Key points:

- The independent member for Indi’s commitments are estimated to decrease the underlying cash, fiscal and headline cash balances over the forward estimates and medium term, relative to PEFO.

- The Parliamentary Budget Officer did not identify any additional commitments made by the member for Indi.

- This is the first time that an independent has chosen to be included in the PBO’s election commitments process.

This chapter presents the budget impact of the election commitments made by the independent member for Indi, Dr Helen Haines MP, who chose to be included in the report. This is the first time an independent has chosen to be included in the PBO’s election commitments process. This chapter adopts the same broad approach as for the major political parties that are required to be included in the report and has been prepared according to the PBO guidance on arrangements for minor parties and independents choosing to opt in to the report.24 A detailed table outlining the source and budget impacts of each of the member for Indi’s election commitments is provided at Appendix D and costing documentation is provided at Appendix H.

Budget impact of election commitments

The combined impact of the member for Indi’s election commitments is estimated to decrease all 3 budget balances over the 2022–23 Budget forward estimates period (Table 9). On an underlying cash balance basis, this decrease averages 0.1% of GDP over the medium term and largely reflects an increase in payments and a small increase in non-tax receipts (Table 10). For the underlying cash and fiscal balances, these decreases are mainly driven by 2 aged care commitments, Minimum Aged Care Staff Times (ECR611) and Home Care Wait Times (ECR610).

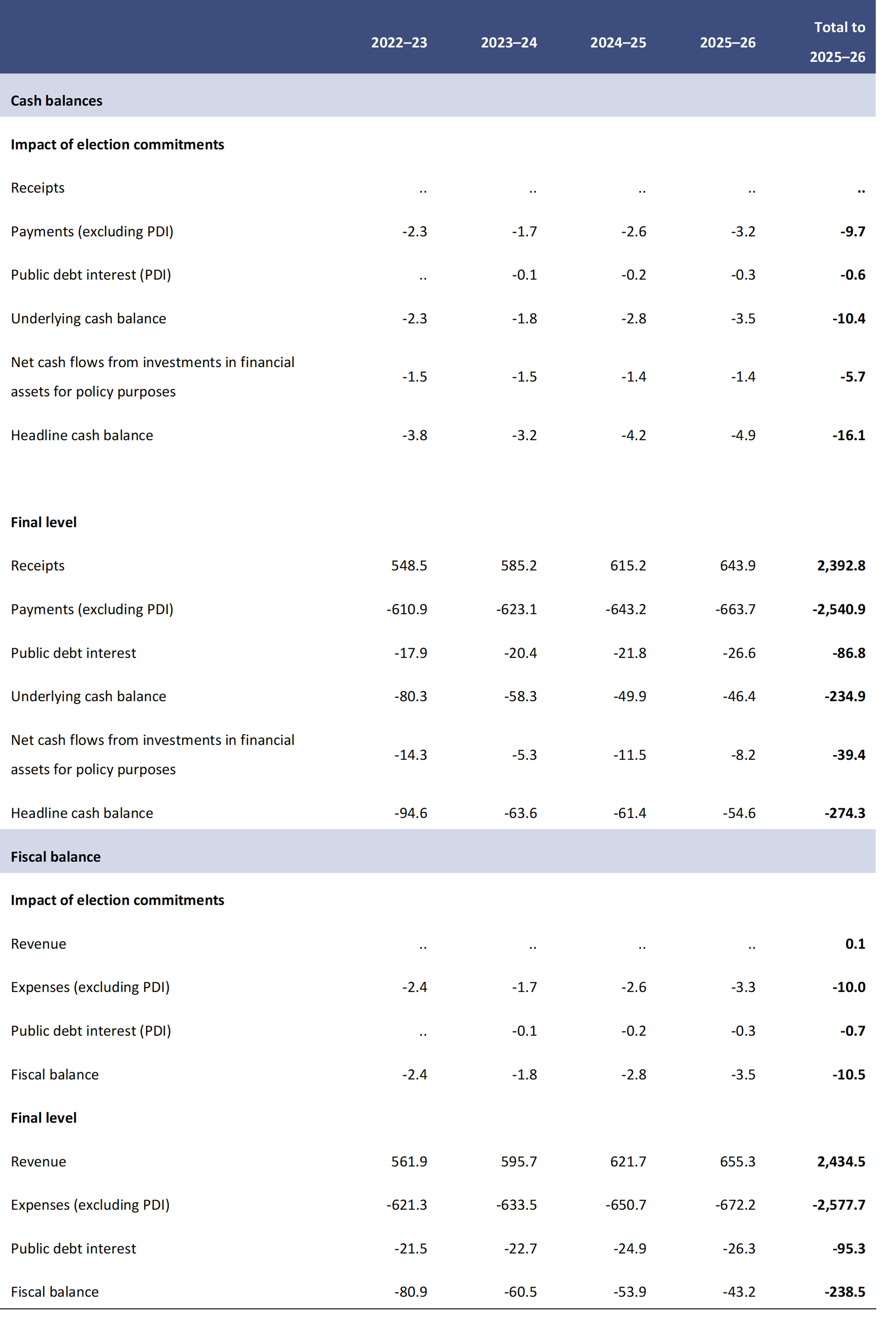

Table 9: Financial implications of the independent member for Indi’s election commitments, 2022–23 forward estimates, underlying cash, headline cash and fiscal balance basis ($billion)

Note: A positive impact on the budget balance indicates an increase in receipts or a decrease in payments. A negative impact on the budget balance indicates a decrease in receipts or an increase in payments. Figures may not sum to totals due to rounding.

.. Not zero but rounded to zero.

The decrease in the headline cash balance is slightly larger and results in an increase of $0.6 billion in public debt interest payments over the forward estimates and $6.5 billion over the medium term.

The main commitment driving the difference between the headline cash, fiscal and underlying cash balances is the Home Ownership Uplift Scheme (ECR612) which uses balance sheet financing arrangements. The policy supports first home buyers to purchase a house through a shared equity scheme with the Australian Government co‑investing up to 25% of the property price. This equity injection is accounted for in the headline cash balance but not the fiscal or the underlying cash balance.

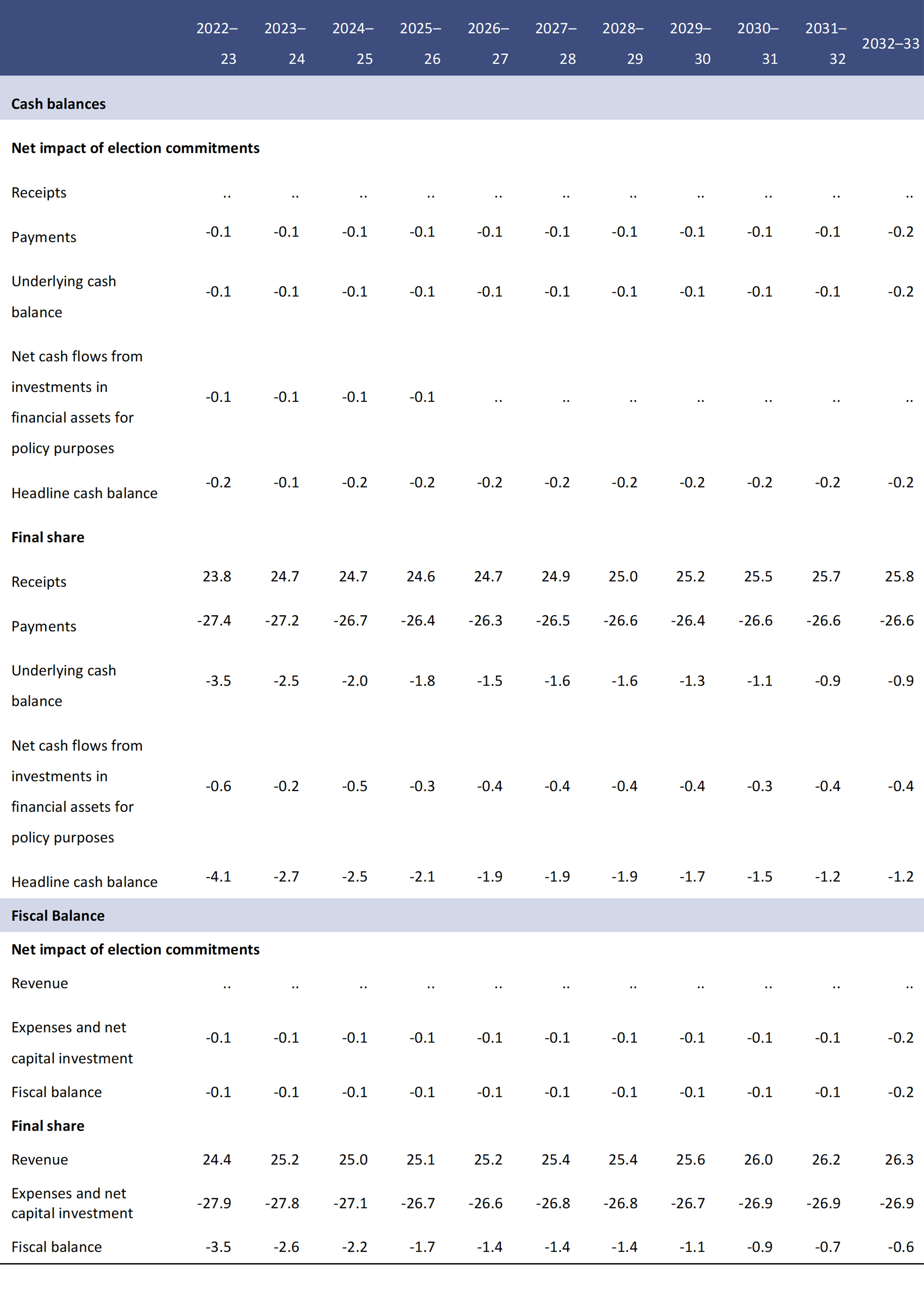

Table 10: Financial implications of the independent member for Indi’s election commitments on budget balances, receipts and payments, medium term, cash and fiscal balance basis (% of GDP)

Note: A positive impact on the budget balance indicates an increase in receipts or a decrease in payments. A negative impact on the budget balance indicates a decrease in receipts or an increase in payments. Figures may not sum to totals due to rounding.

.. Not zero but rounded to zero.

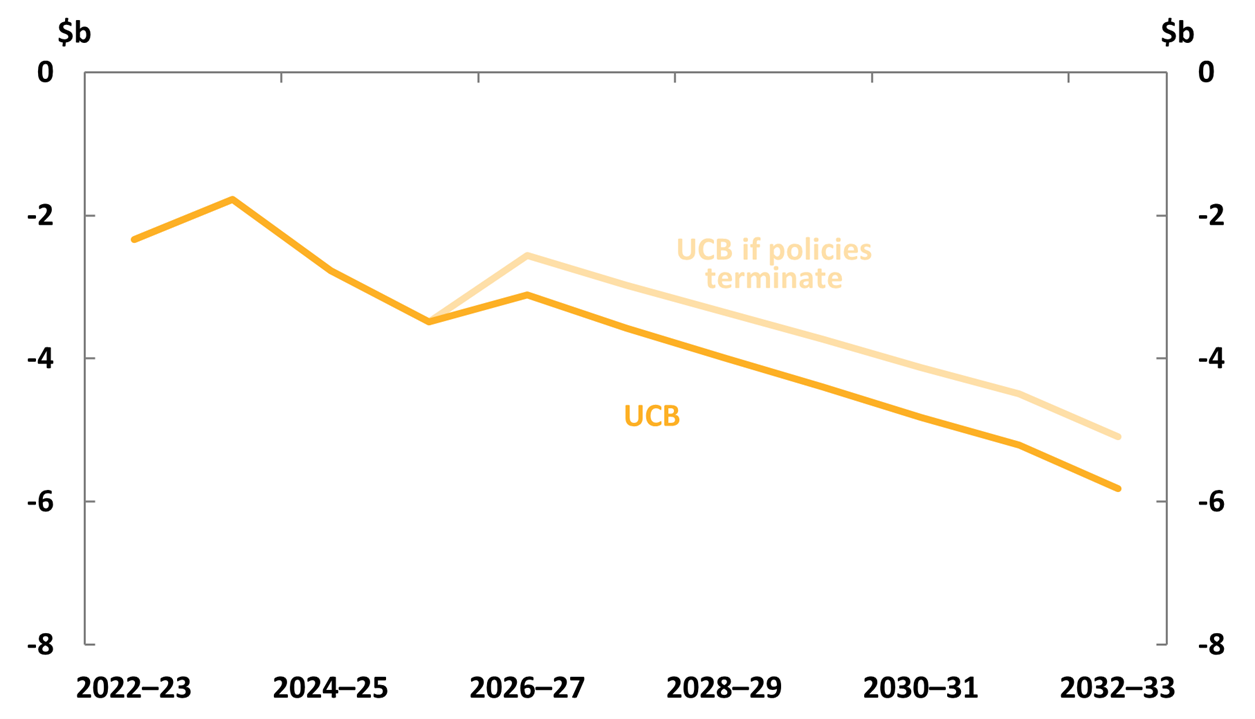

Consistent with the forward estimates, the final level of the underlying cash balance is projected to be slightly lower (slightly more negative) over the medium term as a share of GDP under the member for Indi’s platform compared to PEFO (Figure 8).

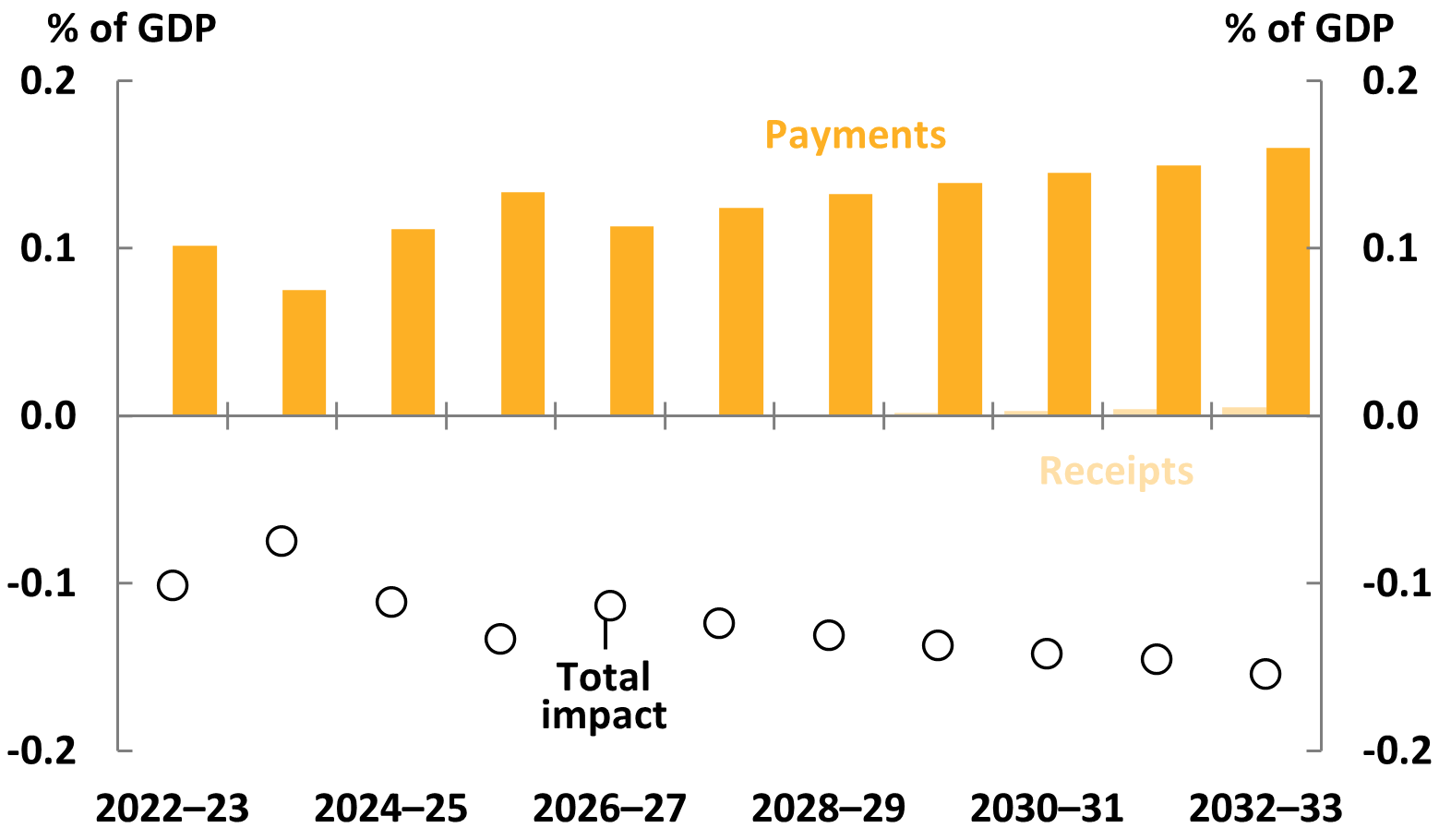

Figure 8: Medium-term impact of the independent member for Indi’s election commitments

Underlying cash balance

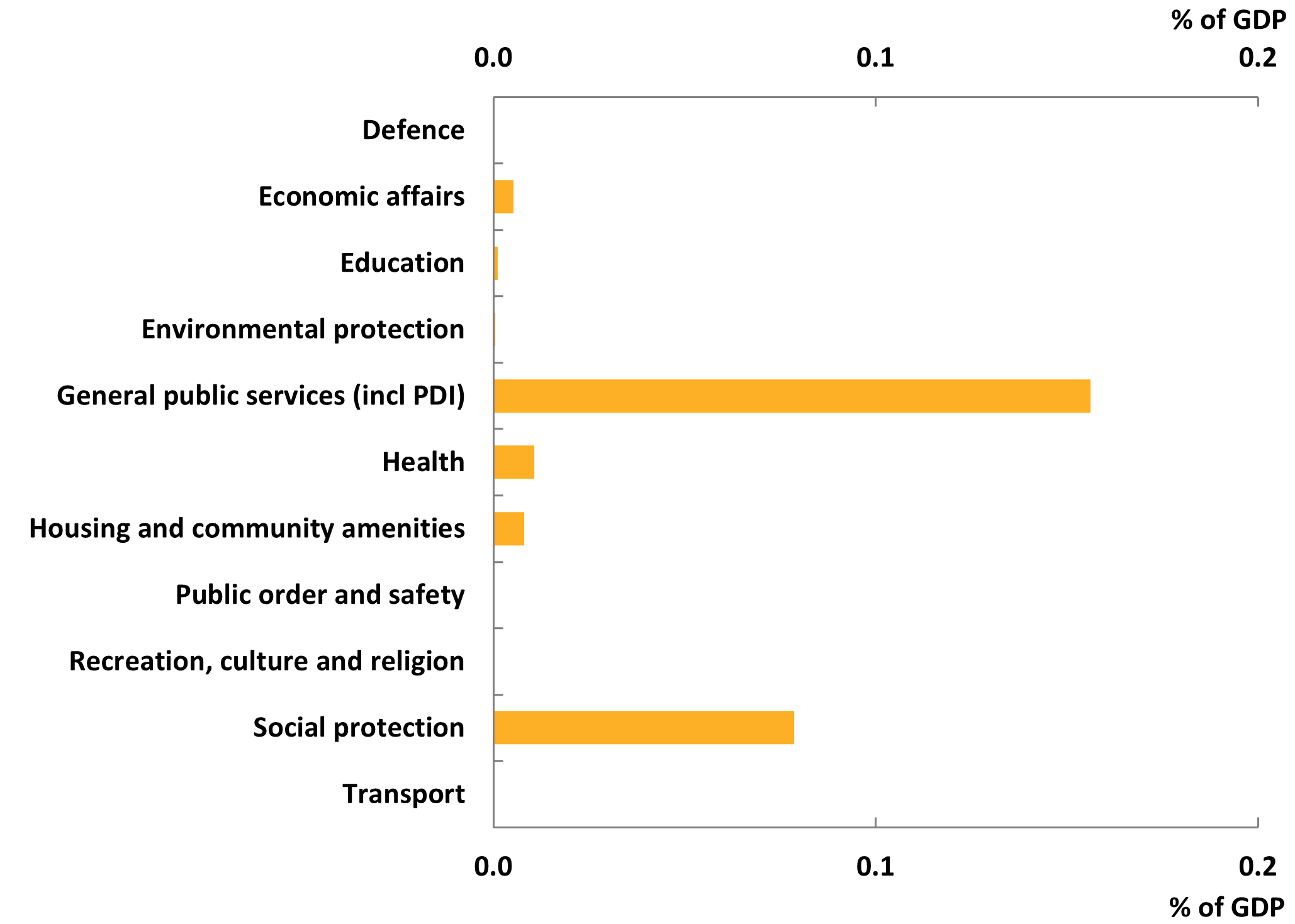

Most of the independent member for Indi’s election commitments are payments rather than receipts measures with the largest categories being general public services and social protection (Figure 9). The increase in general public services is driven by the increase in public debt interest as a result of the commitments.

Figure 9: Impact of member for Indi’s commitments on payments according to purpose

Underlying cash balance, average annual impact 2022-23 to 2032-33

Note: Spending is allocated according to the Classification of the Functions of Government – Australia, consistent with the framework underpinning the Australian Bureau of Statistics’ Government Finance Statistics. Where commitments cover multiple purposes, they have been allocated to the primary category according to the relative dollar value.

Final levels of spending for 2020–21 were: Defence $40.7bn; Economic affairs $100.6bn; Education $47.9bn; Environmental protection $6.9bn; General public services $115.7bn; Health $97.0bn; Housing and community amenities $2.8bn; Public order and safety $6.9bn; Recreation, culture and religion $4.1bn; Social protection $226.1bn; and Transport $12.1bn.

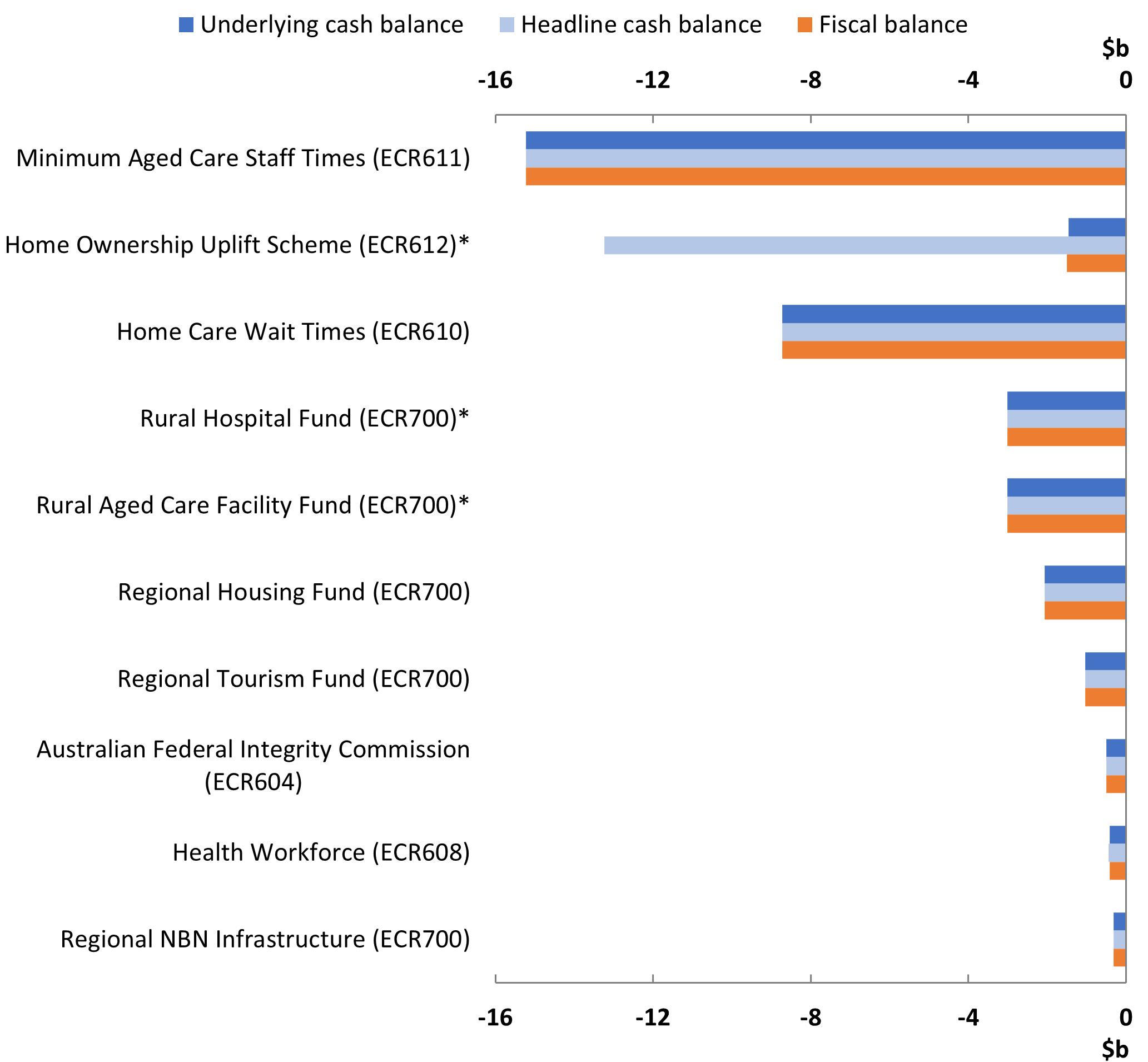

Figure 10 summarises the independent member for Indi’s 10 largest commitments by cumulative impact over the medium term across each budget balance.

The independent member for Indi’s commitment with the largest impact on each of the budget balances is Minimum Aged Care Staff Times (ECR611). This would require aged care providers to provide a minimum of 215 minutes of care for each resident per day and have a registered nurse onsite at all times. This commitment decreases the underlying and fiscal balances by $2.3 billion over the forward estimates period and $15.2 billion over the medium term.

On an underlying cash balance basis, the second largest commitment over the medium term is Home Care Wait Times (ECR610), which legislates a maximum wait time of 1 month for the delivery of home care packages. This commitment decreases the underlying cash balance by $0.7 billion over the forward estimates period and $8.7 billion over the medium term.

However, on a headline cash balance basis, the second largest commitment over the medium term is the Home Ownership Uplift Scheme (ECR612). This commitment decreases the headline cash balance by $5.4 billion over the forward estimates period and $13.2 billion over the medium term.

Figure 10: The independent member for Indi’s largest election commitments over the medium term

Cumulative impact on the underlying cash, headline cash and fiscal balance

Note: * Denotes commitments assumed to be ongoing by the PBO, in line with PBO guidance. All commitments assumed to be ongoing for any party or independent are identified in Appendices A to D. A positive impact indicates an increase in the budget balance. A negative impact indicates a reduction in the balance.

Impact of policies assumed ongoing

Where it is not clear from public announcements whether a policy would be ongoing or would cease (for example, at the end of the forward estimates), the PBO assumes that the policy would be ongoing for the purpose of estimating the medium-term impacts.25 This assumption has been applied to 3 of the member of Indi’s commitments.26 The PBO’s assumption means the medium‑term impacts of the member for Indi’s platform have an additional net cost of $0.7 billion in underlying cash balance terms and $1.3 billion in headline cash balance terms each year over the medium term (Figure 11). The additional cost on the underlying cash balance is driven predominately by Rural Hospital Fund (ECR700) and Rural Aged Care Facility Fund (ECR700). On the headline cash balance, it is driven by Home Ownership Uplift Scheme (ECR612).

Figure 11: Net impact of PBO guidance on the underlying cash balance (UCB),

independent member for Indi

Note: See Appendix I for further information about the method for this sensitivity analysis.

Additional commitments identified by the PBO

This report includes 20 of the 22 election commitments identified by the independent member for Indi in the list provided to the Parliamentary Budget Officer on the day before polling day. Two of the commitments (Fast, Frequent & Reliable Trains and Good Connections) have been excluded from the report, as they do not have a material impact on the Australian Government budget. No additional commitments were identified by the Parliamentary Budget Officer. Dr Haines released some financial information in her election commitment announcements, all of which is consistent with the estimates in this report.

Interactions between election commitments

No significant budget impacts were identified as a result of interactions between the independent member for Indi’s election commitments.

Interaction with the tax cap

The independent member for Indi did not make any commitments regarding the tax cap. As per the PBO’s published guidance, the PBO’s approach in this case is to apply the tax cap from PEFO when calculating the net impact on the underlying cash balance of Dr Haines’ overall election platform.27

Footnotes

- See the PBO’s general election guidance note 1 of 4, How minor parties and independents can opt in to the PBO's election commitments report.

- See the PBO’s general election guidance note 2 of 4, The election commitments report: overview, page 3.

- These policies would still appear in Figure 10 if that assumption had not been made, although the order would be different.

- See the PBO’s general election guidance note 2 of 4, The election commitments report: overview, page 5.