Key points:

- The Coalition’s commitments make small improvements in the underlying cash, fiscal and headline cash balances over both the forward estimates and medium term, relative to PEFO.

- This is driven by a net decrease in payments, with small changes in tax receipts and non-tax receipts largely offsetting each other.

- There are no material differences between the PBO’s estimates of the budget impacts of Coalition policies and those released by the Coalition prior to the election.

- No new commitments beyond those released prior to the election by the Coalition were identified by the PBO through the Election commitments report process.

Budget impacts over the forward estimates

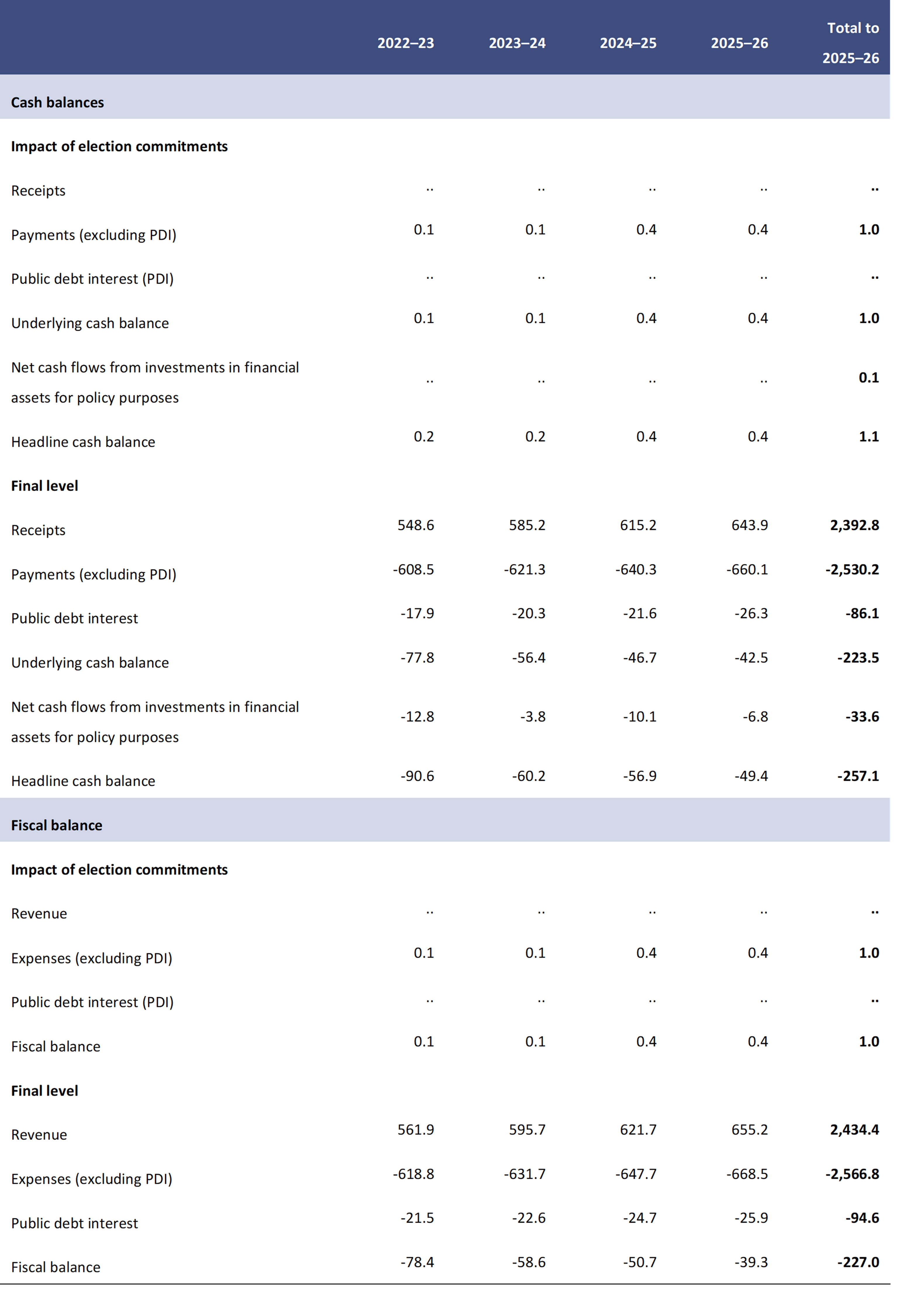

The combined impact of the Coalition’s election commitments is estimated to slightly increase all 3 budget balances over the 2022–23 Budget forward estimates period (Table 4). For the underlying cash balance, this reflects a decrease in payments and tax receipts and an increase in non-tax receipts. The impacts on the fiscal balance are of a similar magnitude and nature. The increase in the headline cash balance results in a slight decrease of $36 million in public debt interest payments over the forward estimates, reflecting the net decrease in payments.

The main commitment driving the difference between the headline cash balance and the underlying cash balance is the Future Farmer Guarantee Scheme (ECR001) which involves the use of balance sheet financing arrangements. This policy supports new farmers by guaranteeing 40% of a commercial loan, up to a maximum of $1 million. This guarantee is accounted for in the headline cash balance but not the underlying cash balance.

These budget impacts exclude the impacts of Coalition election commitments that were included in PEFO, which is the budget baseline for this report. There are no material differences between these budget impacts over the forward estimates and those released by the Coalition prior to the election.17

Most of the Coalition’s election commitments are payments measures with only minor impacts on tax and non-tax receipts. The Coalition commitment with the largest fiscal impact is Agency Resourcing (ECR002), a savings measure which reduces the existing annual funding for Australian Government agencies for the years 2022–23 to 2025–26. While this commitment terminates at the end of 2025-26, it has an ongoing annual saving as the commitment results in a permanent reduction in the level of departmental funding for affected agencies. This commitment would increase the underlying cash balance by $3.3 billion over the forward estimates period.

Table 4: Financial implications of the Coalition’s election commitments, 2022–23 forward estimates, underlying cash, headline cash and fiscal balance basis ($billion)

Note: A positive impact on the budget balance indicates an increase in receipts or a decrease in payments. A negative impact on the budget balance indicates a decrease in receipts or an increase in payments. Figures may not sum to totals due to rounding.

.. Not zero but rounded to zero.

This savings measure more than offsets the 36 other Coalition commitments that decrease the underlying cash balance over the forward estimates, of which the 2 largest are Reducing the PBS Co-Payment (ECR004), which reduces the general patient maximum co-payment of the Pharmaceutical Benefits Scheme by about $10, and Super Home Buyer Scheme and Downsizer Contributions (ECR010), which allows first home buyers to release a proportion of their superannuation as a contribution towards a deposit for a home and reduces the eligibility age for downsizers contributions into superannuation.

The Coalition made announcements during the election campaign that were not election commitments for the purposes of the report, because funding was already in the budget baseline. The PBO identified around 400 announcements that fell into this category.

- Some were decisions of government made prior to the commencement of the caretaker period. Decisions of government include any measures that were in the 2022–23 Budget as well as grants or fund allocations committed by the government through the relevant processes. One example is Stanwell Corporation’s Central Queensland Hydrogen Hub which was announced during the caretaker period but funded under the existing Clean Hydrogen Hubs Program as a decision of government.

- The Coalition also announced several commitments during the election campaign to allocate uncommitted funding from within existing grants programs. Because the grants programs are already in the budget baseline, these commitments are not material.

The PBO seeks advice from all parties on the source of funding for announcements made during the election campaign. Where the party in government advises that an announcement was a decision of government, the PBO verifies this with the relevant government agency. Where any party allocates uncommitted funds in an existing program, the PBO verifies with the relevant government agency that sufficient uncommitted funding is available.

Further discussion of Coalition election commitments is provided in the Medium‑term budget impacts section below. A detailed table outlining the source and budget impacts of each of the Coalition’s election commitments is provided at Appendix A and costing documentation is provided at Appendix E.

The costing documentation prepared by the Department of Finance and the Treasury for the Coalition’s election commitments is used in this report with the exception of 4 costing minutes.18

- The commitments Future Farmer Guarantee Scheme (ECR001) and Rural Health and Medical Training, Far North Queensland (ECR011) have PBO minutes for consistent presentation of public debt interest. The commitment Regional Health Package (ECR005) has a PBO minute to provide some additional information about departmental funding arrangements.

- In some circumstances, including where a policy is expected to have financial impacts over the medium term, the PBO has provided additional information in addenda to the Department of Finance and the Treasury costings.19 The commitment Super Home Buyer Scheme and Downsizer Contributions (ECR010) has a PBO costing minute rather than just an addendum. This is to explain a costing assumption that applies over the period after the forward estimates (the period over which the PBO has extended the original costing).

In addition to the costing documentation prepared by the Department of Finance and the Treasury, this report includes 5 PBO costings. All of these commitments were included in the Coalition’s fiscal plan and the financial implications in this report are consistent with that plan.

- PBO minutes are included for 3 unquantifiable commitments: Maximum penalties under the Building and Construction Industry (Improving Productivity) ACT 2016 (ECR012), Foreign criminals to face the cost of their own immigration detention (ECR013) and Junior Minerals Exploration Incentive (ECR014). These were unquantifiable commitments in the Coalition’s fiscal plan.

- Two capped funding commitments, Infrastructure Investment Program – Additional Funding and Mental Health – Additional Funding, are included in Various capped costings – the Coalition (ECR100).

Interactions between election commitments

No significant budget impacts were identified as a result of interactions between the Coalition’s election commitments. As the majority of the Coalition’s commitments were decisions taken prior to the commencement of the caretaker period, interactions would have been incorporated in the Budget and PEFO.

Medium‑term budget impacts

Tables 2 and 3 in the Summary of major party budget impacts section show the net impacts of the Coalition’s election commitments over the medium term, which are consistent with those over the forward estimates period.

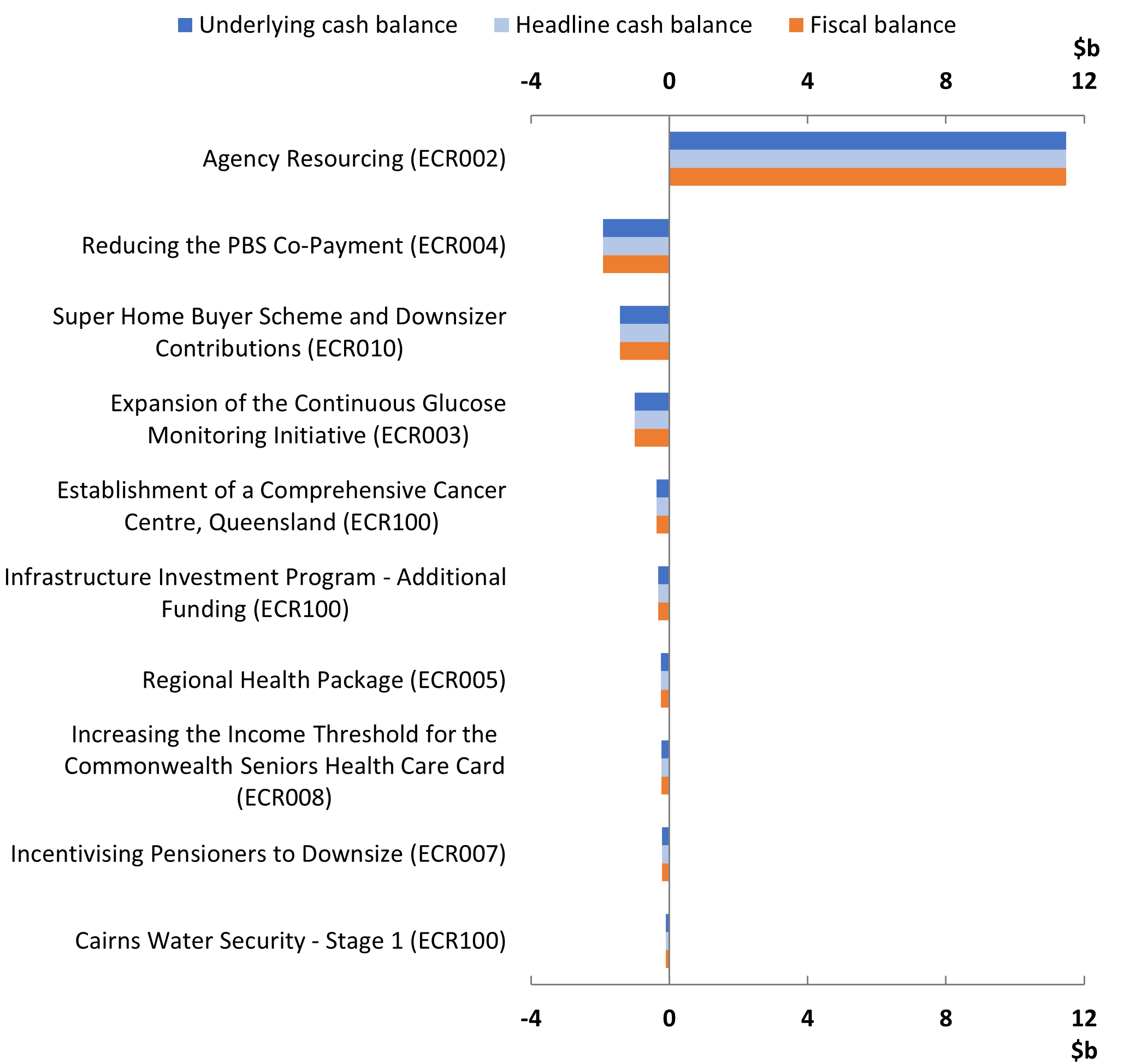

Figure 5 shows the 10 largest commitments by cumulative impact over the medium term across each budget balance.

Consistent with the forward estimates, the Coalition election commitment with the largest fiscal impact is the savings measure Agency Resourcing (ECR002).

The savings from this measure more than offset the $7.0 billion increase in payments from all other Coalition commitments over the medium term. The most significant increase in payments is from the commitment Reducing the PBS Co-payment (ECR004). As this commitment increases the cost of the PBS on an ongoing basis, it decreases the underlying cash balance by $1.9 billion over the medium term.

The second largest spending commitment over the medium term is Super Home Buyer Scheme and Downsizer Contributions (ECR010). This commitment reduces tax receipts on an ongoing basis, decreasing the underlying cash balance by $1.4 billion over the medium term.

Figure 5: The Coalition’s largest election commitments over the medium term

Cumulative impact on the underlying cash, headline cash and fiscal balance

Note: A positive impact indicates an increase in the budget balance. A negative impact indicates a decrease in the balance.

Interaction with the tax cap

The Coalition’s policy is for taxation receipts to not exceed 23.9% of GDP. The impact of the Coalition’s election commitments on tax receipts over the medium term results in additional unspecified tax cuts being included from the year 2031–32, worth $0.2 billion each year, to maintain tax receipts at or below the tax cap. This impact is negligible as a share of GDP.

Additional Coalition commitments identified by the PBO

This report includes all but one of the election commitments identified by the Coalition in the list provided to the Parliamentary Budget Officer on the day before polling day. The commitment Freeze Deeming Rates for Two Years has not been included in this report as it has no material impact on the budget.

No additional commitments were identified by the Parliamentary Budget Officer.

Footnotes

- See the Coalition budget document Our plan for Responsible Economic Management.

- The Department of Finance costing for Increase the Income Threshold for the Commonwealth Seniors Health Card (ECR008) has been revised slightly from that originally published on the www.electioncostings.gov.au website.

- The PBO's legislation does not require the Parliamentary Budget Officer to include the costing documentation prepared by the Department of Finance and the Treasury during the caretaker period if, in their professional judgement, it is considered more appropriate to include a new costing.