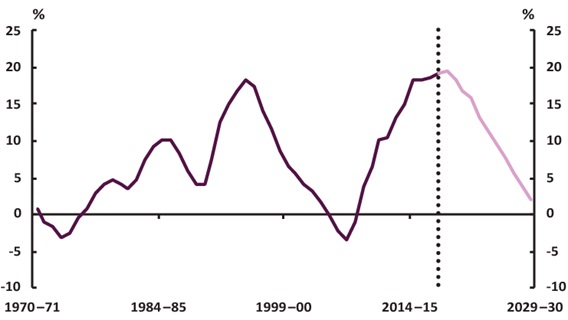

| Figure 1: Underlying cash balance2 Per cent of GDP  |

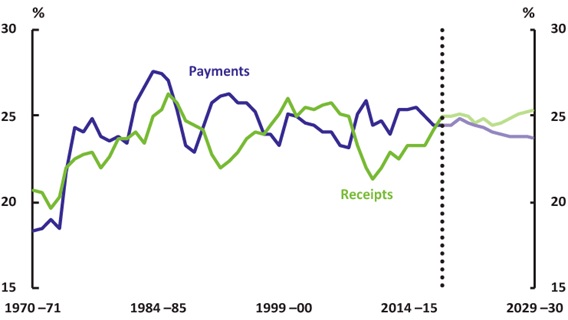

Figure 5: Decomposition of change in underlying cash balance4,7Figure 2: Total payments and receipts2,3 Per cent of GDP

|

Figure 3: Net debt2

|

|

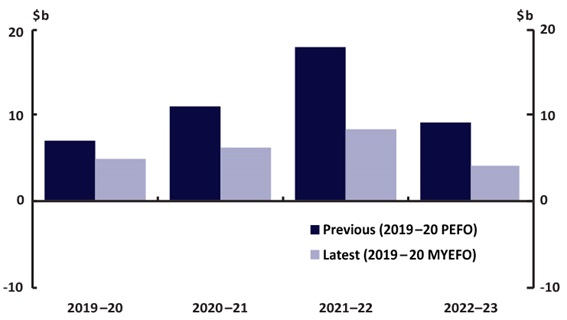

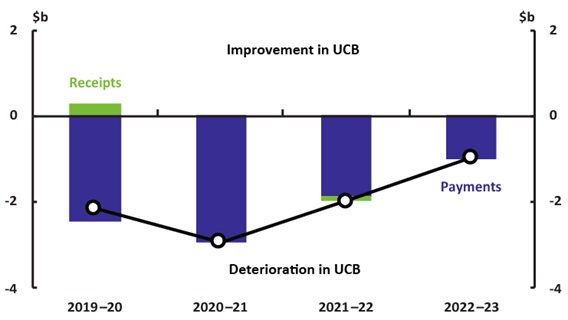

Figure 4: Underlying cash balance

|

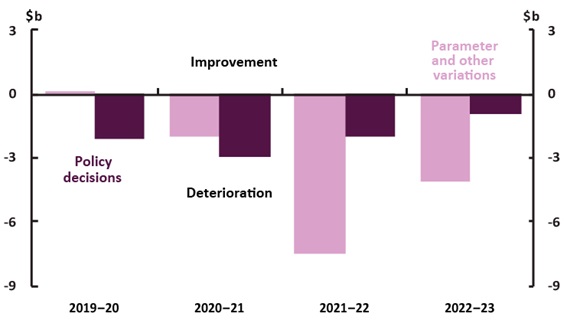

Figure 5: Decomposition of change in underlying cash balance4,7

|

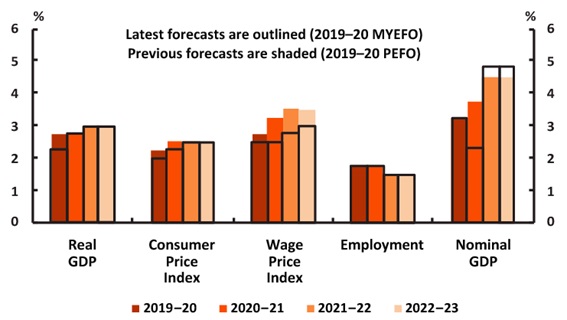

Figure 6: Key economic parameters

|

|

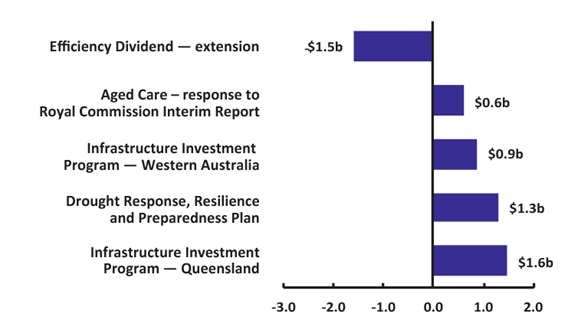

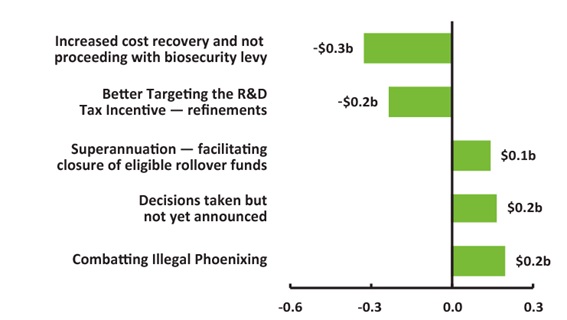

Figure 7: Impact of policy decisions3,8

|

Figure 8: Top five revenue measures5,6,9 Total, 2019–20 to 2022–23

|

Figure 9: Top five expense measures5,6,9

|

|

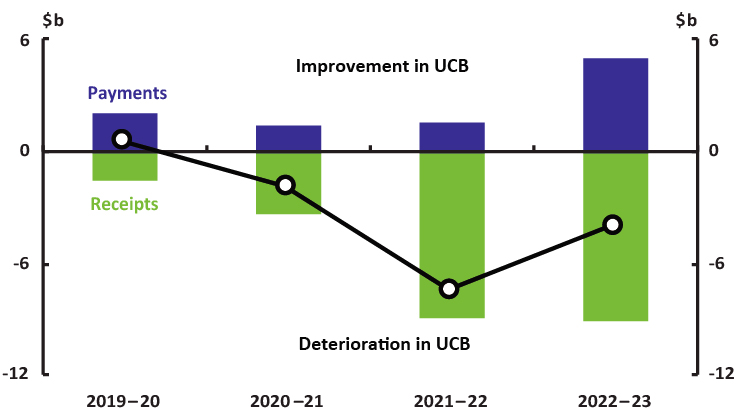

Figure 10: Impact of parameter and other variations3,7,10

|

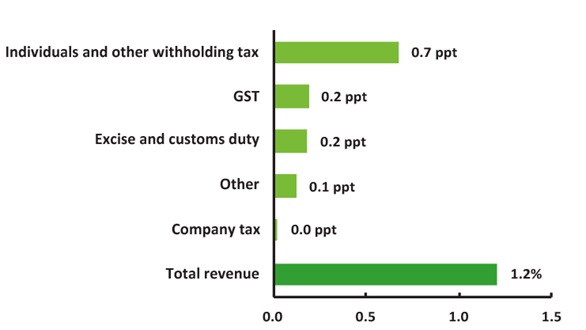

Figure 11: Contributions to annual real growth in revenue5,11,12,13 Average, 2018–19 to 2022–23

|

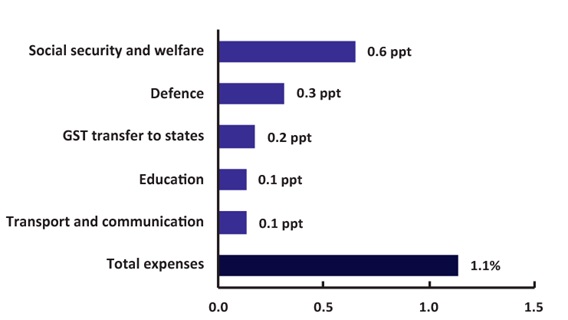

Figure 12: Contributions to annual real growth in expenses5,13,14

|

|

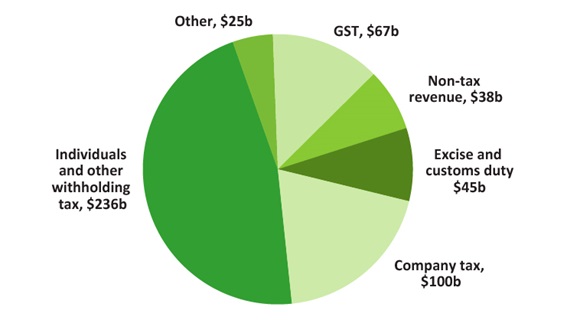

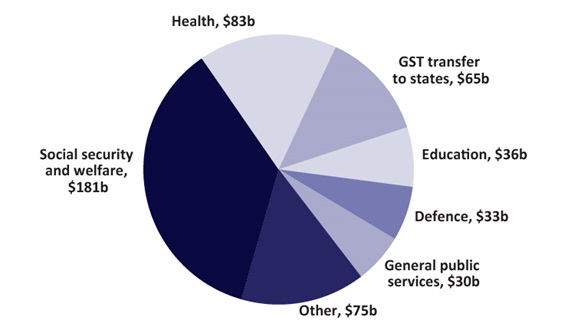

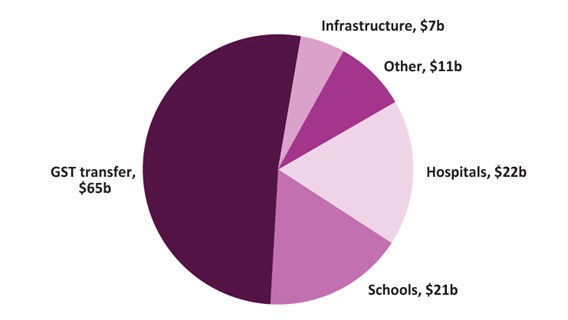

Figure 13: Revenue in 2019–20,

|

Figure 14: Revenue in 2019–20,

|

Figure 15: Revenue in 2019–20,

|

- Figures are prepared using data contained in the 2019–20 Mid-Year Economic and Fiscal Outlook (MYEFO) and the 2019–20 Pre-Election Economic and Fiscal Outlook (PEFO). Any changes shown are since the 2019–20 PEFO. Differences between the 2019–20 PEFO and 2019–20 Budget are minimal.

- Figures are PBO estimates based on published charts. The dotted line indicates the last actual data point.

- Payments and receipts are on a cash basis.

- Consistent with the approach taken in 2019–20 MYEFO Table 3.6, this figure excludes the impact of policy decisions on goods and services tax (GST) payments and receipts, but includes the impact of parameter and other variations on GST payments and receipts.

- Figures are on an accrual (fiscal) basis.

- This figure depicts the net fiscal impact of the top measures. Where a measure affects both revenue and expenses it has been classified according to its principal impact (consistent with Appendix A of the 2019–20 MYEFO).

- Parameter and other variations refer to changes due to a broad range of reasons, including revised economic forecasts, revisions to a program’s estimated costs, revised estimates of the revenue raised by individual taxes and re-profiling of expenditure.

- This figure excludes the impact of policy decisions on GST payments and receipts. UCB is an abbreviation of underlying cash balance.

- Measures are included on the basis of net fiscal impact in the 2019–20 MYEFO. Figures shown here may not match total policy impact due to provisions made in previous budget updates. Measure titles are abbreviated. For full measure titles, please refer to 2019–20 MYEFO Appendix A.

- Consistent with Figure 7, this figure excludes the impact of parameter and other variations on GST payments and receipts. This approach is different to that applied to parameter and other variations in Figure 5. UCB is an abbreviation of underlying cash balance.

- This figure depicts the percentage point contribution from key tax measures to average annual real growth in total revenue from 2018–19 to 2022–23. Average annual growth in total revenue is presented in the bottom bar in the figure.

- ‘Other’ includes superannuation fund taxes, interest and dividend revenue, sales of goods and services, and various other revenue items.

- Components do not necessarily sum to total.

- This figure depicts the percentage point contribution from key functions to average annual real growth in total expenses from 2018–19 to 2022–23. Average annual growth in total expenses is presented in the bottom bar in the figure.

- ‘Other’ includes transport and communication, fuel and energy, public order and safety, housing and community amenities, and various other expense items.

- Payments to states refers to the amount of funding provided to states and territories under the federal financial relations framework. This includes the transfer of the GST collected by the Commonwealth to states and territories for use on general purposes.

See the glossary, for more detail about the terms used in this publication.