Overview

The cost of the Higher Education Loan Programme (HELP) is growing strongly driven by the introduction of the demand driven approach to higher education funding, recently announced policy decisions to reduce subsidies for university courses and to allow universities to set their own course fees, and expansion of HELP loans to vocational education.

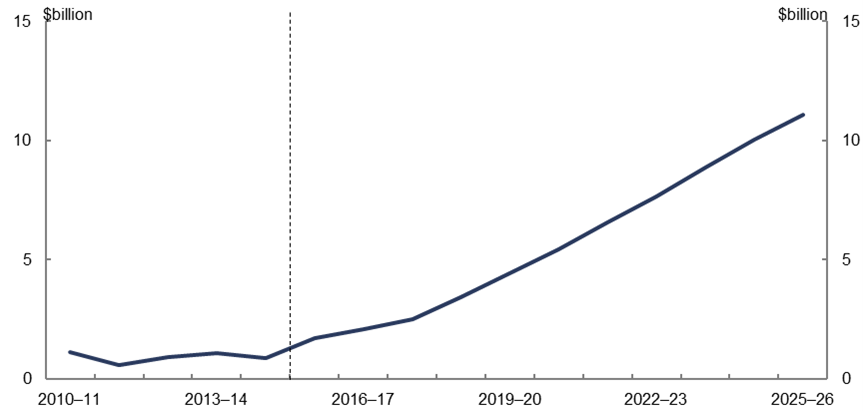

The Parliamentary Budget Office (PBO) projects that the annual cost of HELP loans on an underlying cash basis will rise from $1.7 billion in 2015–16 to $11.1 billion in 2025–26 (Figure 1).

Figure 1: HELP loan portfolio – annual cost on an underlying cash balance basis

The two key sources of the costs of HELP are the concessional interest rate charged on the loans and the doubtful debt cost of loans that are not expected to be repaid. The underlying cash balance reflects the concessional interest rate cost through the shortfall in annual interest receipts on the loans relative to annual public debt interest payments on borrowing used to finance the loans. It also indirectly reflects the doubtful debt costs through increasing public debt interest costs on the outstanding loans that are unlikely to be repaid.

Doubtful debt costs associated with new loans are projected to increase from $1.9 billion (or 19.0 per cent of new loans) in 2015–16 to $4.0 billion (or 21.8 per cent of new loans) in 2025–26. Concessional interest rate costs for new loans are projected to increase from around $1.0 billion (or 10.2 per cent of new loans) in 2015–16 to $2.4 billion (or 13.1 per cent of new loans) in 2025–26.

The full cost of HELP is included in the overall budget underlying cash balance but it is not separately identified in the budget papers. The growing impact of HELP is largely due to policy decisions taken since 2008, particularly the introduction of the demand driven funding model and the announced policies to reduce government subsidies and to allow universities to set their own fees.

The financial consequences of these policy changes were not fully transparent because the published impact of measures affecting HELP are presented on a fiscal balance basis which does not include doubtful debt costs. Also, the published impact of HELP measures does not include the public debt interest cost which is accounted for globally in the budget. As a result, the published costs of these measures only provide a partial picture of the budget impact of the policy decisions.

The annual cost of HELP on an underlying cash balance basis shown in Figure 1 highlights the long term consequences of policy decisions relating to HELP loans. It reinforces the importance of understanding the medium term costs of major programmes in considering policy priorities and fiscal sustainability.

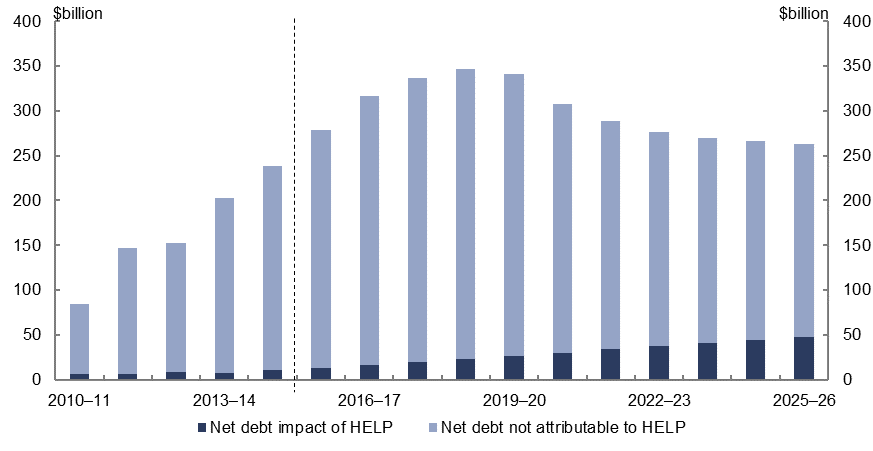

HELP loans also increase the size of net debt because the borrowing used to fund these loans exceeds the value of loans on the balance sheet, which is reduced to account for the concessional interest rate and the provision for doubtful debt. Net debt attributable to the HELP portfolio is projected to rise from $13.4 billion in 2015–16 to $48.1 billion in 2025–26. This will see the proportion of net debt attributable to HELP increase from 4.8 per cent in 2015–16 to 18.3 per cent in 2025–26 (Figure 2).

Figure 2: HELP loan portfolio – impact on net debt

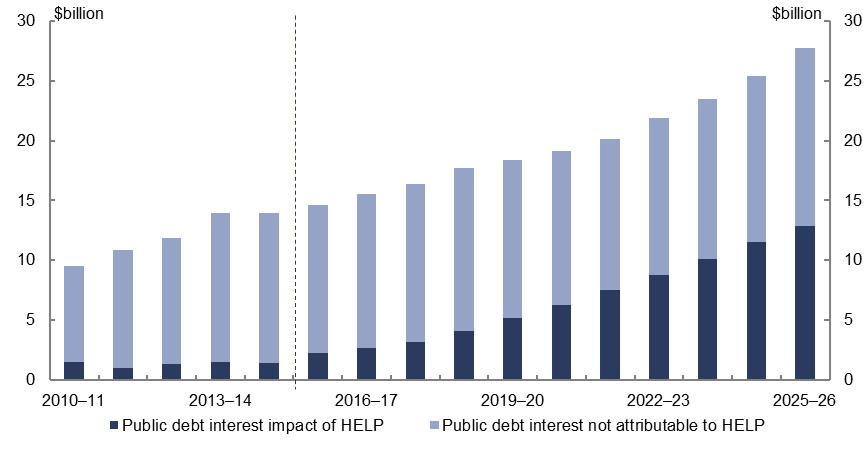

The public debt interest cost of financing the HELP loan portfolio is projected by the PBO to grow strongly as the value of outstanding loans increases. Public debt interest attributable to the HELP loan portfolio is projected to rise from $2.2 billion in 2015–16 to $12.8 billion in 2025–26. The proportion of Australian Government public debt interest required to finance outstanding HELP loans is projected to increase from 15.4 per cent in 2015–16 to 46.3 per cent in 2025–26 (Figure 3).

Figure 3: HELP loan portfolio – impact on public debt interest

Download the full report above.

See also the supplementary report.