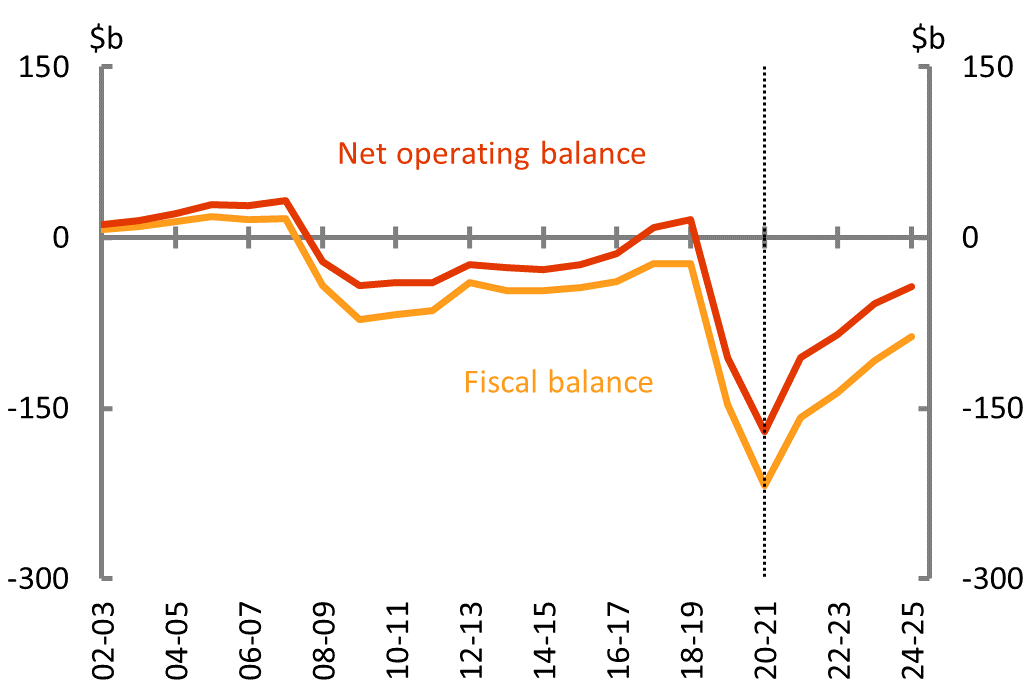

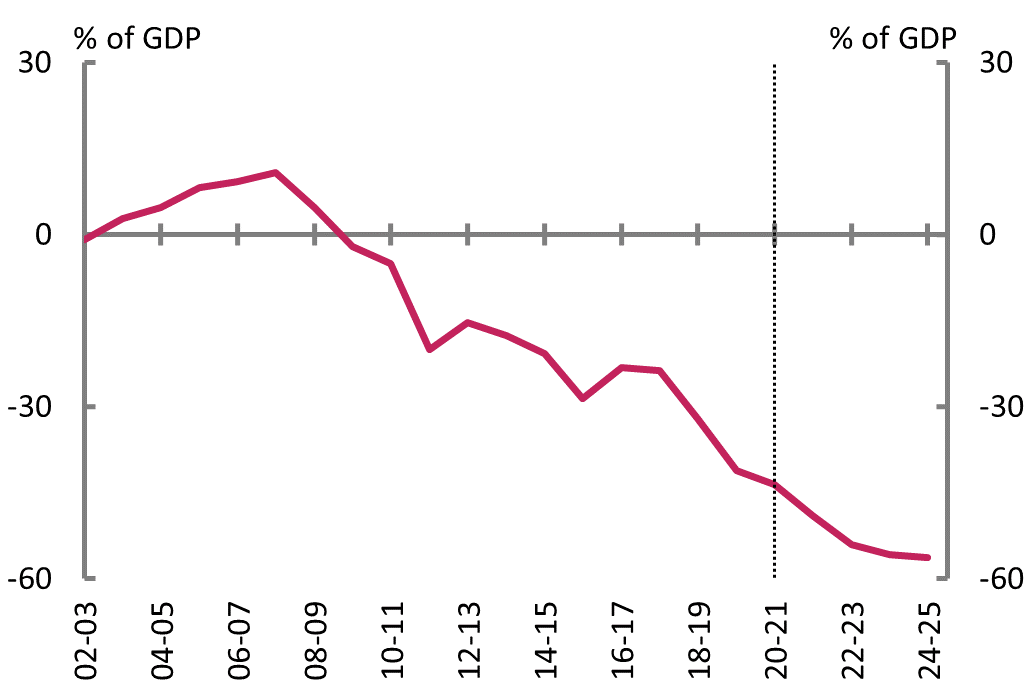

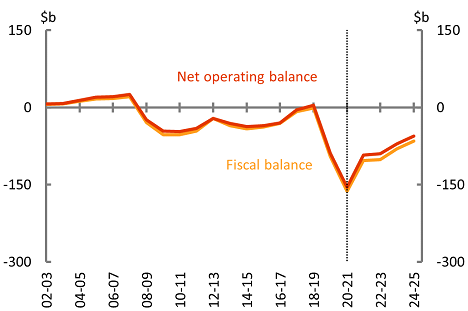

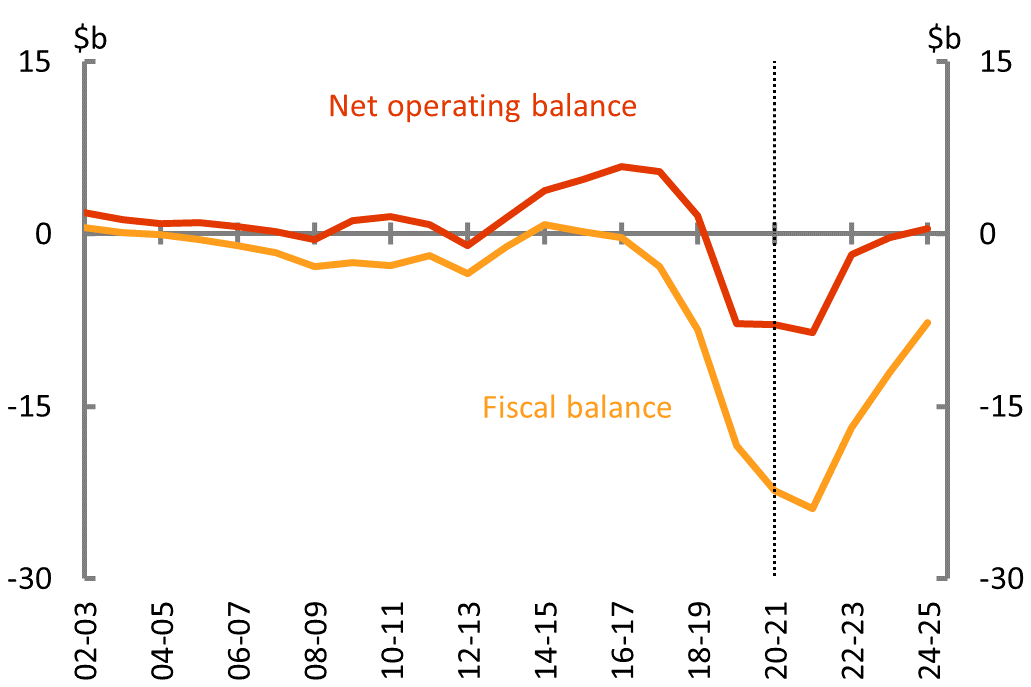

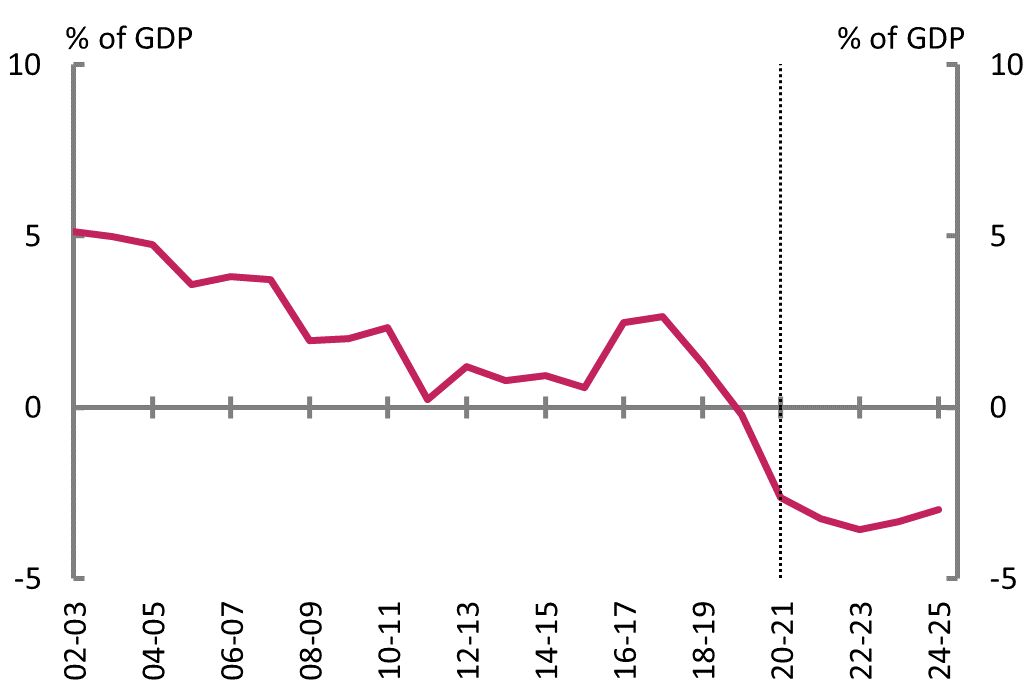

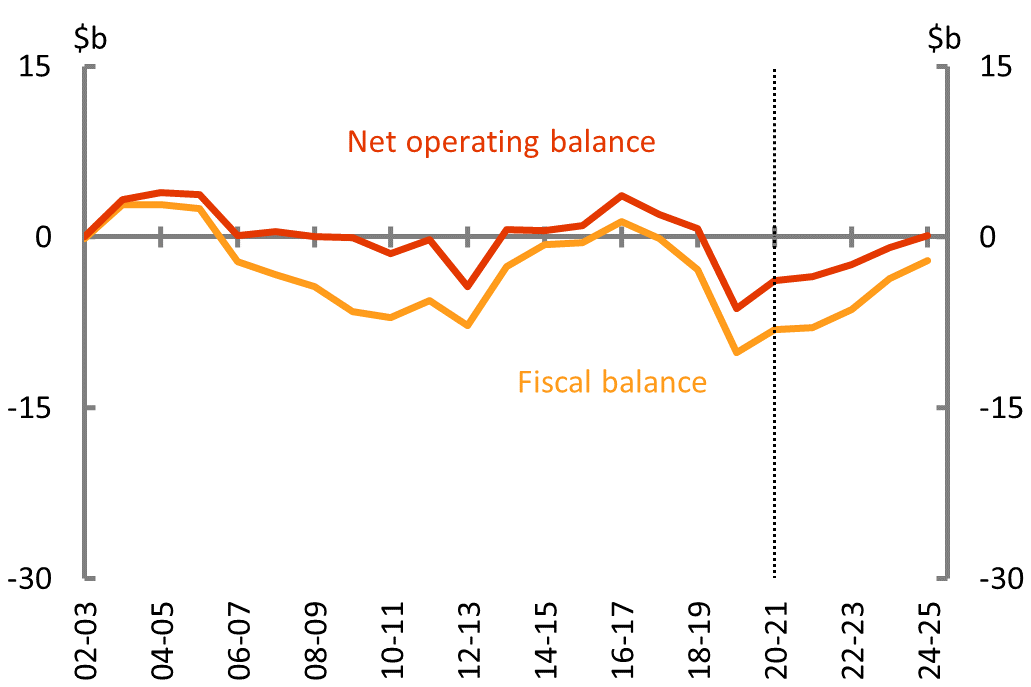

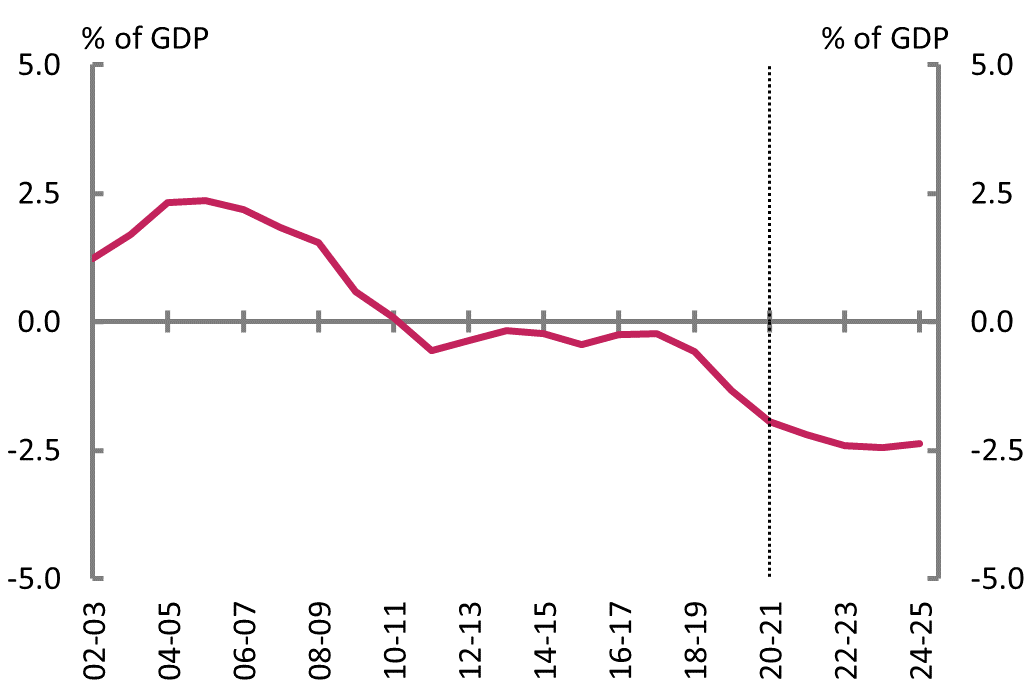

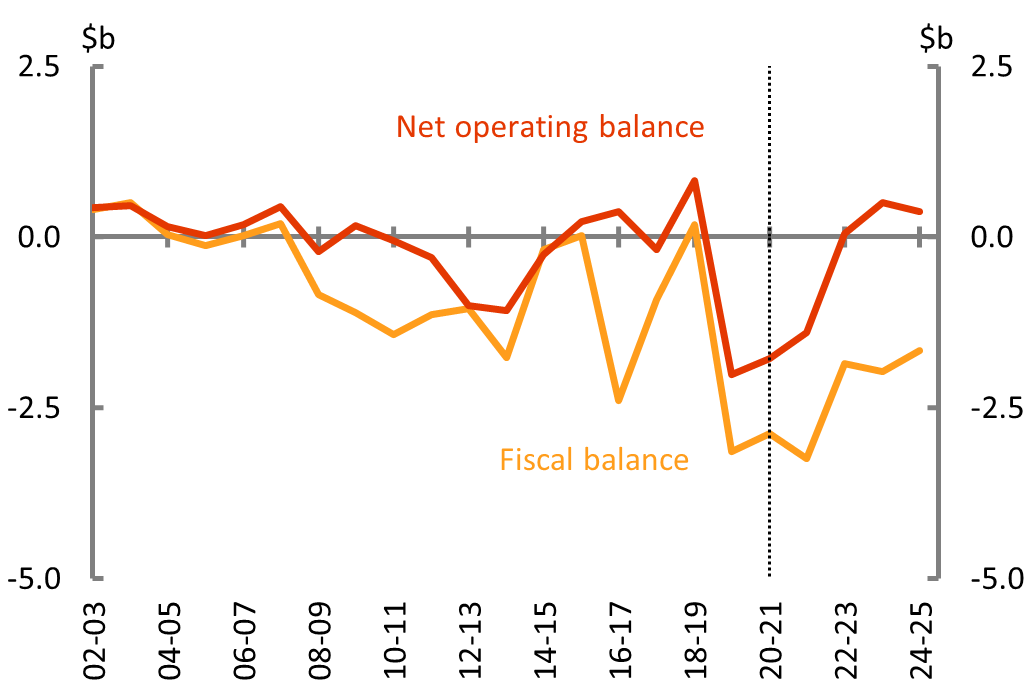

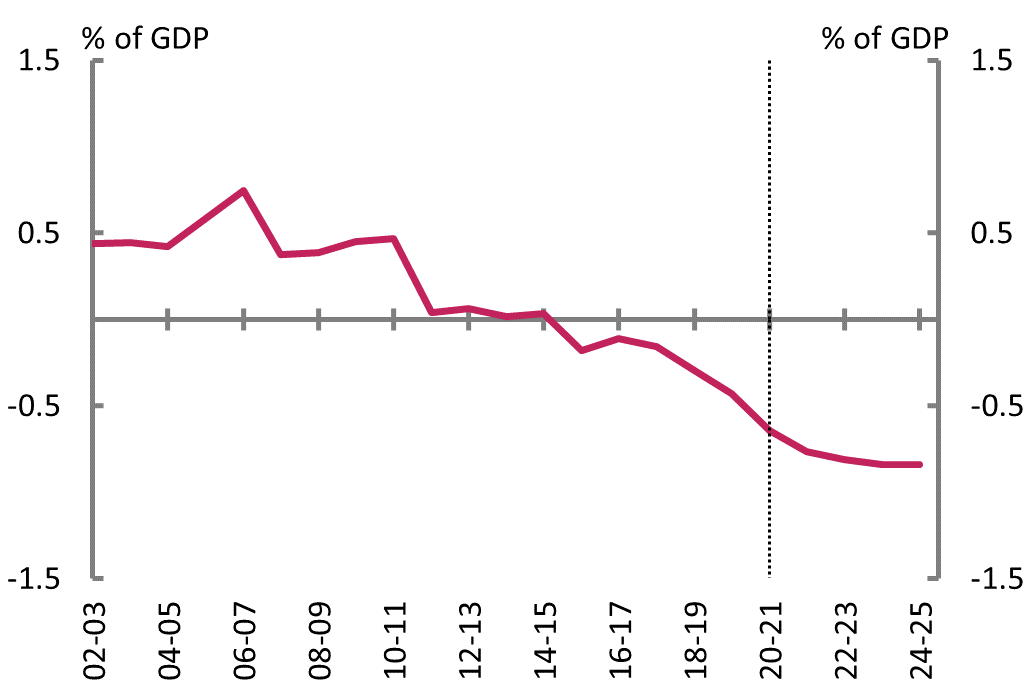

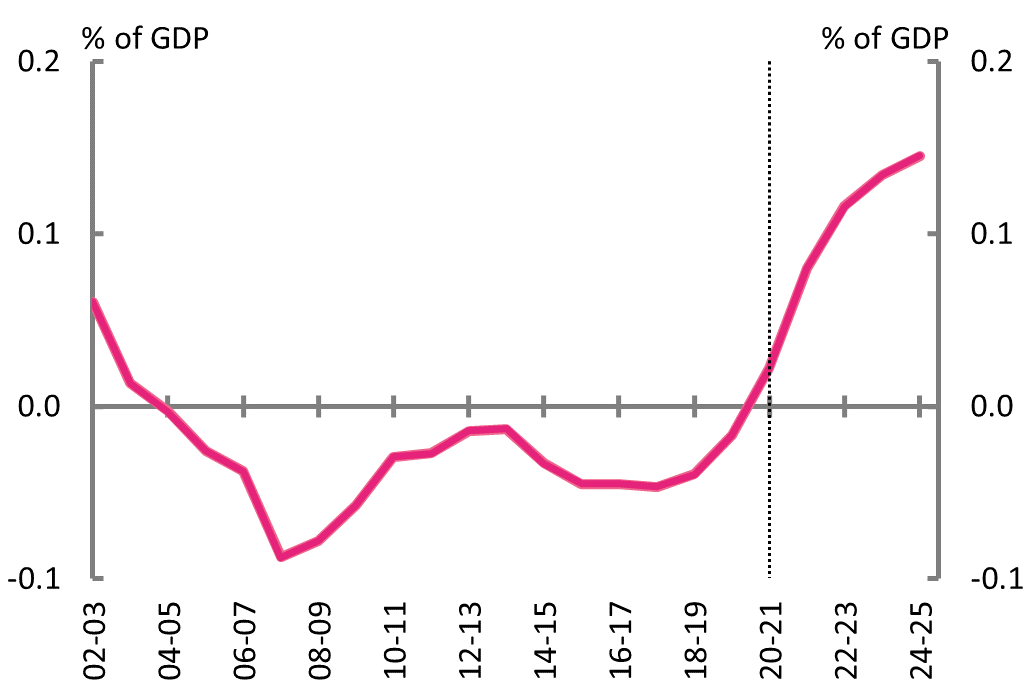

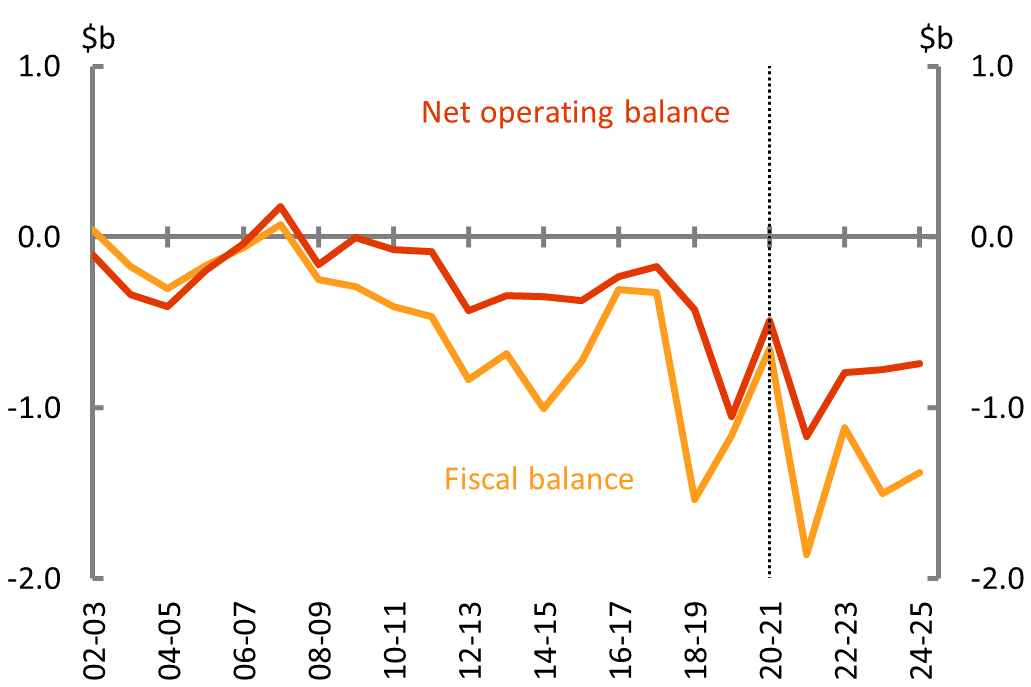

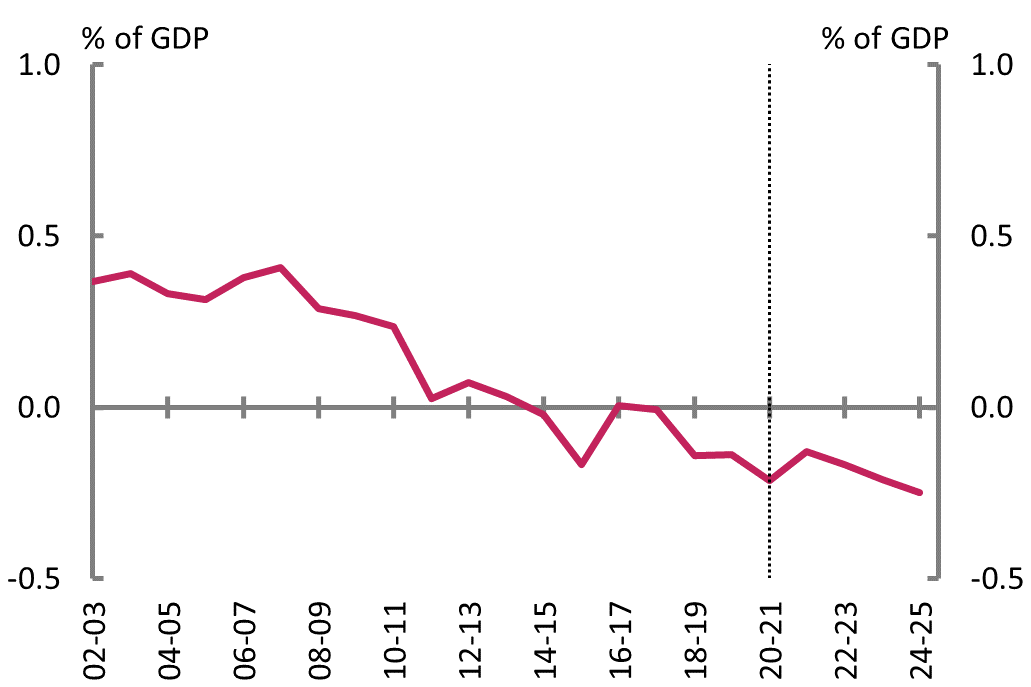

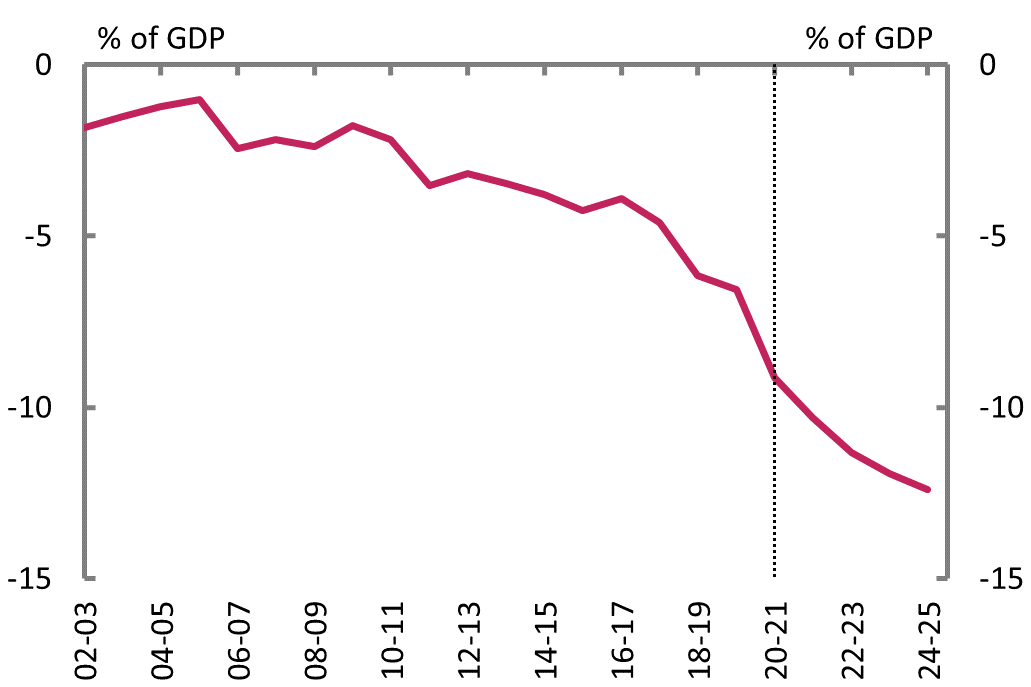

Figure 1A: Net operating and fiscal balance |

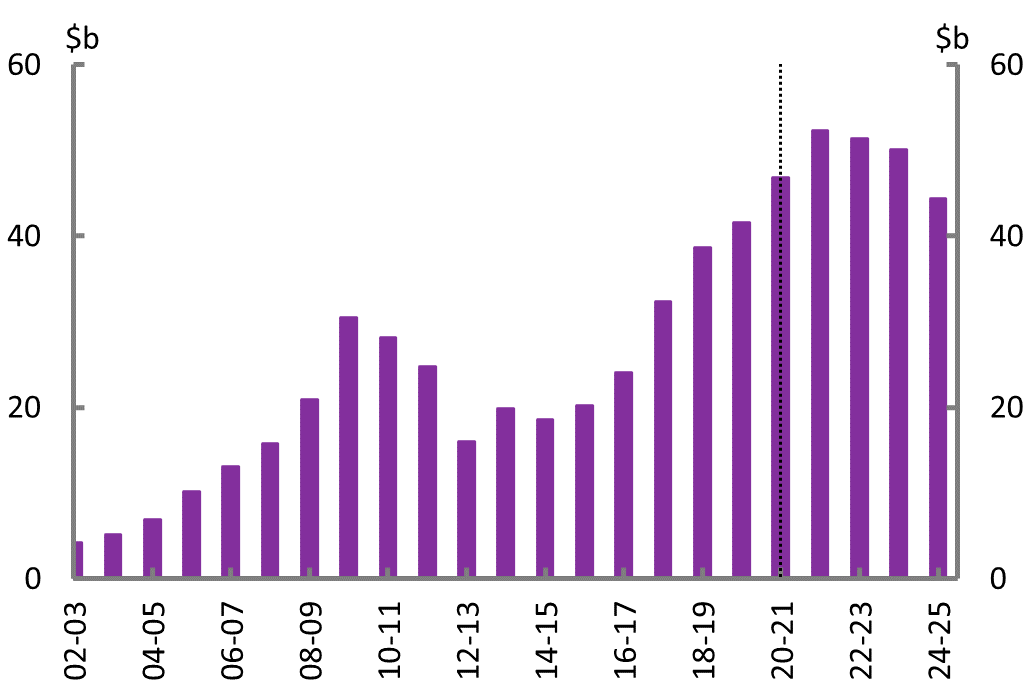

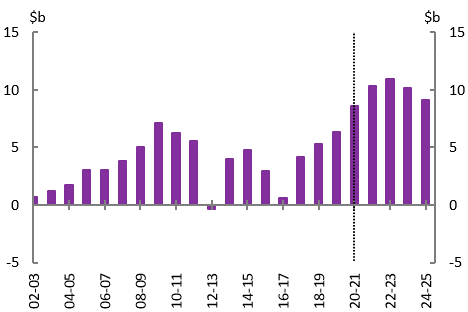

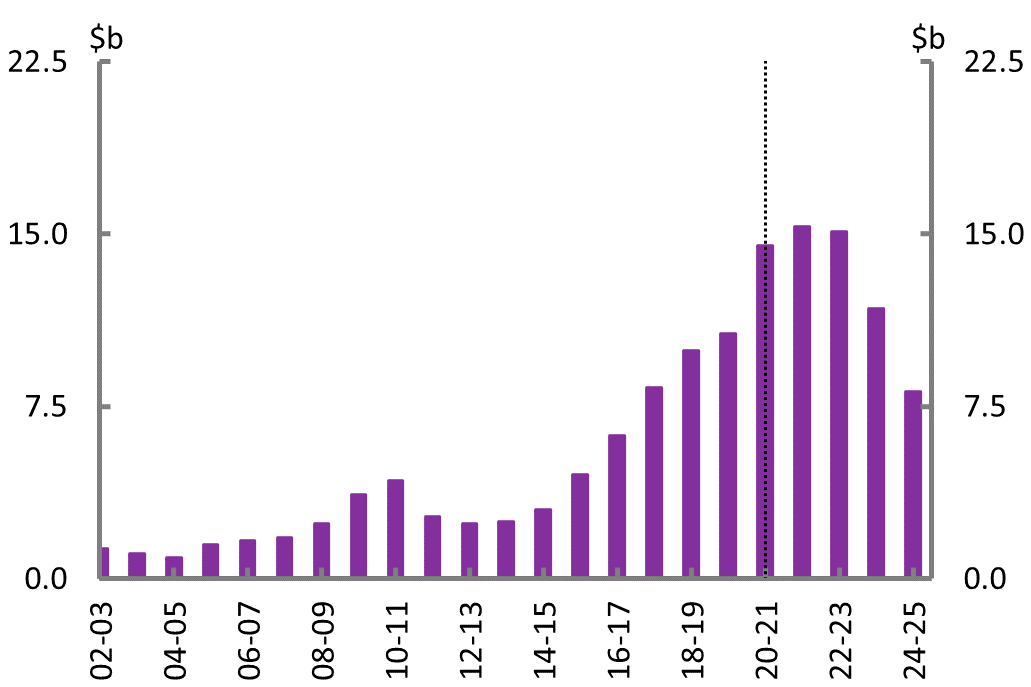

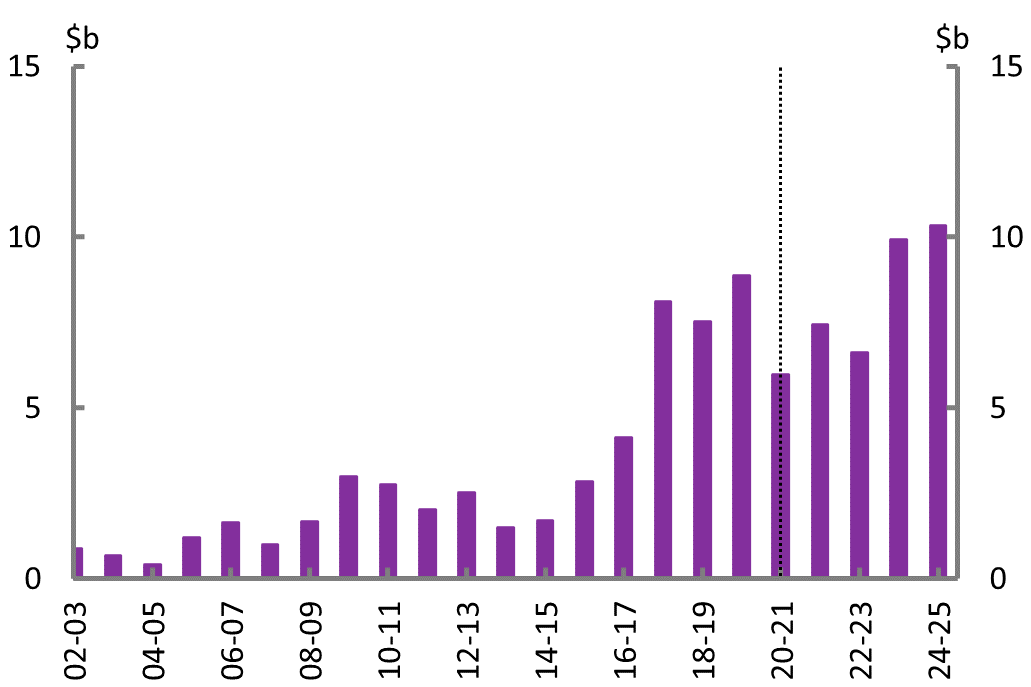

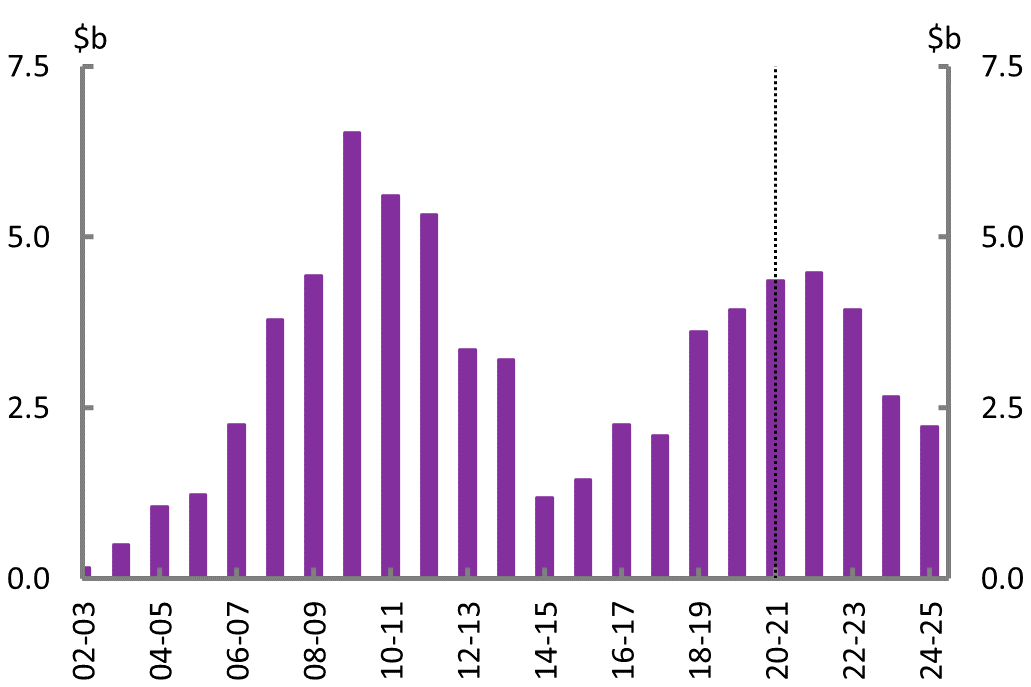

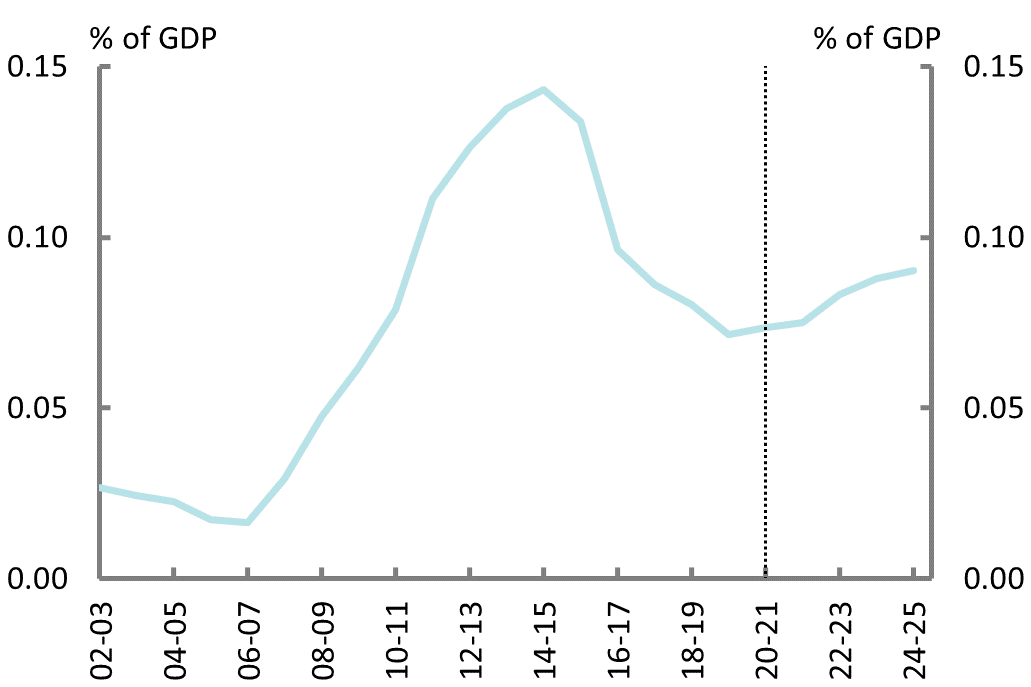

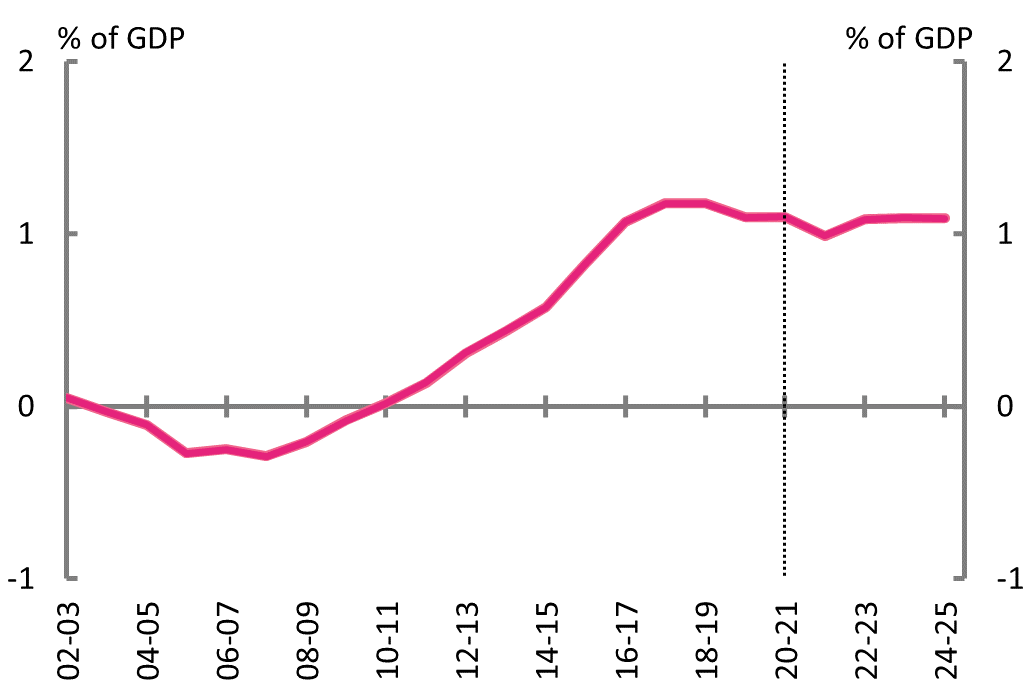

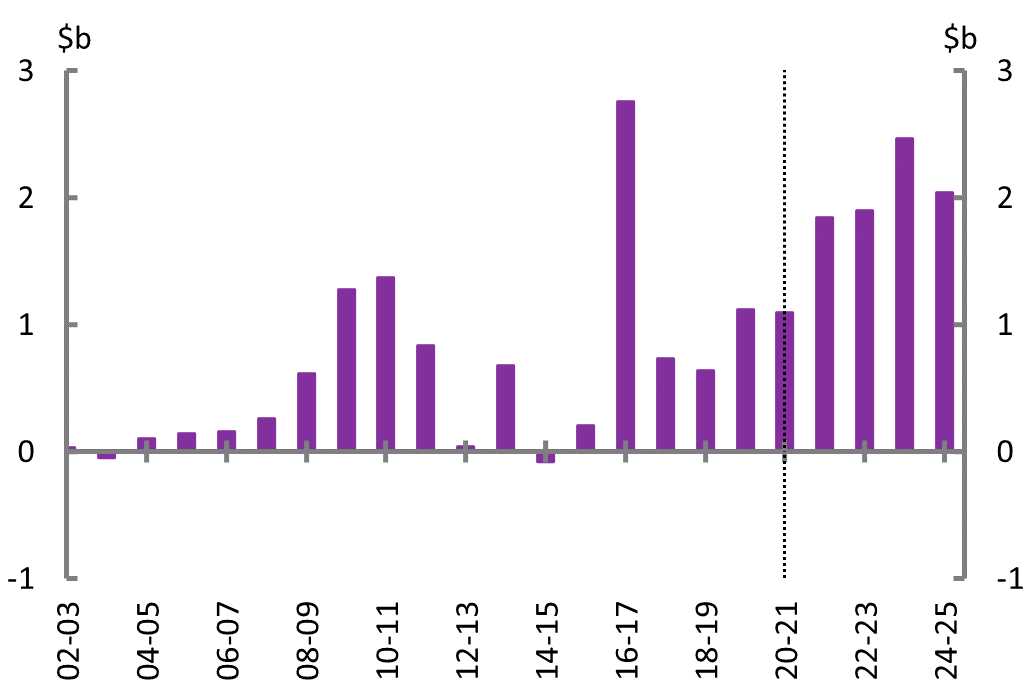

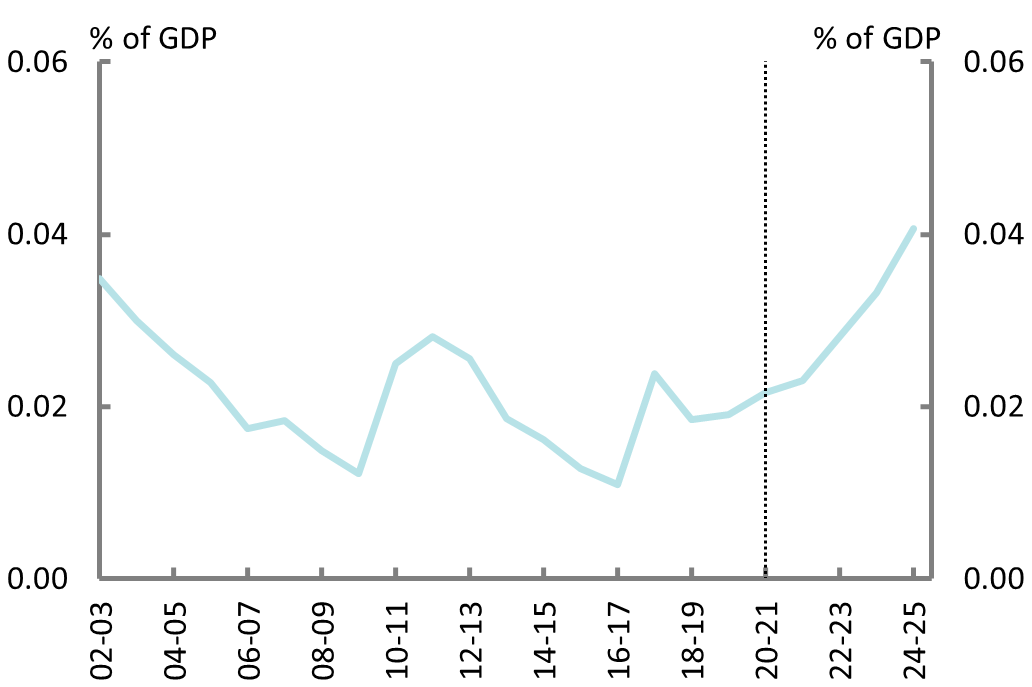

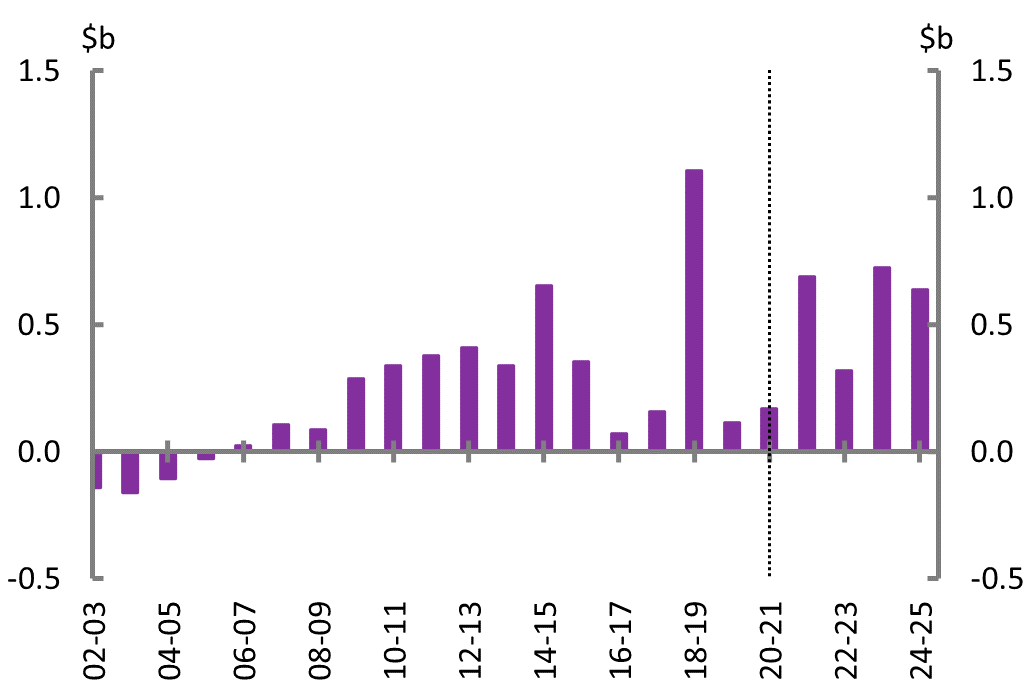

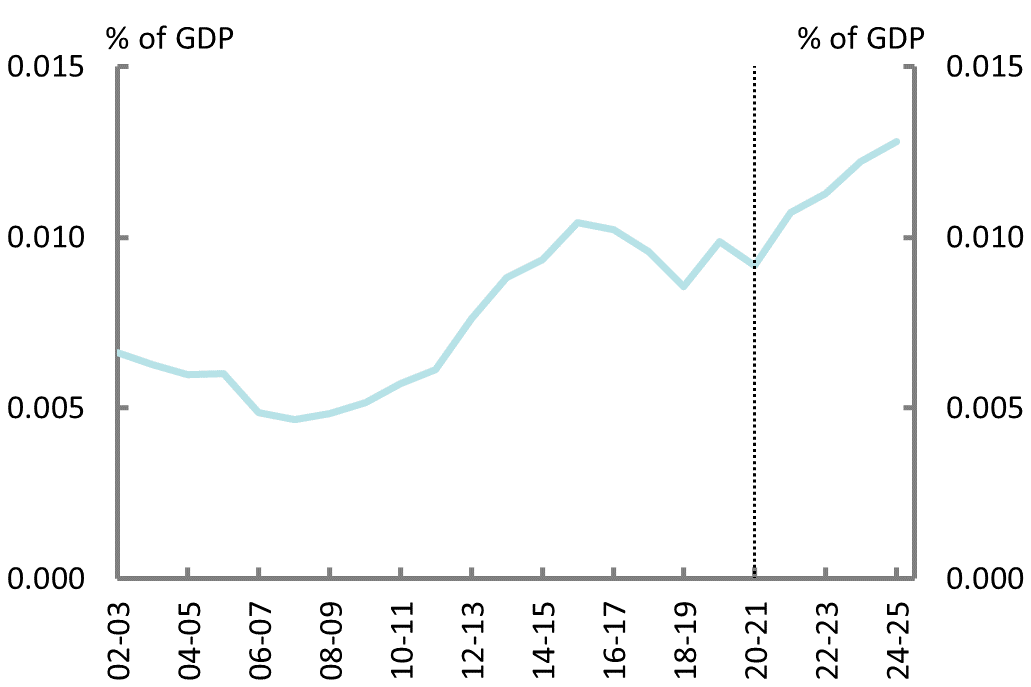

Figure 1B: Net capital investment |

|

|

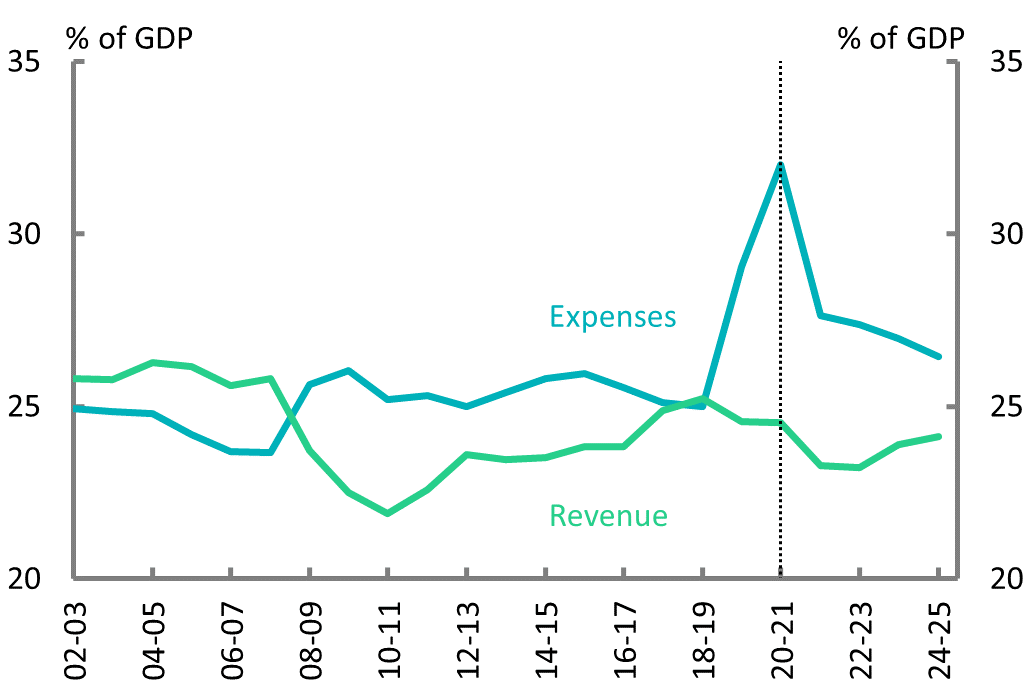

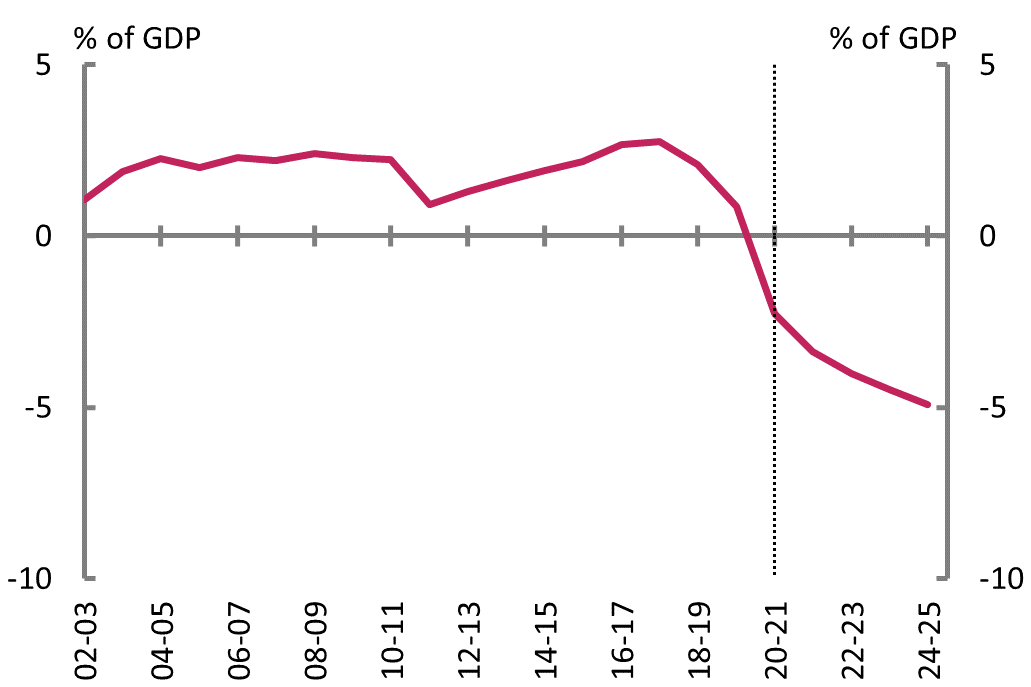

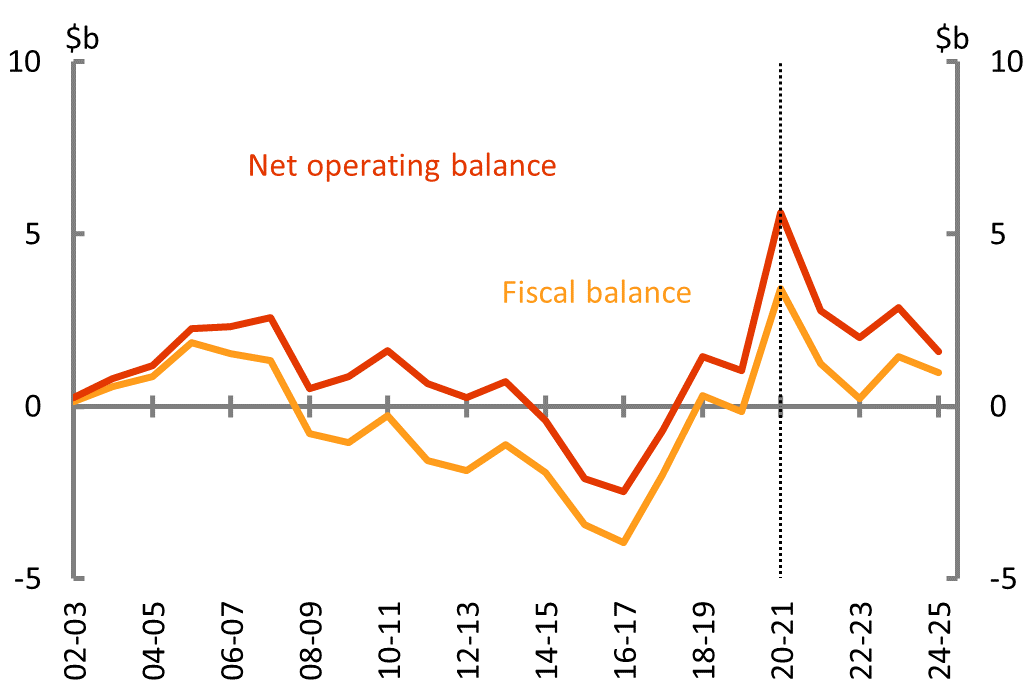

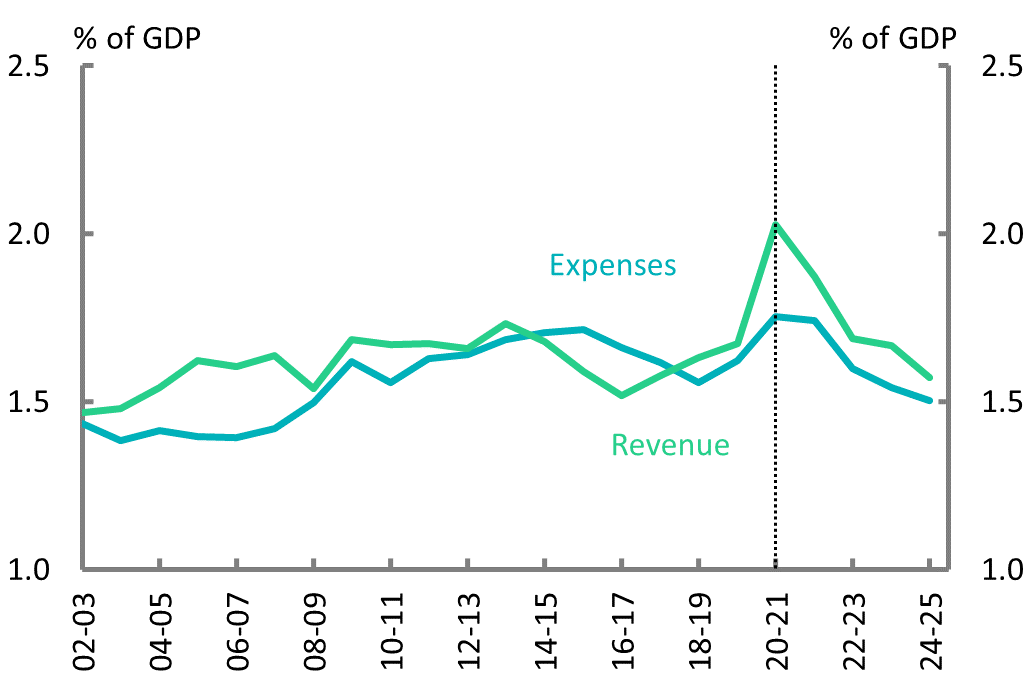

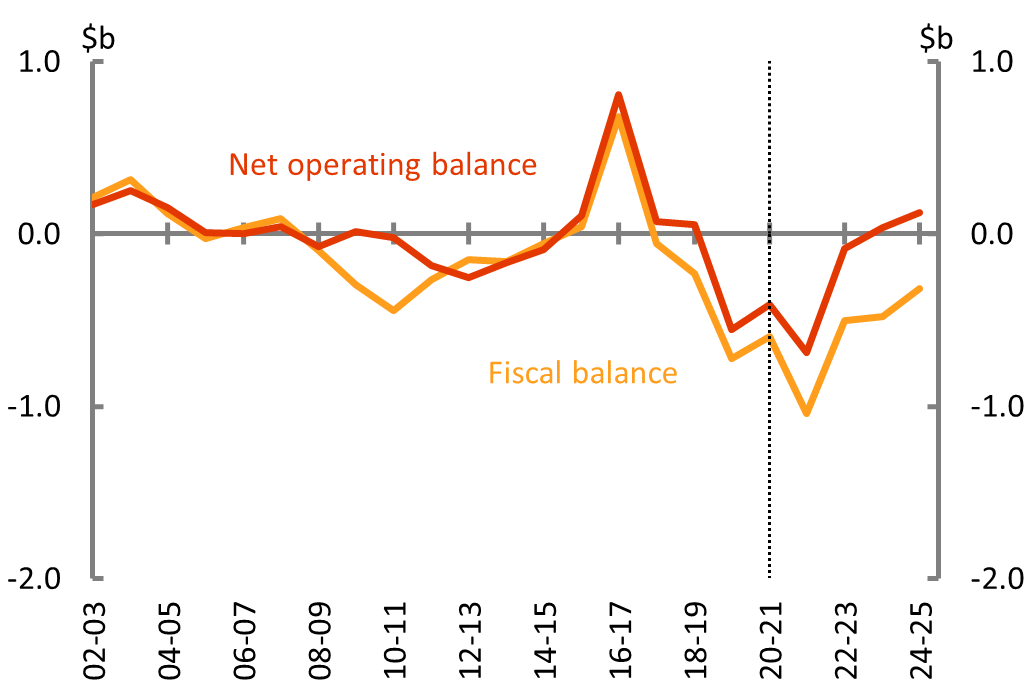

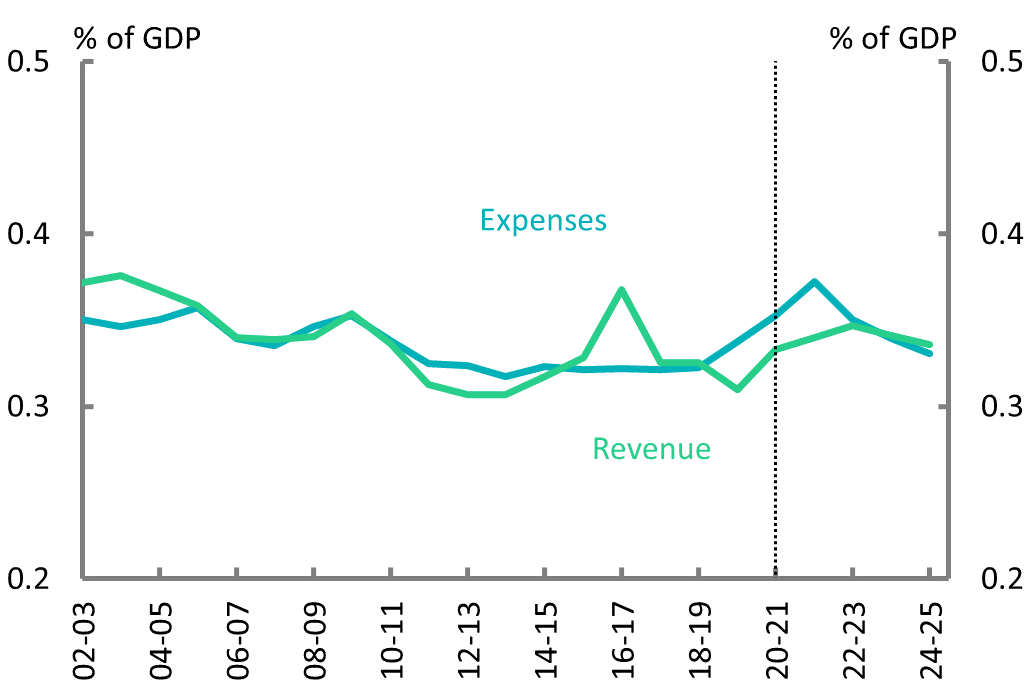

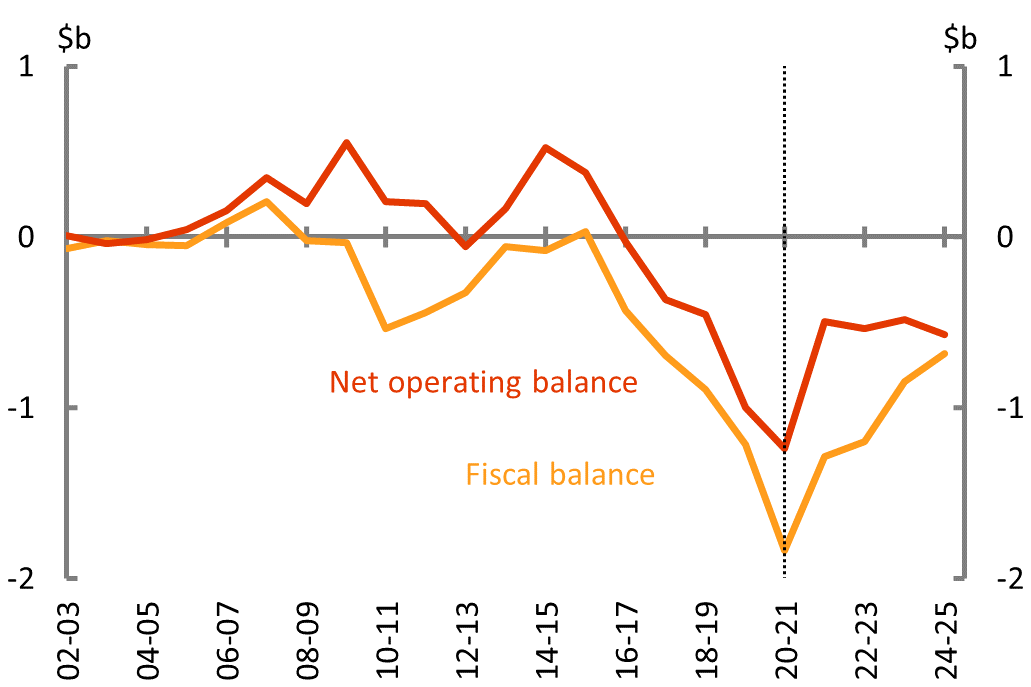

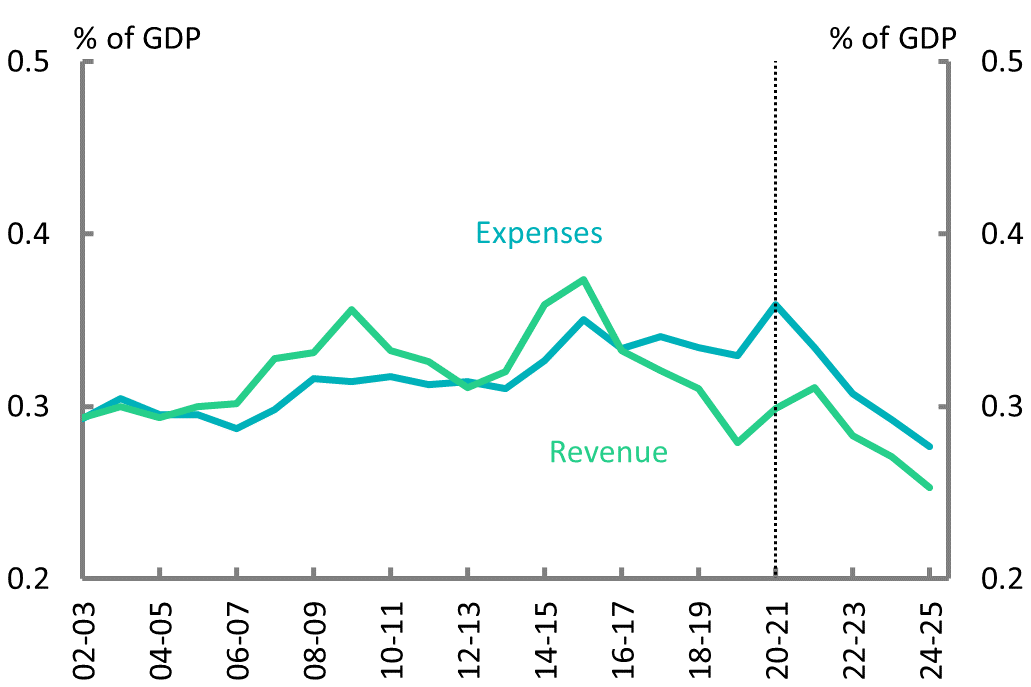

| The national net operating balance is forecast to improve across the forward estimates as Australia emerges from the initial outbreak of the COVID-19 pandemic. | |

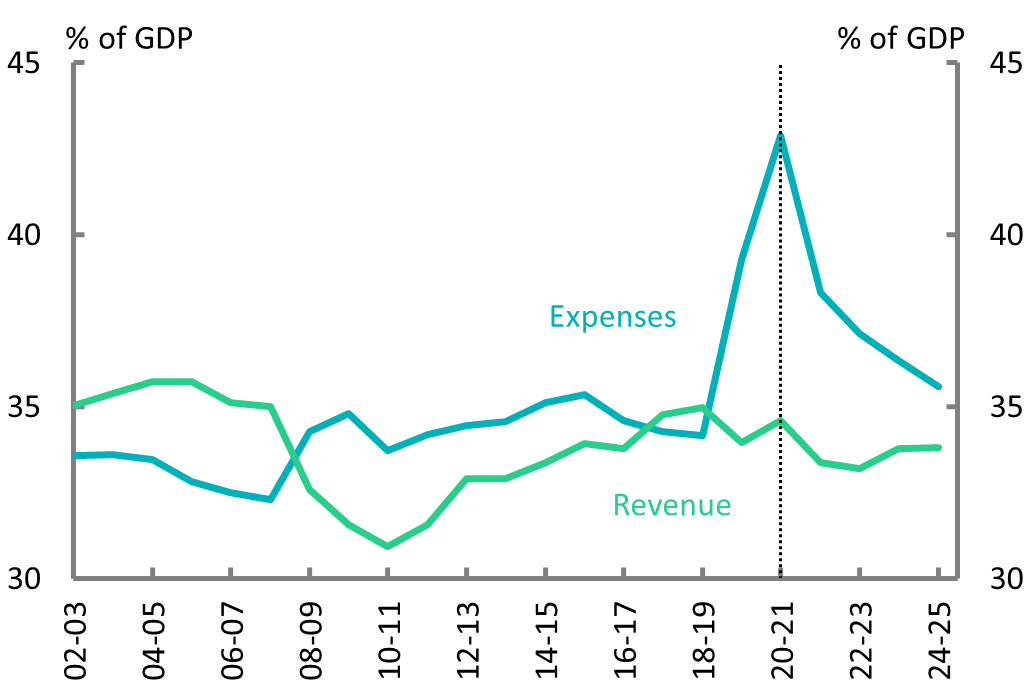

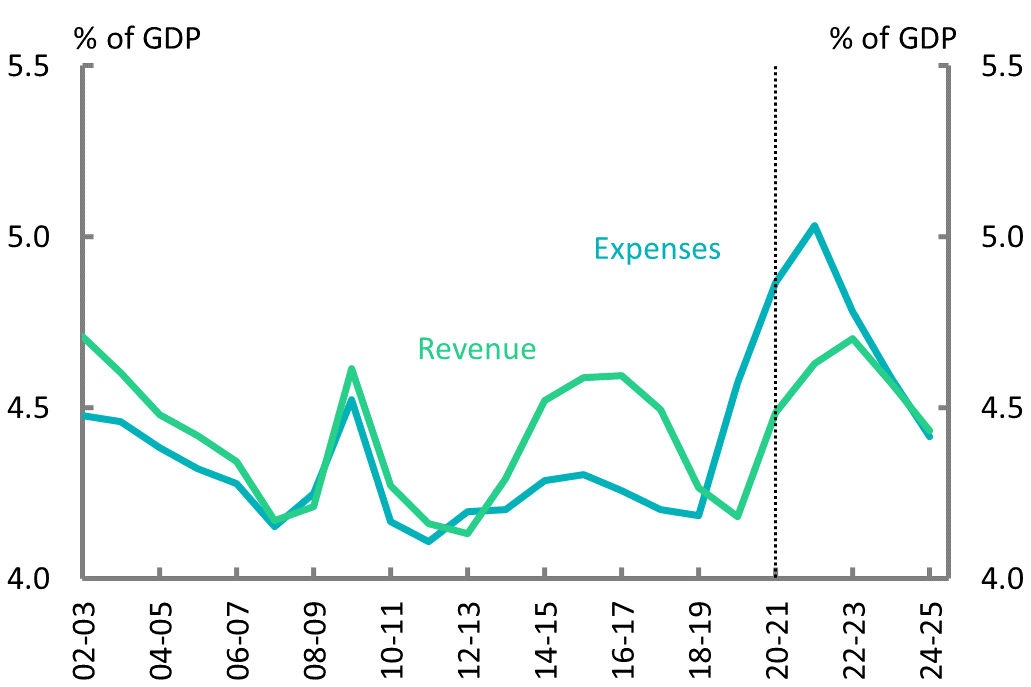

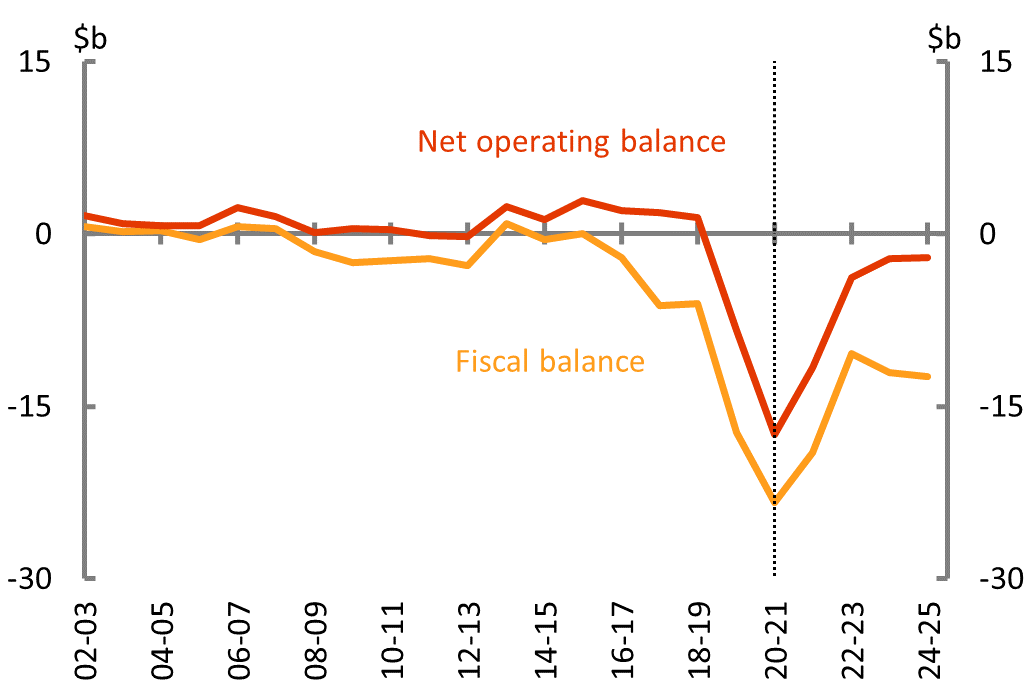

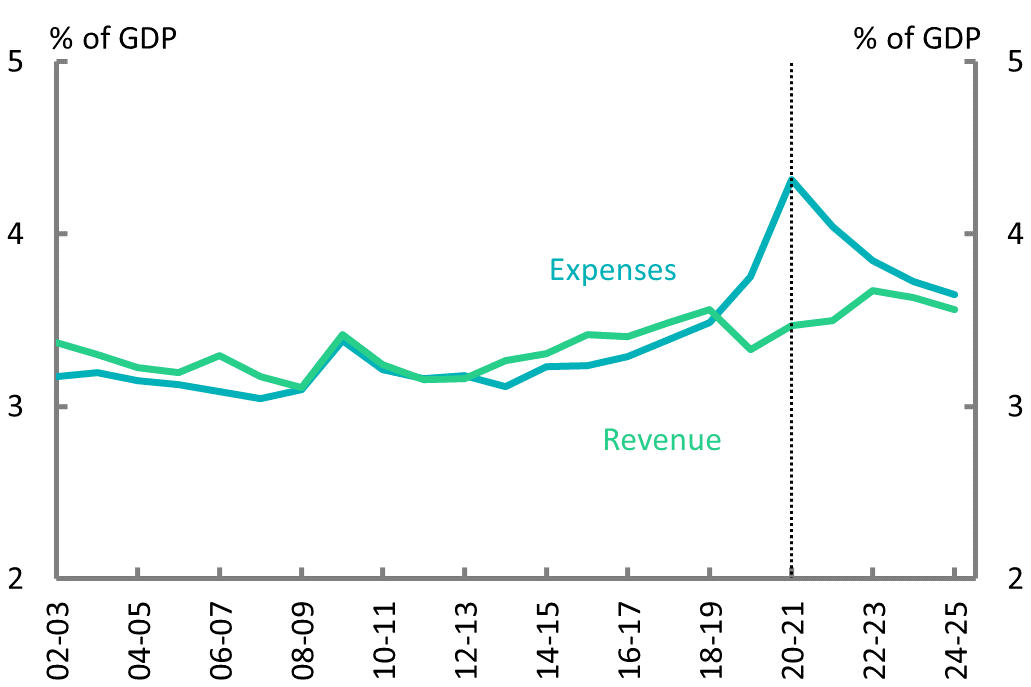

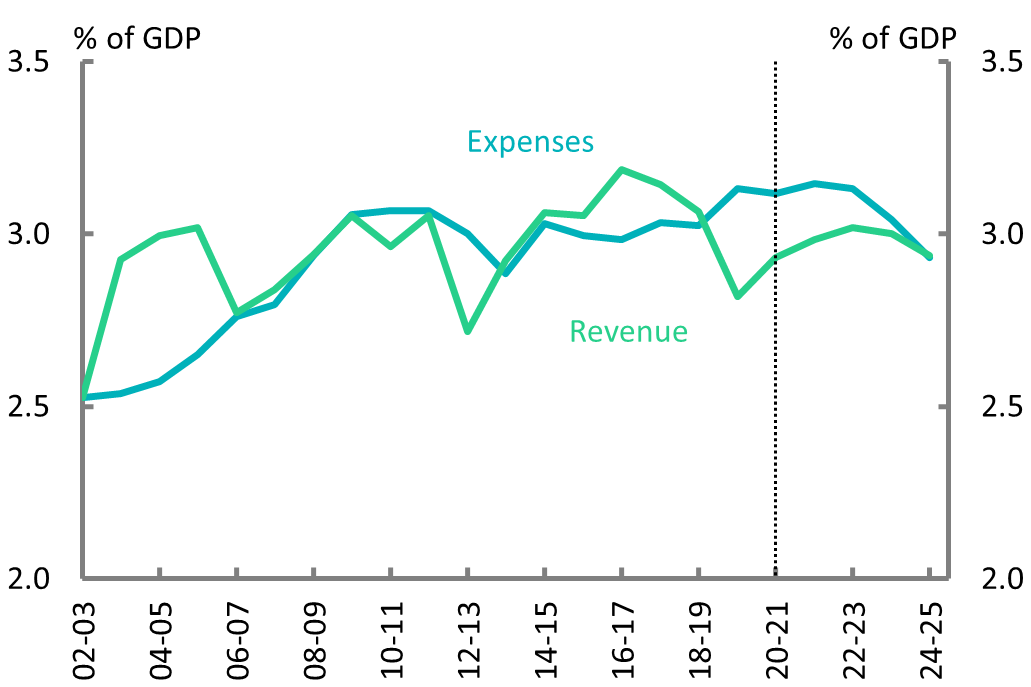

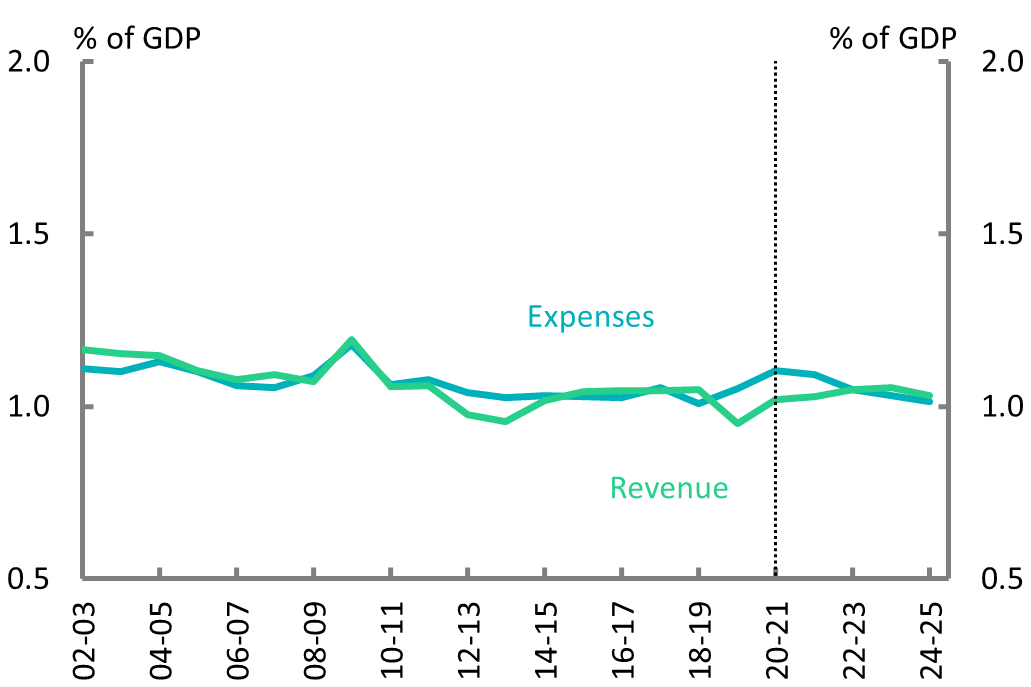

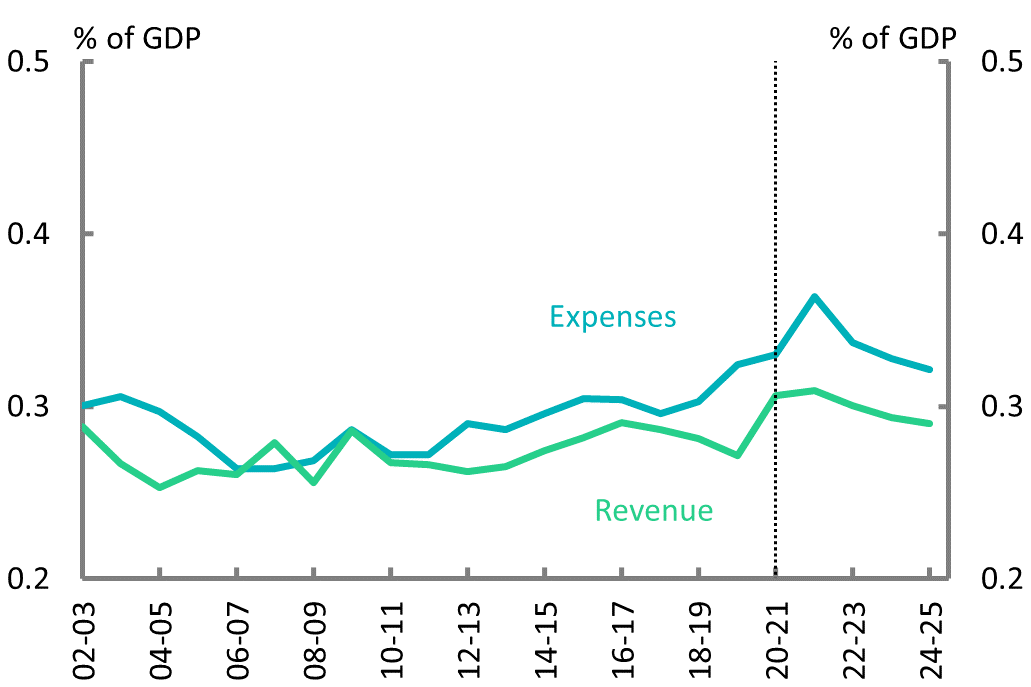

Figure 1C: Revenue and expenses |

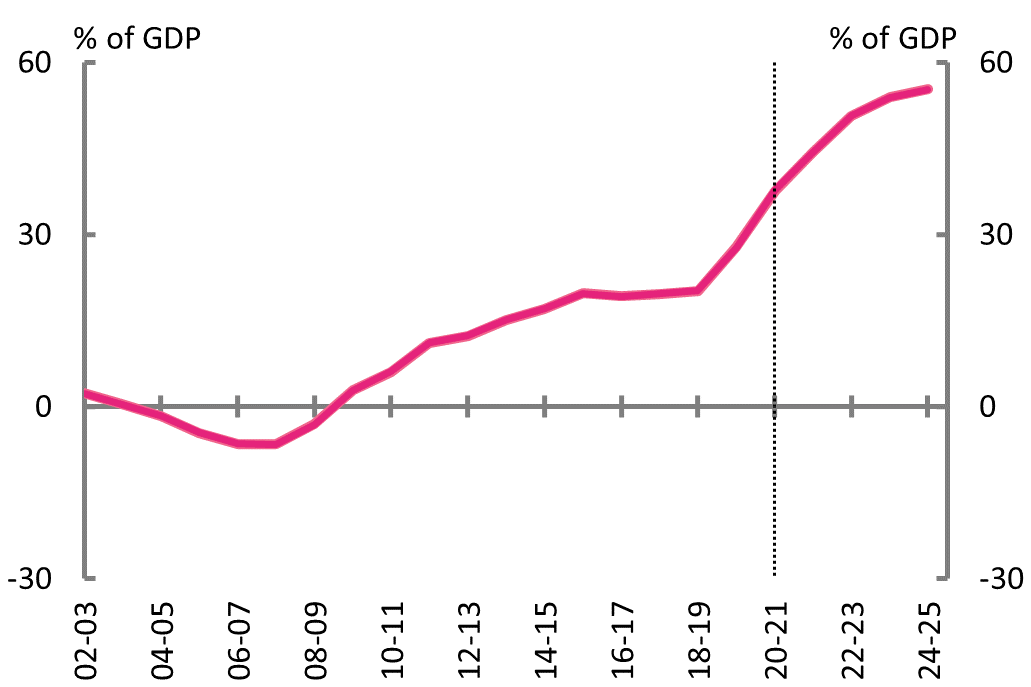

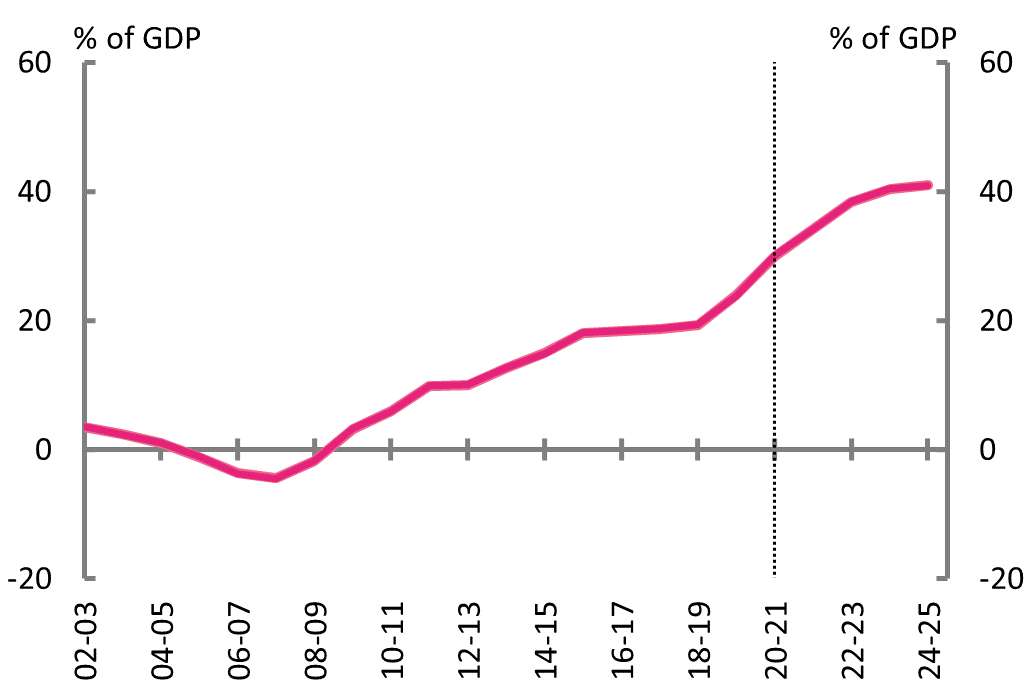

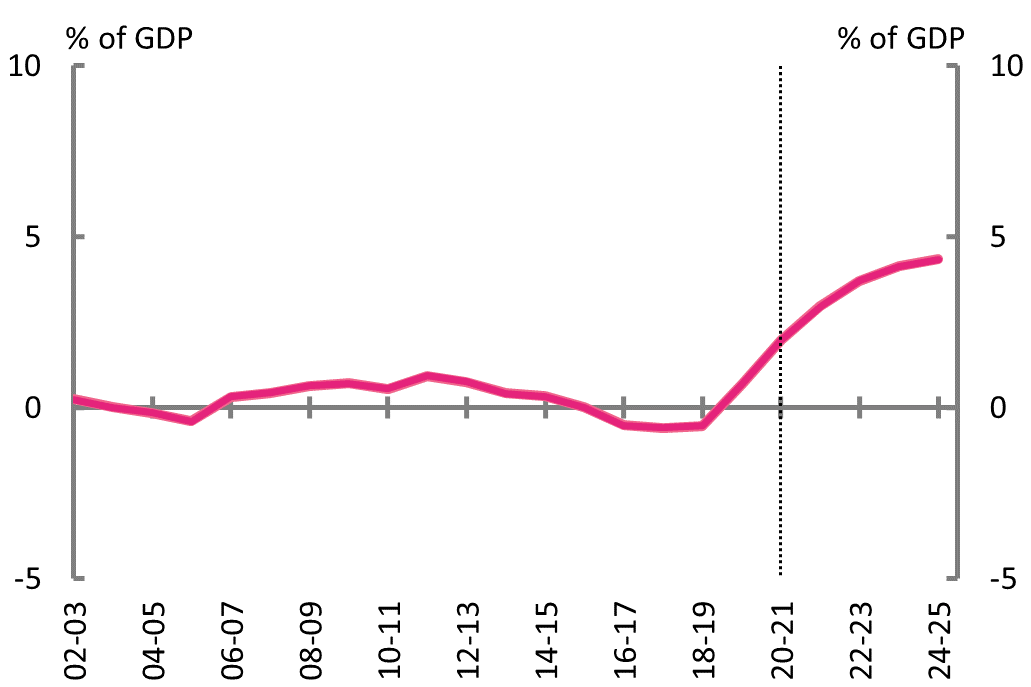

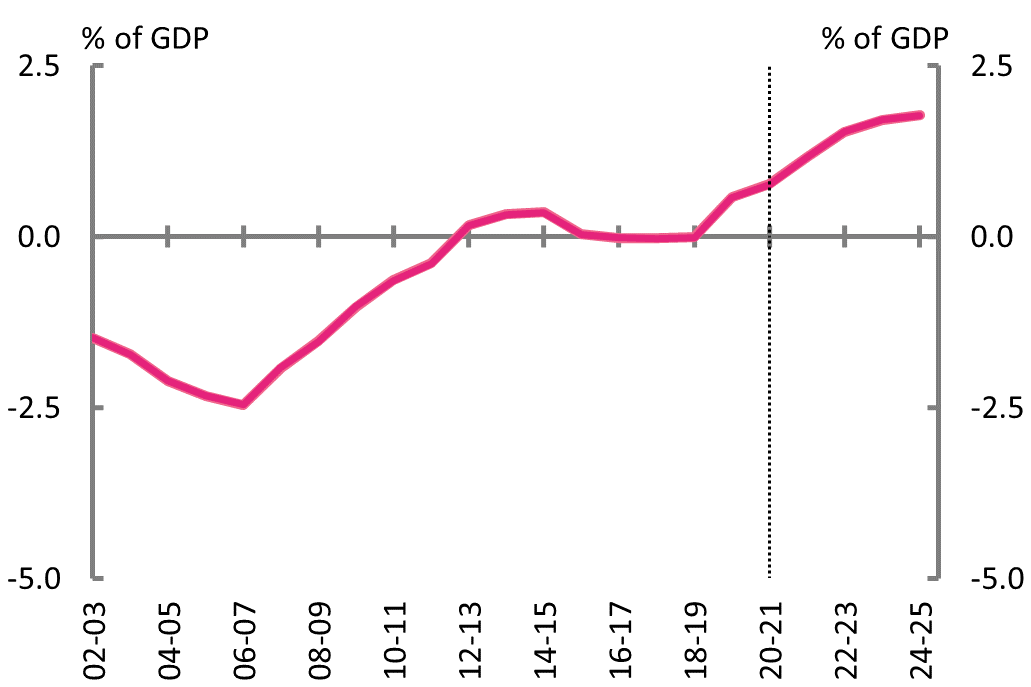

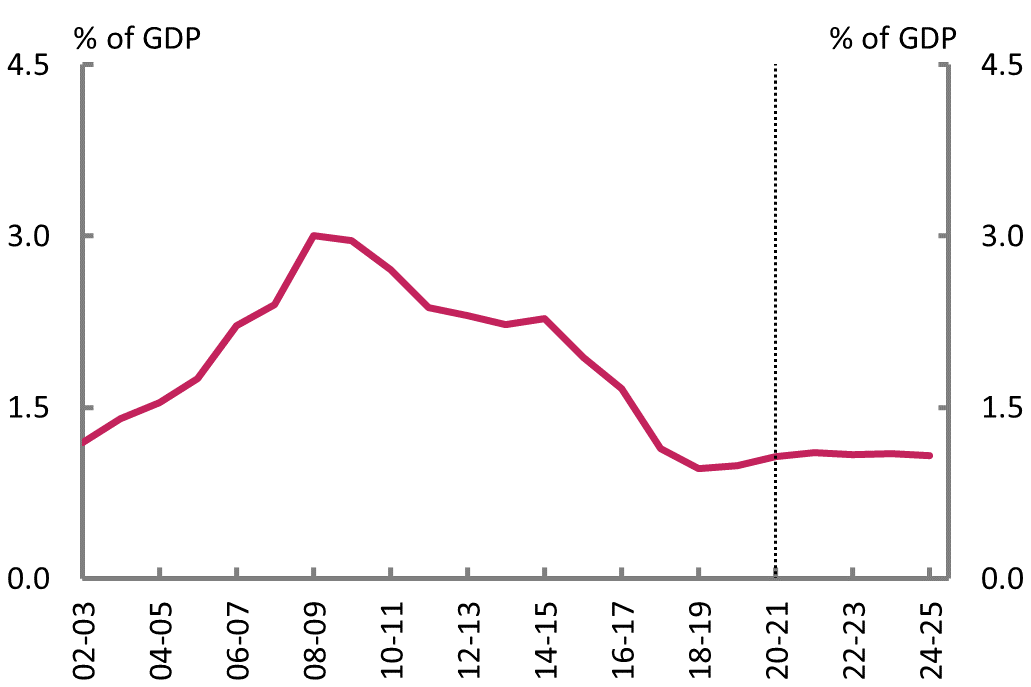

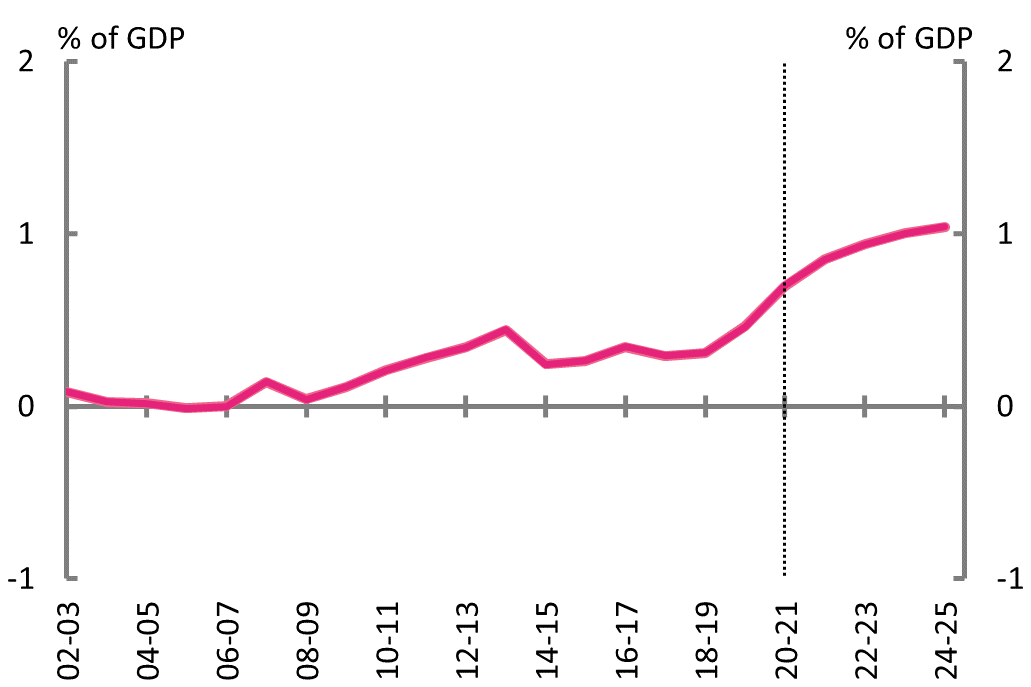

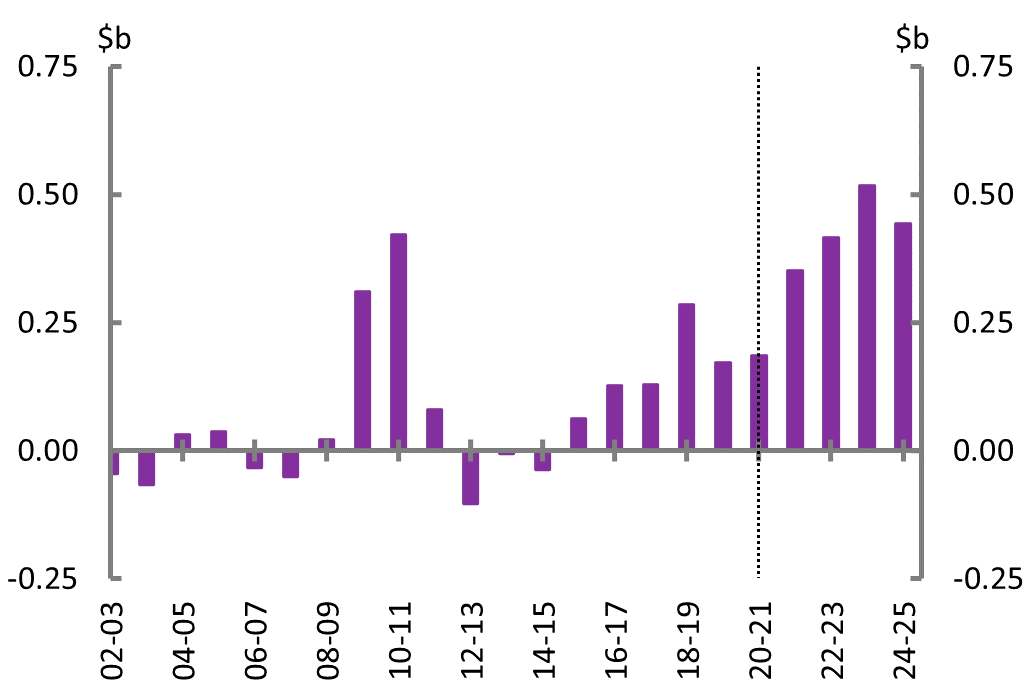

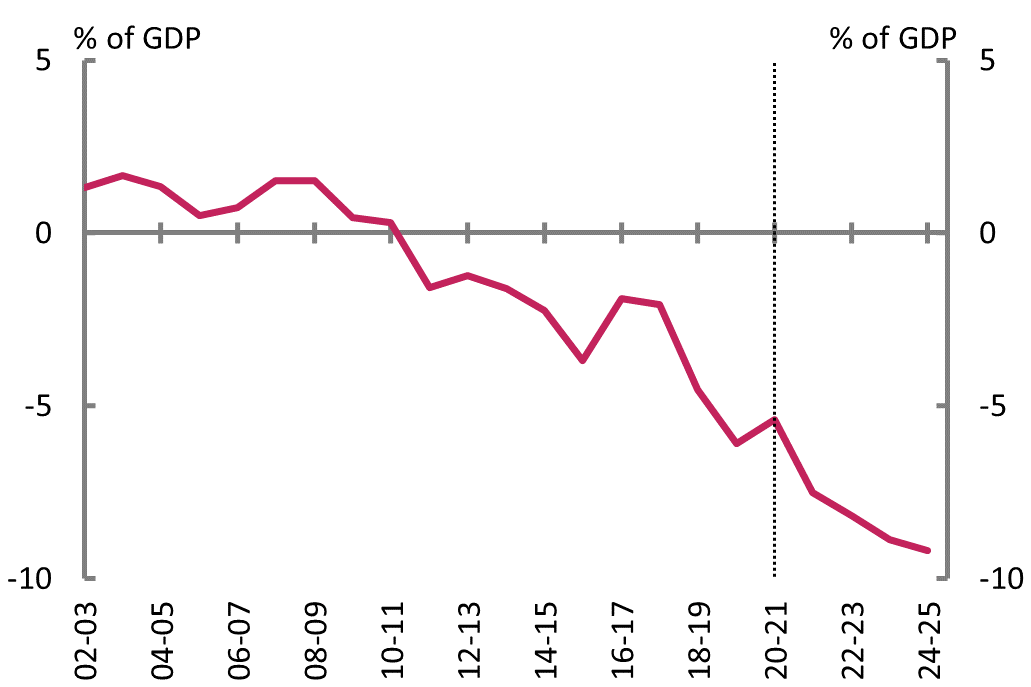

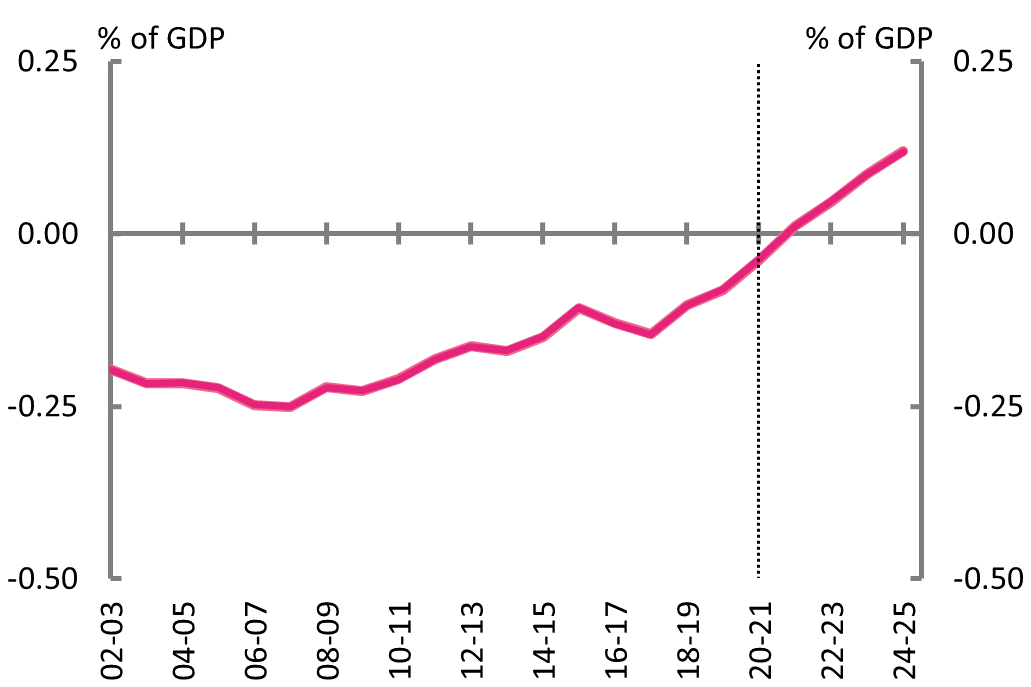

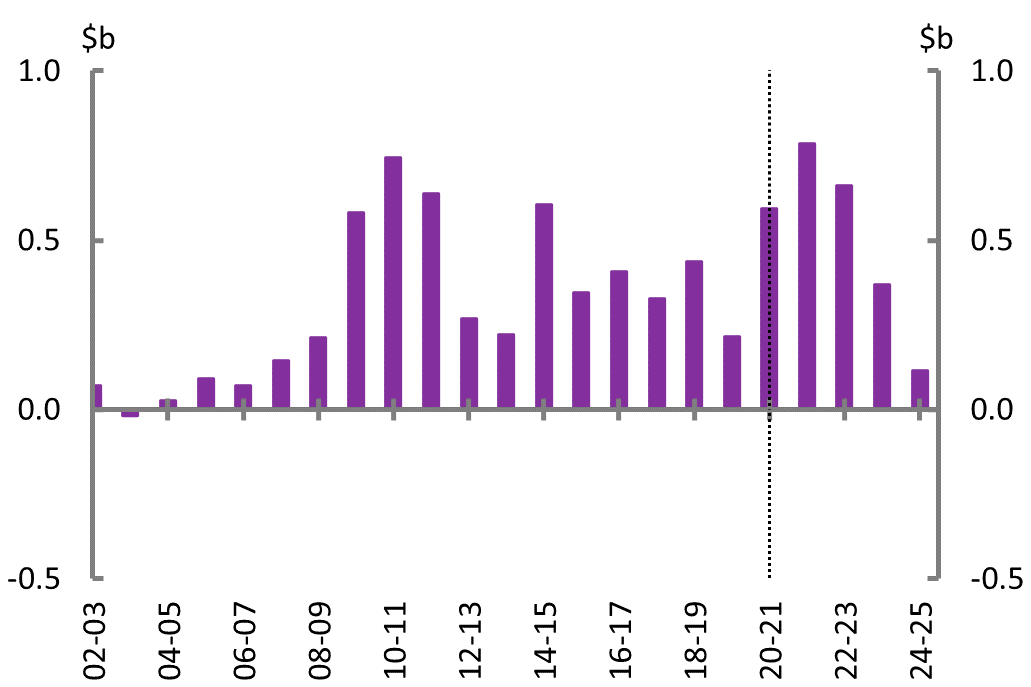

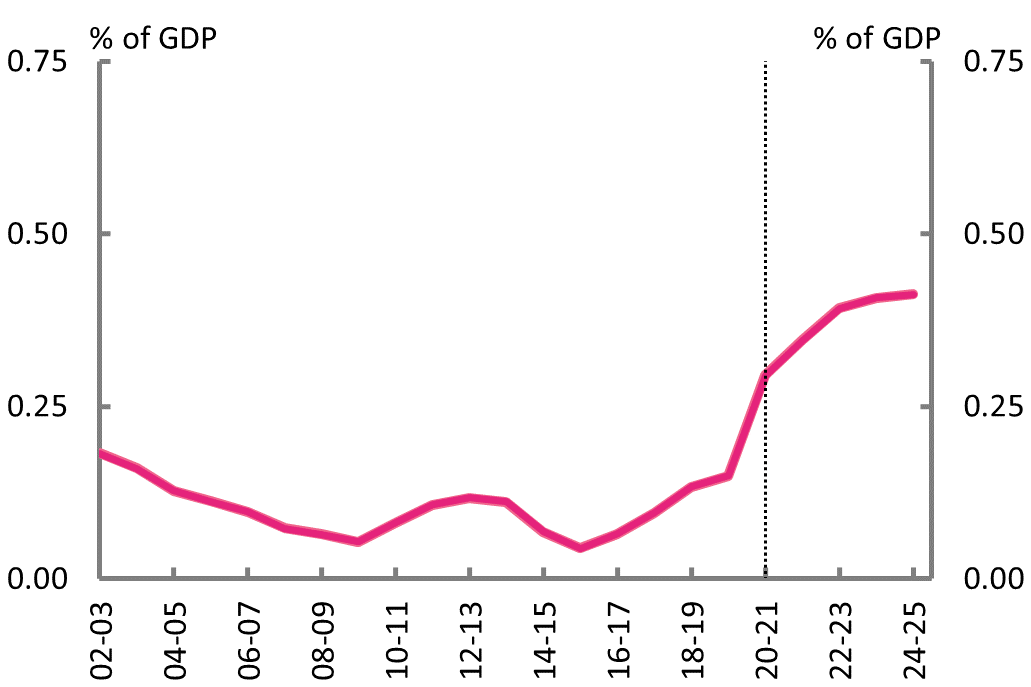

Figure 1D: Net debt |

|

|

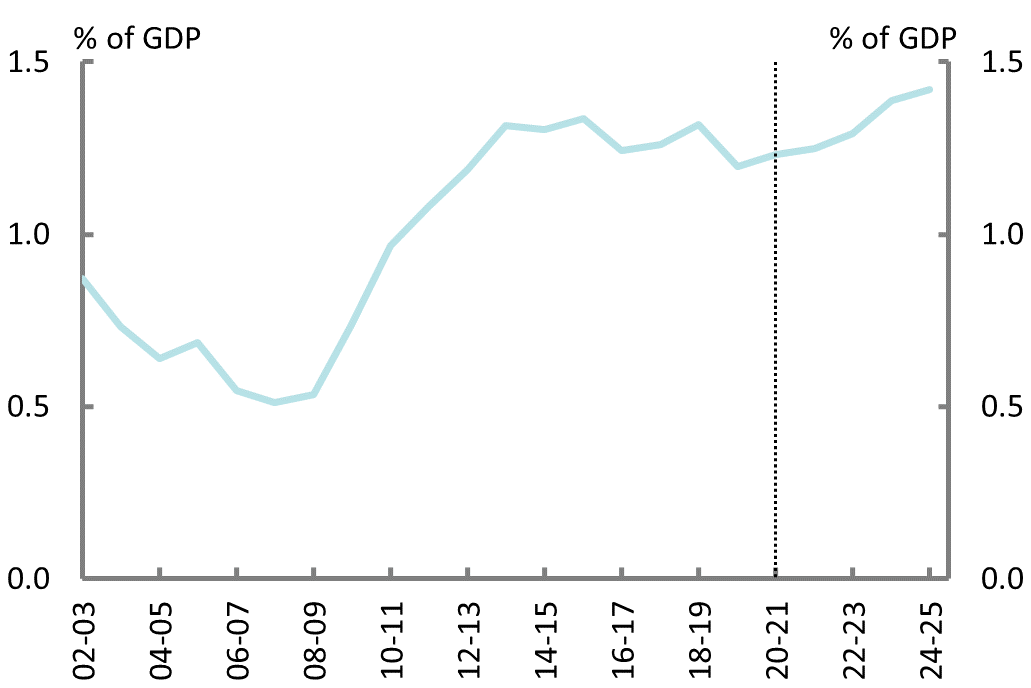

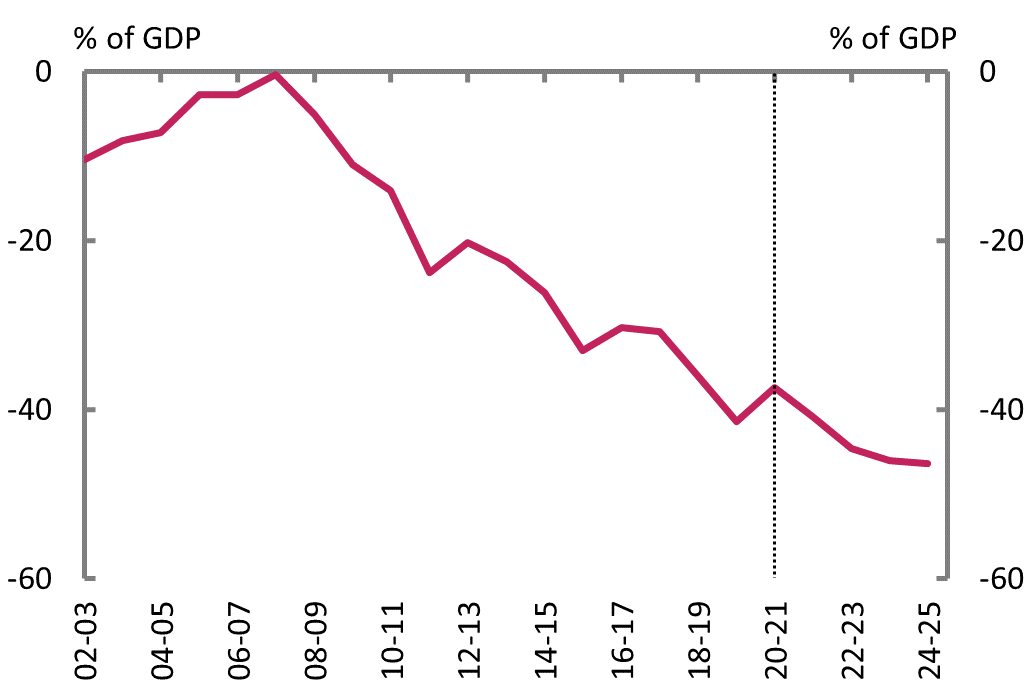

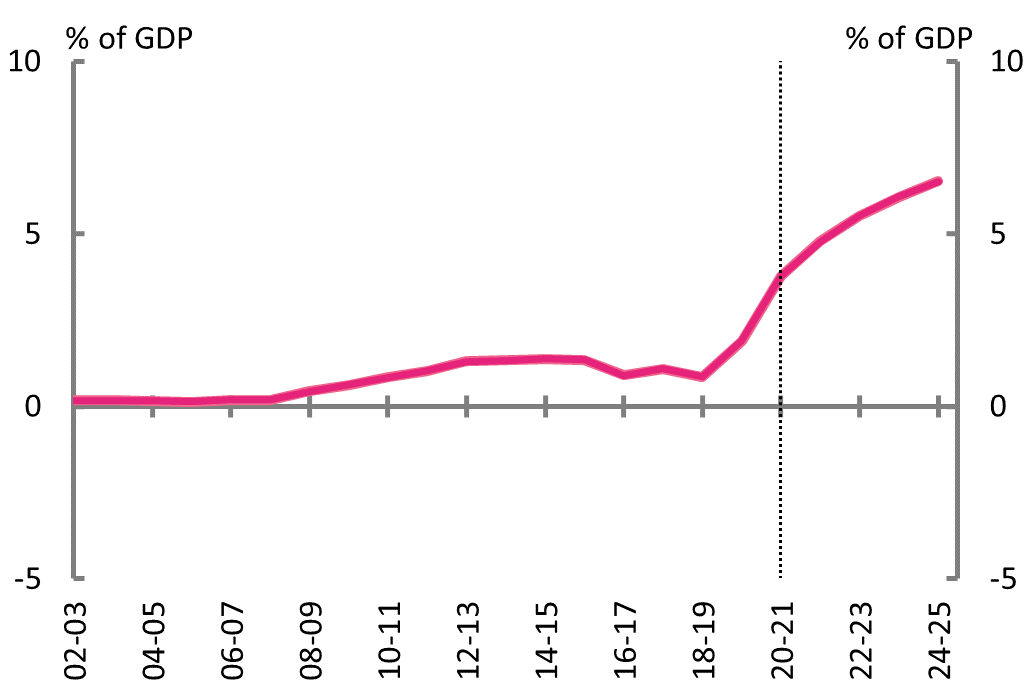

| However, continued operating deficits will necessitate borrowing for most governments, increasing national net debt across the forward estimates. | |

Figure 1E: Net financial worth |

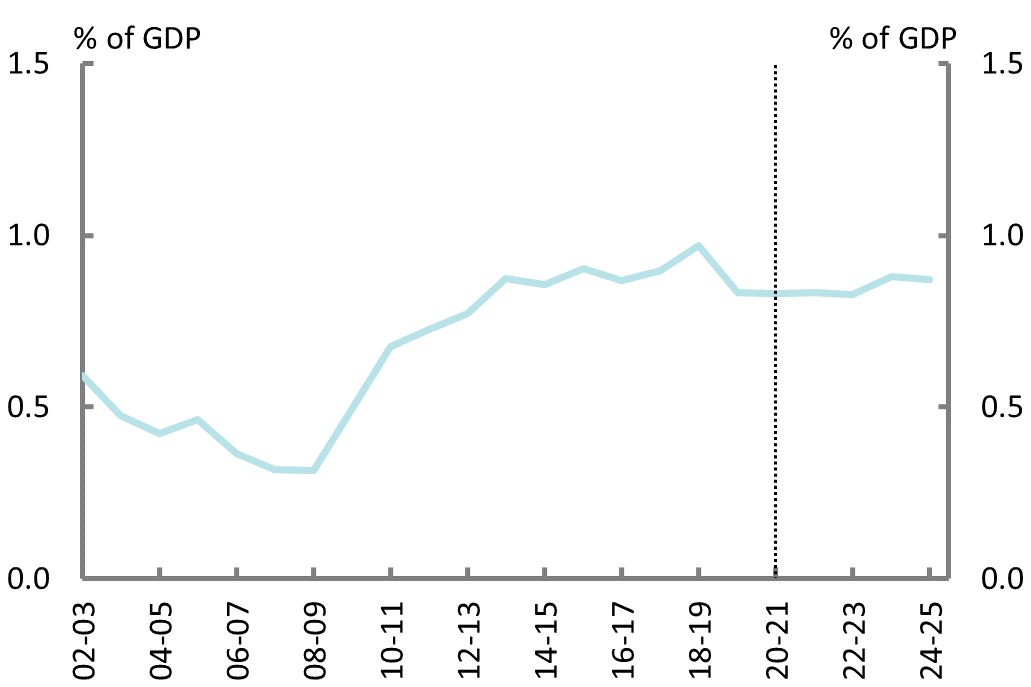

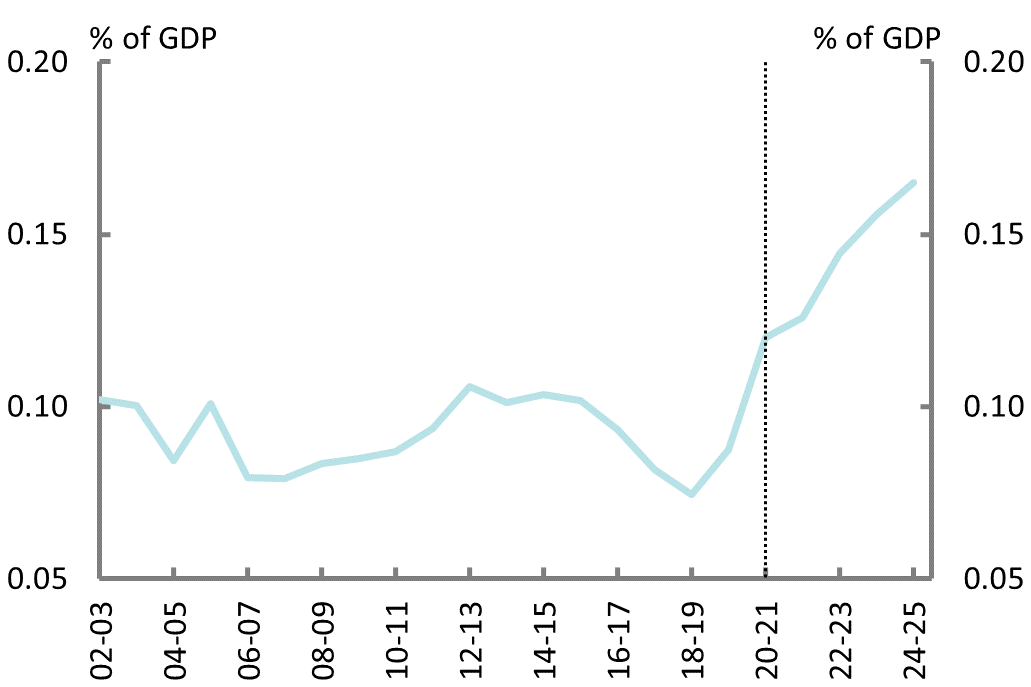

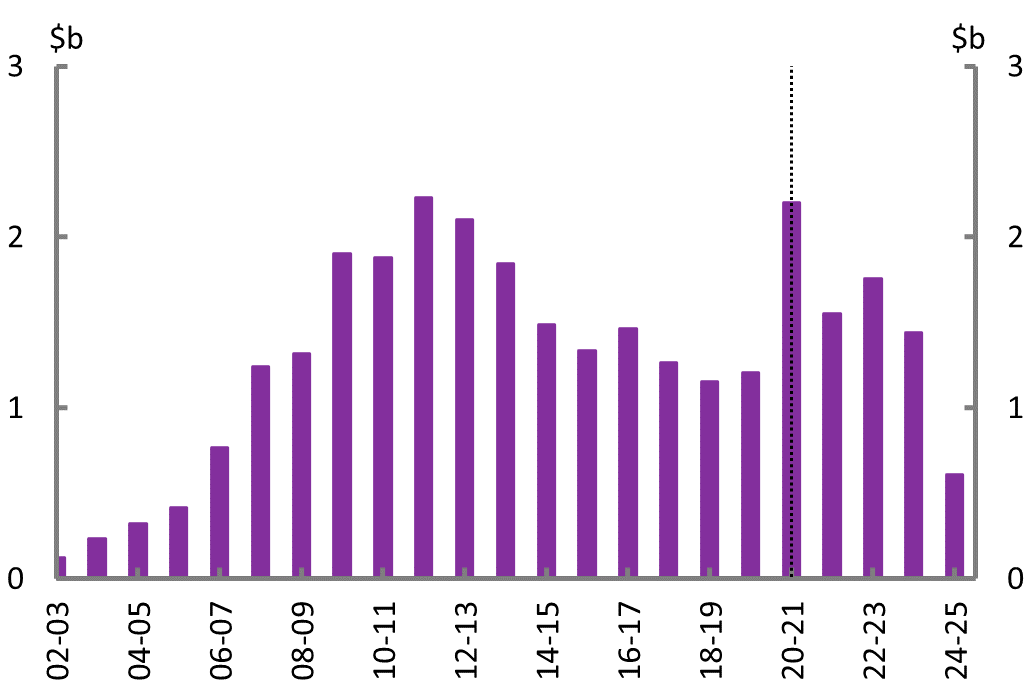

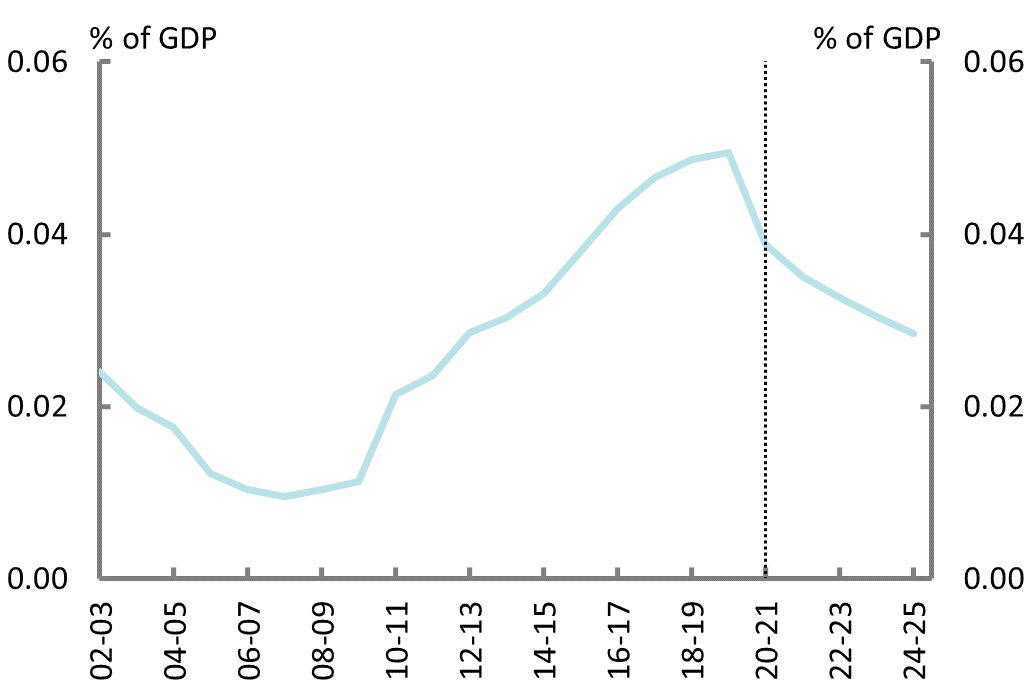

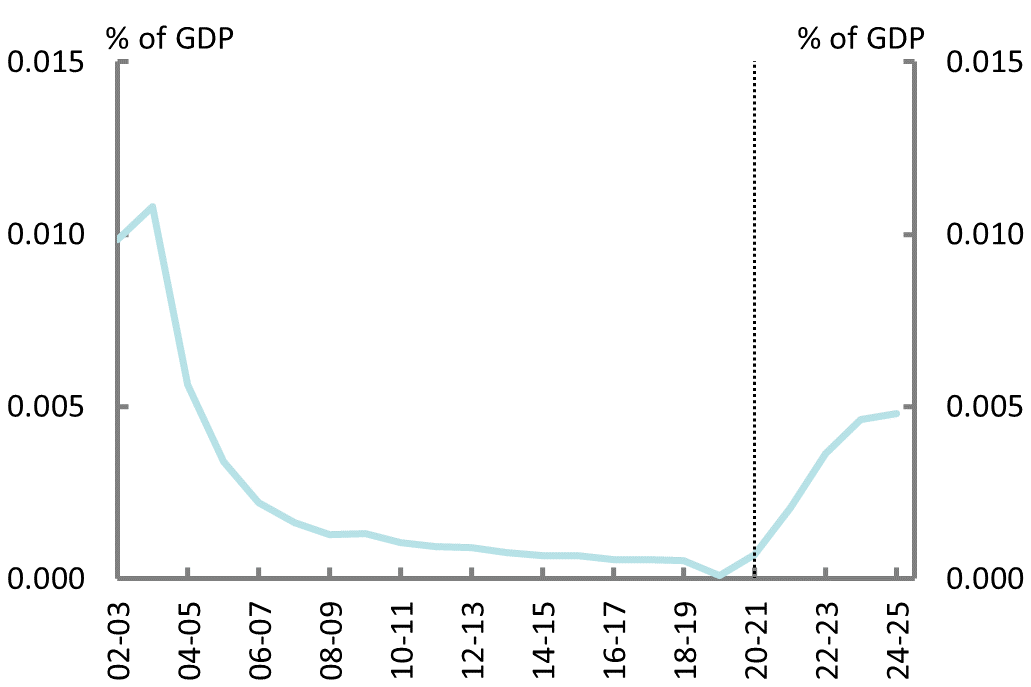

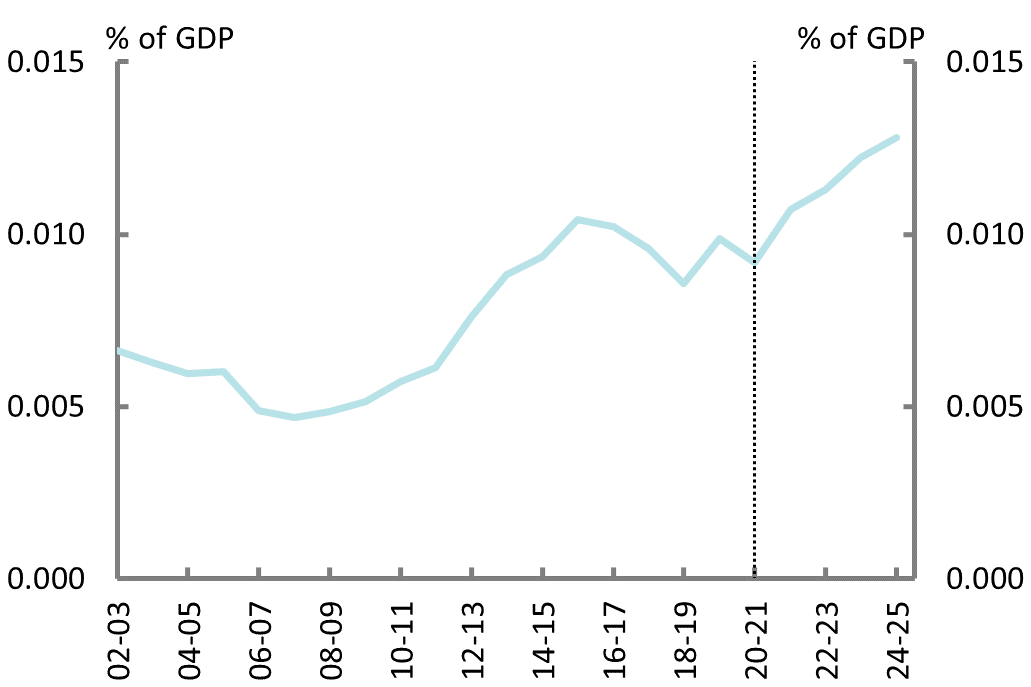

Figure 1F: Public debt interest payments |

|

|

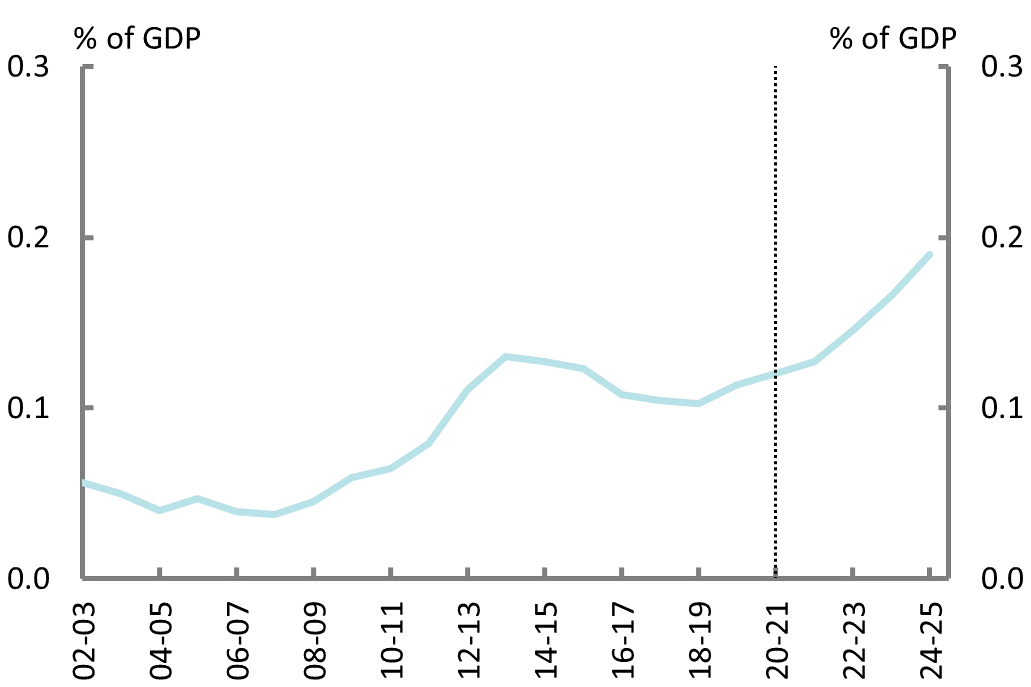

| Despite the increase in debt, public debt interest payments are expected to increase gradually across the forward estimates. | |

Figure 2A: Net operating and fiscal balance |

Figure 2B: Net capital investment |

|

|

| With the winding down of COVID-19-related expenses and improved economic conditions, the Commonwealth forecasts an improved net operating balance across the forward estimates. | |

Figure 2C: Revenue and expenses |

Figure 2D: Net debt |

|

|

| However, with net operating deficits forecast across the forward estimates, Commonwealth debt is still expected to grow over the period. | |

Figure 2E: Net financial worth |

Figure 2F: Public debt interest payments |

|

|

Despite the increase in debt, public debt interest payments are expected to remain broadly flat, largely due to historically low interest rates.

Figure 3A: Net operating and fiscal balance |

Figure 3B: Net capital investment |

|

|

| The New South Wales Budget forecasts a significant increase in net capital investment, with large investments in hospitals, schools, and infrastructure. | |

Figure 3C: Revenue and expenses |

Figure 3D: Net debt |

|

|

| Expenses are forecast to increase as the state responds to the COVID 19 pandemic and flood and storm events, and enhances its bushfire response capabilities. | |

Figure 3E: Net financial worth |

Figure 3F: Public debt interest payments |

|

|

With rising debt due to operating deficits and the state’s infrastructure program, public debt interest payments are also expected to increase.

Figure 4A: Net operating and fiscal balance |

Figure 4B: Net capital investment |

|

|

| Victoria’s Big Build continues, but the COVID-19 pandemic created some uncertainty around the state’s capital program. | |

Figure 4C: Revenue and expenses |

Figure 4D: Net debt |

|

|

| Expenses are estimated to peak in 2020-21, remaining above pre COVID-19 levels across the forward estimates. | |

Figure 4E: Net financial worth |

Figure 4F: Public debt interest payments |

|

|

| With debt increasing as the state borrows to fund operating requirements and its capital investments, public debt interest payments are expected to follow suit. | |

Figure 5A: Net operating and fiscal balance |

Figure 5B: Net capital investment |

|

|

| With improved economic conditions, Queensland forecasts a net operating surplus in 2024-25 after consecutive deficits since 2019-20. | |

Figure 5C: Revenue and expenses |

Figure 5D: Net debt |

|

|

| Expenses are expected to remain elevated as a share of GDP until 2022-23, reflecting the state’s ongoing health and economic response to the COVID-19 pandemic. | |

Figure 5E: Net financial worth |

Figure 5F: Public debt interest payments |

|

|

| While public debt interest payments remain elevated, historically low interest rates see them well below the peak of 2013-14. | |

Figure 6A: Net operating and fiscal balance |

Figure 6B: Net capital investment |

|

|

In contrast to the deficits of other states and territories, Western Australia expects a record operating surplus in 2020-21, attributed to a stronger than expected iron ore price.

Figure 6C: Revenue and expenses |

Figure 6D: Net debt |

|

|

Revenue is forecast to decrease across the forward estimates as the iron ore price returns to its long-run average.

Figure 6E: Net financial worth |

Figure 6F: Public debt interest payments |

|

|

With debt stable, public debt interest payments are forecast to decrease as a share of GDP.

Figure 7A: Net operating and fiscal balance |

Figure 7B: Net capital investment |

|

|

| South Australia forecasts a net operating surplus in 2022-23, with revenues exceeding expenses from 2022-23, as the state recovers from the COVID-19 pandemic. | |

Figure 7C: Revenue and expenses |

Figure 7D: Net debt |

|

|

| Net debt is still forecast to increase across the forward estimates due to substantial infrastructure investment and operating deficits in the short term. | |

Figure 7E: Net financial worth |

Figure 7F: Public debt interest payments |

|

|

| Reflecting the increase in total liabilities, the state’s net financial worth is expected to decrease across the forward estimates. | |

Figure 8A: Net operating and fiscal balance |

Figure 8B: Net capital investment |

|

|

| Tasmania forecasts a significant increase in net capital investment across the forward estimates, with investments in roads and bridges, hospitals and health, and human services and housing. | |

Figure 8C: Revenue and expenses |

Figure 8D: Net debt |

|

|

| Net debt, which has been negative since 2004-05, is forecast to become positive and increase significantly across the forward estimates, mostly due to the state’s investments in response to the COVID-19 pandemic. | |

Figure 8E: Net financial worth |

Figure 8F: Public debt interest payments |

|

|

| With debt growing, public debt interest payments are expected to increase across the forward estimates. | |

Figure 9A: Net operating and fiscal balance |

Figure 9B: Net capital investment |

|

|

| Reflecting the territory’s COVID-19 response, the Australian Capital Territory forecasts a record net operating deficit in 2021-22. | |

Figure 9C: Revenue and expenses |

Figure 9D: Net debt |

|

|

| Reflecting ongoing operating deficits, net debt is forecast to increase across the forward estimates. | |

Figure 9E: Net financial worth |

Figure 9F: Public debt interest payments |

|

|

| Corresponding with the increase in debt, public debt interest payments are forecast to increase across the forward estimates. | |

Figure 10A: Net operating and fiscal balance |

Figure 10B: Net capital investment |

|

|

| The Northern Territory forecasts net capital investment to increase significantly in 2021-22 due to additional infrastructure investment, including strategic planning for future industry and population growth. | |

Figure 10C: Revenue and expenses |

Figure 10D: Net debt |

|

|

| Coupled with operating deficits expected across the forward estimates, the territory’s net debt is expected to increase through to 2024-25. | |

Figure 10E: Net financial worth |

Figure 10F: Public debt interest payments |

|

|

| The territory’s net financial worth is forecast to decrease across the forward estimates, with liabilities increasing through to 2024-25. | |

- This snapshot accompanies the PBO’s 2021-22 National fiscal outlook report. Data from 2002‑03 to 2019‑20 are sourced from the Australian Bureau of Statistics’ Government Finance Statistics, Annual publication. Estimates and forecasts for 2020‑21 to 2024‑25 are sourced from Commonwealth, state, and territory budgets. Data are generally comparable over time, but there are some differences in the treatment of items across jurisdictions. Further information about the data, methods, and terms used in this snapshot is available in the technical appendix.

- Net capital investment does not include government businesses.

- The 2021-22 Budget forward estimates period is 2021-22 to 2024-25.

- National charts include Commonwealth, state, territory, and local government estimates and forecasts. Transfers have been eliminated between levels of government to arrive at a consolidated national fiscal position.

- For a detailed discussion of the Commonwealth fiscal outlook see the PBO’s Beyond the budget 2021-22: fiscal outlook and scenarios report.

- The Commonwealth also provides funding to the states for infrastructure projects through grants, equity injections and debt financing, which are not captured in direct Commonwealth government investment.

- New South Wales estimates and forecasts for revenue and expenses have been adjusted by the PBO to improve comparability through time and across jurisdictions.

- Western Australian estimates and forecasts for revenue and expenses have been adjusted by the PBO to improve comparability through time and across jurisdictions.

- The Australian Capital Territory’s estimates and projections of net debt have been adjusted by the PBO to be consistent with the Uniform Presentation Framework.

National fiscal outlook: As at 2021-22 Budgets

This annual report (full version) provides a national perspective on the fiscal outlook by examining outcomes across all levels of Australian government.