17 December 2018

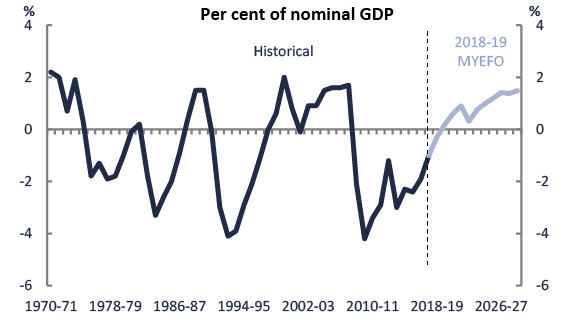

Figure 1: Underlying cash balance |

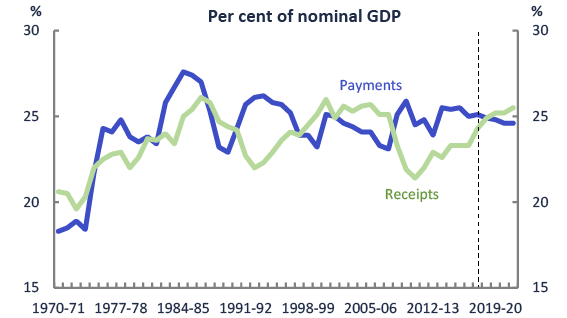

Figure 2: Total payments and receipts2 |

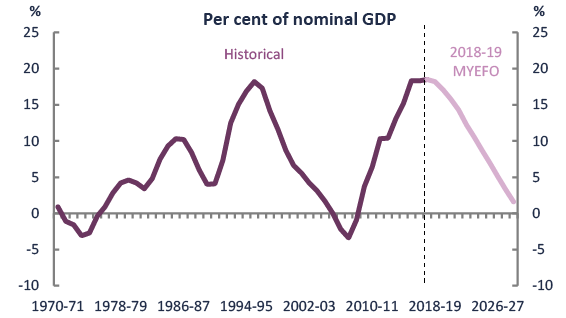

Figure 3: Net debt |

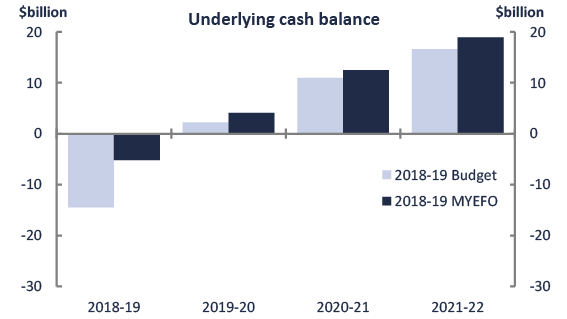

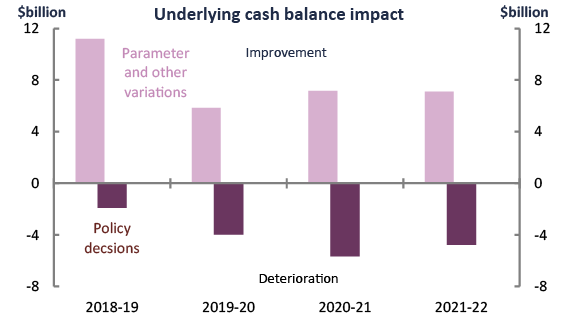

Figure 4: Change in Budget position since 2018–19 Budget |

Figure 5: Components of change in underlying cash balance |

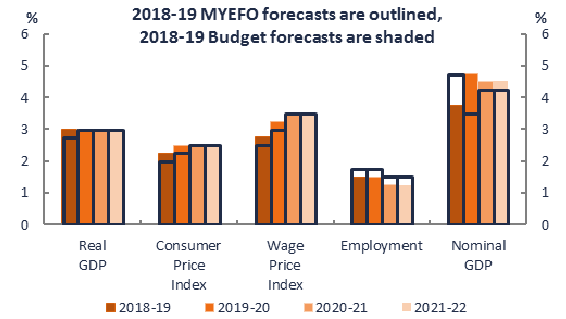

Figure 6: Economic parameters in the

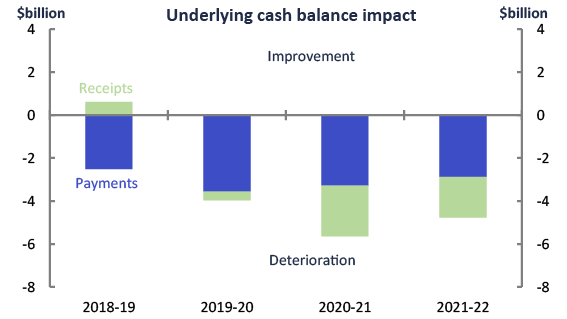

|

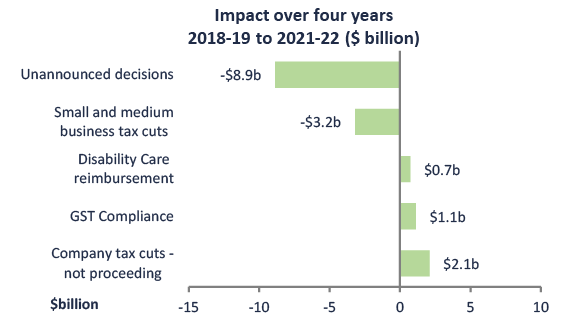

Figure 7: Policy decisions in the 2018–19 MYEFO— payments and receipts2,4 |

Figure 8: Policy decisions in the 2018–19 MYEFO— top five revenue measures5,6 |

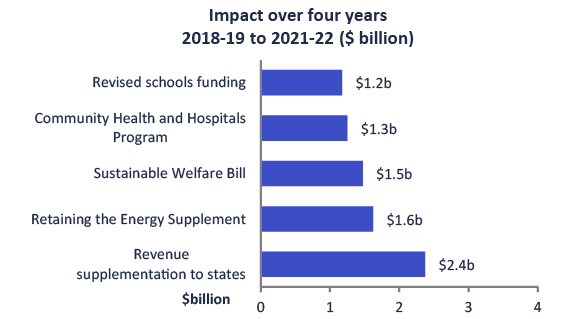

Figure 9: Policy decisions in the 2018–19 MYEFO— top five expense measures5,6,9 |

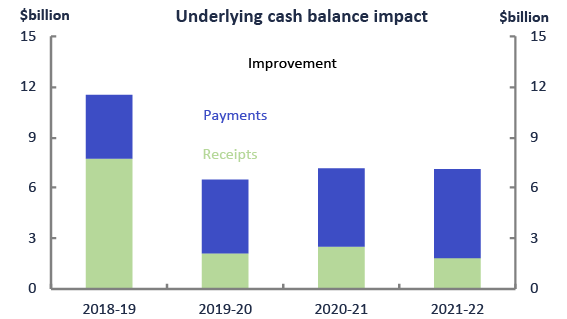

Figure 10: Parameter and other variations in the 2018–19 MYEFO—payments and receipts2,7 |

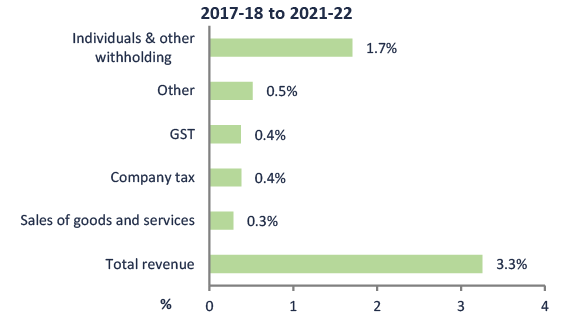

Figure 11: Drivers of growth in revenue— contributions to total annual real growth5,8 |

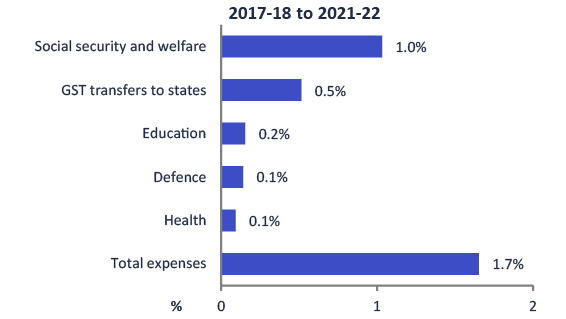

Figure 12: Drivers of growth in expenses— contributions to total annual real growth5,8 |

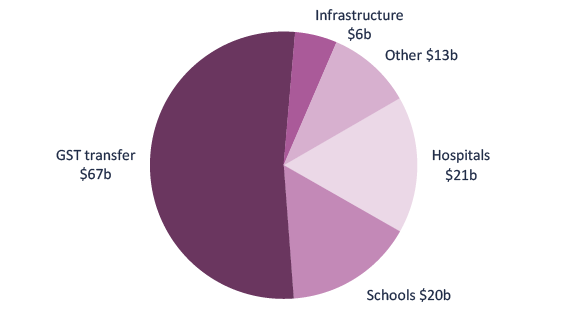

Figure 13: Payments to states in 2018–19, $127b10 |

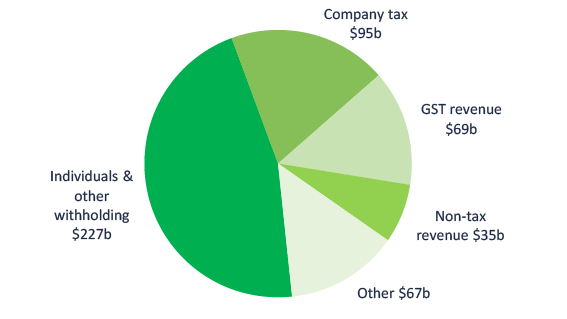

Figure 14: Revenue in 2018–19,

|

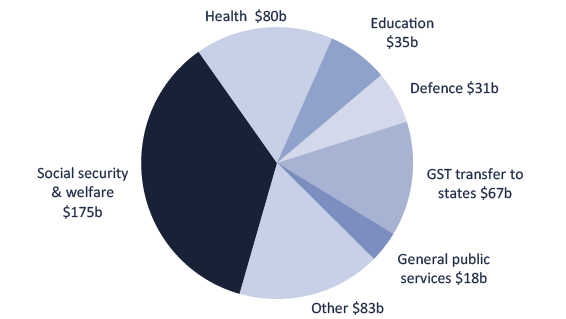

Figure 15: Expenses in 2018–19,

|

- Figures are prepared using data contained in the 2018–19 Budget Papers and 2018–19 Mid-year Economic and Fiscal Outlook (MYEFO). Any changes shown are since 2018–19 Budget.

- Figures are based on payments and receipts which are on a cash basis.

- Figure 6 presents selected economic parameters underpinning the 2018–19 Budget and 2018–19 MYEFO estimates.

- An increase (decrease) in receipts results in an improvement (deterioration) in the underlying cash balance. An increase (decrease) in payments results in a deterioration (improvement) in the underlying cash balance.

- Figures are on an accrual (fiscal) basis.

- This is the net fiscal impact of the measure. Where a measure impacts both revenue and expenses it has been classified according to its principal impact (consistent with Appendix A of the 2018-19 MYEFO).

- Parameter and other variations refer to changes in parameters and assumptions used to estimate payments/expenses and receipts/revenue.

- This is the percentage point contribution to total annual real growth from 2017–18 to 2021–22. Total growth is presented in the total bar in this figure.

- ‘Revised schools funding’ refers to the measure Response to the Review of the Socio-Economic Status Score Methodology. ‘Revenue supplementation to states’ refers to the measure ‘Delivering a Fairer and More Sustainable GST Distribution System.’

- Payments to states refer to the amount of funding provided to states and territories under the Federal Financial Relations framework. This includes the transfer of the GST collected by the Commonwealth to states and territories for use on general purposes.

Supporting material

See the glossary, for more detail about the terms used in this publication.