July 2020 Economic and Fiscal Update1

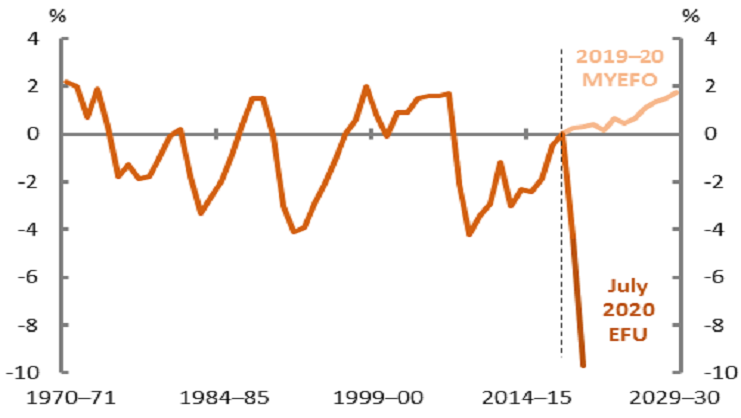

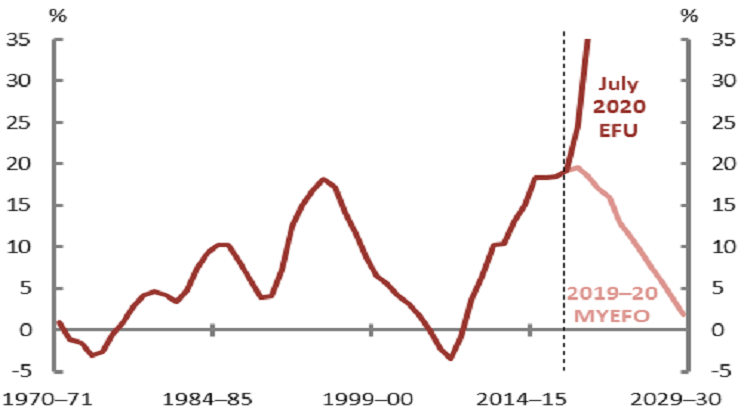

Figure 1: Underlying cash balance2

Per cent of GDP

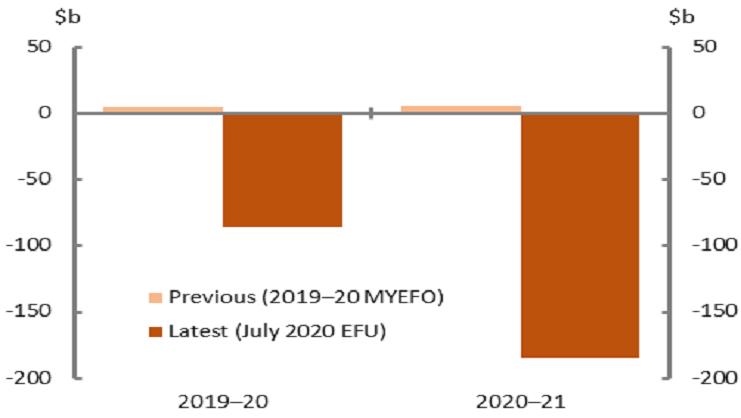

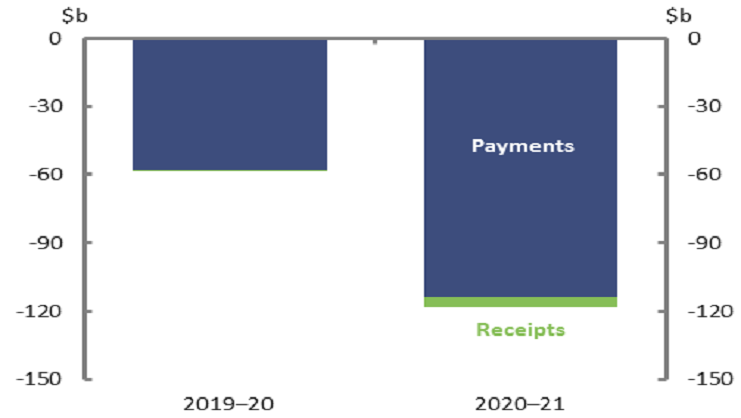

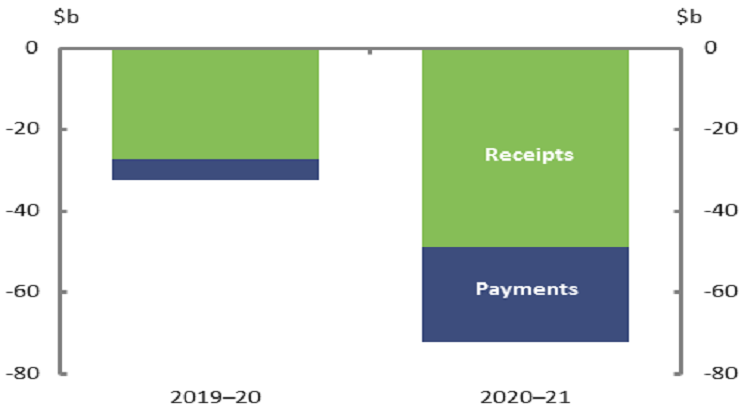

Figure 2: Underlying cash balance

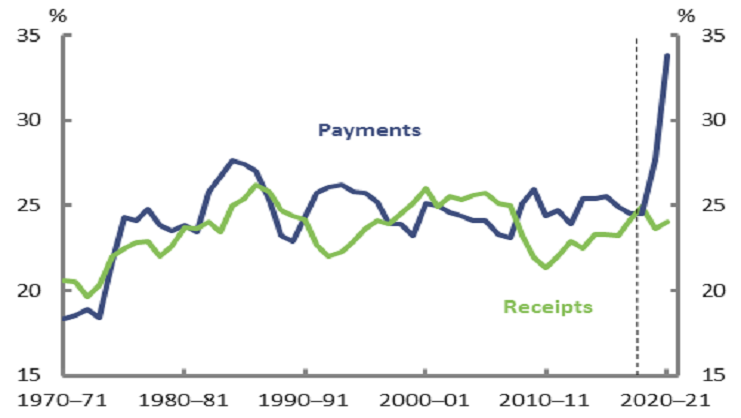

Figure 3: Total payments and receipts2

Per cent of GDP

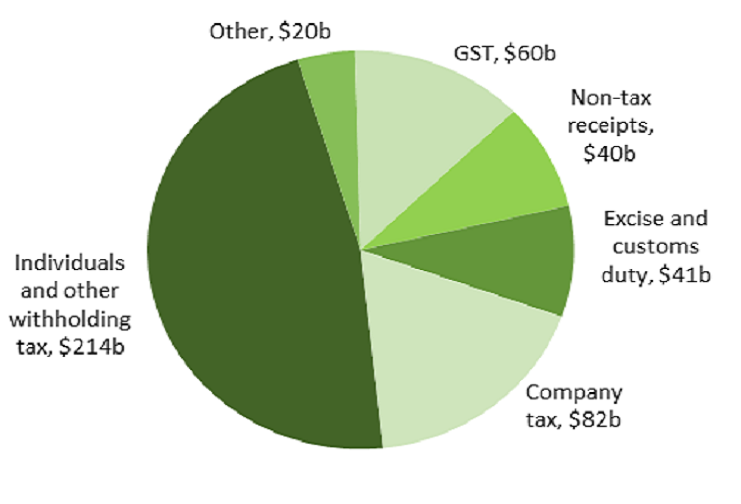

Figure 4: Receipts in 2020-21, $456b3

Figure 5: Net debt2

Per cent of GDP

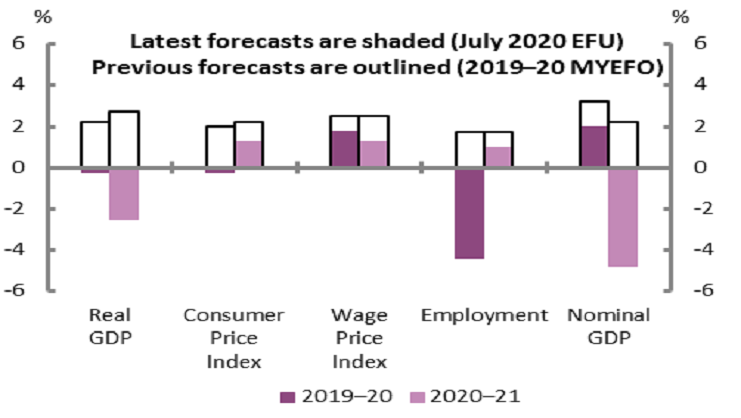

Figure 6: Key economic parameters4

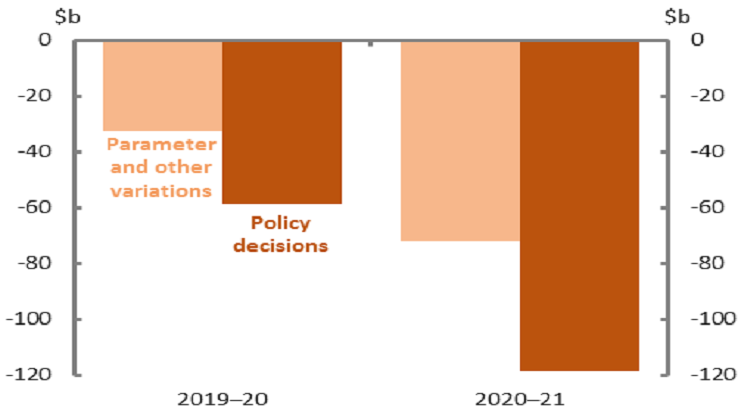

Figure 7: Decomposition of deterioration

in the underlying cash balance5,6

Figure 8: Impact of policy decisions on

the underlying cash balance7

Figure 9: Impact of parameter and other

variations on the underlying cash balance6,8

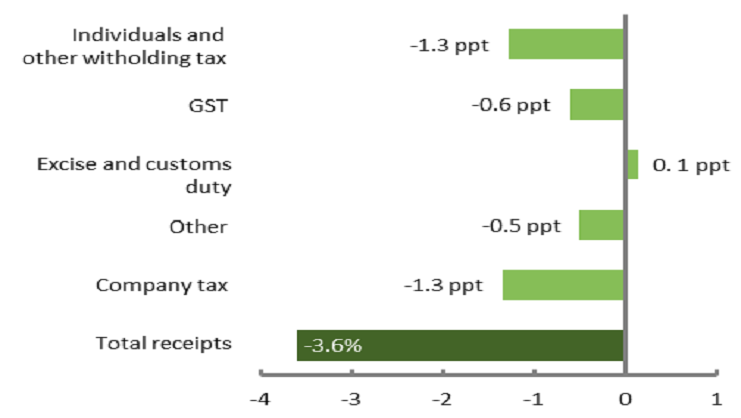

Figure 10: Contributions to annual real growth in receipts3,9,10

Average, 2018–19 to 2020–21

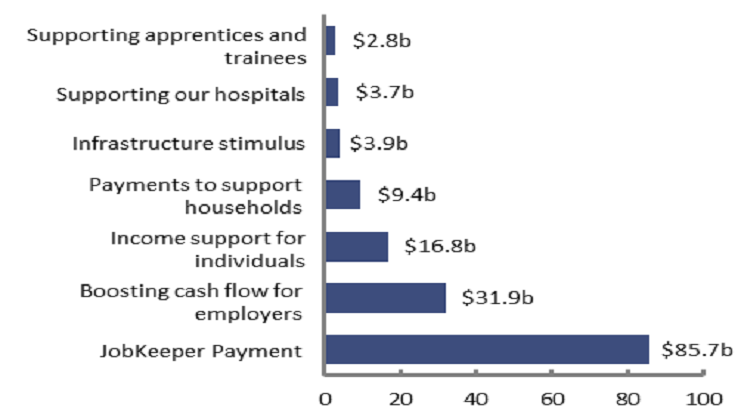

Figure 11: Top payments measures11

Total 2019–20 to 2023–24

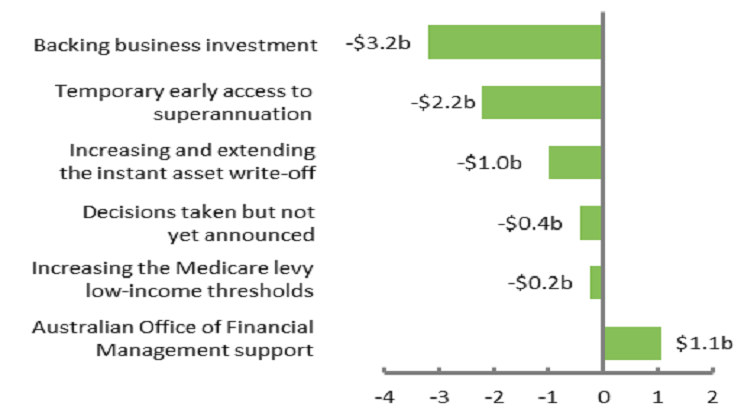

Figure 12: Top receipts measures11

Total, 2019–20 to 2023–24

- Figures are prepared using data contained in the July 2020 Economic and Fiscal Update (EFU) and the 2019–20 Mid-Year Economic and Fiscal Outlook (MYEFO). Any changes shown are since the 2019–20 MYEFO. Figures are on a cash basis.

- The dashed vertical line indicates the last actual data point.

- ‘Other’ includes superannuation fund taxes, other indirect taxes and non-taxation receipts.

- 2019–20 growth rate for employment in the July 2020 EFU is the actual outcome.

- Table 3.3 of the July 2020 EFU.

- Parameter and other variations refer to changes due to a broad range of reasons, including revised economic forecasts, revisions to a program’s estimated costs, revised estimates of the receipts raised by individual taxes and re-profiling of payments.

- Policy decisions for receipts in 2019–20 are -$0.4b.

- This figure excludes the impact of parameter and other variations on GST payments and receipts. This approach is different to that applied to parameter and other variations in Figure 5.

- This figure depicts the percentage point contribution from key tax measures to average annual real growth in total receipts from 2018–19 to 2020–21. Average annual growth in total receipts is presented in the bottom bar in the figure.

- Components do not necessarily sum to total due to rounding.

- This figure depicts the net fiscal impact of the top measures, except for 'decisions taken but not yet announced' which is in receipts terms only. Where a measure affects both receipts and payments it has been classified according to its principal impact (consistent with Appendix A of the July 2020 EFU). Measure titles are abbreviated. For full measure titles, please refer to July 2020 EFU Appendix A.

See the glossary, for more detail about the terms used in this publication.