Overview

The composition of Commonwealth tax receipts shifts over time as a result of changes in policy and the economic environment, as well as changes in the behaviour of individuals, companies, and other entities.

The sustainability of Australia’s tax system depends on the overall level of taxes as well as the mix of taxes, which influences the efficiency and equity of the tax system overall. Information on the trends within the tax system can help inform judgements about whether enough revenue will be collected to fund a desired level of government spending, and whether the tax system is optimally designed.

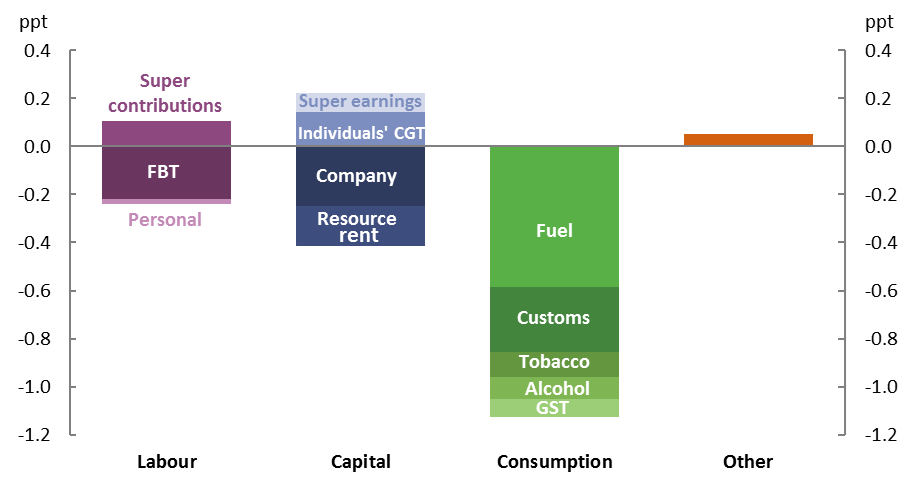

This paper examines the broad trends within the Commonwealth tax system and the risks they present. It shows that since 2001–02, the most significant overall changes in tax receipts as share of GDP have been:

- a fall in fuel excise, driven by the previous freeze to indexation arrangements and ongoing improvements in fuel efficiency

- a fall in customs receipts as free trade agreements and other tariff changes have come into effect

- a fall in company tax receipts as investment has become more concentrated in capital intensive industries, which have higher losses that are carried forward.

The changes to tax receipts since 2001–02 are shown in Figure 1.

Figure 1: Change in tax receipts as a share of GDP (2001-02 to 2015-16

Based on recent trends and current policy, the coming decade is likely to see further changes to tax receipts, including:

- a decrease in company tax receipts due to policy changes, though there could be a counteracting positive effect as losses carried forward in the resources industry are exhausted

- an increase in personal income tax receipts due to ongoing bracket creep, notwithstanding the Personal Income Tax Plan in the 2018–19 Budget

- ongoing decreases in various consumption tax receipts, driven by consumer behaviour and technological change.

Looking beyond these trends, there remain risks to tax receipts from other sources. Internationally, there is increasing uncertainty stemming from policy changes in company tax rates and tariffs, both of which could have flow-on effects for Australia. At the same time, the peer to peer ‘share economy’ is growing, which may increase the volatility in personal income tax receipts as well as increasing the scope for tax minimisation, although the impacts of this are not yet evident.

Overall, given current policy settings and recent consumption and structural trends, there is a likelihood that taxes on consumption will continue to trend downwards, taxes on capital will be flat or trend downwards and an increasing proportion of labour income will be taxed concessionally through the superannuation system. If these risks to tax receipts eventuate, and in the absence of other taxation reforms, maintaining Commonwealth Government revenue at recent levels as a share of GDP will lead to an increasing reliance on taxes on labour income through the personal income tax system.

Download the full report above.