Introduction

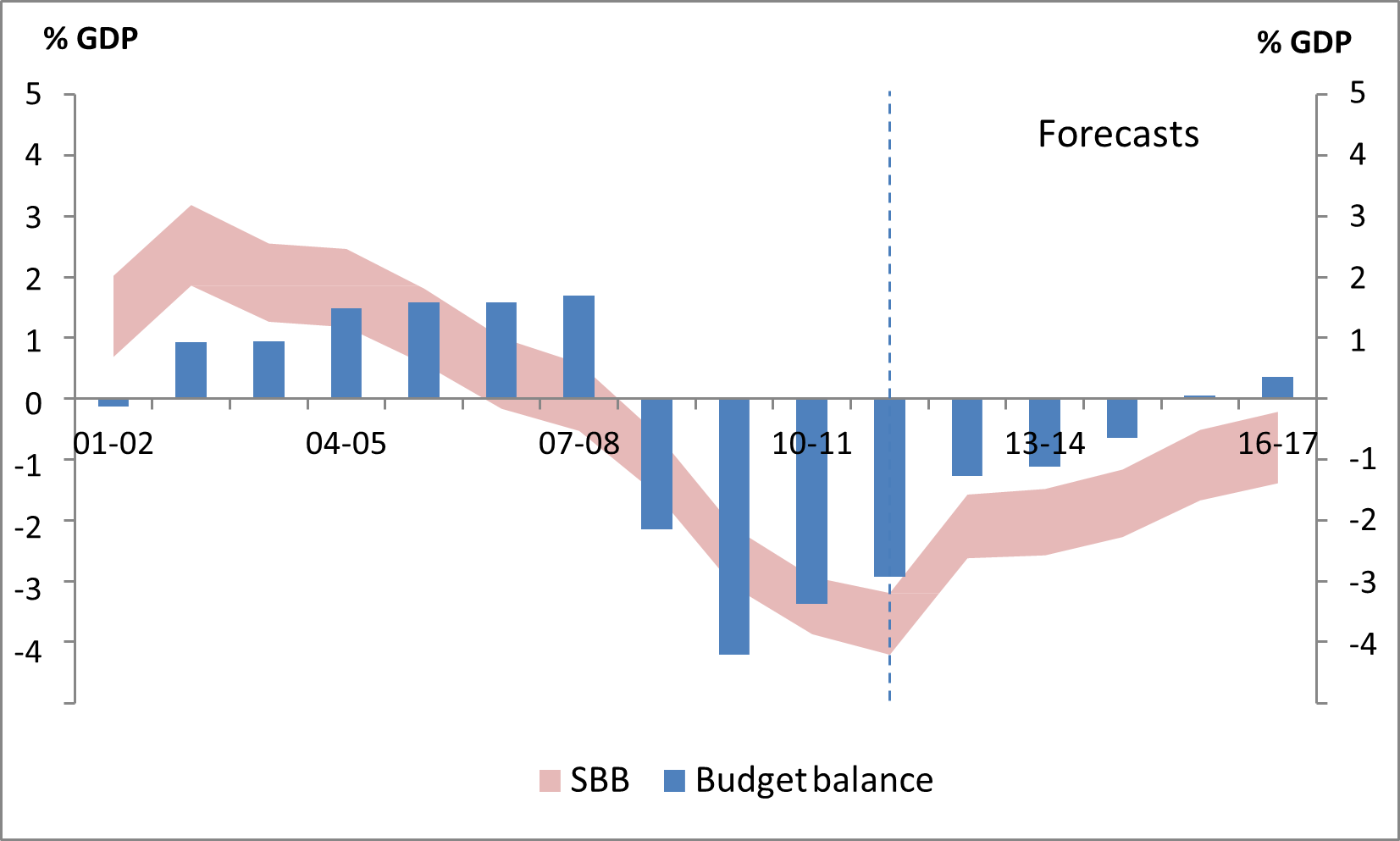

The structural budget balance (SBB) is a partial measure of the sustainability of the budget. It shows the underlying position of the budget after adjusting the actual budget balance for the impacts of major cyclical and temporary factors. The SBB reflects the impacts of underlying budgetary trends and discretionary fiscal policy decisions.

Taken in isolation, the SBB does not provide a sufficient basis for short-term fine tuning of fiscal policy. However, if estimated on a regular basis and considered together with other measures of budget sustainability, including the health of the government’s balance sheet and debt sustainability, the SBB is a useful additional tool that can help to inform the government’s fiscal policy stance over the medium term.

The SBB is a measure that is widely reported by fiscal authorities and parliamentary budget organisations in many advanced economies. International institutions, including the OECD and the IMF, also publish estimates of the SBB for member countries.

In this report, the Parliamentary Budget Office (PBO) has prepared estimates of the SBB over the period 2001-02 to 2016-17. Because of the uncertainties surrounding the estimates of certain key variables in the calculation of the SBB, in particular the structural level of the terms of trade, the PBO’s estimates of the SBB are presented within a plausible band rather than as point estimates.

The upper bound of the SBB estimates has been chosen to moderate the record high growth that occurred in the terms of trade over the period 2003-04 to 2011-12. The lower bound recognises that the terms of trade is likely to remain above its long-term average, in particular due to the continuing rise of China as a major economic power.

The PBO’s estimates of the SBB exclude the impact of the economic cycle, the temporary fiscal stimulus in response to the Global Financial Crisis (GFC) and the more extreme movements in the terms of trade.

The estimates have been prepared using internationally accepted methodologies. They incorporate the latest economic forecasts and budget estimates published in the 2013-14 Budget.

Key findings

The Parliamentary Budget Office’s structural budget balance estimates

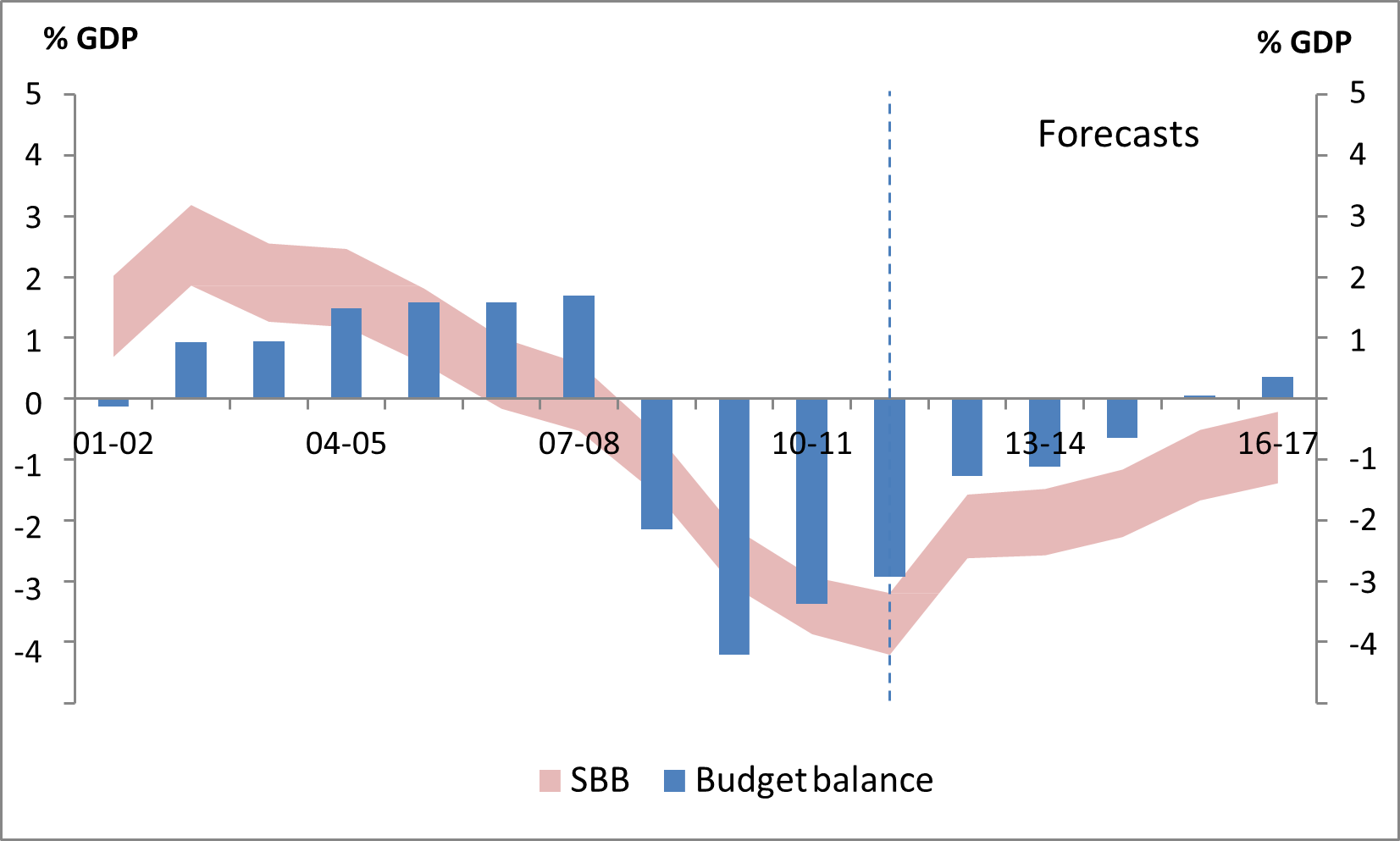

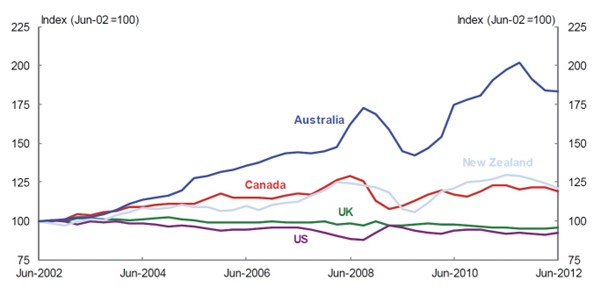

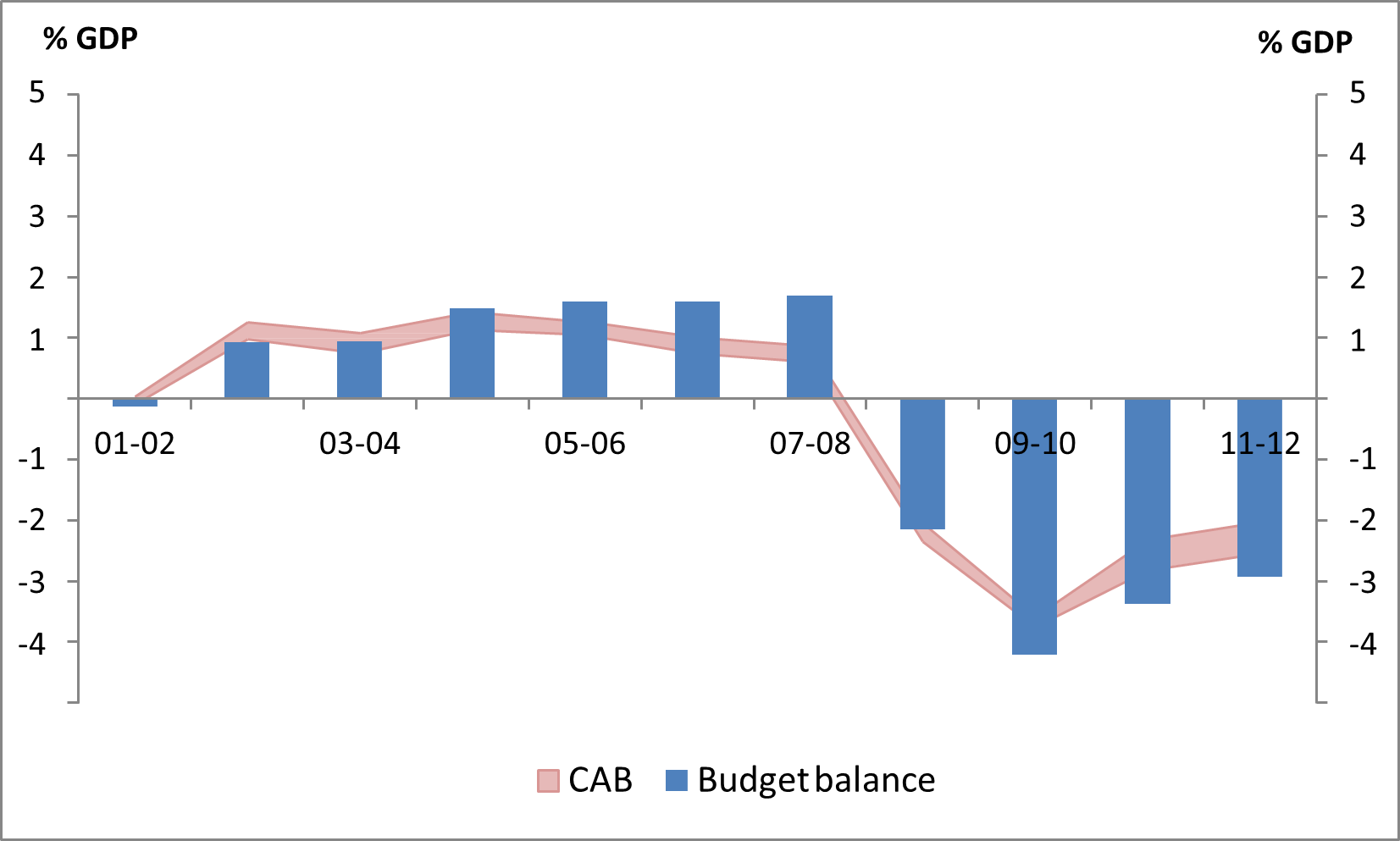

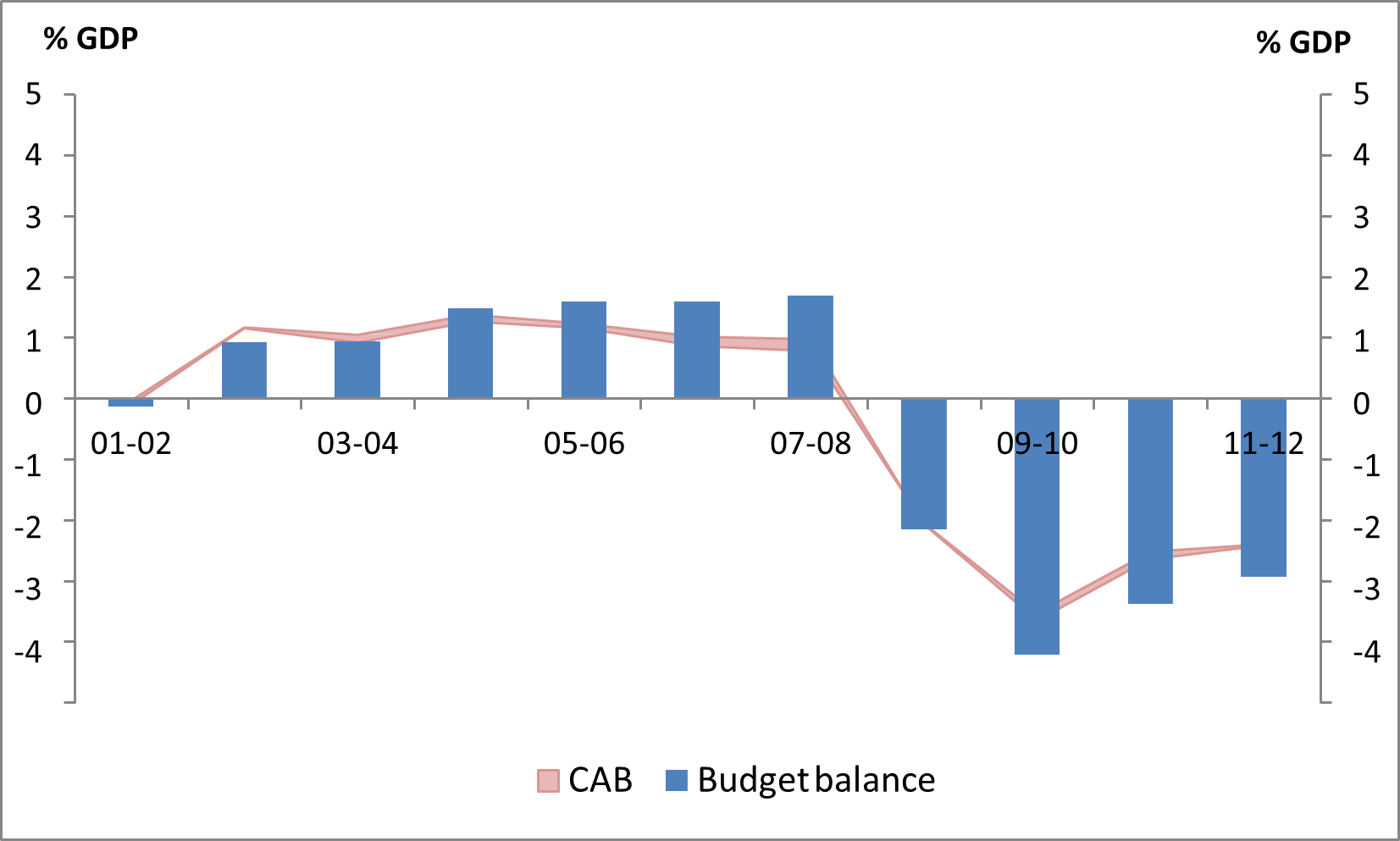

The PBO’s estimates of the SBB are shown in Figure 1 below.

Source: PBO, Budget Papers, ABS.

The estimated SBB declined steadily over the period 2002-03 to 2011-12. From a structural surplus in the range of 1¾ to 3¼ per cent of GDP in 2002-03, the estimated SBB moved into structural balance briefly somewhere in the period 2006-07 to 2007-08 before falling to a structural deficit of around 3¼ to 4¼ per cent of GDP in 2011-12. It then showed a sharp improvement in 2012-13 with the structural deficit recovering to around 1½ to 2¾ per cent of GDP. Based on the latest budget estimates further improvement is expected from 2013-14 with the structural deficit in 2016-17 estimated at between ¼ and 1½ per cent of GDP.

Key drivers of the structural budget balance

These trends in the SBB estimates can be explained by changes in the structural levels of government receipts and payments. From the SBB peak in 2002-03 to its trough in 2011-12, the structural level of receipts excluding GST fell by around 5 percentage points of GDP. The structural level of government payments excluding GST over this period rose by around 1 percentage point of GDP and hence the SBB fell into deficit1. Over the period 2011-12 to 2016-17 the structural level of receipts is expected to increase by approximately 1¾ percentage points of GDP while the structural level of payments is expected to decline by around 1 percentage point of GDP leading to the expected reduction in the structural deficit over the period of the 2013-14 budget and forward estimates years.

Over two thirds of the 5 percentage points of GDP decline in structural receipts over the period 2002-03 to 2011-12 was due to the cumulative effect of the successive personal income tax cuts granted between 2003-04 and 2008-09. A further quarter was the result of a decline in excise and customs duties as a proportion of GDP. Significant factors driving this trend included the abolition of petroleum fuels excise indexation in the 2001-02 Budget and the decline in the consumption of cigarettes and tobacco over the period. In contrast, the structural level of company tax receipts as a proportion of GDP remained relatively stable over the period. The estimated 1¾ percentage point increase in structural receipts over the period 2011-12 to 2016-17 is mainly the result of increasing personal tax receipts due to the impact of bracket creep (fiscal drag) and the net effect of government policy decisions. A further contributor to the increase in the structural level of receipts is the introduction of the Carbon Pricing Mechanism and the Minerals Resource Rent Tax in 2012-13.

Contributing to the decline in the estimated structural deficit over the period of the 2013-14 budget and forward estimates years is the impact of the savings that have been identified to fund the National Plan for School Improvement and DisabilityCare Australia. This is because the level of savings over this period is greater than the costs of these schemes.

Beyond the forward estimates years, however, these savings will be largely consumed by the costs of the schemes and, therefore, they will no longer be available to alleviate pressure on the SBB.

Implications of the structural budget balance

Under the Charter of Budget Honesty Act 1998 Australian governments must specify their long-term fiscal objectives within which shorter-term fiscal policy will be framed. Since the adoption of the Charter of Budget Honesty, successive governments have sought either to maintain budget balance on average over the course of the economic cycle or to achieve surpluses on average over the medium term. By abstracting from cyclical and temporary factors, regular estimation of the SBB could help inform the likelihood of governments being able to achieve their long-term fiscal objectives.

The SBB, viewed in the context of the health of the government’s balance sheet, is also an indicator of the underlying strength of the government’s fiscal position and its capacity to respond to adverse economic and fiscal shocks. The PBO’s analysis suggests that the budget has been in structural deficit since 2006-07 or 2007-08 and that, while declining, the structural deficit will persist at least until 2016-17. At the same time, the government’s balance sheet is in a strong position. The level of government net debt, which in the 2013-14 Budget is forecast to peak at 11.4 per cent of GDP in 2014-15, is low by international standards. This provides a degree of fiscal space for the government to continue to address the underlying structure of the budget and maintain its sustainability.

Derivation of the structural budget balance

Defining the structural budget balance

The SBB is the actual budget balance adjusted for cyclical and other temporary factors. It provides a measure of how underlying budgetary trends and discretionary changes in fiscal policy impact on the budget balance.

Structural Budget Balance (SBS) = Actual Budget Balance - Cyclical Component - Other Temporary Factors

The economic cycle impacts on tax revenue and government expenditure through the operation of the so called automatic stabilisers, tax revenue and unemployment benefit payments. The cyclically-adjusted budget balance adjusts the actual budget balance for the impact of these factors. Other temporary factors will also influence tax revenue and government expenditure. Such factors might include changes in asset and commodity prices, changes in output composition, and large one-off revenue and expenditure impacts.

Cyclically-adjusted budget balance

The details of how the cyclically-adjusted budget balance (CAB) is calculated are contained in the technical appendix to this report. In summary it is first necessary to remove the cyclical component of the actual budget balance (the actual budget balance used in this analysis is the underlying cash balance). To do this an estimate is made of the extent to which the actual output of the economy is either above or below the economy’s potential output, that is output produced when the economy is operating at full capacity, consistent with stable inflation.

This measure of the deviation of actual output from potential output is referred to as the output gap and is expressed as a percentage of potential output. A positive output gap occurs when actual output is above its estimated potential while a negative output gap occurs when actual output is below its estimated potential.

Output Gap = (Actual Output - Potential Output)/Potential Output x 100)

Having derived an estimate of the output gap it is then necessary to determine the impact of the output gap on the budget balance by estimating the sensitivity of tax revenue and government expenditure to this gap. This sensitivity is referred to as an elasticity and measures the degree to which the level of tax revenue and government expenditure will change as a result of a change in the output gap.

While the sensitivity of tax revenue to the output gap can be estimated using total tax revenue, a more accurate result is achieved by disaggregating total tax revenue into its major components because different components have different economic drivers. In this analysis individual revenue elasticities have been derived for personal income tax and company tax.

Total government expenditure is treated as almost entirely structural with the exception of unemployment benefit payments and the temporary fiscal stimulus spending in response to the GFC.

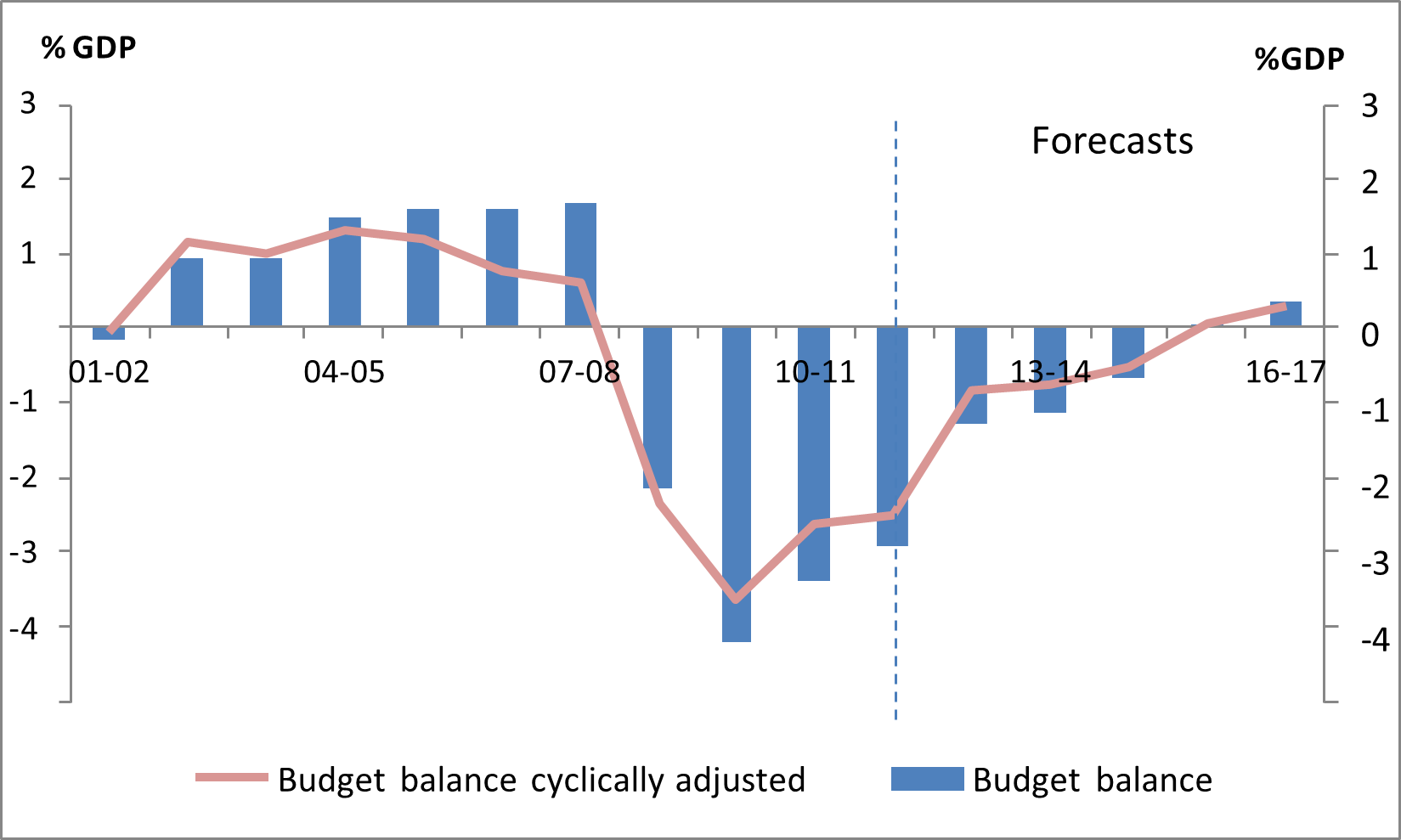

The CAB is presented in Figure 2. This estimate includes an adjustment for the impact of large asset price movements on capital gains tax (details are contained in the technical appendix).

Source: PBO, Budget Papers, ABS.

The results suggest that the CAB was in surplus for most of the past decade. It was broadly flat up to the middle part of the past decade, generally following the profile of the actual budget balance. The CAB surplus declined from 2005-06 and, following the onset of the GFC, fell to a deficit of around 3¾ per cent of GDP in 2009-10. From this position the deficit slowly recovered in line with developments in the actual budget balance as the temporary fiscal stimulus was withdrawn. Over the forward estimates, the CAB is expected to move into a small surplus in 2016-17. The reason for such a close correspondence between the actual budget balance and the estimated CAB reflects the estimates of the output gap over this period.

Source: PBO, Budget Papers, ABS.

The output gap was positive through most of the early and middle parts of the past decade thus resulting in the cyclically-adjusted budget surpluses being slightly smaller than the actual budget surpluses. Over the period 2008-09 to 2011-12 following the GFC, in contrast to most other advanced economies, the output gap has been only slightly negative and thus the cyclically adjusted budget deficits have been slightly smaller than the actual budget deficits. Over the forward estimates years the CAB is forecast to improve as the negative output gap closes.

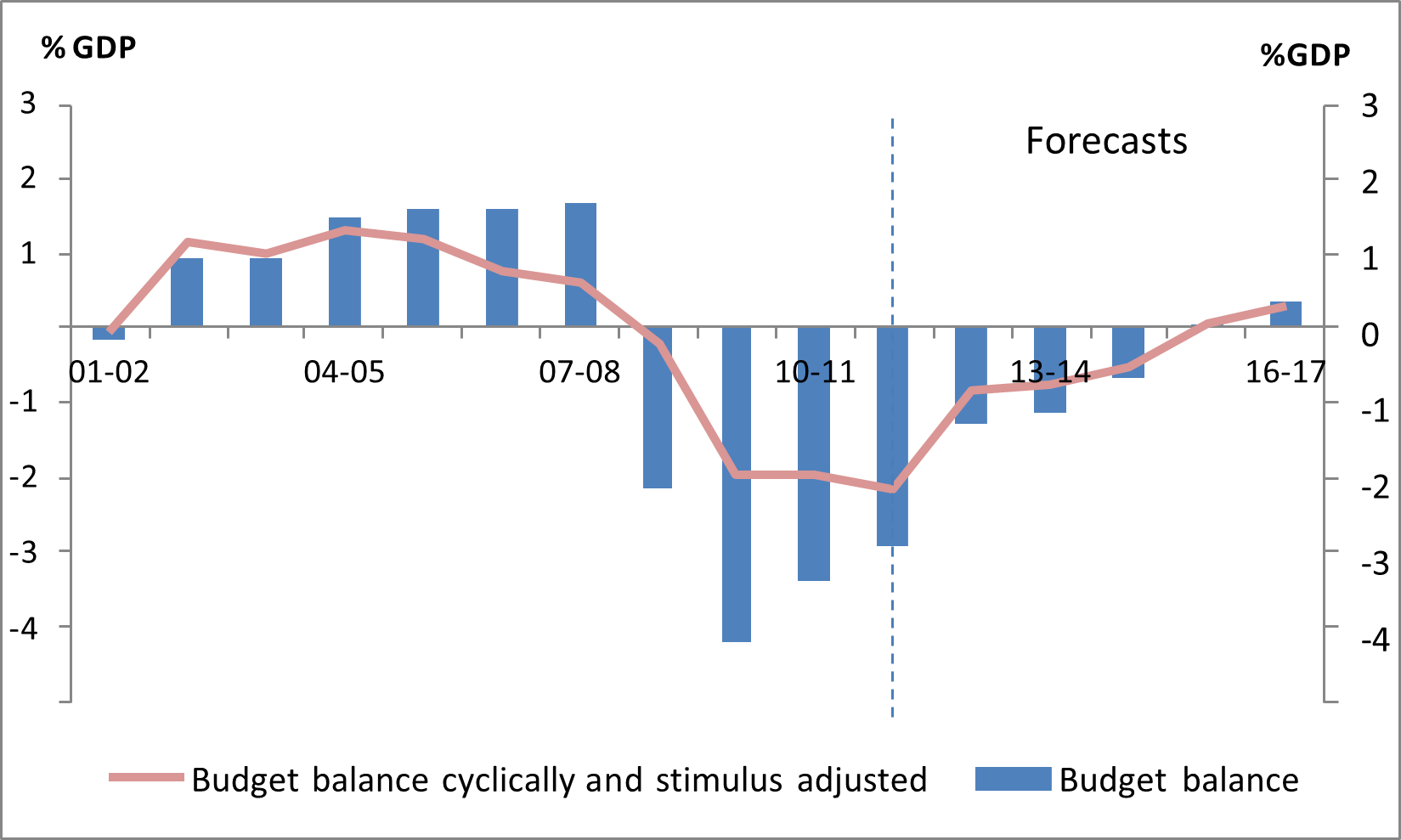

Removing the temporary fiscal stimulus

The movement in the CAB from surplus to deficit from 2007-08 to 2009-10 was heavily influenced by the temporary fiscal stimulus spending in response to the GFC. While clearly discretionary, such a large fiscal policy measure masks the underlying trend in the CAB and SBB. The IMF (2011) suggests that to gain a better understanding of the trend in the CAB and the SBB, major revenue and expenditure items that are clearly temporary (one-off) should be removed.

Accordingly, given the extraordinary nature of the circumstances that led to the fiscal stimulus, its large size and, most importantly, its temporary nature, the analysis removes the fiscal stimulus from the estimates of the CAB and SBB. It should be noted that while the fiscal stimulus spending has been excluded as a one-off item, the associated ongoing rise in debt interest payments has been retained.

To determine the size and profile of the fiscal stimulus, the spending packages identified in Treasury (2009) were examined and adjusted to ensure that the fiscal stimulus only included spending and revenue items that were one-off in nature. The size of the temporary fiscal stimulus is estimated to be $27 billion in 2008-09, $23 billion in 2009-10, $12 billion in

2010-11 and $5 billion in 2011-12. Figure 4 displays the profile of the CAB excluding the fiscal stimulus.

Source: PBO, Budget Papers, ABS.

The removal of the fiscal stimulus results in a smaller CAB deficit over the period 2009-10 to 2011-12 with the trough of 2¼ per cent of GDP pushed out to 2011-12.

Adjusting for the terms of trade

The dramatic rise in the terms of trade over the past decade has significantly boosted national incomes and hence tax revenues. While it is likely that the terms of trade will not fall back to its long term average it is also likely that only part of the rise in the terms of trade is structural. Thus an adjustment to the actual budget balance is required to remove the temporary component of the terms of trade. This is a difficult task and requires an assessment of the level that the terms of trade will converge to over the next few years as demand and supply for Australia’s iron ore and coal commodities align.

The increase in Australia’s terms of trade over the period from 2003-04 until 2011-12 has been dramatic by historical and international standards as displayed in Figure 5 from the Treasury (2012) forecasting review. Indeed, as noted by Treasury the rise in the terms of trade has been exceptional when compared with other advanced and commodity exporting countries.

Source: Treasury.

The process of urbanisation in Asia combined with the region’s rapid growth, industrialisation and infrastructure building has resulted in strong demand for energy and mineral resources. The Chinese economy has been at the forefront of these developments and has led this growth in demand for resources. For Australia, this strong demand resulted in a rapid rise in the prices of commodities, particularly iron ore and coal, through most of the past decade resulting in a strong sustained surge in the terms of trade and a significant contribution to national income. While it appears that iron ore and coal prices and thus the terms of trade peaked in late 2011 the strong demand for energy and mineral resources is expected to continue for some years to come as the Asian economies continue to grow and transform.

Sustained high energy and mineral prices have resulted in a global resources investment boom as resources companies have sought to increase production to meet this sustained demand.

Both demand and supply developments will impact on the price outlook for resources. While there are many short-term forecasts of commodity prices, to the PBO’s knowledge there have been no detailed studies that attempt to estimate the structural level of these commodity prices and therefore by implication the structural level of Australia’s terms of trade.

In the absence of a well-researched point estimate of the structural terms of trade, an approach that adopts a range of estimates of the structural terms of trade and therefore the SBB adjusted for the terms of trade effect is appropriate to reflect this uncertainty. McDonald et al (2010) adopted an assumption that the structural terms of trade was 20 per cent above the 30 year average. Recognising the arbitrary nature of this assumption, the authors also produced a 20 per cent bound and a 40 per cent upper bound for the terms of trade around their central estimate.

The lower bound of the structural terms of trade adopted by the PBO in this report is a historical average calculated over the period 1989-90 to 2011-12. This is a conservative estimate and suggests that most of the rise in the terms of trade seen over the period 2003-04 to 2011-12 was temporary despite the dramatic changes occurring in the Asian region.

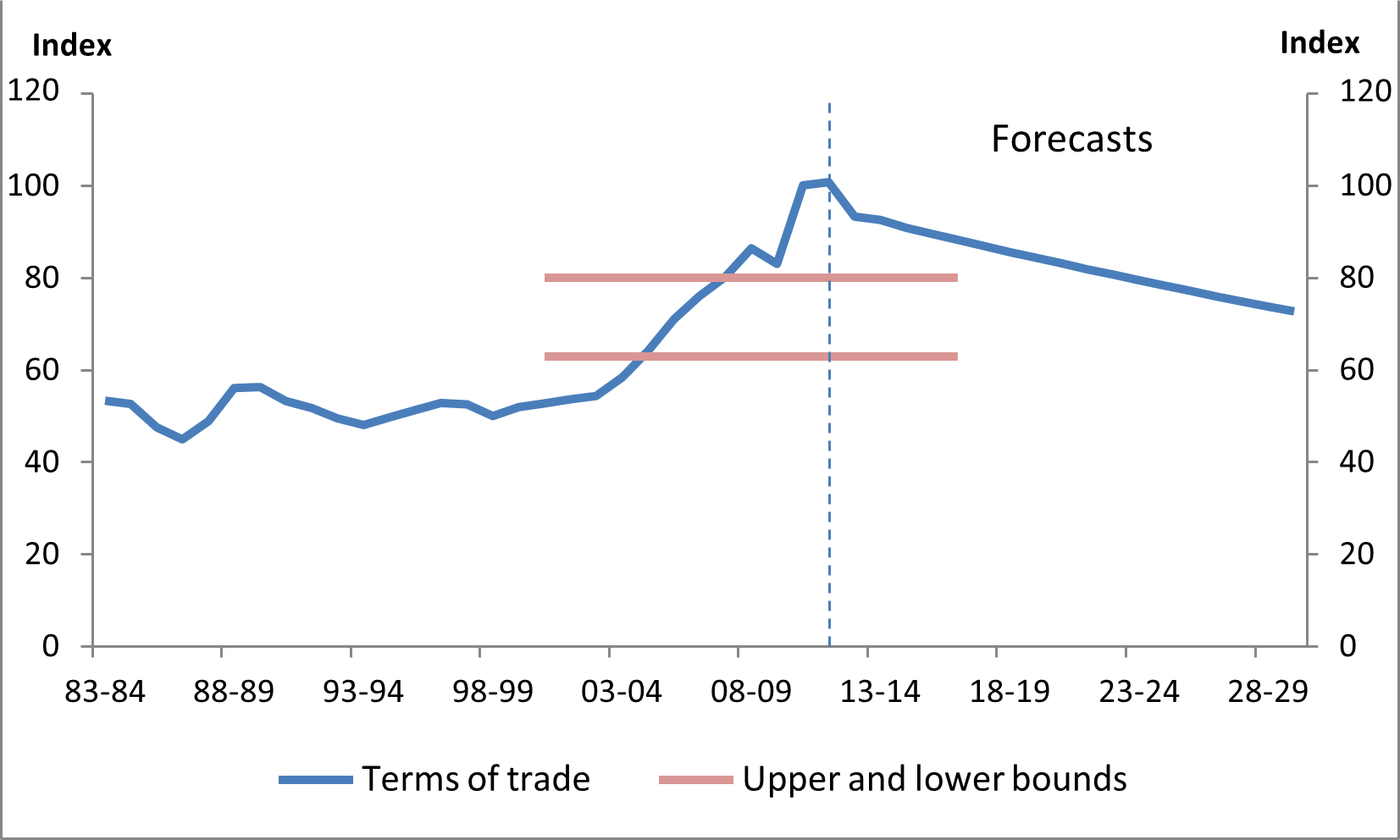

Determining the upper bound for the structural terms of trade is more problematic. For this report the PBO has taken the average of the terms of trade over the period 2003-04 to 2011-12 which captures the period over which the terms of trade rose most strongly. This assumption reflects a view that the changes witnessed in the Asian region have raised the structural level of Australia’s terms of trade but the extent of the recent rise is partly temporary. Figure 6 highlights the actual and the 2013-14 Budget forecast terms of trade, and the PBO’s chosen range of the structural terms of trade.

Source: PBO, Budget Papers, ABS.

The upper and lower terms of trade scenarios are used to derive the band within which the SBB estimates are most likely to occur. The PBO has followed the OECD (2006) and Barnett et al (2010) methodologies to calculate the income gap which is a combined measure of the output gap, already discussed, and the terms of trade gap, that is the gap between the actual terms of trade and the structural terms of trade. Given there are two structural terms of trade estimates (one for each of the lower and upper bounds) there are also two income gap estimates.

Income Gap = Real Output Gap + Share of Exports to GDP x (Terms of Trade - Structural Terms of Trade)

Given the two income gap estimates (due to the two structural terms of trade estimates) and the short period over which it is estimated that the structural level of the terms of trade has changed, the PBO has chosen not to estimate tax revenue elasticities with respect to the income gaps. Instead the estimated tax revenue elasticities with respect to the output gap (used earlier to derive the CAB) are applied to the income gaps to determine structural receipts. This approach assumes that the individual receipt components have the same sensitivity to the output gap and the income gap.

Figure 7 shows estimates of the SBB reflecting the adjustments to the actual budget balance for the economic cycle, asset prices, the temporary fiscal stimulus and the terms of trade. (This is the same chart that appears as Figure 1 in the key findings section of this report.)

Source: PBO, Budget Papers, ABS.

The estimated SBB declined steadily over the period 2002-03 to 2011-12. From a structural surplus in the range of 1¾ to 3¼ per cent of GDP in 2002-03, the estimated SBB moved into structural balance briefly somewhere in the period 2006-07 to 2007-08 before falling to a structural deficit of around 3¼ to 4¼ per cent of GDP in 2011-12. It then showed a sharp improvement in 2012-13 with the structural deficit recovering to around 1½ to 2¾ per cent of GDP. Based on the latest budget estimates further improvement is expected from 2013-14 with the structural deficit in 2016-17 estimated at between ¼ and 1½ per cent of GDP.

Uncertainty of the CAB and SBB estimates

Estimates of the CAB and SBB are sensitive to estimates of the output gap, elasticity values and other key assumptions such as the assumed structural level of the terms of trade.

There are many approaches to estimating potential GDP and therefore the output gap estimate can vary depending on the approach adopted. The estimation used to calculate the elasticities is also subject to uncertainty. Testing of these uncertainties (contained in the technical appendix) shows that estimates of the CAB are only moderately impacted by differences in estimates of the output gap and elasticity values.

The main degree of uncertainty arises from the assumed structural level of the terms of trade. Given this uncertainty, the analysis presents estimates of the structural level of the terms of trade and, therefore, the SBB within a plausible band rather than as point estimates.

Technical appendix

Detailed methodology

This appendix contains the details of the estimation of the CAB and the SBB. It is divided into five parts including estimating potential output, estimating the elasticities, adjusting capital gains tax receipts, examining uncertainty, and presenting a comparison with other recent estimates of the SBB for Australia by the OECD and IMF.

Estimating potential GDP

The first step in calculating the SBB is to estimate the economy’s level of potential real GDP (output) and then calculate the output gap (ie the gap between potential and actual real GDP). Given that potential output is not observable it has to be estimated. There are many methods that can be employed to estimate potential output which range in complexity. Approaches include statistical filtering through to fully specified models that are econometrically estimated. Depending on the approach adopted and the data used, estimates of potential output and therefore the output gap can vary for the same economy. A comparison of estimates is discussed later in the appendix.

This report adopts the commonly used approach of deriving potential output from a two-factor Cobb-Douglas economy-wide production function of actual output. This approach has been adopted as it is intuitively easier to understand what is influencing potential output than approaches using multivariate and/or Kalman filtering and econometric estimation of a production function. An area of further work would be to fully explore the range of techniques for estimating potential output.

This Cobb-Douglas approach can be expressed in the following form:

Real GDP (output) = 0.6 x Hours Worked + (1 - 0.6) x Capital Stock + Total Factor Productivity

To calculate potential output and therefore the output gap it is necessary to derive trends of the three inputs used in the production function, namely the capital stock, total hours worked and total factor productivity. The capital stock is assumed to be at its trend.

Total hours worked can be broken down into its key components of average hours, the unemployment rate, the participation rate and the working age population. The following formula defines the calculation for trend total hours:

Trend hours worked = (working age population x trend participation rate x (1 - trend unemployment rate) x trend average weekly hours worked) x 52

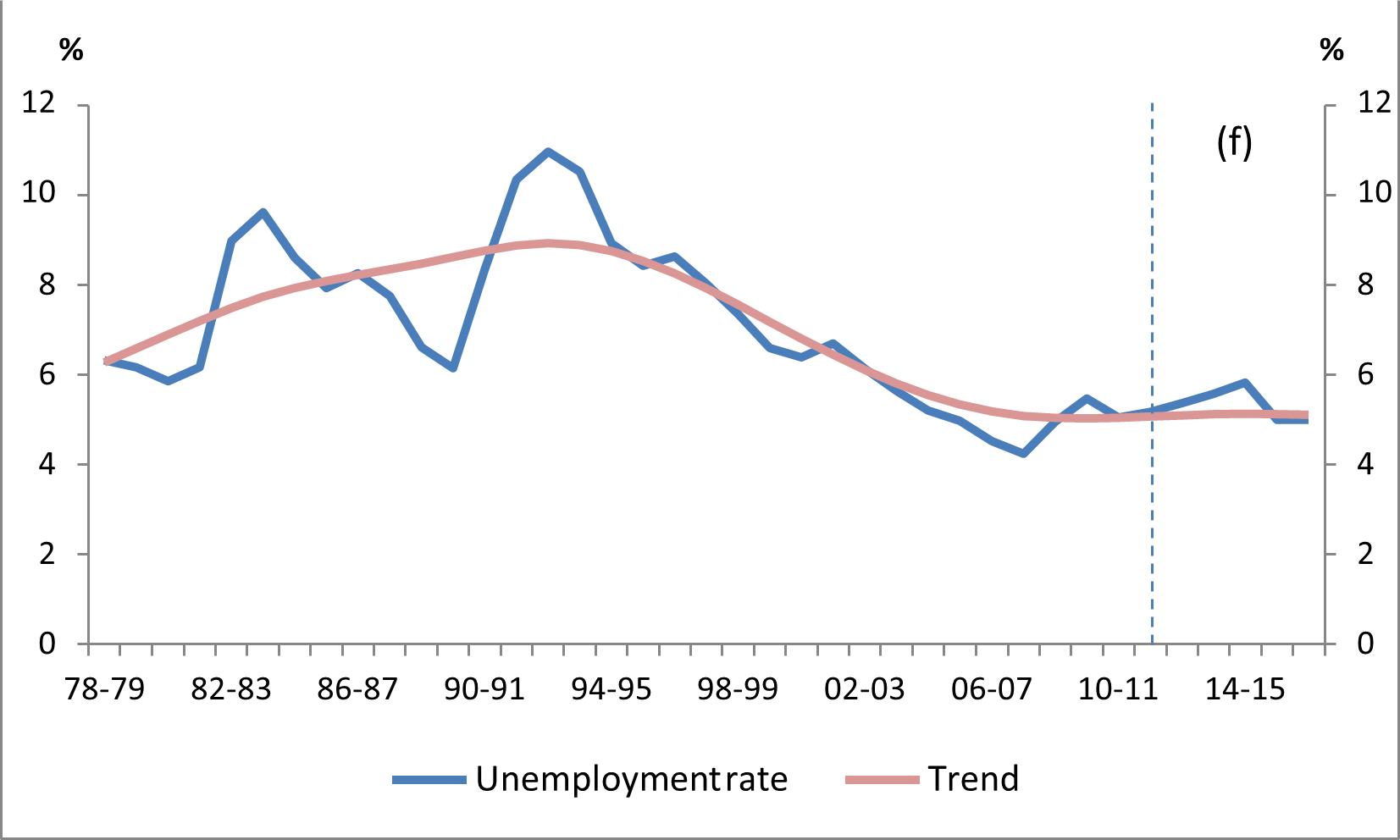

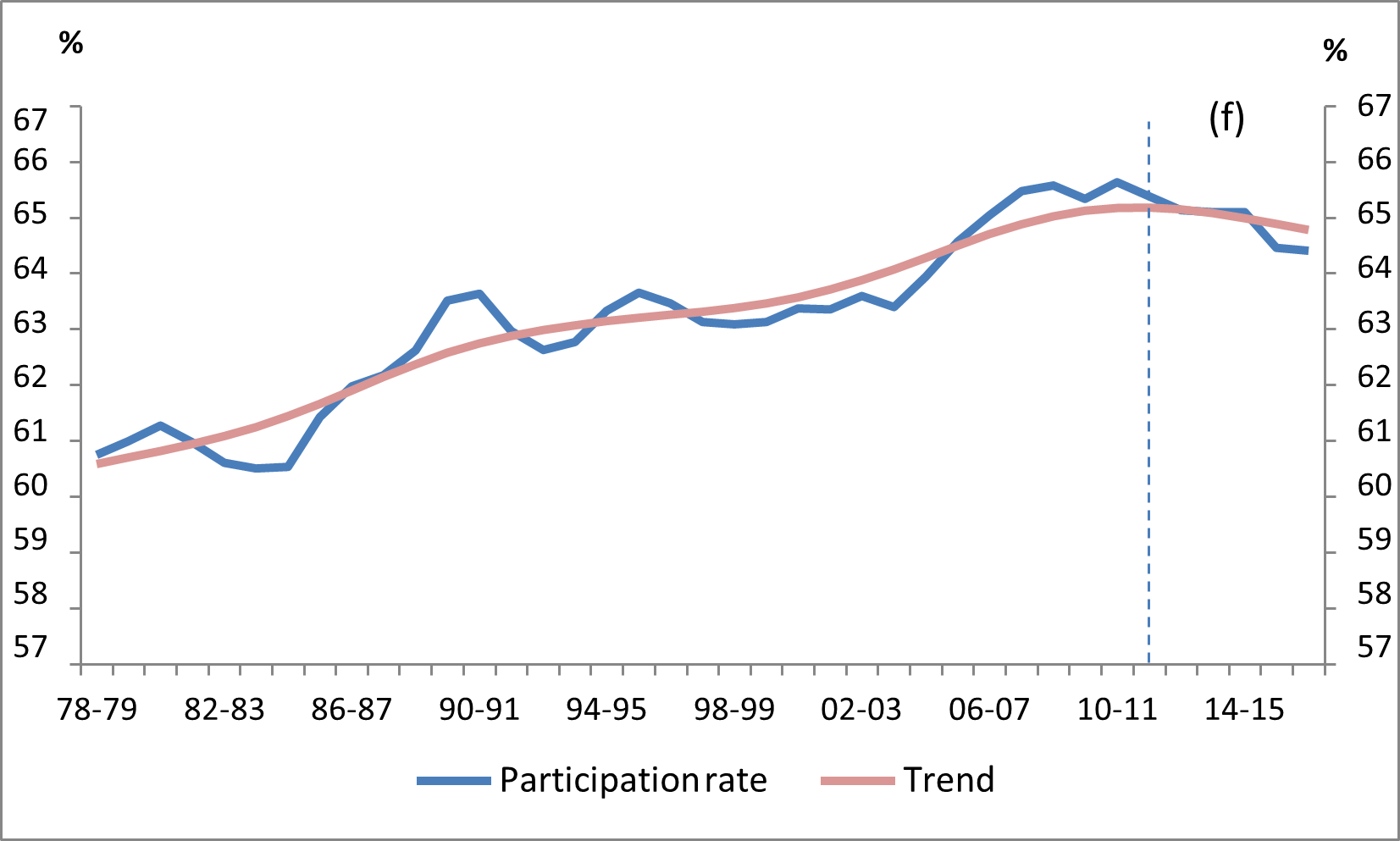

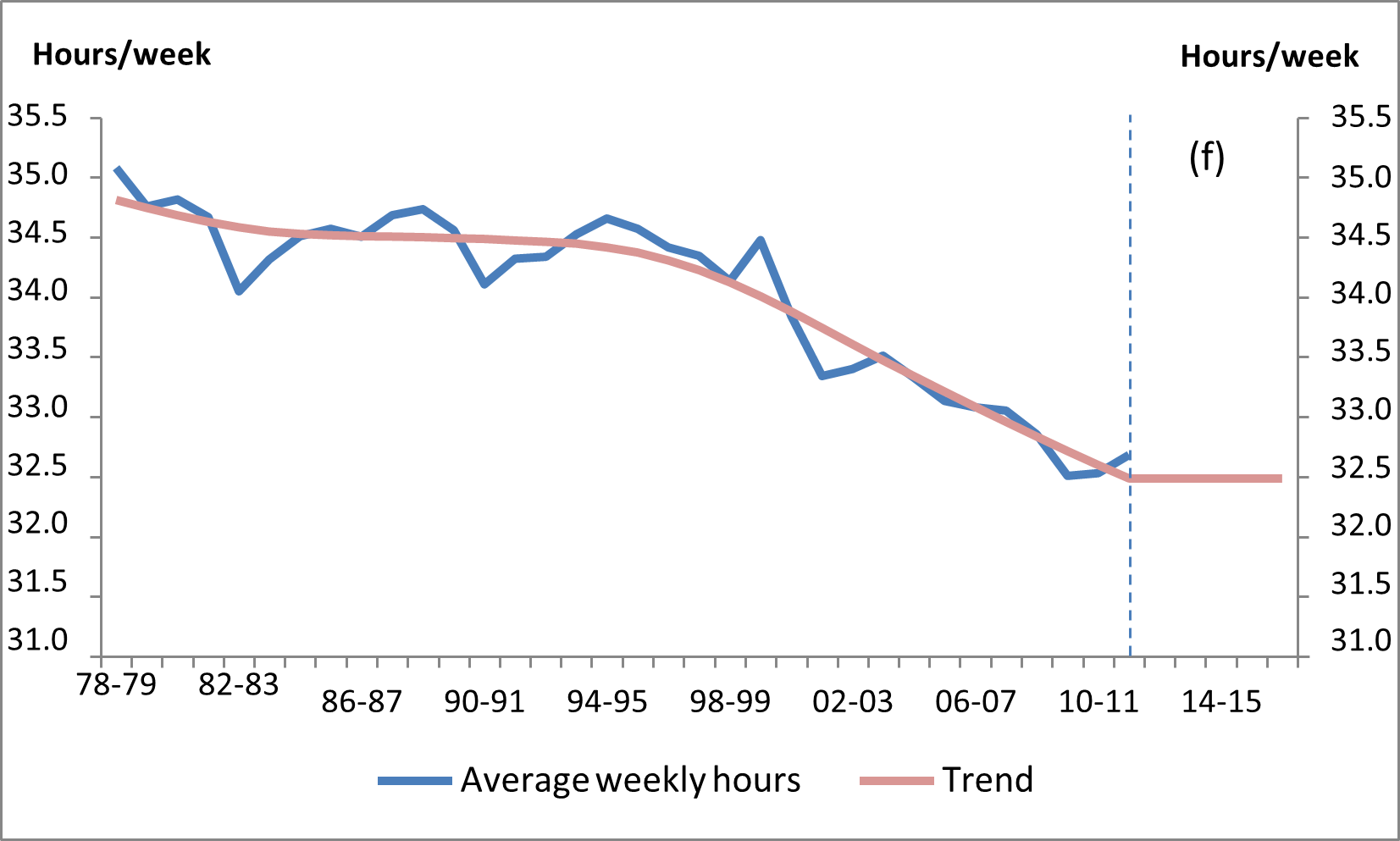

It can be seen from the formula that all of the variables are expressed in trend terms with the exception of the working age population. The charts below highlight the trend adjustment applied to each of the other components using the Hodrick-Prescott filter with the smoothing

parameter (lambda) set to 100. The unemployment rate and the participation rate utilise the 2013-14 Budget medium-term projections to address the end-point problem of the filter. This provides a further 10 years of data out to 2029-30 over which to run the filter.

Source: PBO, Budget Papers, ABS.

Source: PBO, Budget Papers, ABS.

Average hours worked are smoothed over history and then assumed to remain at their 2011-12 trend level over the forward estimates period.

Source: PBO, ABS.

The final component that needs to be de-trended is total factor productivity which is calculated as the residual from the production function equation as follows:

Total Factor Productivity = Real GDP (output) - 0.6 x Hours Worked - (1 - 0.6) x Capital Stock

Actual total factor productivity is then smoothed using the same technique as applied to smooth the unemployment rate and the participation rate.

Over the forward estimates period a number of inputs are needed to construct potential output. The capital stock uses a combination of the forecasts of total investment and an assumed profile for the depreciation rate based on the historical trend. Trend total hours use forecasts of the working age population and an assumption that trend average working hours remain constant.

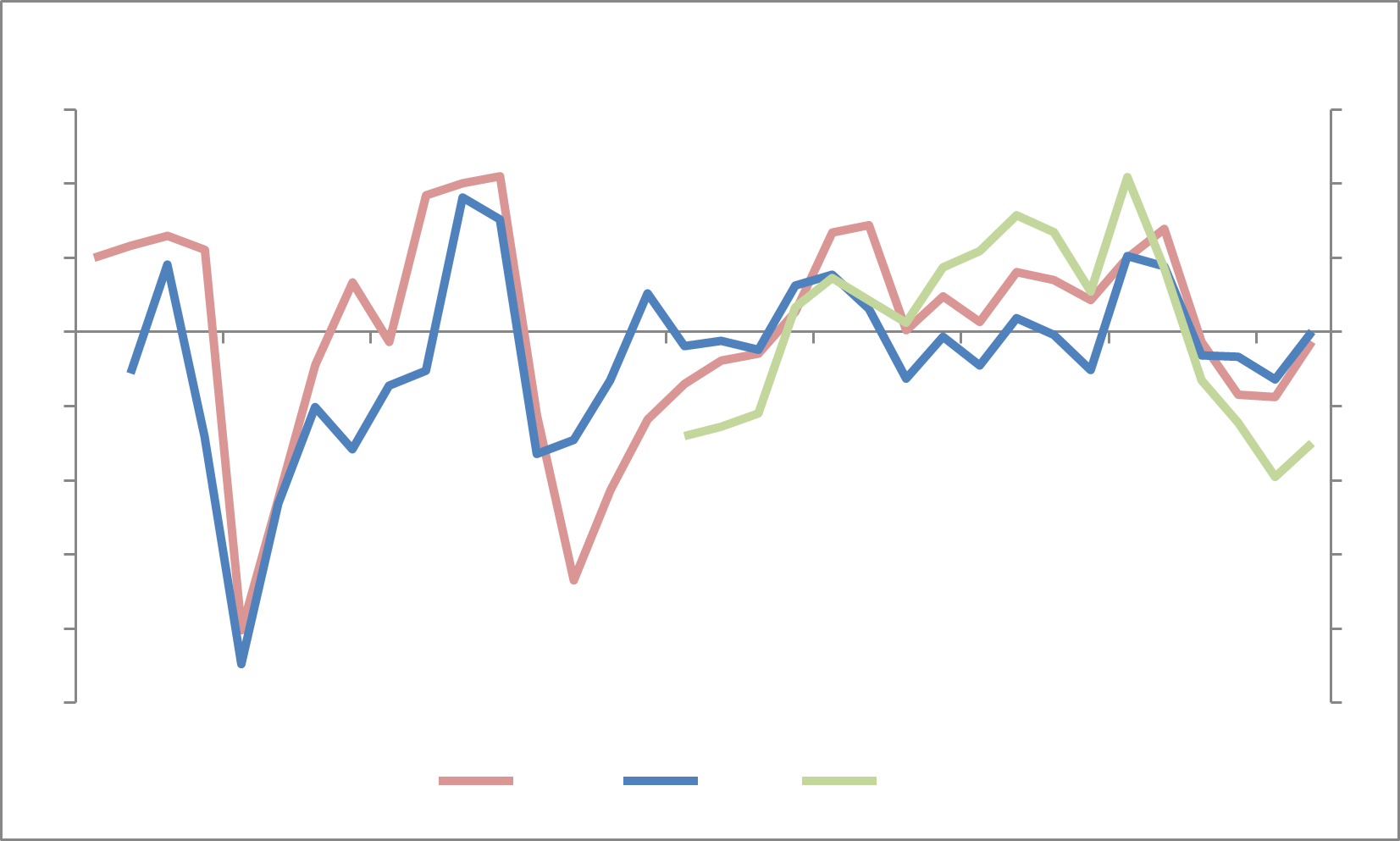

As mentioned, various estimation techniques can lead to different estimates of potential output and the output gap. Figure 11 compares the PBO, OECD and IMF estimates of the output gap. An additional complication in this comparison is that the OECD and IMF estimates of the output gap are on a calendar year basis. The OECD and IMF use a production function approach similar to the PBO.

Source: PBO, IMF, OECD.

(The IMF and OECD estimates are on a calendar year basis.)

While the broad trend in the output gap estimates are similar (the early 1980s and 1990s are periods when the economy is estimated to have operated below potential while the mid-2000s is a period when the economy is estimated to have operated above its potential) there are obviously some differences in the assumptions, trend adjustments and data which will explain the slight differences in the magnitudes of the output gap.

These differences in the estimates of the output gap will have an impact on estimates of the SBB. The section on uncertainty later in the report attempts to quantify this difference by comparing estimates of the SBB using the PBO and OECD estimates of the output gap.

Estimating tax receipts and government payments elasticities

Having derived an estimate of the output gap the next step is to estimate the sensitivity of tax revenue and government expenditure to this measure of the economic cycle. This sensitivity (the elasticity) can be quantified through a number of approaches, which are outlined below, and provide a measure of the degree to which tax revenue and government expenditure are expected to change as a result of a change in the output gap. By way of example, McDonald et al (2010) assumed an aggregate tax revenue elasticity of 1¼, so for every percentage point increase in the output gap, tax revenue increases by 1¼ percentage points.

There are two main approaches employed to formalise these relationships. The United Kingdom’s Office of Budget Responsibility (Helgadottir et al (2012)) provides a useful discussion of the two approaches which it refers to as the one-step and two-step approaches. The one-step approach involves econometric estimation of the relationship between total tax revenue (policy-adjusted) and total government expenditure and the output gap. These elasticities are then used to adjust total tax revenue and government expenditure for the economic cycle.

The two-step approach, which is adopted in this report, estimates the relationship between tax revenue and its tax base, ei,bi, and then the tax base to the output gap, ebi,ygap. This approach allows for a more detailed examination of the estimated elasticity. An additional degree of detail, again adopted in this report, is to disaggregate total tax revenue into major categories and estimate their respective elasticities. This approach should help to improve the accuracy of the elasticity estimates given that each tax revenue type may have different economic drivers and may evolve differently.

Previous elasticity estimates have been derived by the Girouard et al (2005) and OECD (2006) and McDonald et al (2010) for Australia. The IMF uses the Girouard et al (2005) elasticity estimates to calculate its measure of Australia’s SBB.

Girouard et al (2005) provides a detailed analysis in which the authors disaggregate total tax revenue into four categories from which elasticities are then derived. This report updates these elasticity estimates using the approach outlined above. A nuance in this analysis is to identify GST revenue separately from other indirect taxes and to separate out capital gains tax.

Estimating the elasticity of tax to the tax base (ei,bi)

For the elasticity of personal income tax the PBO’s personal income tax micro simulation model has been used. It analyses a one per cent sample of 2009-10 individual tax returns sourced from the Australian Taxation Office. This approach in estimating the personal income elasticity recognises the progressive nature of personal income tax in Australia and is expressed in the following formula.

For 2009-10 the elasticity is 1.5, identical to that calculated by the Girouard et al (2005).

Other tax types are assumed to have an elasticity of tax revenue with respect to their respective tax bases of 1.0 following the OECD.

Estimating the elasticity of the tax base to the output gap (ebi,ygap)

The estimation of these elasticities is an empirical question which attempts to capture how respective tax bases respond to the economic cycle over time. Estimates of these elasticities are derived from the estimated relationship between the respective tax base and the output gap. The tax receipt bases used are a broad definition of household incomes (compensation of employees, gross mixed income, and property income) and total corporate gross operating surplus. In this approach no attempt is made to estimate the structural tax bases. They are treated as unobservable.

A different approach from the output gap is to attempt to measure the ‘gap’ in each tax revenue base and thus attempt to more closely capture composition changes in the economy. This approach was pioneered by the European Central Bank (2001). While having some appeal, this method lacks a theoretical basis as there is no equivalent to an output gap for individual tax bases.

To estimate the relationships between the separate tax bases of household income and total gross operating surplus the equation takes the following form:

where X is household income or total gross operating surplus as a ratio of potential nominal output (since the actual GDP deflator is used to reflate both actual and potential GDP, the nominal tax base can be expressed relative to nominal potential output). These relationships have been estimated using the Newey-West correction for possible autocorrelation.

The results of the estimation are broadly consistent with past studies.

While it is demonstrated later in the appendix that the elasticity values do not significantly impact on the SBB estimates, closer investigation of the relationships is a potential area for further work.

Estimating the elasticity of unemployment related expenditure

Unemployment benefit payments are assumed to be strictly proportional to unemployment. This assumption translates into estimating the relationship between the cyclical component of

unemployment and the output gap to derive the sensitivity of cyclical unemployment to the economic cycle and therefore to unemployment benefit payments.

To estimate the elasticity of the cyclical component of unemployment to the output gap the equation takes the following form:

where U is actual unemployment, U* is trend unemployment, Y is actual output and Y* is potential output.

To obtain the elasticity of total expenditure to the output gap the estimated elasticity from above is weighted by the share of unemployment benefit payments to total payments. The total elasticity is calculated to be -0.15.

Summary of the elasticity results

Table 1 provides a summary of the results. The updated estimates remain close to the Girouard et al (2005) estimates with the only difference being a slightly higher updated estimate for the elasticity of personal income tax to the output gap. This outcome is consistent with Parkyn (2010) study which compared the Girouard et al (2005) estimates to updated results for New Zealand. Indeed, the IMF in its analysis of SBBs still uses the Girouard et al (2005) estimated elasticities for all countries.

Capital gains tax

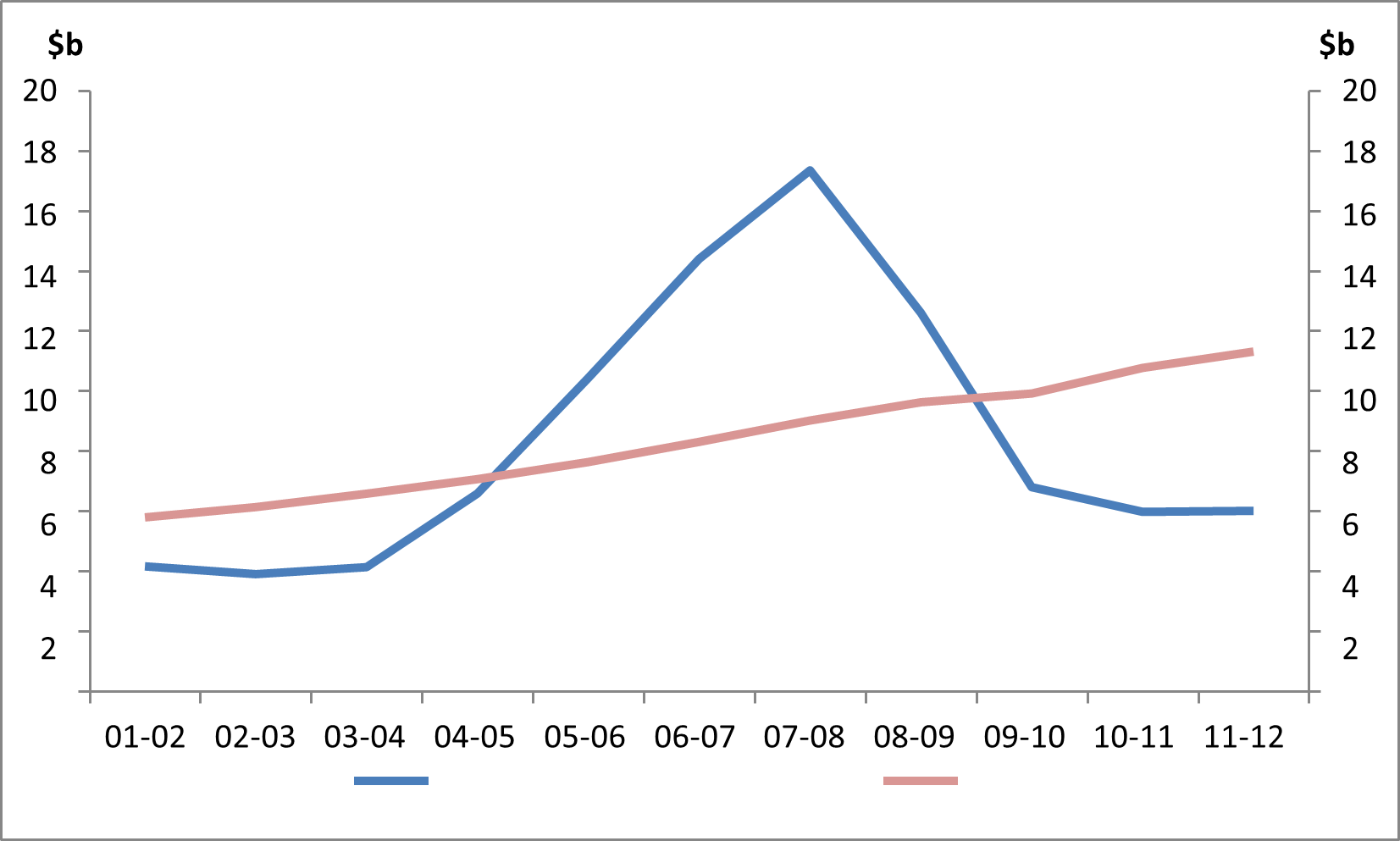

Capital gains are a small and volatile component of tax revenue. The volatility reflects movements in asset prices and variability in realisation rates and the extent to which capital losses are offset against capital gains. Given how difficult it would be to determine a structural level of asset prices the approach adopted by McDonald et al (2010) is used in this analysis to gain an estimate of the appropriate adjustment to actual capital gains tax revenue. Figure 12 highlights the adjustment to capital gains tax for each year, with the blue line showing actual capital gains tax receipts and the red line showing the adjusted capital gains tax receipts used to construct estimates of the SBB.

Source: PBO, Budget Papers.

Assessing uncertainty

The calculations of the CAB and SBB involve uncertainty. That is not to say that estimates are not useful in helping understand current trends in the stance of fiscal policy and the implications of the current position in terms of future fiscal policy. However, it is important to recognise that there is a degree of uncertainty attached to the estimates.

The uncertainty attached to the output gap measure and the elasticity values is discussed below.

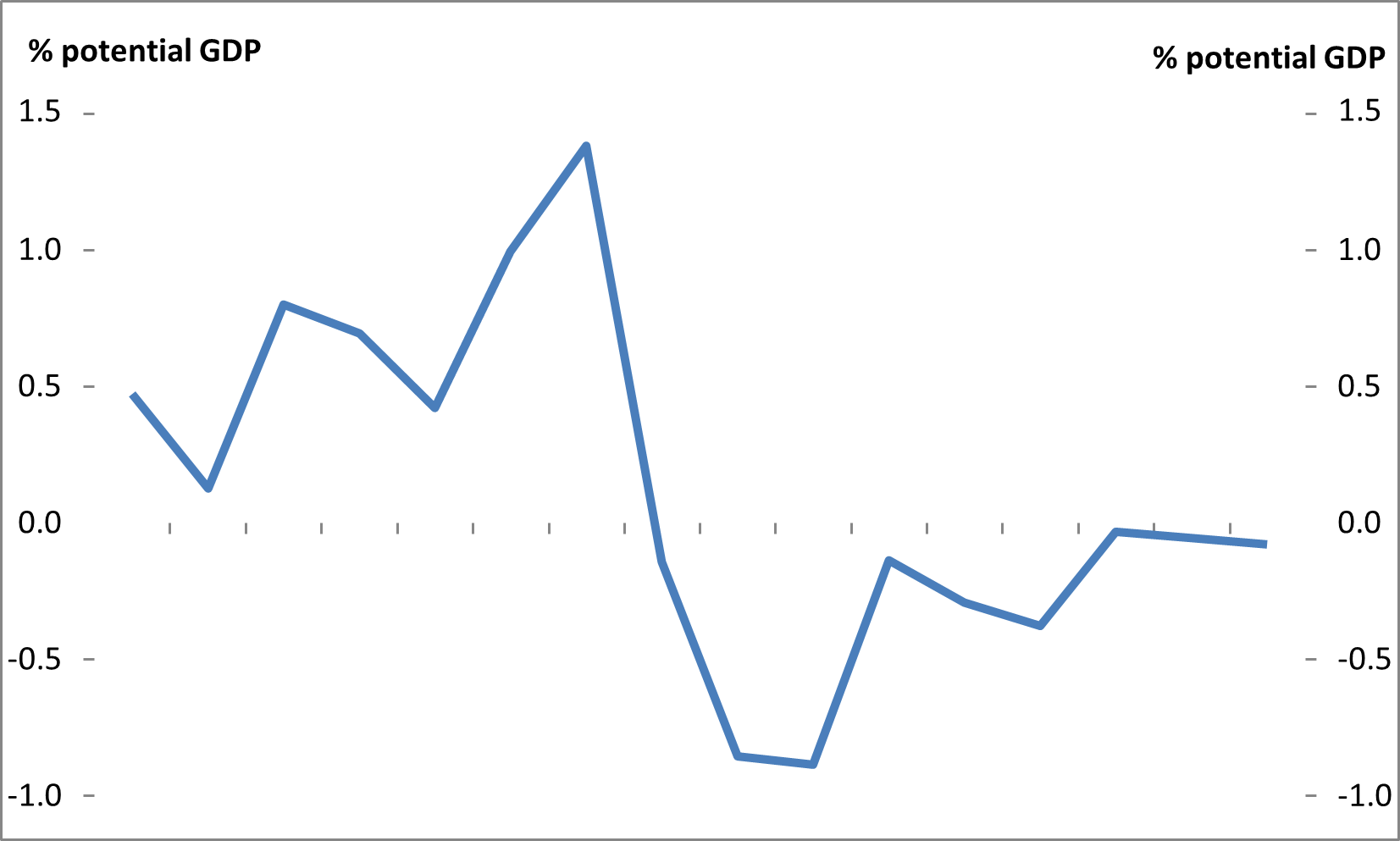

The output gap

Estimates of potential output are subject to uncertainty as they depends on the methodology adopted and, potentially, the data used. While not within the scope of this report other studies have highlighted these differences. Parkyn (2010) provides a useful discussion and example of the differences that can arise in estimates of potential output by comparing the Hodrick-Prescott filter, a multivariate filter, the Kalman filter and production function methodologies.

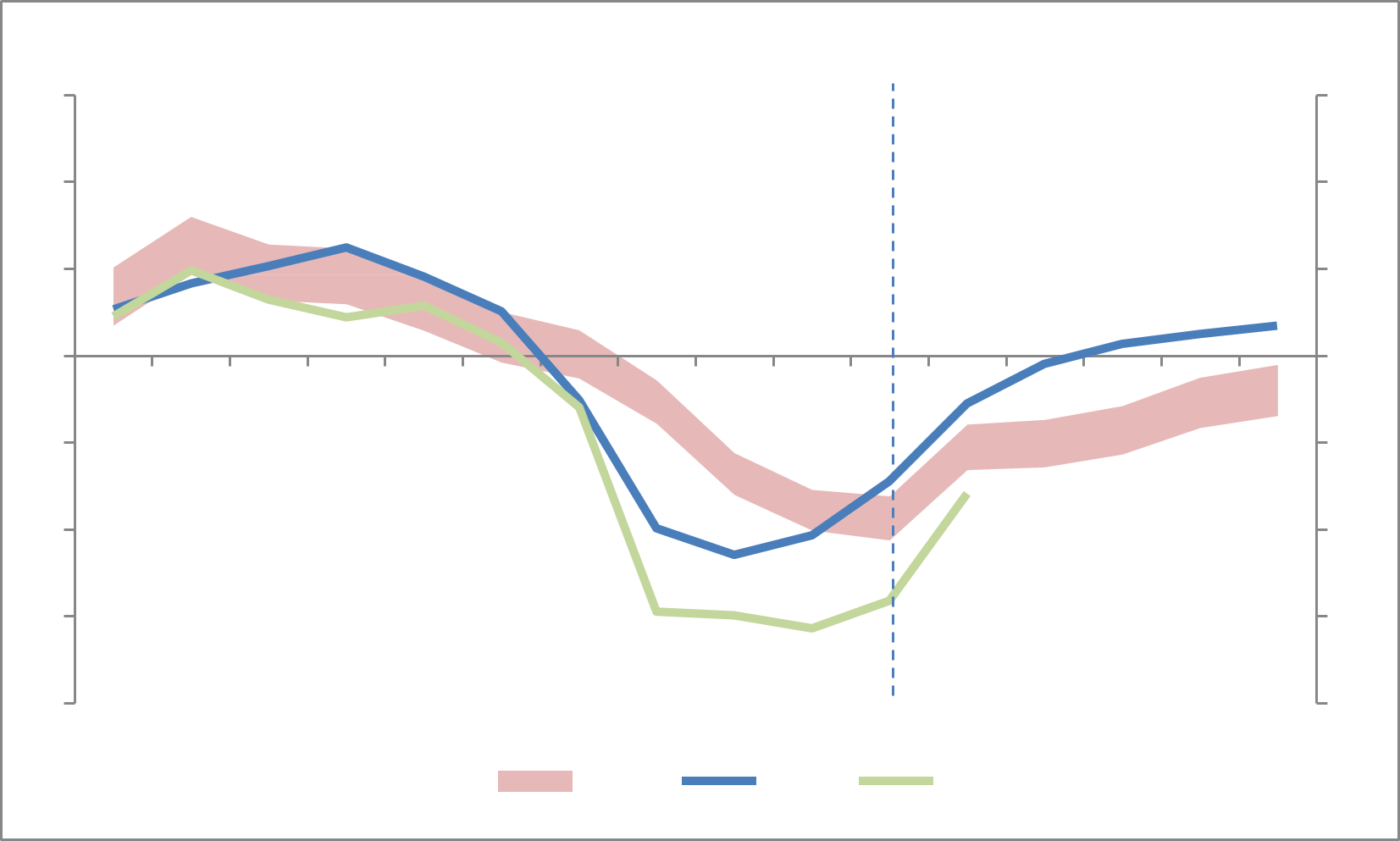

As an example, Figure 13 highlights the estimates of the CAB using the PBO’s estimate of Australia’s output gap, an output gap calculated using the Hodrick-Prescott filter on actual real GDP to estimate potential GDP and the OECD’s recent estimate of Australia’s output gap. The differences in the output gap measures lead to differences in the magnitude of the estimates of the CAB which is displayed as the band in Figure 13, by on average a ¼ percentage point of GDP, but have no significant impact on the trend of the CAB.

Source: PBO, Budget Papers, ABS.

Elasticities

The elasticities used in the report are either directly estimated or adopted from the OECD estimates and therefore may not represent the ‘true’ value. To test the sensitivity of the CAB to different values of the elasticities a 95 per cent confidence interval of the personal income tax elasticity has been constructed and then a high and low value for the CAB has been derived. Figure 14 highlights that while there are differences as represented by the band, the CAB is not particularly sensitive to the magnitude of the estimated or assumed elasticities.

Source: PBO, Budget Papers, ABS.

A comparison with other recent estimates of Australia’s structural budget balances

Estimates of Australia’s SBB have been produced by a number of agencies. Most recently both the OECD (2012) and IMF (2013) have published point estimates. McDonald et al (2010) published point estimates and discussed the issue of uncertainty in determining the fundamental level of the terms of trade and the Non-Accelerating Inflation Rate of Unemployment, that is, the unemployment rate at which inflation is stable.

Figure 15 highlights the profile of the recent OECD and IMF estimates of Australia’s whole-of-government SBBs. It should be noted that these estimates were prepared before the 2013-14 Budget update. Each of the estimates displays a similar profile.

2016-17

Source: PBO, Budget Papers, ABS, IMF, OECD.

(The IMF and OECD estimates are on a calendar year basis and are as a percentage of potential GDP.)

Footnotes

1. As GST receipts are paid to the States and Territories there is no net impact on the Budget bottom line over time. Over the period 2002-03 to 2011-12, GST receipts fell by around ¾ of a percentage point of GDP as household savings rates jumped post-GFC and the proportion of expenditure on items that attract GST declined.

References

Australian Government, 2013, Budget Strategy and Outlook 2013-14, Budget Paper No. 1, Canberra.

Barnett, R., and Matier, C., 2010, Estimating Potential GDP and the Government's Structural Budget Balance, Office of the Parliamentary Budget Officer, Ottawa.

Bartlett, R., Cameron, S., Lao, H., and Matier, C., 2012, Fiscal Sustainablity Report 2012, Office of the Parliamentary Budget Officer, Ottawa.

Bornhorst, F., Dobrescu, G., Fedelino, A., Gottschalk, J., and Taisuke, N., 2011, When and How to Adjust Beyond the Business Cycle? A Guide to Structural Fiscal Balances, International Monetary Fund, Washington.

Bouthevillain, C., Cour-Thimann, P., Van Den Dool, G., Hernandez De Cos, P., Langenus, G., Mohr, M., Momigliano, S., and Tujula, M., 2001, Cyclically-adjusted Budget Balances: An Alternative Approach, European Central Bank, Working Paper No. 77, Frankfurt.

Escolano, J., 2010, A Practical Guide to Public Debt Dynamics, Fiscal Sustainability, and Cyclical Adjustment of Budgetary Aggregates, International Monetary Fund, Washington.

Ford, B., 2005, Structural fiscal indicators: an overview, Treasury Economic Roundup, Autumn, Canberra.

Giorno, C., Richardson, P., Roseveare, D., van den Noord, P., 1995, Estimating Potential Output, Output Gaps and Structural Budget Balances, OECD Economics Department Working Papers No. 152, Paris.

Girouard, N., and Andre, C., 2005, Measuring Cyclically-adjusted Budget Balances for OECD Countries, OECD Economics Department Working Papers Nos. 434, Paris.

Girouard, N., and Price, R., 2004, Asset price cycles, "one-off" factors and structural budget balances, OECD Economics Department Working Papers No. 391, Paris.

Helgadottir, T., Chamberlin, G., Dhami, P., Farrington, S., and Robins, J., 2012, Cyclically adjusting the public finances. United Kingdom: Office for Budget Responsibility, Working paper No. 3, London.

International Monetary Fund, 2013, World Economic Outlook April 2013, World Economic and Financial Surveys, International Monetary Fund, Washington.

Kanda, D., 2010, Asset Booms and Structural Fiscal Positions: The Case of Ireland, International Monetary Fund, Washington.

Matier, C., 2011, A Comparison of Finance Canada and PBO Estimates of the Government of Canada's Structural Budget Balance, Office of the Parliamentary Budget Officer, Ottawa.

McDonald, T., Yan, Y H., Ford, B., and Stephan, D., 2010, Estimating the structural budget balance of the Australian Government, Treasury Economic Roundup Issue 3, Canberra.

OECD, 2006, Should Measures of Fiscal Stance be Adjusted for Terms of Trade Effects, OECD Publishing, OECD Economics Department Working Papers No. 519, Paris.

OECD, 2012, OECD Economic Surveys: Australia 2012, OECD Publishing, Paris.

Office for Budget Responsibility, 2011, Estimating the output gap, Office for Budget Responsibility, Briefing paper No. 2, London.

Office for Budget Responsibility, 2012, Fiscal sustainability report, The Stationery Office Ltd., London.

Office for Budget Responsibility, 2012, How we present uncertainty, Office for Budget Responsibility, Briefing paper No. 4, London.

Parkyn, O., 2010, Estimating New Zealand's Structural Budget Balance, New Zealand Treasury, NZ Treasury Working Paper 10/08, Wellington.

Price, R., and Dang, T., 2011, Adjusting fiscal balances for asset price cycles, OECD Economic Department Working Papers No. 868, Paris.

The Treasury, 2009, Treasury Briefing Paper for the Senate Inquiry into the Economic Stimulus Package, The Treasury, Canberra.

The Treasury, 2012, Review of Treasury macroeconomic and revenue forcasting, The Treasury, Canberra.