|

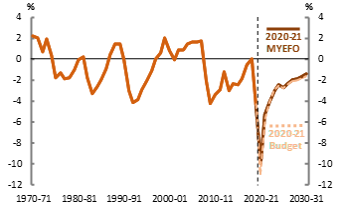

Figure 1: Underlying Cash Balance2 |

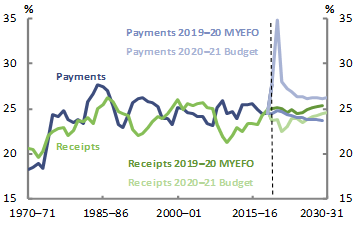

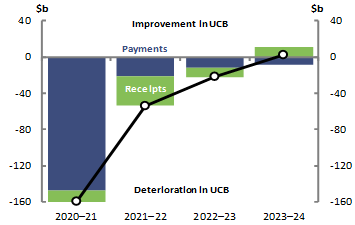

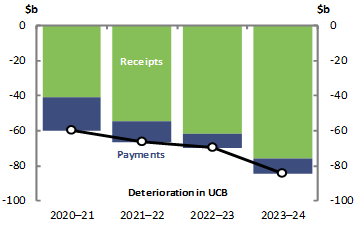

Figure 2: Total payments and receipts2,3 |

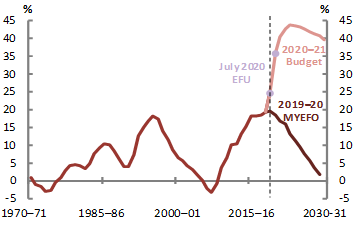

Figure 3: Net debt2 |

|

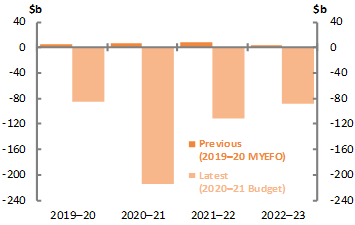

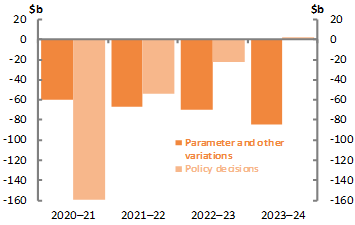

Figure 4: Underlying cash balance |

Figure 5: Decomposition of change in underlying cash balance4 |

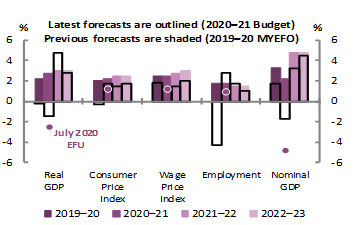

Figure 6: Key economic parameters |

|

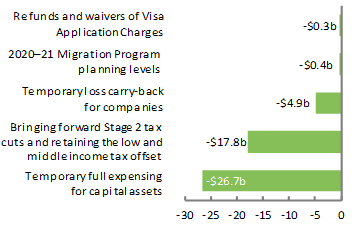

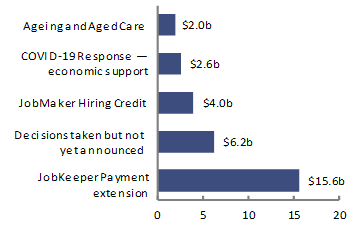

Figure 7: Impact of policy decisions3,5 |

Figure 8: Top five receipt measures6,7 |

Figure 9: Top five payment measures6,7 |

|

Figure 10: Impact of parameter and other variations3,4,5 |

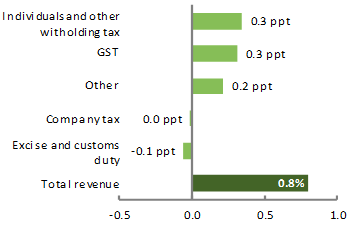

Figure 11: Contributions to annual real growth in revenue8,9,10 |

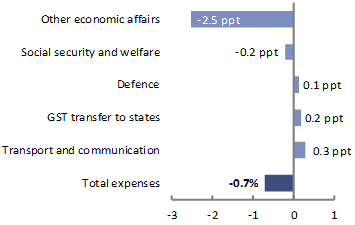

Figure 12: Contributions to annual real growth in expenses8,11 |

|

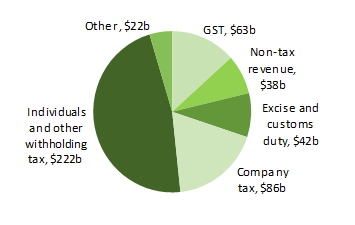

Figure 13: Revenue in |

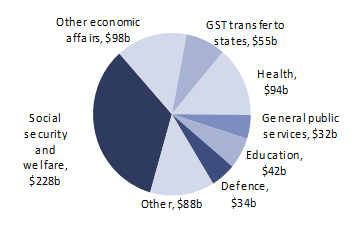

Figure 14: Expenses in |

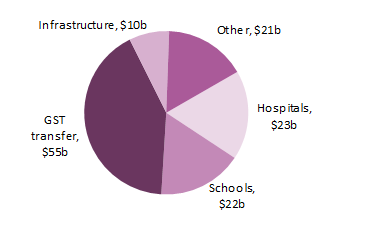

Figure 15: Payments to states in |

- Figures are prepared using data contained in the 2020–21 Budget, the 2019–20 Mid-Year Economic and Fiscal Outlook (MYEFO), July 2020 Economic and Fiscal Update (EFU) and the 2019–20 Final Budget Outcome (FBO). Any changes shown are since the 2019–20 MYEFO. For more information about the terms in this snapshot see the Online budget glossary on the PBO website. All 2019–20 values are outcomes.

- Figures are PBO estimates based on published charts. The dashed line indicates the last actual data point in the 2020–21 Budget.

- Payments and receipts are on a cash basis.

- Parameter and other variations refer to changes due to a broad range of reasons, including revised economic forecasts, revisions to a program’s estimated costs, revised estimates of the revenue raised by individual taxes and re-profiling of expenditure.

- UCB is an abbreviation of underlying cash balance.

- This figure depicts the net underlying cash balance impact of the top measures in the 2020–21 Budget. Where a measure affects both receipts and payments it has been classified according to its principal impact (consistent with 2020–21 Budget Paper 2). Figures shown here may not match total policy impact due to provisions made in previous budget updates.

- Measure titles are abbreviated. For full measure titles, please refer to 2020–21 Budget Paper 2.

- Figures are on an accrual (fiscal) basis.

- This figure depicts the percentage point contribution from key tax measures to average annual real growth in total revenue from 2019–20 to 2023–24. Average annual growth in total revenue is presented in the bottom bar of the figure. Components do not necessarily sum to total.

- ‘Other’ includes superannuation fund taxes, interest and dividend income, sales of goods and services, and various other revenue items.

- This figure depicts the percentage point contribution from key functions to average annual real growth in total expenses from 2019–20 to 2023–24. Average annual growth in total expenses is presented in the bottom bar of the figure. Components do not necessarily sum to total.

- ‘Other’ includes transport and communication, fuel and energy, public order and safety, housing and community amenities, and various other expense items.

- Payments to states refer to the amount of funding provided to states and territories under the federal financial relations framework. This includes the transfer of the GST collected by the Commonwealth to states and territories for use on general purposes.

- 'Other' includes affordable housing, community services, skills and workforce development, and various other payments items.

See the glossary, for more detail about the terms used in this publication.