts of tax are credited to the employees. This payment system ensures that when employees submit their tax returns after the year ends they don’t find themselves with large tax bills (as they often did before 1942, when pay-as-you-earn tax - as it was then called - was introduced2). In fact, the amount of tax already paid on an employee’s behalf is often slightly more than the eventual tax liability, resulting in a tax refund for the employee. Sometimes the amounts already paid are less than the eventual tax liability, resulting in the employee needing to pay more – an additional tax bill on assessment.

In a system of dividend imputation, company income tax is a pre-payment by the company of the shareholders’ eventual income tax. A simple parallel is PAYG withholding tax on wages: the business sends tax to the ATO as a pre-payment of tax on behalf of the individual.

Dividend imputation is more complex than PAYG withholding tax because the business’s management may choose to retain profits in order to grow the business rather than distribute the profits to the owners. Another complexity is that many owners of Australian businesses are foreigners who mostly cannot take advantage of tax credits (see Chapter 2 for more on this).

Nevertheless, in an imputation system the tax paid by companies is not on their own behalf but on behalf of their owners. From this perspective companies in Australia are not actually taxed at all and company tax can be thought of simply as another withholding tax.

Dividends that are paid together with franking credits are referred to as ‘franked dividends’. If the company did not distribute franking credits with the dividends, they would be ‘unfranked’. In less common cases, the company may distribute franking credits with the dividend but of a lower value than the company tax rate allows. For example, the company may distribute a $700 dividend with only a $100 franking credit. In this case, the dividends are ‘partly franked’ (see Chapter 3 for more on this).

1.2 Imputation across marginal tax rates

Because the shareholders ultimately pay the tax on company profits, the eventual tax rate applied will depend on the shareholder’s total income. The shareholder may earn other income, such as wages, in addition to the dividends.

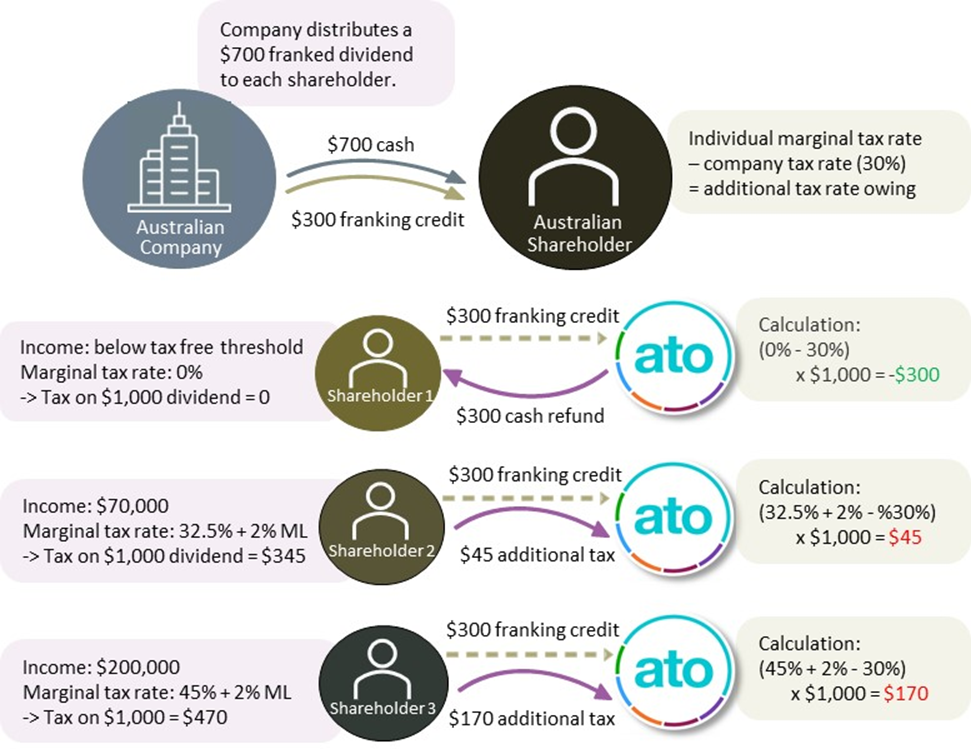

The example shown in the next diagram shows how the Australian corporate income that results in dividends paid to Australian resident shareholders is ultimately only taxed once, at the individual tax rates of the various shareholders.

In the example, an Australian company earns income and pays tax, which generates franking credits. Three shareholders of the company each receive a $700 cash dividend and a $300 franking credit.

Each of the three shareholders also receives varying amounts of other income that puts each of them into different tax brackets. The difference between the company tax rate (which has already been paid, signified by the franking credit) and their marginal income tax rate including the Medicare levy (ML) will determine if the shareholder receives some of the tax back or needs to pay more.

Figure 2 – Franking credits at different marginal tax rates

The imputation system means that the difference between the tax rate of the shareholder and the tax rate of the company is settled when the shareholder’s tax return is assessed. If you’re a shareholder who has received a franked dividend:

- If your tax rate is above the company tax rate → you pay the difference to the ATO

- If your tax rate is the same as the company tax rate → no impact

- If your tax rate is below the company tax rate → you get the difference from the ATO

This means that shareholders with low incomes (such as retirees) can receive a cash refund from the ATO through refunding franking credits that they have received on dividends.

High income earners must still pay tax on dividends, but because the company has already paid some of the tax on their behalf, they only have to pay the difference between the company tax rate and their individual income tax rate.

1.3 Franking credit refundability

Central to the imputation system for Australians with low taxable incomes or low tax rates is that franking credits can be refunded. This means that if the individual does not have a tax liability large enough to absorb all the franking credit on a dividend, the excess franking credit is paid to the individual as a cash refund, as illustrated in the simple example above.

The system of taxing wages works in the same way, where employees receive a tax refund after it is clear, in retrospect after the end of the year, that too much tax has been withheld.

One aspect of a dividend imputation system is that no special tax arrangements are needed for dividend income. Dividends are included with other income into the individual’s end of year calculations. If you have paid too much, once everything is factored in, you get a refund. As discussed later, tax systems in other countries often involve separate arrangements for different sources of income. In Australia, individuals are ultimately taxed on the basis of their combined income from all sources.

There are three common cases where franking credits result in refunds. The first case is for organisations including charities and government investment entities such as the Future Fund, which pay no income tax so any franking credits received will be refunded to the entity.

The second common case is self-managed superannuation funds (SMSF), which operate differently from large superannuation funds due to their smaller client pools. This is explained in detail in the next section.

The third case is for individuals with low taxable income. For instance, if the individual shareholder’s income is below the tax-free threshold ($18,200 as of 2022-23), with an assessment of zero tax, then the shareholder receives a cash refund of the tax previously paid by the company on the dividends.3

Prior to 1 July 2000, any franking credits in excess of a shareholder’s tax assessment were not eligible to be refunded and were simply lost. This led to several effects on individuals:

- While high-income individuals generally received the full value of their franking credits, because their tax bill was higher than their franking credits, low-income individuals received only part of the value of franking credits, and those whose income was below the tax-free threshold received none of their franking credits because they paid no tax;

- Incentives to invest in assets other than shares, because non-refundable franking credits meant that the overall after-tax return would be lower for shares, all else being equal;

- Incentives for small businesses to remain unincorporated, such that the profits for a sole owner was taxed at the owner’s tax rate, however low that was; and

- Incentives towards investing through large superannuation funds, which have sufficient contributions and other earnings income to absorb franking credits, rather than self-managed super funds (see the next section).

The impact of these effects increased over the 1990s with the increase in the superannuation guarantee rate to 9%, leading to a rapidly increasing stock of assets in super funds looking for tax effective investments.

The refundability amendment4 of 1 July 2000 removed these effects.

Refundability of franking credits has been the subject of debate over recent years, particularly in the context of self-managed superannuation funds, which will be discussed in the next section.

Quick Fact: The word ‘impute’ derives from the Latin imputare, meaning to attribute or ascribe a value or cost. Historically, the word has been used in legal and theological contexts, as the ‘imputation of blame’ to someone, but also in financial contexts, where the value of an asset or transaction is not directly determined but assigned. In economics, the ‘opportunity cost’ of not acting may be imputed from other information. In the Australian National Accounts, Gross Domestic Product (GDP) includes an allowance for ‘imputed rent’, which is the notional amount that owner-occupiers pay to themselves. In the case of the taxation of company profits, ‘imputation’ refers to the tax paid by the company being attributed to the shareholder.

1.4 Superannuation funds and refundable franking credits

The extent to which franking credits are refunded to superannuation funds is related to the size of the fund. Funds with thousands of members and many assets under management will receive relatively small refunds of franking credits or none at all, while funds with up to 6 members, usually SMSFs, will often receive significant refunds of franking credits. The reason for the difference is explained here, and it relates to the fact that income tax on superannuation is not levied on each member individually but on the fund as a whole.5

Super funds pay tax on their total income from member contributions and from investment earnings. A flat tax rate of 15% is applied to the fund’s total income except for that earned on behalf of those who are retired and drawing a pension. Investment earnings for retired members with assets below the ‘transfer balance cap’ (currently $1.9 million) are exempt from tax.

Large super funds have thousands or millions of members either working and contributing or retired and drawing a pension. Around half of all large fund income is from contributions and half from investment earnings. These funds invest in a wide range of asset types, receiving income through different streams such as rent, interest, capital gains and dividends. Large funds need a ‘balanced’ investment strategy owing to the mix of members contributing and drawing a pension. Around 20% of large fund investment income is dividends with franking credits.

Given that large funds receive much more income (approximately 90%) from member contributions and other earnings, the value of franking credits are unlikely to exceed the funds’ total tax liability, such that these funds rarely receive refunds of franking credits.6

An example of how franking credits operate for a large super fund is shown in the box below.

BigSuper is a superannuation fund with 100,000 members, of which 75,000 are still contributing and 25,000 have retired and are drawing a pension.

Over the year, BigSuper receives $1,100 million in contribution from its employed members, and earns $900 million in investment earnings, for total income of $2,000 million. The fund’s taxable income is only $1,800 million, since some of the investment earnings ($200 million) were for retired members drawing a pension, who are exempt from tax.

Over the year, BigSuper receives $1,100 million in contribution from its employed members, and earns $900 million in investment earnings, for total income of $2,000 million. The fund’s taxable income is only $1,800 million, since some of the investment earnings ($200 million) were for retired members drawing a pension, who are exempt from tax.

The table shows the calculation of the fund’s tax in this simplified illustrative example. If the franking credits were greater than the total tax liability ($270 million), then the BigSuper would receive a refund of the amount in excess of the tax – this scenario would be referred to as a case of ‘refundable franking credits’.

|

|

Working members |

Retired members |

Total |

|

Contributions |

1,100 |

0 |

1,100 |

|

Earnings |

|

|

|

|

Dividends |

160 |

40 |

200 |

|

Other earnings |

540 |

160 |

700 |

|

Total income |

1,800 |

200 |

2,000 |

|

Taxable income |

1,800 |

0 |

1,800 |

|

Tax assessed (15%) |

|

|

270 |

|

Franking credits |

|

|

-60 |

|

Tax to pay |

|

|

210 |

On the other hand, the 1 to 6 members of a self-managed superannuation fund are often at similar stages of life and likely to be either all employed and contributing, or all retired and drawing a pension. In this case, franking credits are more likely to be refundable, as shown in the illustrative example below of a retired couple.

The significant refund of the franking credits in the example reflects both that the fund has no income (and no associated tax) from employed, contributing members, and that the fund’s assets are strongly weighted towards dividends. When the members are retired, self-managed funds tend to invest in assets which provide a steady cash flow, such as interest and dividends, rather than those that provide capital growth.

A retired couple administer their superannuation pension through a self-managed super fund with a balance of $1 million. The fund investments are weighted towards providing a steady income rather than building the fund balance through capital gains. As such, half the fund assets are term deposits, which generate income in the form of interest at a rate of 5%, and the other half in shares in companies which generate dividends, also at a rate of 5%.

The $500,000 of shares produce a dividend return of $25,000, in the form of $17,500 of cash and $7,500 in franking credits. Because all the fund members are retired and drawing a pension from sufficiently low balance, the income is exempt from tax. The $7,500 tax already paid by the company on the shareholders’ behalf is therefore refunded to the fund.

The table shows the calculation of the fund’s tax in this illustrative example.

|

|

Working members |

Retired members |

Total |

|

Contributions |

0 |

0 |

0 |

|

Earnings |

|

|

|

|

Dividends |

0 |

25,000 |

25,000 |

|

Other earnings |

0 |

25,000 |

25,000 |

|

Total income |

0 |

50,000 |

50,000 |

|

Taxable income |

0 |

0 |

0 |

|

Tax assessed (15%) |

|

|

0 |

|

Franking credits |

|

|

-7,500 |

|

Tax liability |

|

|

7,500 refunded |

If there was no refundability, the impact on government revenue would depend on how affected individuals responded.7 As shown above, very large funds receive sufficient contributions and diversified earnings which generate sufficient tax to absorb franking credits without resulting in refunds. Members of SMSFs could continue to receive franking credits simply by rolling their fund balances into a large fund. In this case, removing refundability may generate relatively little additional tax revenue.

An alternative response by SMSFs may be to diversify assets away from Australian shares (with an associated fall in share prices) and towards other assets such as foreign shares, fixed interest or rental housing. In this case, removing refundability would also result in a relatively small amount of additional tax revenue.

Public debate on refundability sometimes involves concerns that the tax concessions available for super funds have resulted in the use of self-managed super funds as a preferred tax-minimisation vehicle for high-wealth individuals.

Funds were able to accumulate very high balances during the years up to 2006, when there were fewer limits to concessionally taxed contributions. Since 2006, individuals have been limited in the amounts they can contribute to funds, which are currently8 a maximum of $27,500 before incurring additional tax. The ‘transfer balance cap’ introduced from 2017-18 means that funds with high balances will continue to pay 15% tax on earnings even after retirement. From 1 July 2025, an additional 15% tax rate will apply on superannuation fund earnings from assets above a value of $3 million, regardless of if the fund is in the retirement phase or not.

These policies limit the building of new concessionally taxed super fund balances of many millions of dollars. They reduce the previous advantages from the zero tax rate on earnings after retirement for high-wealth individuals and hence the impact of refundability of franking credits. Policies based on the size of superannuation fund balances preserve the benefits to retirees in general while reducing the incentives to use superannuation as a high-wealth investment vehicle. However, the changes add further complexity to the superannuation tax system.

Quick Fact: The word ‘frank’ in ‘franked dividends’ derives from the French affranchir (“free”), itself derived from the Latin francus. In a postal context, the term has historically related to printing a mark on an envelope to show that the cost of sending it has already been paid. Equivalently in this context, a ‘franking credit’ can be treated as a note that accompanies dividends that says that tax on the dividend has already been paid by the company.

2. Profits paid to foreigners or kept by the company

2.1 'There is no such thing as company tax'

So far, this explainer has drawn a parallel between the PAYG withholding system, where a company remits tax to the ATO on behalf of its employees, and the imputation system, where a company remits tax on profits on behalf of its shareholders. In both cases an individual’s income is eventually taxed at a rate determined by their total income from all sources, resulting in additional tax or refunds.

Considered this way, the company does not actually pay ‘company tax’ on its own behalf, but always on behalf of its shareholders, which can lead to a conclusion that there is effectively no such thing as company tax.

However, accounting standards in Australia treat the tax paid by companies on behalf of shareholders as ‘company tax’, drawing on international standards. The international standards assign the PAYG withholding tax on wages to individuals even though it is paid to the ATO by businesses on the individuals’ behalf.9 A key difference between the PAYG system and the imputation system is that while all PAYG withholding tax will eventually be credited to Australian individuals in the same year, this is often not the case for tax paid by companies.10

The two most important exceptions are:

- Companies are not required to distribute dividends to shareholders, but may retain earnings and accumulate franking credits for distribution in a later year, or perhaps never; and

- Companies may distribute dividends to shareholders unable to utilise franking credits, particularly foreigners.

Sections 2.3 and 2.4 will explain these cases in more detail.

So, while there is such a thing as ‘company tax’, it is important to recognise different perspectives in assigning tax to entities within an imputation system, and that allocating taxes to ‘heads of revenue’, which is done for budget accounting purposes, uses a method which cannot account for these nuances.

For example, the government’s 2020-21 Final Budget Outcome reports tax revenue from companies of $99 billion and superannuation fund tax revenue of $13 billion. However, superannuation funds had received franked dividends, out of which $7 billion of tax had already been paid by the companies.

On the basis of the entities which eventually bore the tax liability, total tax revenue from superannuation funds would be $20 billion, including the $7 billion paid by companies on behalf of shareholder funds, and total company tax would be $7 billion less. The Government Finance Statistics (GFS) standard reflects the amounts that the entities paid to the ATO. The amounts do not reflect which entities eventually bore the tax assessments.

2.2 Is the company tax rate in Australia irrelevant?

For domestic shareholders, the imputation system has the effect of reducing the importance of the company tax rate, which is currently 30% (or 25% for companies with turnover of less than $50 million).

For example, if the company tax rate was 20% and the shareholder’s tax rate was 40% then the company would remit less tax and pay a larger cash dividend, with the shareholder likely paying more tax to make up the difference from the shareholder’s tax rate. Similarly, if the company tax rate was 40%, then the company would remit more tax and pay a smaller cash dividend, with the shareholder likely claiming a refund. In either case, the shareholder is in the same post-tax position.

In other words, company tax acts as a withholding tax for domestic shareholders. In the context of an imputation system, raising more or less revenue from Australian corporate profits would likely involve altering the tax rates of the shareholders rather than focusing solely on the statutory company tax rate.

The current company tax rate of 30% for most corporate income is convenient for the operation of the tax system because at this rate the amount of tax paid by companies on behalf of Australian shareholders closely matches, on average, the tax later applicable for the shareholders. The average marginal tax rate for shareholders happens to be close to 30%. This means that across all domestic shareholders the total amount of refunds is generally balanced out by the total amount of additional tax paid by shareholders on higher tax rates.

An imputation system also means that corporate tax laws which affect the tax base rather than the rate are limited in their impact on total tax collections. For example, a law which provides an investment allowance, such as immediate deduction of capital purchases, will result in less tax being paid by the company.11 In this case, the company will be able to provide a larger dividend to shareholders, but with fewer franking credits, and the shareholders will again make up the difference such that they pay the relevant tax for their income. Such laws may, however, assist companies with their cash-flows in an economic downturn.

A key implication of corporate income being effectively taxed through the shareholder is that the incentives for companies to minimise or avoid paying tax is reduced. This is discussed further in Chapter 3.

In terms of the total tax eventually collected for Australian-owned corporate income, the impact of corporate tax laws (both the tax rate and other laws) on government revenue are reduced in an imputation system.12 But, as explained in the next section, these laws are highly relevant for foreign investors who cannot utilise franking credits and whose income is subject to the company tax system alone.

2.3 Dividends paid to and from non-residents

So far, this explainer has focussed on the case of companies being owned by Australian shareholders. Being in a small and open economy, the impact of Australia’s tax system on foreign shareholders is also important.13

Franking credits can be used as a tax credit only by Australian residents. The tax treatment of dividends paid to foreign (non-resident) shareholders is therefore less favourable than that for their Australian counterparts. International investors therefore face different incentives for investing in Australian companies for the purpose of receiving dividends as an income stream, all else being equal.

The inability to utilise Australian franking credits means dividends paid to foreigners are subject to ‘double taxation’, meaning that both the Australian company and the foreign shareholder pay tax on the same corporate profits separately at their own tax rates. In the United States, for example, the shareholder pays 15% tax14 on dividends received. Dividends paid to an American shareholder from an Australian company are therefore taxed at a combined rate of 40.5%.15

In contrast, the American corporate tax rate is 21%. When combined with the 15% tax rate on dividends, American shareholders pay a combined tax rate of 32.85%, lower than if the dividends had originated in Australia.16 The ‘double tax’ system is explained further in Appendix A.1.

The higher overall tax rate for American shareholders in this example is because of the higher company tax rate in Australia compared to the United States, not because of the imputation system itself. For domestic shareholders on high marginal tax rates, the after-tax return on dividends may be similar to some foreign shareholders, depending on their own marginal tax rates.

Given that foreigners cannot use Australian franking credits to offset their tax in their own country, companies operating in Australia with largely foreign shareholders may decide to arrange their affairs to reduce their tax and distribute only unfranked dividends. In a case like this, a company would distribute only unfranked dividends, which attract a 30% dividend withholding tax when paid to a foreign shareholder (between 5% and 15% for around 40 countries with tax treaties with Australia). The dividend withholding tax reduces (but does not eliminate) the incentive for such companies to minimise their tax paid in Australia.

Income paid to Australian shareholders from overseas is taxed less favourably than Australian source income because it has been taxed already in the ‘home’ country. The foreign source income is subject to taxation in both countries – ‘double taxation’ – when distributed to Australian resident shareholders (although in some cases the foreign tax is recognised in Australia as a tax offset).

International companies need to outperform Australian companies to generate similar returns as a result of this favourable tax treatment, and domestic investors may prefer to invest in domestic companies as a result.17

Note, however, that the reverse is not necessarily the case. For investors residing in countries which maintain a ‘double taxation’ system, the incentive to invest in Australia will in part depend on the Australian corporate tax rate compared to other countries. The fact that Australia maintains an imputation system is largely irrelevant to the foreign investor. Unlike the domestic investor, who may be indifferent to the corporate tax rate, the foreign investor will consider the relevant tax circumstances.

Importantly, the corporate rate is not the only determinant of the tax impact on profits. While the corporate tax rate in Australia was relatively high in the 1980s, companies could benefit from several significant tax arrangements which narrowed the company income tax base, such as investment allowances and accelerated depreciation. After allowing for the net effect of these impacts, the average ‘effective tax rate’ on corporate income in Australia has fallen by less than the reduction in the statutory rate from 49% to 30%.18

A further consideration for non-residents looking to invest is a range of less tangible aspects such as political and economic stability, potential exchange rate volatility, other tax treaties, economic specialisation and the regulatory environment. As such, a simple comparison of statutory tax rates is unlikely to paint a complete picture of incentives for foreign investment.

In addition to Australia, other nations have had full or partial imputation systems, including New Zealand and some European nations, such as Austria, Italy, Finland, France and Spain. However, in 2003 the European Court of Justice determined that dividend imputation breached European tax treaties because the different corporate tax systems in different countries could distort investment decisions.

Within Europe, where nations are relatively close geographically and relatively similar economically (including a single currency), differences in taxation may affect investment flows as foreign investors rapidly move funds between countries in search of the best returns. The Court summarised: “Where, in applying their systems, Member States differentiate between the tax treatment of domestic and inbound or outbound dividends this can be a restriction on cross-border investments and it can result in fragmented capital markets in the European Union (EU).”19

Most of these European nations returned to a system of double taxation during the following 15 years, leaving only New Zealand and Malta as countries maintaining a full imputation system.

The different political, geographic and economic contexts for Australia compared to Europe may not lead to similar impacts.

As a nation with significant natural resources, a key role for the Australian tax system is in ensuring that income generated from Australian activity is taxed within Australia, before the income leaves its shores. In the context of mining companies being significantly foreign owned, Tilley (2024) notes “the importance of company tax in ensuring an adequate community return for natural resource extraction”.

2.4 Retained earnings and accumulated franking credits

In practice, companies often do not distribute all their profits. For example, a company may retain its profits in order to grow the business. In this case the franking credits accumulated by the company may never be distributed to shareholders and are effectively lost (see Chapter 3). Compared to other systems of taxing corporate profits, dividend imputation encourages companies to distribute profits through dividends so the shareholders can get the full value of the franking credits.20

Retaining profits may still be beneficial to shareholders. When a company retains earnings then the value of the company will increase, all else being equal. The increase in value will result in capital gains tax when the shares are eventually sold.21

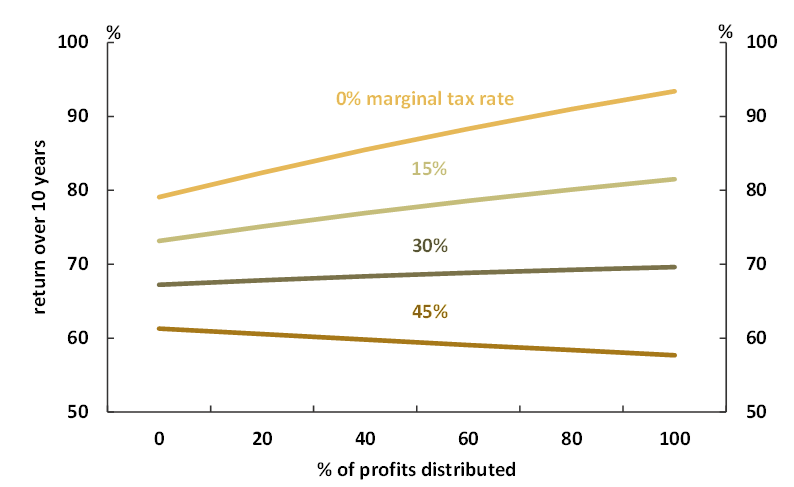

Despite the lost franking credits and the additional capital gains tax, the company retaining its profits will still be advantageous to some shareholders. Box 3 (below) shows a simple illustrative scenario of a company either choosing to distribute or retain all of its post-tax earnings for a single year. Chart 1 summarises the results from the same calculation over a 10 year period. The after-tax return for the shareholder varies according to the percentage of corporate profits distributed and the shareholder’s own marginal tax rate.

Chart 1: Investment returns over ten years depend on

the percentage of profits distributed and the shareholder’s marginal tax rate22

As a simplified illustrative example of how corporate income is taxed, consider a company owned by a single shareholder. The company is worth $1 million at the start of a year and makes a 5% profit ($50,000) during the year, paying income tax of $15,000 and receiving franking credits. The value of the company also increases with inflation (2.5%). At the end of the year the shareholder sells the shares.

If the company retains all those net earnings, its value increases by that amount, and the shareholder will pay income tax on those capital gains.

If the company distributes all the $35,000 of post-tax earnings, with the $15,000 of franking credits, the shareholder will pay income tax on those earnings.

The table shows both these scenarios, which result in near identical post-tax income for the shareholder, who is assumed to have significant other income such that the top marginal tax rate of 45% applies.

Over a 10 year period, the compounded retained earnings means that the shareholder receives the highest post-tax income if the company retain its earnings rather than distribute them (see Chart 1). This is due to the capital gains discount, where the shareholder reports only half of the capital gain of $60,000 as taxable income.

For shareholders on lower tax rates, the balance shifts towards distributing the earnings, because of the reduced impact of the capital gains tax discount.

|

|

Retain |

Distribute |

|

Value at start of year |

1,000,000 |

1,000,000 |

|

Profit (5% of value) |

50,000 |

50,000 |

|

Tax (30% of profit) |

-15,000 |

-15,000 |

|

Inflation (2.5% of value) |

25,000 |

25,000 |

|

Dividends paid to shareholder |

0 |

-35,000 |

|

Value at end of year |

1,060,000 |

1,025,000 |

|

|

|

|

|

Dividends |

0 |

35,000 |

|

Franking credits |

0 |

15,000 |

|

Capital gain (50% discount applied) |

30,000 |

12,500 |

|

Taxable income from shares |

30,000 |

62,500 |

|

Tax (at 45%) |

13,500 |

28,125 |

|

Less franking credits |

0 |

-15,000 |

|

Total tax |

13,500 |

13,125 |

|

Value at end of year |

1,060,000 |

1,025,000 |

Shareholders with low tax rates get the best return if the company distributes all its profits, otherwise the franking credits have no value. When the shares are sold at the end of the decade, there will be a capital gain (solely from inflation) which is subject to capital gains tax.

Shareholders with high marginal tax rates will lose the value of the franking credits if the company retains its profits (assuming the credits are never distributed) but benefit from the increase in value of the company when the shares are sold at the end of the decade. Given the shares were held for at least 12 months, the shareholder is eligible for the capital gains tax discount, meaning that only half the capital gain is taxable, an advantage for those subject to high tax rates. The tax advantage from the capital gains tax discount outweighs the disadvantage from the ‘lost’ franking credits.

Therefore, while the imputation system encourages companies to distribute profits to shareholders and discourages strategies to minimise tax, the incentive is somewhat counterbalanced by the significant tax advantage from the capital gains tax discount for those shareholders subject to high tax rates.23

In practice company managers do not make decisions solely on the basis of tax advantages to shareholders. They strive to balance the need to grow the business with the after-tax benefits to shareholders in general.

3. Dividend imputation in practice

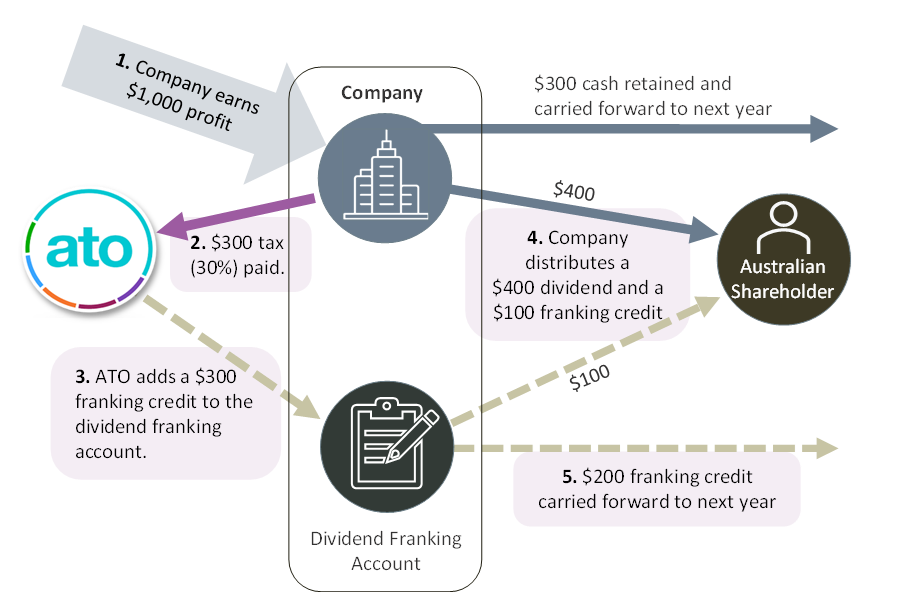

3.1 The franking account balance and 'trapped' franking credits

As described earlier, for operational reasons companies sometimes don’t issue dividends even if they made a profit, paid company tax and received franking credits. In order to allow companies discretion to distribute or retain profits, unimpeded by tax considerations, the imputation system allows companies to maintain a running stock of franking credits in a ‘dividend franking account’. Any ‘left over’ franking credits are added to the dividend franking account balance and carried forward to future years, when they may later be distributed.

This process is illustrated in Figure 3, where a company earns $1,000 profit and pays $300 tax, receiving franking credits from the ATO of the same value. The company distributes only $100 of the franking credits to shareholders, making the dividends ‘partly franked’, leaving the remaining $200 to be carried over for distribution in a later year.

Figure 3 – Dividend franking account

The franking credit a shareholder receives therefore may have originally been earned from company tax paid years prior. This means that comparisons of company tax paid and franking credits distributed and/or claimed can be misleading.

Companies may attach franking credits to dividends only up to the value corresponding to the company tax rate. For example, if the company tax rate is 30% and a company distributes $700 of dividends then up to $300 of franking credits may be attached, such that the franking credits are worth 30% of the $1000 total distributed to shareholders. A company cannot reduce its franking account balance by attaching, for example, $2000 of franking credits to a $700 dividend.

In order to reduce the size of its franking account in a later year, the company must pay shareholders more dividends than its profit for that year. In practice, companies’ franking credit accounts tend to accumulate over time. Should a company keep accumulating franking credits, the account may reach a level which the company is practically unable to ever reduce. These may be referred to as ‘trapped’ franking credits.24

Companies which do not distribute dividends may therefore accumulate a large franking account balance which is difficult to reduce. If a company generates a profit and pays tax but retains the earnings to expand the business, the franking credits will remain in the franking account balance. If the company is successful in expanding the business and generating twice as much profit in a later year, for example, the company will pay twice as much tax and generate twice as many new franking credits. Even if the company distributes all these new earnings and franking credits to shareholders, the originally retained franking credits remain.

Because trapped franking credits are effectively value lost to shareholders, the imputation system tends to encourage companies to pay out dividends rather than accumulate profits and associated franking credits within the company. As explained earlier, however, the capital gains tax discount can offset this incentive.

Companies may seek to reduce their franking account balance by raising funds through methods unrelated to the operation of the business. One method is to raise funds (through issuing shares or borrowing) solely for paying out special franked dividends, on the basis that the benefit to shareholders of receiving the franking credits is greater than the cost (a reduced share price resulting from the capital raising or interest repayments).

Another method is for the company to buy its own shares back from shareholders but making the payment partially or wholly in the form of franked dividends. This would enable the company to buy their shares for less than market value, with shareholders keen to accept on the basis that they are also receiving franking credits. These and other related mechanisms are the subject of past and recent legislation intended to curb their usage.25

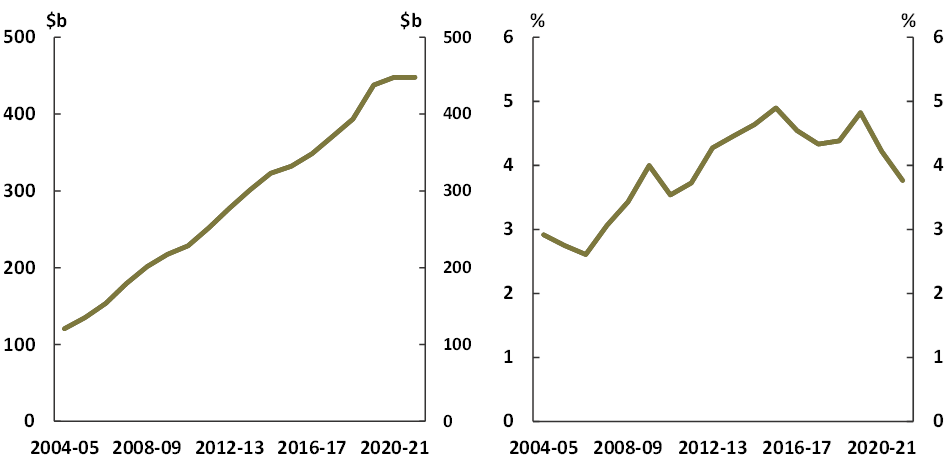

At the end of 2020-21, companies’ total franking account balance was around $450 billion. It is unknown how much of this balance is effectively trapped, unlikely to be ever paid. An overview of the balance of franking credits over time is included in Appendix A.2.

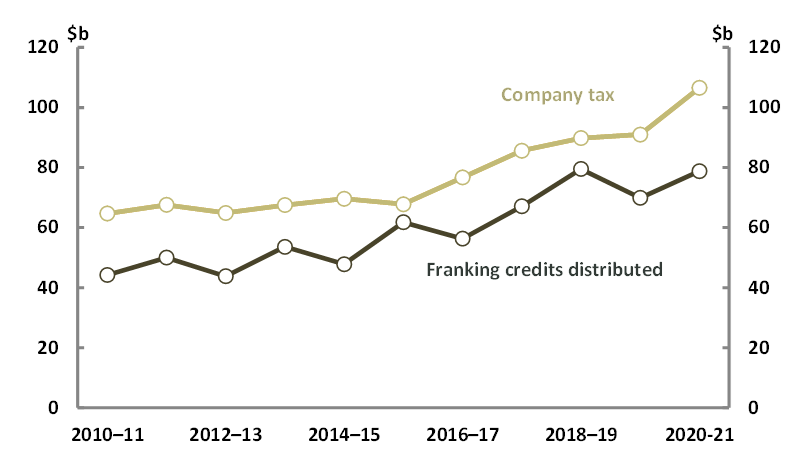

Chart 2 shows company tax and franking credits distributed over recent history. Over the last decade, companies have distributed franking credits worth 77% of the company tax paid over the same period. Given that there may be a gap of a year or more between the tax being paid and the associated franking credit being distributed, the percentage of company tax eventually distributed is higher. For example, distributed franking credits were worth around 85% of the average company tax over the previous 3 years.

The gap between company tax paid and franking credits distributed will result in an increasing franking account balance over time.

Chart 2: Company tax and franking credits distributed26

3.2 Franked and unfranked dividends

In an imputation system, company income that is distributed to resident shareholders is taxed at the shareholder’s tax rate regardless of whether the company has paid Australian tax on that income or not. A company may distribute dividends even though it did not pay tax, and thus has no franking credits to distribute as well.

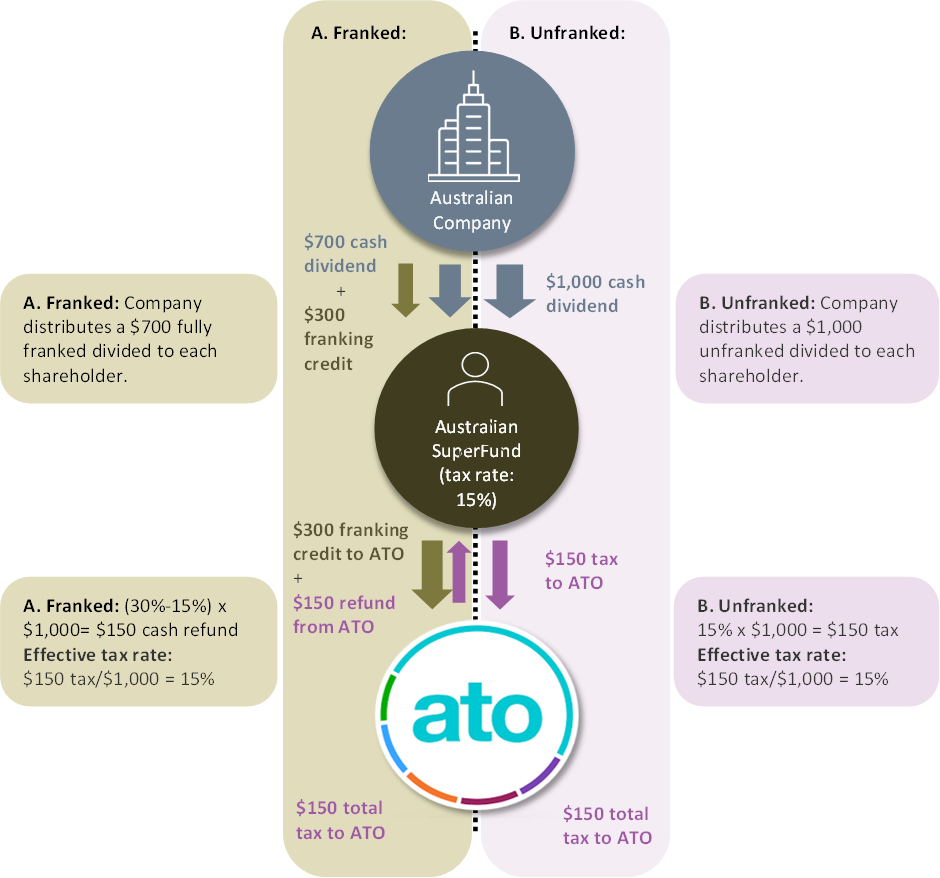

Figure 4 below is an illustrative example of tax outcomes for a shareholder with a 15% marginal tax rate (e.g. a superannuation fund in an accumulation phase), under the following scenarios:

- scenario A in gold where a company dispenses a franked dividend to its shareholder; and

- scenario B in pink where a company dispenses an unfranked dividend to its shareholder.

Figure 4: Imputation – franked vs unfranked dividends

In scenario A, the company pays a $300 company tax on its gross profit and therefore reduces the cash available for dividend distribution to its shareholder. The company tax paid gives rise to a $300 franking credits on the dividend. The divided distributed to the shareholder is taxed at the shareholder’s marginal tax rate, in this instance at 15%, which implies that the shareholder must pay $150 tax on the $1,000 gross divided. As the $300 franking credit attached to the dividend is greater than the $150 tax obligation of the shareholder, the shareholder is entitled to a $150 cash refund.

In scenario B, the company pays no Australian tax on its income, for instance because of tax concessions such as for research and development or accelerated depreciation. In this case, the company pays no Australian tax so has more cash income to distribute, but there are no franking credits on the dividend. The dividend is taxed at the same effective tax rate (15%) as in the case where the company paid Australian tax (and accordingly gained franking credit).

The final outcome is that the total tax paid under both scenarios is identical at a rate of 15%. The imputation system does not affect the amount of tax collected from the Australian source income distributed to shareholders. In both cases, the shareholders receive the same total value of $1,000 from the company, but in the scenario A the amount is split between cash dividends and a franking credit. The difference in cash dividend paid between the two scenarios is compensated by the franking credit on the distribution. This means that imputation reduces, but does not eliminate, the incentive to avoid paying company tax, as discussed in the next section. 27

The two scenarios show the extremes: dividends which are ‘fully franked’, where the franking credit is the maximum allowed, and ‘unfranked’, with no franking credit. In practice, companies sometimes distribute fewer than the maximum allowed credits as ‘partly franked’ dividends. For simplicity, most of the examples in this explainer have assumed fully franked dividends.

3.3 Tax minimisation

All tax systems result in taxpayers modifying their behaviour to reduce their tax bill. In some cases this is a feature of the system, such as people being encouraged to save for retirement through concessional tax rates on superannuation or being encouraged to reduce smoking through high rates of tobacco excise.

Other behavioural incentives created by a tax system are not deliberate features but are difficult to eliminate entirely. An important consideration in the design of an efficient tax system is reducing the risk of entities significantly distorting their behaviour solely to reduce their tax.

The imputation system reduces the incentive for a company to minimise company tax because shareholders value the tax credit associated with their dividend income.28 For domestic shareholders, an imputation system encourages the company to maximise its profits before company tax, not after, since the company is not the eventual taxpayer on the profits.

The incentives are not fully eliminated, however. In each of the following cases, a company would have an incentive to minimise company tax at least to some extent.

(a) Company uses retained earnings to finance growth

Many companies use their profits to finance investments with the aim of increasing future returns to their shareholders. For a company intent on financing investment expenditure, there is no incentive to pay company tax on earnings that the company intends to invest, as paying tax reduces the amount available for investment.

As already discussed, such a capital growth strategy is a way of increasing the value of the company that can be realised by selling shares in the company. Only half of the resultant capital gain for the shareholder is taxable, making this an attractive tax minimisation strategy.2

(b) Company has a large accumulated franking account balance

Many companies regularly pay out dividends that are less than their after-tax income. These companies will accrue more credits in their dividend franking account than they pay out, with the result that their franking account balance grows over time. This can continue to a point where the company does not need to pay tax in the current year in order to frank its annual dividend. For such a company, minimising tax has no impact on its ability to fully frank its current-year dividend to shareholders. Such a company could continue to fully frank its dividends until it runs down its franking account balance. Note, however, that in order for the company to consistently issue dividends in this scenario it still needs to consistently make profits without paying tax.

Some shareholders of companies do not benefit from imputation credits. For instance, non-resident shareholders do not receive franking credits on franked dividends (but the franked dividends are not subject to dividend withholding tax - DWT). This treatment can have varied impacts on the non-resident in their home country depending upon how the dividend is treated in the shareholder’s country of residence.30

3.4 Who receives franking credits?

Shareholders who receive franking credits may be individuals, other companies, superannuation funds, not-for-profit entities (charities) or non-residents. A trust structure may be utilised as an intermediary between the issuing company and the eventual beneficiary.

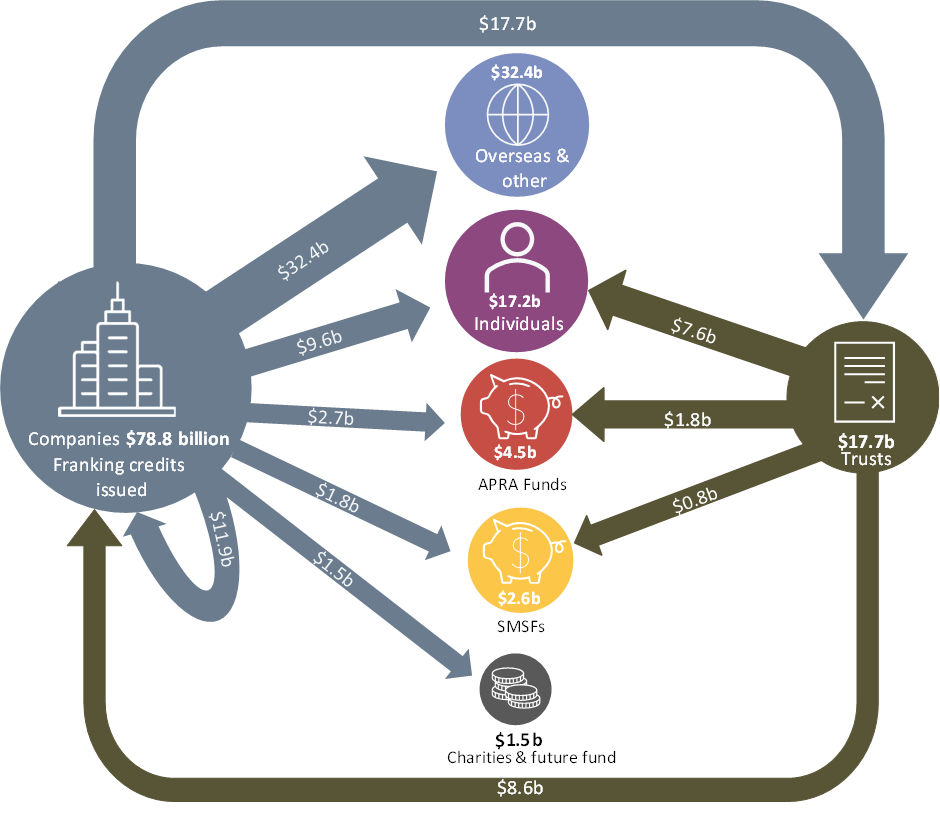

Figure 5 shows the flows of franking credits from companies for the 2020-21 income year, as an illustrative single year.31

Figure 5: Flows of franking credits 2020-2132

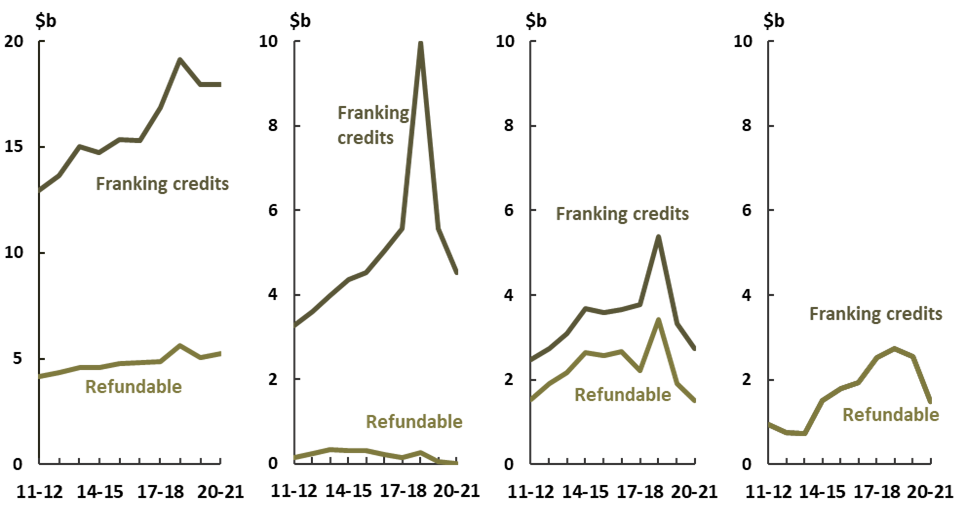

Of franking credits distributed to domestic shareholders (excluding other companies) over the last decade, nearly 60% have gone to individuals, 20% have gone to large superannuation funds, 13% to SMSFs and the remainder to charities and the Future Fund, the Australian government’s investment fund to pay public service superannuation and other programs. The trends over the last few years are shown in Chart 3 (note the different vertical scale for the first panel). The spike in franking credits in 2018-19 is related to several large off-market share buybacks (see the previous section).

Chart 3: Franking credits received by domestic shareholders

Individuals APRA funds Self-managed funds Charities & Future Fund

If the amount of franking credits received is greater than the shareholder’s tax bill for the year, then the excess amount is refunded. Compared to the amounts of franking credits received, the amounts refunded are disproportionately weighted towards self-managed superannuation funds, where all the members may be in retirement with a zero tax rate, and to charities and the Future Fund, which are not subject to tax so all franking credits are fully refunded.

Around 15% of franking credits received by individuals are refunded, compared to 2% for large superannuation funds, 62% for self-managed funds and 100% for charities and the Future Fund.

Abstracting from the 2018-19 spike in franking credits, franking credits received by self-managed superannuation funds, and particularly those refunded, have fallen significantly. While more data is required to clearly discern the trends, the introduction of the transfer balance cap is likely to have been the primary driver of the reduction. From 1 July 2017, superannuation assets above $1.6 million could not be transferred into the retirement pension account, meaning that earnings on these (non-transferred) assets continue to be taxed at 15%. The amount of refundable franking credits decreases because the fund is paying more tax than before, so the franking credits are being used to offset that tax liability rather than being refunded. In addition, some funds will move assets out of shares or out of superannuation altogether, also reducing the amount of franking credits (both refundable and not).

These recent trends in dividend income, particularly to self-managed superannuation funds, may indicate that the overall impact of refundability is decreasing.

On average, around a third of franking credits distributed by companies are not recognised on the tax return of beneficiaries. The vast majority of these are expected to have been distributed to foreigners. This is consistent with the fact that around a third of shares for listed companies are foreign owned33, although many companies are entirely domestically owned and many entirely foreign owned, with the rest in between.

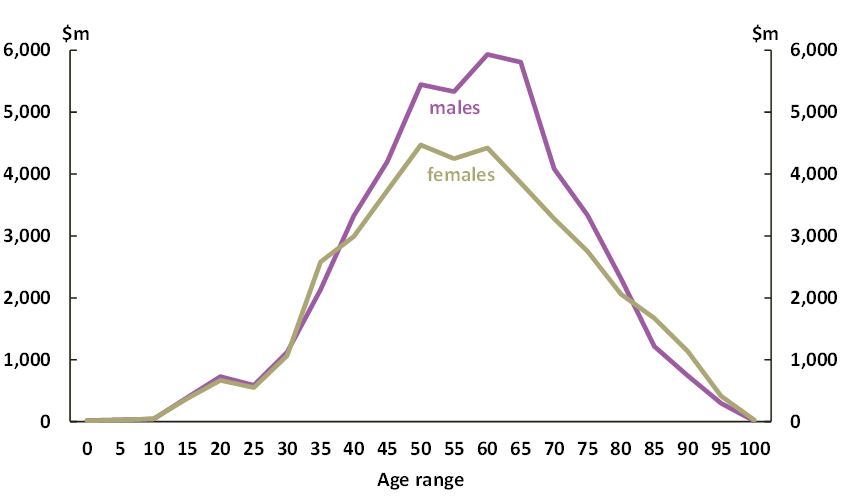

For franking credits distributed to individuals, 54% are received by males and 46% by females, indicating a relatively weak correlation to sex. This compares to only 41% of taxable income being earned by females, who pay around 36% of tax. The correlation is much stronger with age. Those aged 65 and over receive around 42% of the franked dividends and franking credits received by individuals, compared to less than 8% of all other taxable income.

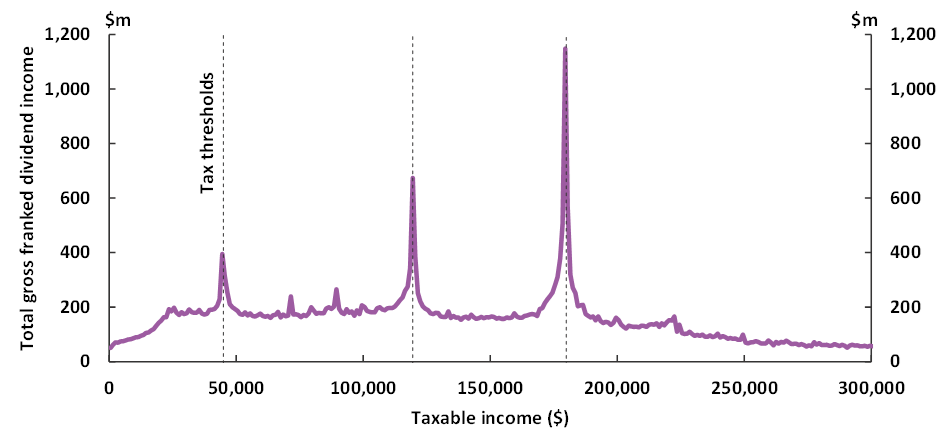

Total gross franked dividend income for each age and sex is shown in Chart 4. This distribution is consistent with younger persons receiving most of their income from wages and business income, while older persons receive a larger share of their income from investments.

Chart 4: Gross franked dividends received for each age group34

Dividend income also tends to be earned by those with higher incomes. For those with taxable incomes around $100,000, gross franked dividends make up only around 2% of income, compared to around 20% of income for those with taxable incomes higher than $200,000.

Appendices

A.1 Before imputation: the ‘classical’ system of taxation of corporate profits35

Companies and their shareholders are separate legal entities, with each subject to tax on their incomes. In Australia companies generally pay 30% of their profit as tax and individuals pay up to 47% (including Medicare levy) of their income as tax, with the rate depending on their income. Other types of shareholders will pay tax at rates applicable to them, for instance superannuation funds pay a 15% tax on working-age members’ contributions and earnings, and zero tax for retirees. This separate taxation of the company and its shareholders is known as the ‘classical’ system of corporate taxation and applied in Australia from the early 1940s to up until the introduction of imputation from 1 July 1987.36

Under the classical system of taxing corporate profits, when companies pay dividends to their shareholders the income underlying the dividend is therefore taxed twice – once when the company pays tax on its profits and again when individuals pay tax on their income. The classical system is sometimes referred to as ‘double taxation’.

For example, if a company pays a shareholder a dividend of $700, this amount has already been subject to tax. The original profit was $1,000, less tax of $300 paid by the company. The shareholder receiving the $700 dividend will also pay tax. If the highest tax rate of 47% applies, then another $329 of tax would be paid by the shareholder and the eventual after-tax amount received would be $371. In total, tax of $629 would be paid on the original profit of $1000, a rate of 62.9%.

At the time imputation was introduced in 1987, the company tax rate was 46% and the top marginal personal income tax rate was 50.25% (including Medicare levy) resulting in an overall effective tax rate of 73.14% under the classical system.

Reinhardt and Steel (2006) describe the history of the classical system this way:

From 1940 to 1986, Australia maintained this classical company taxation system, under which profits were taxed at the company rate and at personal rates when distributed. In 1987, Australia introduced an imputation system. Prior to this there had long been calls from business to remove what was seen as double taxation under the two tier classical system. The classical system resulted in both equity and efficiency problems (Australian Government 1985). For example, it provided a disincentive to incorporate, distorted corporate financing decisions by providing a bias towards debt and, combined with the absence of a capital gains tax, provided an incentive for companies to retain profits.

Businesses responded to the classical system in several ways, including:

- Tending towards raising money by ‘debt financing’: taking out loans, where the interest is tax-deductible, rather than issuing shares, where the dividends are not tax-deductible and are taxed at a high rate.

- Issuing shares but paying little or no dividends to shareholders, a less attractive option for investors.

- Paying out company earnings as wages to their proprietors. In turn, this led to complex taxation provisions that limited the income a company could retain or distribute as a payment of interest (for instance, the former Division 7 tax on the retained earnings of private companies).

- Remaining unincorporated, particularly for small businesses. As an unincorporated business, profits are taxed once, through the owner’s personal income tax return. An imputation system reduces incentives for businesses to adopt a particular structure solely for the purposes of reducing tax, allowing them to operate with the structure most suitable for the nature of their businesses.

To avoid distorting business decisions due to double taxation, most countries provide some form of tax ‘relief’ for dividends. The most common is to simply tax both companies and dividends at lower rates. For example, if company profits were taxed at 20% and the dividends received by individuals were also taxed at a flat rate of 20% (separate from other income), then the overall tax rate for the dividend would be 36%. Separate set of rates for dividends, however, do not easily work together with a progressive system of rates for other income.

Other means of providing relief from double taxation of company income include exempting dividends from tax (in full or part) at the shareholder level or alternative systems of corporate tax such as an allowance for corporate capital system or a company level expenditure tax or making dividends tax deductible to companies. Such arrangements inevitably add complexity to the corporate tax system.

A.2 Historical trends in franking activity

Franking account balances increase when companies pay more tax than they distribute to shareholders in the form of franking credits. At the end of the 2020-21 year, companies reported around $450 billion in their combined franking account balances, compared to around $100 billion combined 18 years earlier. Over that time, the stock has fluctuated from around 3 times the amount of company tax paid in each year to an average of around 4.5 times over the past 8 years.37

Chart A1 shows that while franking account balances have increased over time, the increase is not increasing significantly or in a ‘runaway’ fashion compared to the associated company tax.

Chart A1: Total franking account balance (left) and as a percentage of company tax (right)38

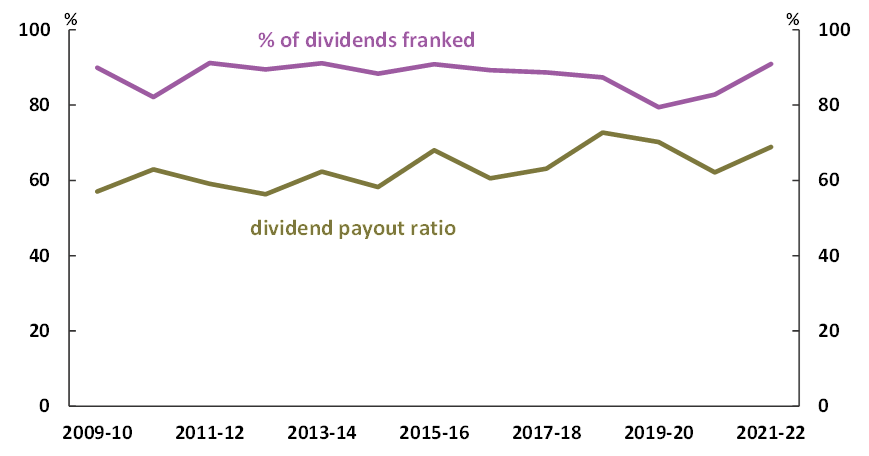

Companies have distributed around 60 per cent of their after-tax taxable profits to shareholders39, with around 80 to 90 per cent of dividends franked (Chart A2).

Chart A2: Dividend payout ratio and the percentage of dividends that are franked

A.3 Discretionary dividend income

Dividend income is most familiar in the context of purchasing shares in large companies listed on the stock exchange. These companies typically distribute yearly dividends of hundreds of millions of dollars, and sometimes billions of dollars, to many thousands of shareholders.

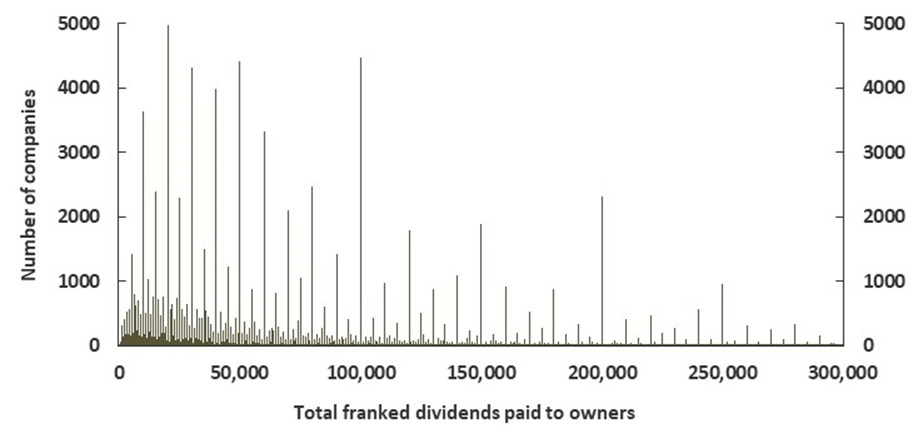

However, for most companies that distribute franked dividends, the total amount for each is less than $100,000, and the amounts are often divisible by multiples of 100. Chart A3 shows the distribution of these small amounts of franked dividends paid by around 120,000 small companies.

Chart A3: Distribution of franked dividends paid by companies to owners40

The ‘spikes’ in the distribution are clear. For example, over 2,000 companies paid their owners exactly $200,000 (which may be split between one or several individuals), while only around 20 companies paid their owners exactly $199,000 or $201,000. The reason for the ‘spikes’ in the distribution is that the owners of these relatively small companies are also the managers, and they decide how much the company will pay in dividends.

The fact that the amounts tend to be rounded demonstrates that the size of dividends is discretionary. The owners control the size of the dividend pay-outs. Control of the size of the dividend has some tax advantages in terms of spreading the income evenly across years rather than receiving more in some years, subject to a higher rate of tax.

For example, consider an individual who receives $1 million over a 10 year period. If the individual receives the money evenly over the decade, at $100,000 each year, the total tax assessed41 will be $208,000. If the individual receives $200,000 every second year and nothing every other year, the total tax assessed will be $280,000. If the individual receives the entire $1 million in one year and nothing in the other 9 years, the total tax assessed will be $416,000.

A corporate (or trust) structure allows the owners to smooth their income out over the years, even though the company’s income may be more volatile. This explains the presence of similar ‘spikes’ in the distribution of dividends received by the individuals who own these small companies, as shown in Chart A4.

The spikes occur just below tax thresholds, illustrating the discretionary nature of dividend flows from companies where the owners and managers are the same individuals. The owners may have other income during the year, but are able to wait until near the end of the year to determine the precise amount of dividends that the company should pay out in order for the owners to stay below a tax threshold (or not far above) and therefore maximise their earnings after tax over several years. Almost a quarter of all gross franked dividends paid to individuals are in these ‘spikes’, and are hence related to discretionary flows from companies.

Chart A4: Value of gross franked dividends received by individuals

Ainsworth, Partington and Warren (2015) Do franking credits matter?, Centre for international Finance and Regulation Working Paper No 058/2015.

Australian Bureau of Statistics (2015), Australian System of Government Finance Statistics: Concepts, Sources and Methods.

Australian Government (1985) , Reform of the Australian Taxation System (draft white paper)

Australian Government (1985), Reform of the Australian Taxation System, Statement.

Australian Government (May 1988), Economic Statement.

Australian Government (25 May 1988), Reform of the Taxation of Superannuation.

Australian Government (26 February 1992), One Nation.

Australian Government (1 August 1998), Tax Reform: Not a New Tax, A New Tax System.

Australian Government (2016), Quick facts from Tax stats 2012-13

Australian Government (2023), Franking credit disclosures, Man, Tan and Lee, Australian Accounting Standards Board Staff Paper.

Australian Taxation Office, Individual income tax rates for prior years.

Australian Taxation Office, Imputation, a short definition.

Australian Taxation Office, Taxation Statistics.

Beggs and Skeels (2005), Market Arbitrage of Cash Dividends and Franking Credits, University of Melbourne Department of Economics, research paper 947.

Brown, Lim and Evans, The impact of full franking credit refundability on corporate tax avoidance, eJournal of Tax Research (2020) vol. 17, no. 2.

Clark, Pridmore, Stoney (2007), Trends in aggregate measures of Australia’s corporate tax level, Economic Roundup.

Heaney (2010), Dividend imputation in Australia: The value of franking credit balances, RMIT University School of Economics, Finance and Marketing, working paper.

Parliament of Australia, Inquiry into the implications of removing refundable franking credits (2018): Submissions.

Parliament of Australia, Treasury Laws Amendment (2023 Measures No. 1) Bill 2023

Reinhardt and Steel (2006), A brief history of Australia's tax system.

Sobeck, Breunig and Evans (2022), Corporate income taxation in Australia: Theory, current practice and future policy directions, Tax and Transfer Policy Institute (TTPI) Policy Report No. 01-2022.

The Treasury, The history of Australia's company tax rate.

The Treasury (2009), Australia's Future Tax System - Final Report - Part 1.

The Treasury (2009), Australia's Future Tax System - Final Report - Part 2, Volume 1.

Tilley, Paul (2024), Mixed fortunes: A history of tax reform in Australia, Melbourne University Press.

PBO costings and other information related to refundability of franking credits

Notes

Notes

[1] Based on the 2023-24 rates and thresholds. Income of $100,000 is liable for tax of $5,092 plus 32.5 cents for each dollar over $45,000, making total tax of $22,967. Other rates, such as the Medicare Levy, have been ignored for this illustrative example.

[2] A brief history of Australia's tax system, Sam Reinhardt and Lee Steel (2006).

[3] See the Australian System of Government Finance Statistics: Concepts, Sources and Methods, Australian Bureau of Statistics, 2015. Part L – The treatment of tax refunds and tax credits in GFS, section 13.142. Franking credits are unusual because the payment is made by one entity – the company – on behalf of another entity. Because the reporting of tax aggregates is commonly at the entity level, separating companies and shareholders, the cash flows related to franking credits may be incorrectly interpreted as ‘negative tax’ for the shareholders.

[4] Australian Government, Tax Reform: Not a New Tax, A New Tax System, 1 August 1998. A key purpose of the amendment was that: “The refunds of excess franking credits would provide a fairer outcome for low-income people in a way consistent with the original objectives of the full imputation system. The overall tax paid on profit distributed by a company or trust to low-income resident individuals would reflect their marginal tax rates. They would not be disadvantaged simply because tax was first paid on the profit by the company or trust.”

[5] With the exception of Division 293 tax on contributions for individuals earning above $250,000, and the Division 296 tax (from 1 July 2025 subject to the passage of legislation) on earnings on the value of superannuation balances above $3 million.

[6] Funds also do not pay tax on investment income for members drawing a pension, which reduces the total tax liability and increasing the chance of a refund of franking credits, but this income accounts for only 10% of the total.

[7] The introduction of refundability from 1 July 2000 did not appear to affect behaviour much, at least initially. In the 4 years before, funds had claimed franking credits worth around 4% of taxable income and in the 4 years after, funds claimed franking credits worth around 4.8% of taxable income. Although claimed franking credits subsequently rose to around 8% of taxable income 15 years later, it is difficult to disentangle the impact of refundability from other major changes, particularly the introduction of tax-free superannuation pensions from 2006.

[8] The concessional contributions cap is due to increase to $30,000 from 1 July 2024.

[9] See the Australian System of Government Finance Statistics: Concepts, Sources and Methods, Australian Bureau of Statistics, 2015. Part L – The treatment of tax refunds and tax credits in GFS, section 13.142. Franking credits are unusual because the payment is made by one entity – the company – on behalf of another entity. Because the reporting of tax aggregates is commonly at the entity level, separating companies and shareholders, the cash flows related to franking credits may appear as ‘negative tax’ for the shareholders.

[10] Another key difference between company tax and PAYG withholding tax on wages is that there is a direct legal link between the withholding tax and the particular individuals who received the wages, while there is no such link between company tax and particular shareholders who will receive the profit through dividends. In fact, in an extreme case the company may be owned by one group of shareholders when it generates its profit but an entirely different group of shareholders when it pays its dividends.

[11] In this case, the immediate deduction of a purchase will mean that the capital cannot be depreciated over the following years, resulting in a higher tax bill in the future, all else being equal.

[12] An alternative way of considering dividend imputation is to think of company tax as the payment for the purchase of a franking credit from the ATO. The company is no worse off, having exchanged cash for an asset of the same value. The franking credit differs from other assets in that it is an asset that can only be passed on to shareholders rather than used directly by the company, and that in some cases the franking credit may never be distributed (see Chapter 3) in which case its value is effectively zero.

[13] Literature on the taxation of Australian corporate income often focusses on the relative impacts on Australian shareholders (who are relatively low taxed) and foreign shareholders (who are relatively highly taxed). Two key issues are the extent that: (a) Australian investors are biased towards Australian companies rather than foreign companies; and (b) foreign investors are discouraged from investing in Australia. Australia tends to maintain a relatively high statutory company tax rate compared to other nations. However, the imputation system means that the rate may not translate into high taxes for domestic investors.

[14] The 15% rate applies to shareholders with taxable income of between $44,626 and $492,300. For lower incomes, the tax rate on dividends is zero, and for higher incomes the rate is 20%.

[15] Like many countries, the United States does not apply the standard personal income tax rates and thresholds to dividend income. Instead, there is a separate ‘schedule’ of tax rates for dividend income. In many countries, these rates are chosen such that the combination of the corporate rate and the dividend rate closely match the top marginal tax rate for individuals. This is sometimes referred to as a ‘schedular rate system’ for taxing dividend income. Such systems do not easily account for individuals’ income as a whole, sometimes necessitating a complex schedule of tax rates for dividend income as well as other income.

[16] The 32.85% combined rate works as follows: consider $100 of profit, which is taxed at 21%, leaving a dividend of $79 paid to the shareholder. The $79 dividend is then subject to the 15% tax on dividend income, another $11.85, for a total tax paid of $32.85.

[17] In order to maximise the use of franking credits, some companies previously sought to ‘stream’ their dividends, meaning to direct the franking credits disproportionately to shareholders able to benefit from them. Anti-streaming laws have been enhanced over several amendments since the introduction of imputation in 1987. Because of this any company wishing to pay a franked dividend must also allocate franked dividends to its international shareholders regardless of if they can use the franking credits.

[18] Many of the tax concessions were removed over the 1990s and 2000s, particularly significant accelerated depreciation arrangements. These were reduced commensurate with a reduction in the statutory company tax rate. Clark, Pridmore, Stoney, Trends in aggregate measures of Australia’s corporate tax level, Economic Roundup (Winter 2007).

[19] eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52003DC0810

[20] A long-term chart of dividend payout ratios, showing a significant increase following the introduction of the imputation system, is found in Do franking credits matter? (2015), Ainsworth, Partington and Warren.

The extent to which the market places a tangible value on franking credits is debated. An Australian Accounting Standards Board Staff Paper, Franking credit disclosures (2023) includes a literature review.

[21] Capital gains tax was introduced at the same time as dividend imputation (1987). Tilley (2024) notes that “the introduction of CGT achieved a more effective taxation of undistributed company income” (p226).

[22] Assuming a 5% rate of return for the company (after depreciation but before tax) and that any dividends paid to shareholders are then invested by the shareholders in other assets, resulting in a return of 5% (which is also subject to the shareholder’s marginal tax rate). Yearly inflation of 2.5% applies to the value of the company. Note that the ‘percentage of profits distributed’ is pre-tax, because it includes the distribution of the franking credits (this amount is therefore not the same as a typical ‘dividend payout ratio’). The calculation assumes that franking credits accumulated from retained earnings are worthless. For simplicity, the line for the 37% marginal rate has been omitted as well as the Medicare levy.

[23] Consistent with largest companies being more likely to be foreign owned and more likely to generate capital gains for shareholders, Heaney (2010) found that “while larger companies are more likely to accumulate franking credit balances over time smaller companies with concentrated shareholdings are less likely to accumulate these balances.”

[24] The imputation system also applies to dividends paid by a resident company to other Australian resident companies. Resident companies that receive franked dividends directly from other resident companies will include the ‘grossed up’ dividend in their taxable income. Excess franking credits are not refundable to a company. The imputation credits can reduce a company’s tax bill to zero and any excess imputation credits can be converted to a tax loss which can be carried forward to future years. This rarely occurs because companies usually earn significant income other than franked dividends.

[25] These transactions are known as an ‘off-market’ share buyback, where the company makes a private offer to shareholders rather than simply buying the shares directly from the share market. The private offer means that the payment by the company may be in the form of dividends with associated franking credits. These dividends are independent of the operation of the company and its normal yearly dividend payouts. While share buybacks are a common occurrence, 2018-19 featured a particularly large number of instances with large dollar amounts involved. Share buybacks were also particularly large during 2021-22. In November 2023, new laws were enacted (Treasury Laws Amendment (2023 Measures No. 1) Bill 2023) which will limit or prevent the use of off-market share buybacks for distributing franking credits.

[26] See, for example, the 2020-21 edition of Taxation Statistics, company detailed tables, Table 1. ‘Company tax’ is shown in row 452 and ‘Franking credits distributed’ is derived from franked dividends paid (row 202), multiplied by 30/70. Since then 2015-16 income year, small companies have been taxed at a lower rate (now 25%) so the franking credits distributed shown in the chart will be slightly over-estimated.

[27] See, for example, The impact of full franking credit refundability on corporate tax avoidance, Brown, Lim and Evans, eJournal of Tax Research (2020) vol. 17, no. 2, pp. 134-167. The paper argues that dividend imputation “provides a strong countervailing influence on the incentives managers of certain firms may have to engage in tax avoidance”, and concludes that “firms undertake less tax avoidance in the post 1 July 2000 period [after the introduction of franking credit refundability] given the presence of stronger incentives for them to pay corporate tax”.

Beggs and Skeels (2005) examined six major legislative amendments intent on improving the efficiency of the dividend imputation system, finding that, “only the most recent tax change, which provided full income rebates for unused franking credits, appears to have caused the market to put a statistically significant value on franking credits.”