08 June 2021

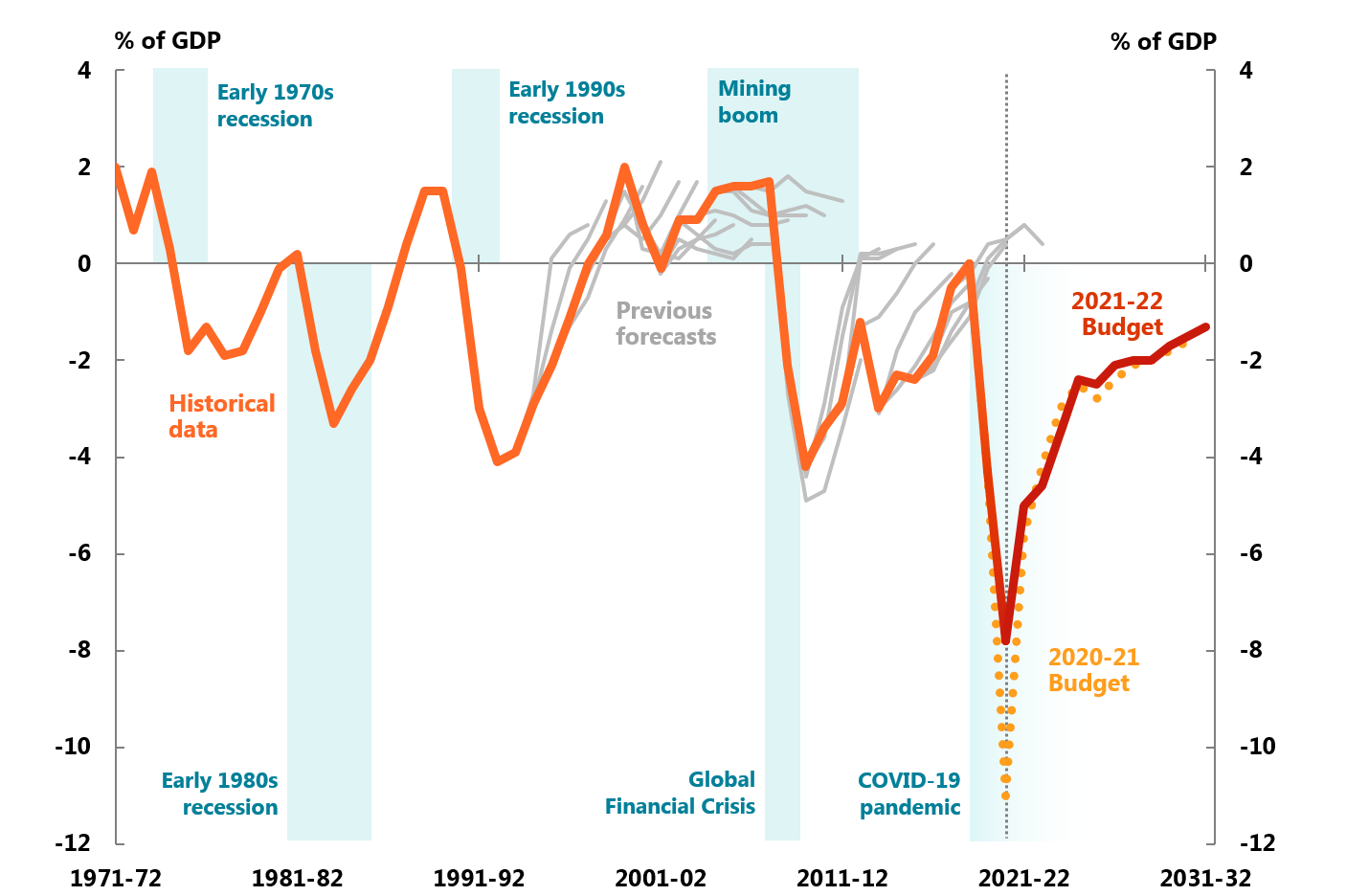

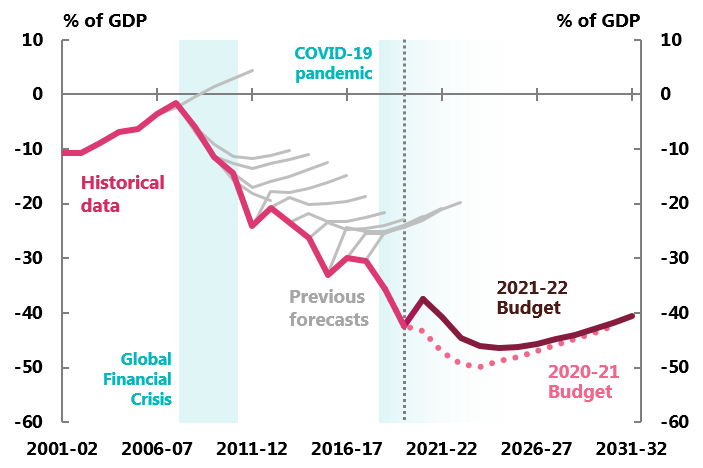

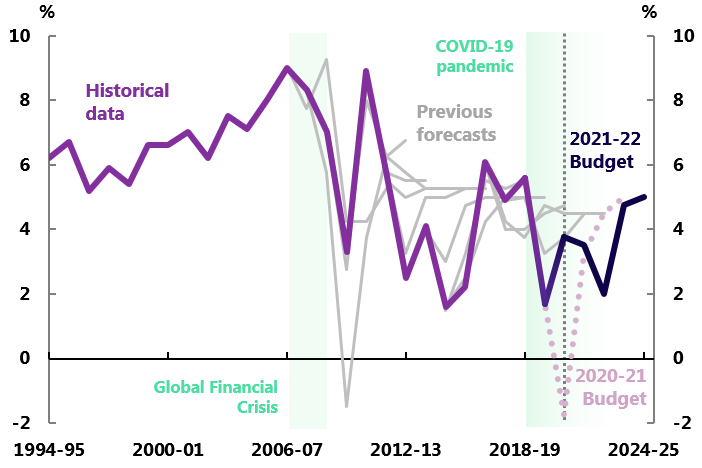

Figure 1A: Underlying cash balance2,3 |

|

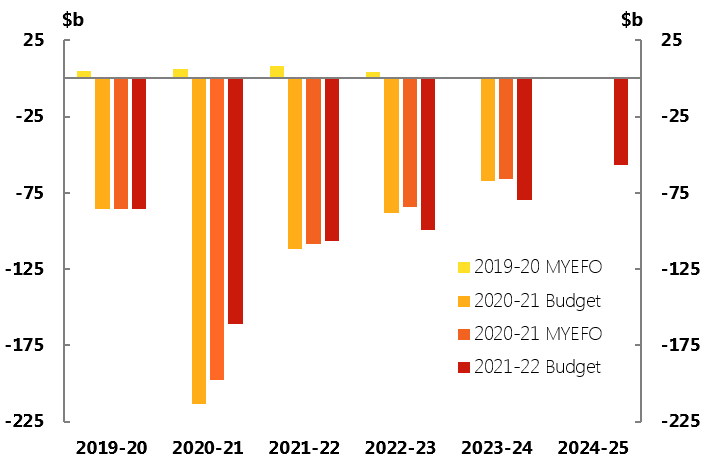

Figure 1B: Underlying cash balance4

|

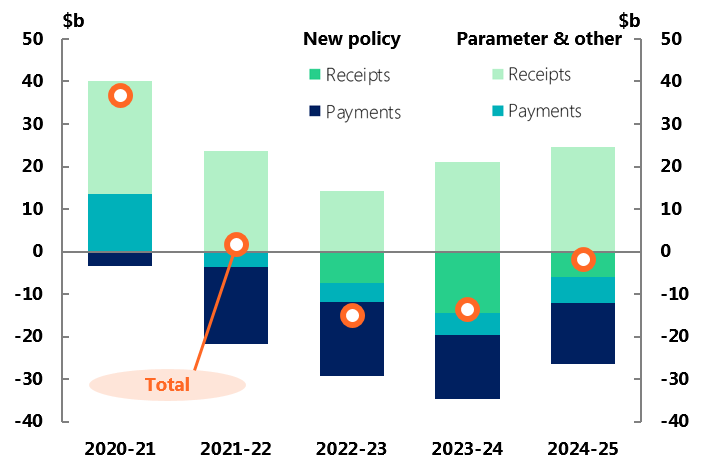

Figure 1C: Decomposition of change in underlying

|

|

|

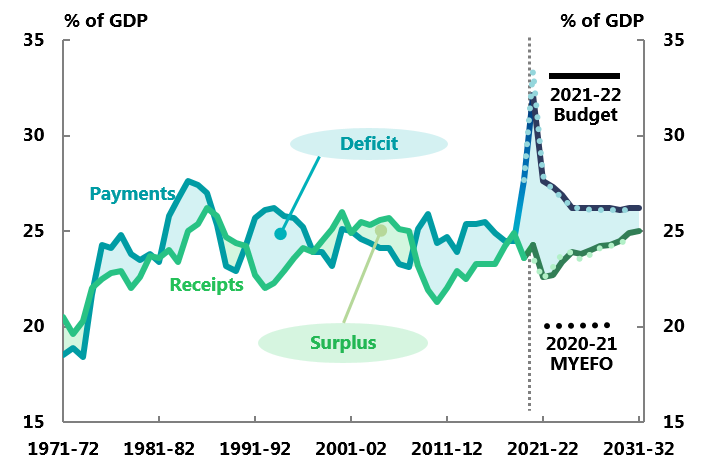

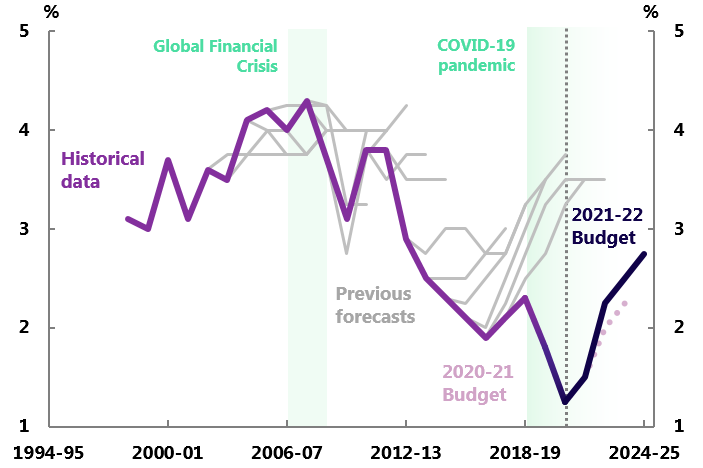

Figure 2A: Total payments and receipts2,6 |

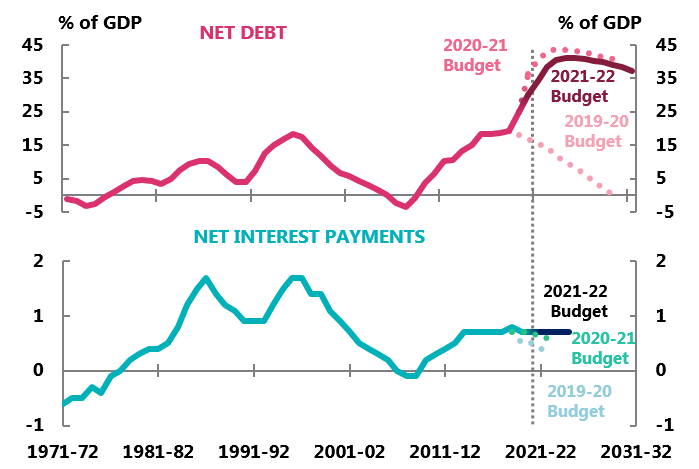

Figure 2B: Net debt and interest payments2 |

|

|

Figure 2C: Net financial worth2,3 |

Figure 2D: 10-year bond rate2,3 |

|

|

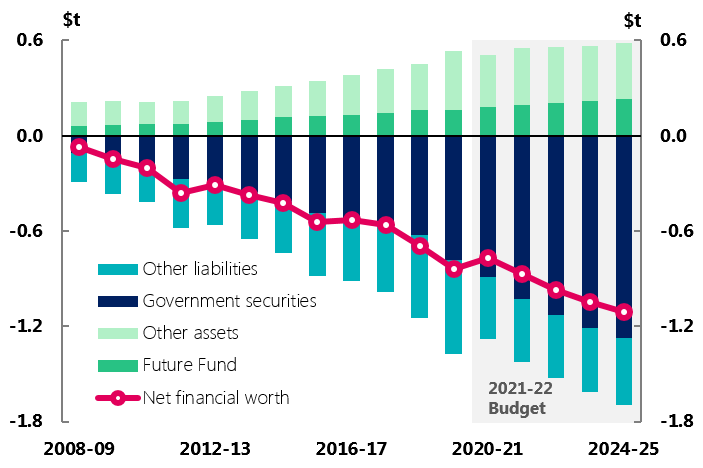

Figure 2E: Components of net financial worth2,7 |

|

|

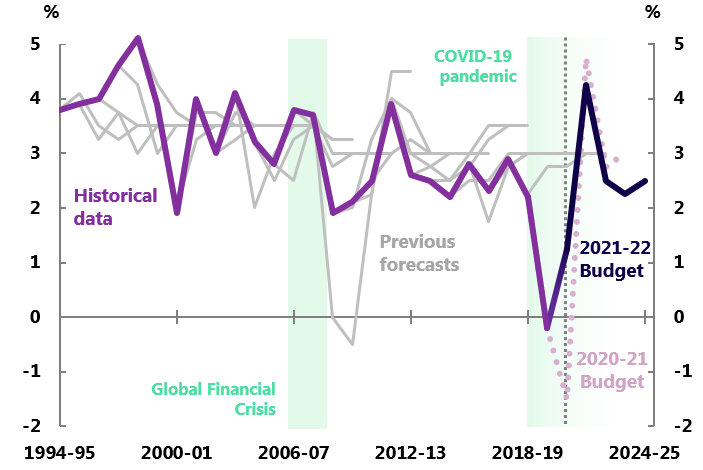

Figure 3A: Real GDP2,3,8 |

Figure 3B: Employment2,3,8 |

|

|

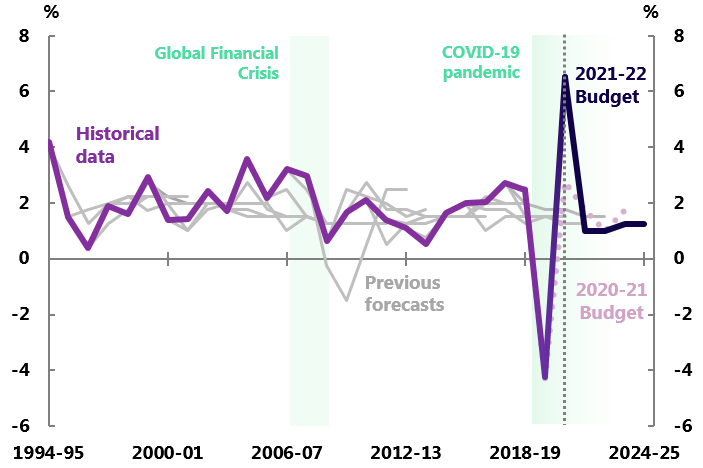

Figure 3C: Consumer price index2,3,8 |

Figure 3D: Wage price index2,3,8 |

|

|

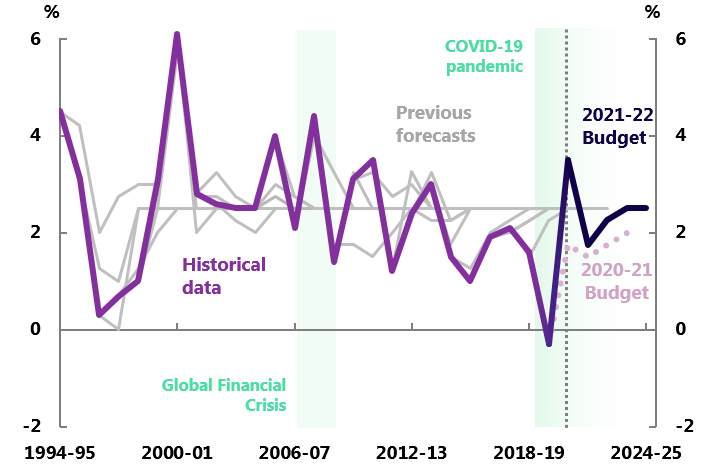

Figure 3E: Nominal GDP2,3,8 |

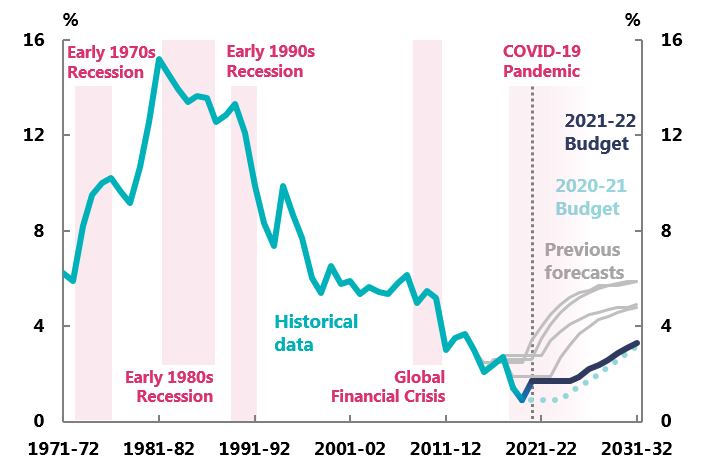

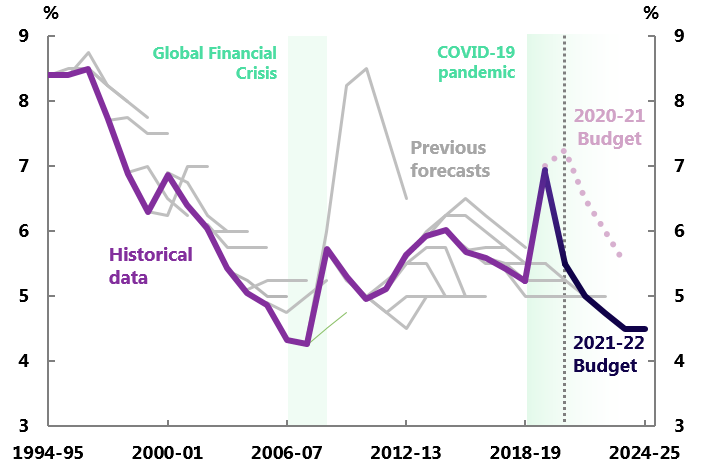

Figure 3F: Unemployment rate2,3,8 |

|

|

Figure 4A: Heads of revenue in 2021-229

|

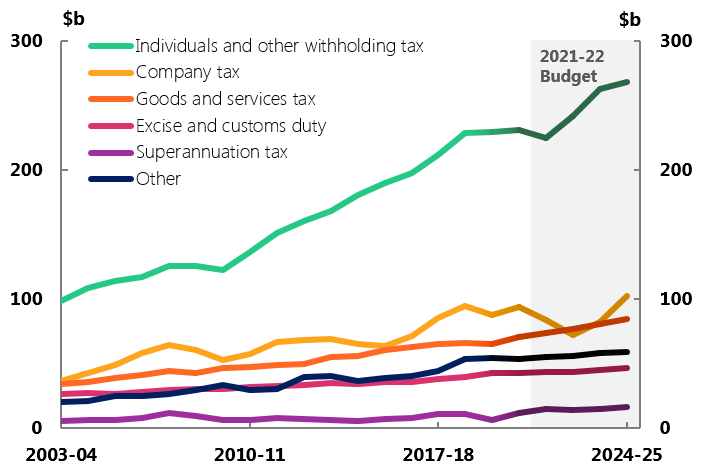

Figure 4B: Heads of revenue9 |

|

|

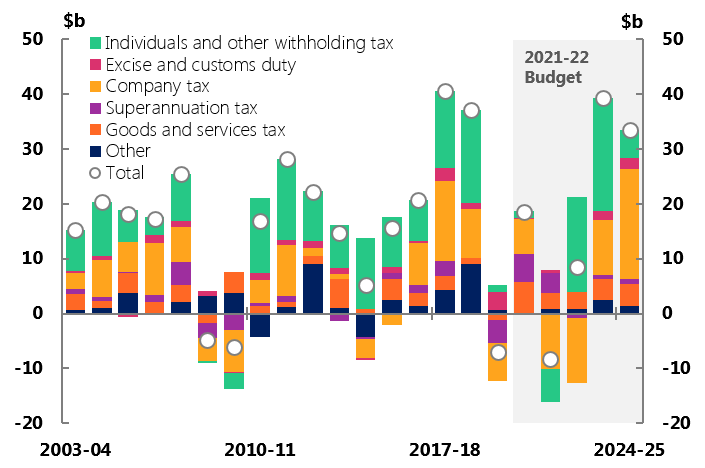

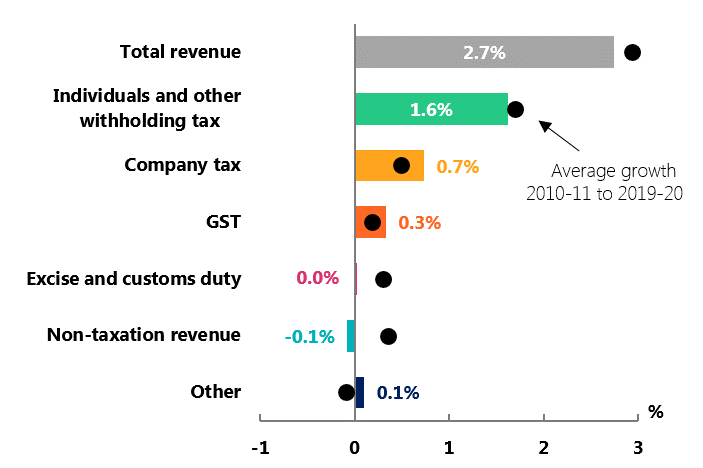

Figure 4C: Contributions to annual growth in revenue9 |

Figure 4D: Contributions to real growth in revenue9

|

|

|

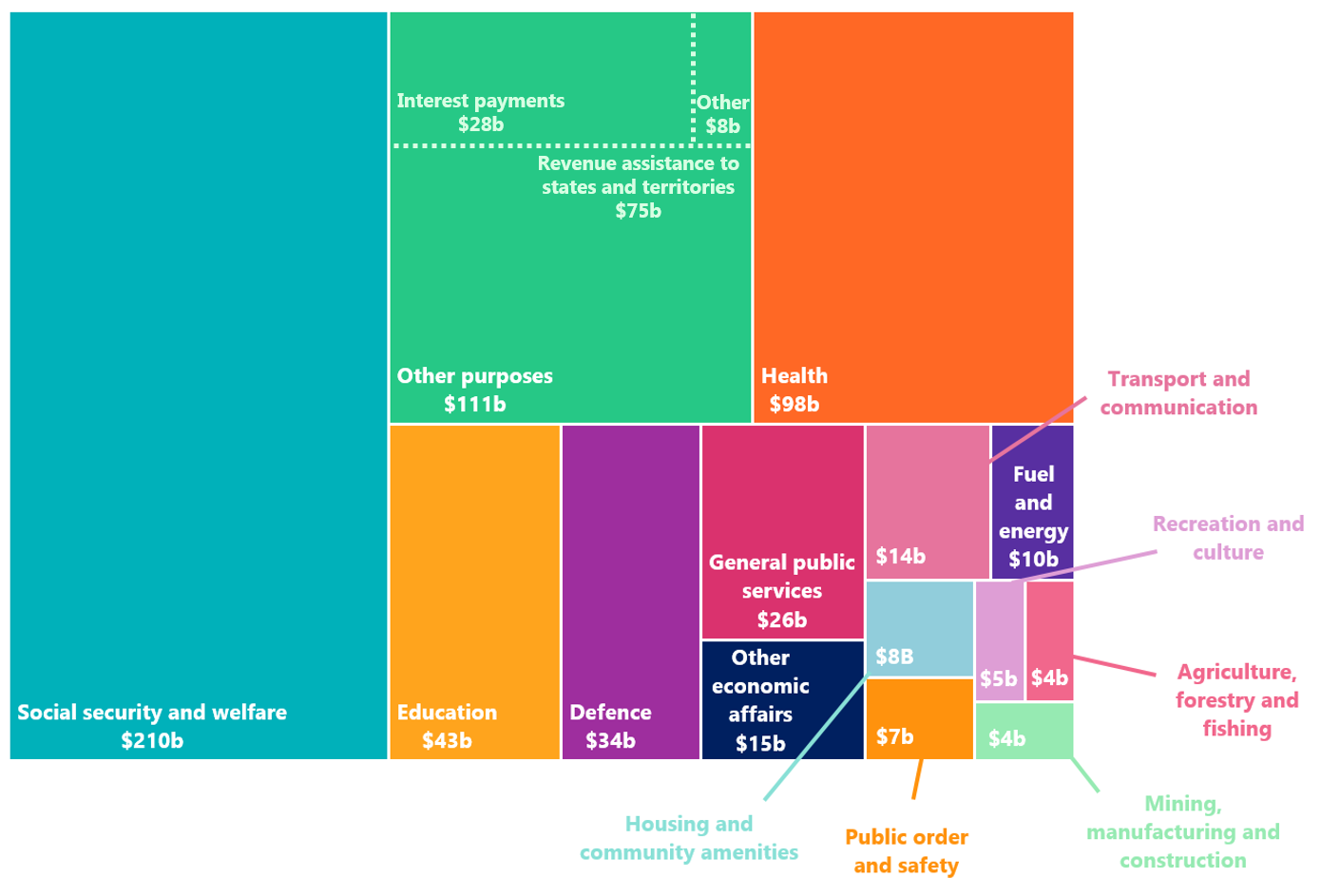

Figure 5A: Expenses by function in 2021-2210,11,12

|

|

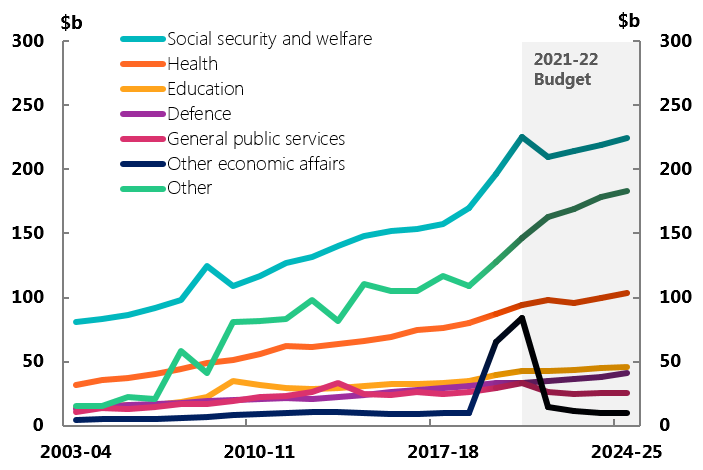

Figure 5B: Expenses by function13 |

Figure 5C: Contributions to annual growth in expenses13 |

|

|

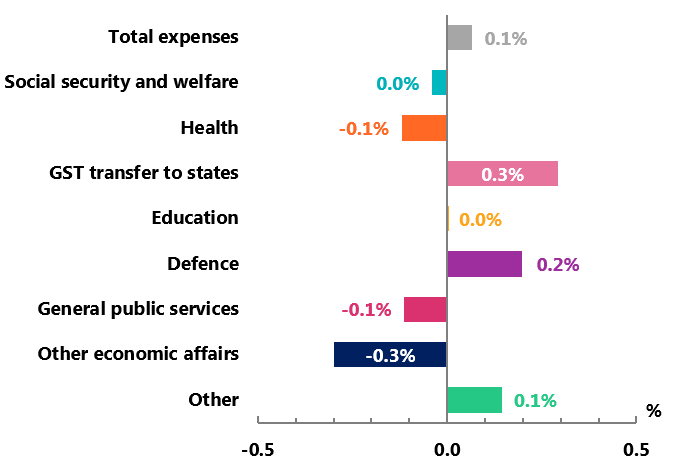

Figure 5D: Contributions to real growth in expenses13

|

|

|

Figure 5E: Top 20 programs in 2021-2210,12,14

|

|

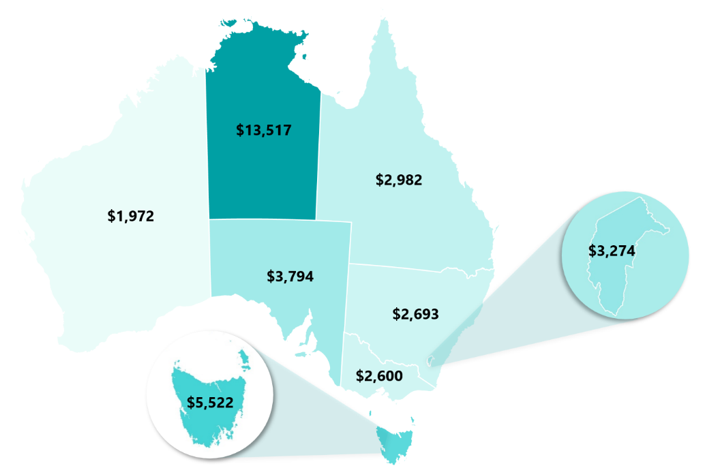

Figure 6A: GST pool per capita

|

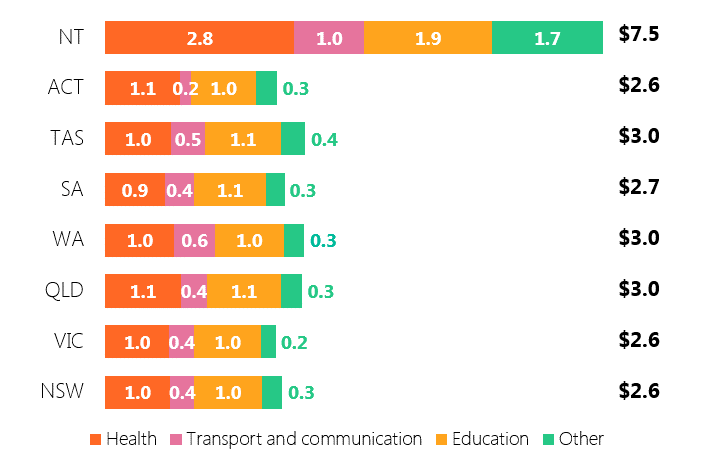

Figure 6B: Payments for specific purposes per capita

|

|

|

- Figures are prepared using data contained in the 2021-22 Budget, 2020-21 Mid-Year Economic and Fiscal Outlook (MYEFO), and previous budgets. All values prior to and including 2019-20 are outcomes.

- The grey dotted vertical line indicates when forecasts begin.

- Outcomes in history may have been revised since first published. Grey lines represent forecasts in previous budgets, with each line beginning with the history at the 2021-22 Budget.

- The 2019-20 MYEFO forecast ends in 2022-23, and the 2020-21 Budget and MYEFO forecast ends in 2023-24.

- Parameter and other variations are any changes to the finances of the Commonwealth that are not due to policy decisions. These primarily include revised economic forecasts, revisions to a program’s estimated costs, and re-profiling of expenditure.

- Receipts and payments are on a cash basis. Revenue and expenses are on an accrual basis.

- All values between 2008-09 and 2019-20 reflect those reported in their respective Final Budget Outcomes and Future Fund Portfolio updates, and do not incorporate any subsequent revisions. Future Fund asset values are those reported by the Future Fund Management Agency in their 2021-22 Portfolio Budget Statement.

- Real GDP and nominal GDP are percentage change on preceding year. The consumer price index, employment and the wage price index are through-the-year growth to the June quarter. The unemployment rate is for the June quarter.

- ‘Other’ includes, interest and dividend income, sales of goods and services, and various other revenue items. In figures 4B and 4C ‘Other’ includes non-taxation revenue, while in figure 4D ‘Other’ includes superannuation fund taxes.

- The functions classification separates government expenditure according to the general purpose for which the funds are used. Programs are determined by government and typically aim to deliver specific benefits, services or welfare payments to individuals, businesses, or communities. Programs will often align with functions but may also be cross-cutting. Programs have been shaded according to the function they most align with.

- ‘Other purposes’ includes revenue assistance to states and territories, interest payments and ‘other’ (primarily the contingency reserve). Interest payments includes public debt interest ($18.2b in 2021-22) and nominal superannuation interest ($10.0b in 2021-22).

- Revenue assistance includes the states’ GST entitlement, transitional GST top-up payments and some other payments (primarily for royalties).

- ‘Other’ includes other purposes, transport and communication, fuel and energy, housing and community amenities, public order and safety, and various other expense items. In figure 5D GST transfers to the states have been separated from ‘Other’.

- ‘NPP’ is an abbreviation of National Partnership Payments.

- Western Australia includes transitional GST top-up payments of $2.1 billion.

- ‘Other’ includes housing and community amenities, social security and welfare, and various other expense items.

Supporting material

2021-22 Budget Snapshot