Figure 1A: Total payments and receipts2,3

Figure 1B: Underlying cash balance2,4

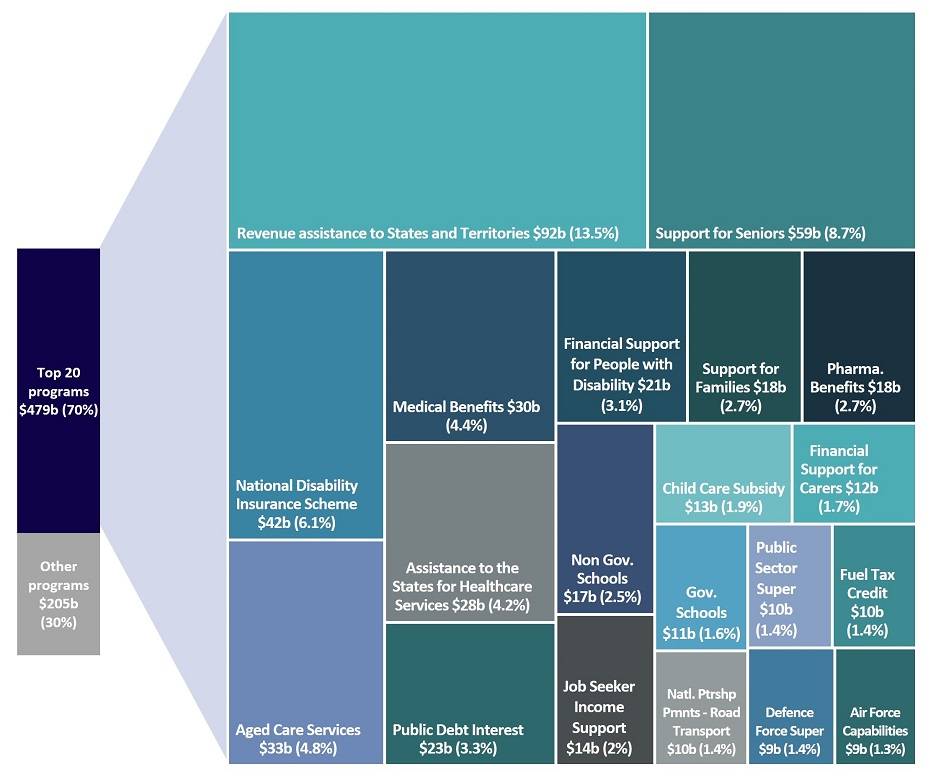

Figure 1C: Top 20 programs in 2023-24, value and share of total expenses5

Total expenses: $684b

Figure 1C: Heads of revenue in 2023-24, value and share of total revenue6

Total revenue: $680b

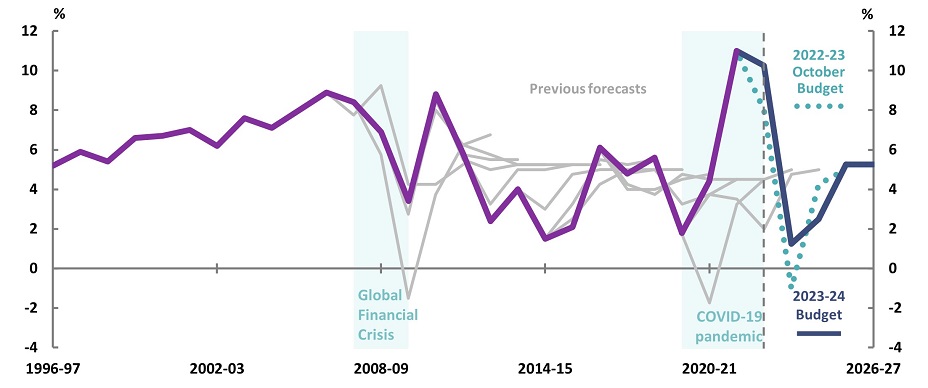

Figure 2A: Real GDP growth

Figure 2B: Consumer Price Index

Figure 2C: Wage Price Index

Figure 2D: Nominal GDP growth

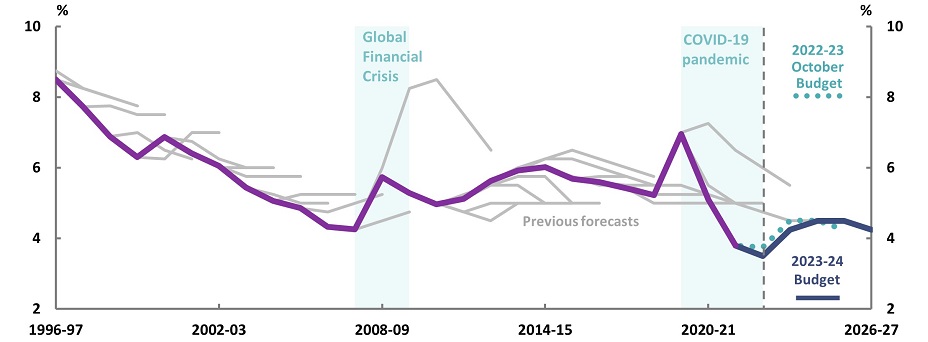

Figure 2E: Unemployment rate

Figure 2F: Employment growth

Figure 3A: Australian Government expenses over time2,8

Figure 3B: Australian Government revenue over time2

Figure 4A: Net Debt2

|

Figure 4B: Net financial worth2,9

|

Figure 4C: Change in underlying cash balance since the October Budget10

|

|

Figure 4D: Interest payments2,11

|

Figure 4E: 10-year bond rate2,4

|

Figure 5A: Top 10 largest measures (2023-24 to 2026-27) ($b)12

- Figures are prepared using data contained in the 2023-24 Budget, and previous budgets unless otherwise stated. All values prior to and including 2021-22 are outcomes.

- The grey dotted vertical line indicates when forecasts begin.

- Revenue and expenses are on an accrual basis. Receipts and payments are on a cash basis.

- Outcomes in history may have been revised since first published. Grey lines represent forecasts in previous budgets.

- The functions classification separates government expenditure according to the general purpose for which the funds are used. Programs are determined by government and typically aim to deliver specific benefits, services or welfare payments to individuals, businesses, or communities. Programs will often align with functions but may also be cross-cutting. Revenue assistance to states and territories includes GST, transitional GST top-up payments and some other payments (primarily for royalties). Values may not sum to totals due to rounding.

- 'Non-tax revenue' includes interest and dividend income, sales of goods and services, and various other revenue items. Values may not sum to totals due to rounding.

- Real GDP and nominal GDP are percentage change on preceding year. The consumer price index, employment, and the wage price index are through the year growth to the June quarter. The unemployment rate is for the June quarter.

- 'Other' includes other purposes, transport and communication, fuel and energy, housing and community amenities, public order and safety, and various other expense items.

- All values between 2009-10 and 2021-22 reflect those reported in their respective Final Budget Outcomes, and do not incorporate any subsequent revisions. Future Fund asset value estimates are those reported by the Future Fund Management Agency in its 2023-24 Portfolio Budget Statement.

- Parameter and other variations are any changes to the finances of the Commonwealth that are not due to new policy decisions. These primarily include revised economic forecasts, revisions to a program’s estimated costs, and re-profiling of expenditure.

- The medium term projected lines between 2027-28 to 2032-33 are calculated values only.

- Measure titles have been abbreviated in some cases. A positive number indicates an increase in revenue or a decrease in expenses. A negative number indicates a decrease in revenue or an increase in expenses.

See the glossary, for more detail about the terms used in this publication.