Key points:

- Labor’s commitments are estimated to decrease each of the budget balances over the forward estimates and the medium term, relative to the PEFO baseline. Labor’s platform, if fully delivered, would result in a decrease in the underlying cash balance of not more than 0.1% of GDP in any year, relative to PEFO.

- The underlying cash balance decrease over the forward estimates is largely driven by increases to payments, partially offset by savings proposals and an increase in taxation receipts. Commitments with large concessional loan and equity financing arrangements result in the headline cash balance decrease being larger than the underlying cash balance decrease over both the forward estimates and the medium term.

- Overall, the estimates presented in this report are not materially different from those published by Labor for the forward estimates prior to the election.

- The PBO identified 4 Labor election commitments additional to those in their party list. Each of these commitments is either fully offset or unquantifiable, so there is no additional estimated expenditure for these commitments.

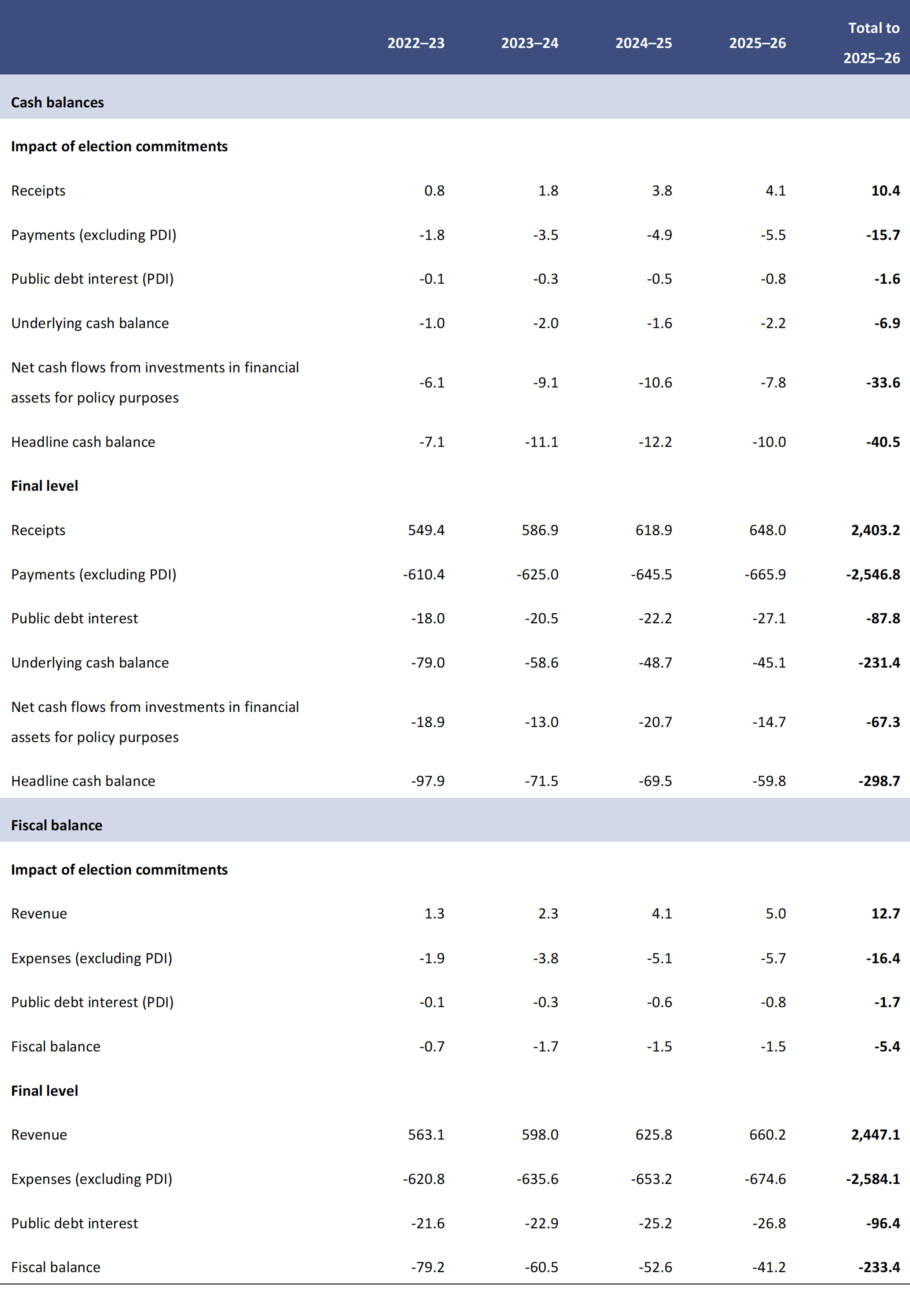

Budget impacts over the forward estimates

The combined impact of Labor’s election commitments is estimated to decrease all 3 budget balances over the 2022–23 Budget forward estimates period (Table 5). For the underlying cash balance, this reflects an increase in receipts, exceeded by an increase in payments (including public debt interest). The impacts on the fiscal balance are of a similar magnitude and nature. The decrease in the headline cash balance is larger than that of the underlying cash balance, reflecting a net increase in payments on a headline cash basis. Overall, the commitments result in an increase of $1.6 billion in public debt interest payments over the forward estimates, relative to PEFO.

The commitments driving the difference between the headline cash balance and the underlying cash balance are Powering Australia – Rewiring the Nation (ECR125), Help to Buy (ECR163), National Reconstruction Fund (ECR157) and Housing Australia Future Fund (ECR165), which involve the use of balance sheet financing arrangements through increases in loans and equity investments.

The PBO’s estimates are not materially different from the costs for the forward estimates period released by Labor prior to the election.20 While there are some material differences for individual commitments, when taken together, these differences amount to not more than 0.1% of GDP in any given year. The PBO’s estimates increase the expected budget position in total over the forward estimates relative to those in Labor’s fiscal plan.

Notable differences which increase the underlying cash balance relative to the estimates in Labor’s fiscal plan include:

- Abolish the Cashless Debit Card (ECR129), where the PBO’s costing estimates the savings arising from this measure

- Infrastructure Projects (ECR181), where the PBO identified a small number of projects already funded within the budget baseline

- Cutting the PBS General Co-Payment to $30 (ECR143). For this commitment, the PBO costing in this report uses a costing methodology that accounts for the receipt of manufacturer rebates from drug sponsors under Special Pricing Agreements.

The commitment with the biggest decrease to the underlying cash balance relative to the estimates in Labor’s fiscal plan is Fixing the Aged Care Crisis (ECR146), where updated PEFO parameters have resulted in a small revision to costs (relative to the overall size of the proposal).

Table 5: Financial implications of Labor’s election commitments, 2022–23 forward estimates, underlying cash, headline cash and fiscal balance basis ($billion)

Note: A positive impact on the budget balance indicates an increase in receipts or a decrease in payments. A negative impact on the budget balance indicates a decrease in receipts or an increase in payments. Figures may not sum to totals due to rounding.

The bulk of Labor's commitments affect payments, including both spending and savings measures. These comprise a large number of payments measures that would reduce the underlying cash balance, partially offset by 15 savings measures. Labor’s platform also includes 10 commitments that would affect taxation receipts and 17 that would impact non-taxation receipts (noting commitments can affect all of payments, tax and non-tax receipts). Overall, the impact on receipts would have a positive impact on the underlying cash balance.

The Labor commitments contributing the most to the decrease in the underlying cash balance are Cheaper Child Care (ECR115) and Fixing the Aged Care Crisis (ECR146). They are estimated to have a net cost of $5.1 billion and $2.5 billion respectively over the forward estimates. These impacts are driven by increases to administered payments.

Labor’s commitments with the largest increases to the underlying cash balance primarily feature higher taxation receipts, with Extend and boost existing ATO programs (ECR161) and Plan to ensure Multinationals Pay Their Fair Share of Tax (ECR167) improving the underlying cash balance by $3.1 billion and $1.9 billion over the forward estimates, respectively. There are also significant increases to the underlying cash balance from Savings from External Labour (ECR170), a measure to reduce Australian Public Service spending on contractors, consultants and labour hire companies, which would reduce payments by $3.0 billion over the forward estimates.

Further information on significant election commitments is provided in the Medium‑term budget impacts section below. A detailed table outlining the source and budget impacts of each of Labor’s election commitments is provided at Appendix B. Costing documentation for Labor’s election commitments is provided at Appendix F.

Interactions between election commitments

Seven of Labor’s commitments would be expected to interact with each other. In particular, the expected savings from Ending the 10% upfront fee discount (ECR116) would be larger than originally costed when accounting for its impact on 2 other Higher Education Loan Program commitments – 20,000 More University Places (ECR113) and Rural Health and Medical Training for Far North Queensland (ECR173). Interactions between these proposals would increase the underlying cash balance by $2.3 million over the forward estimates period and by $2.8 million over the medium term.

While the PBO has also identified 2 other potential interactions across 4 of Labor’s commitments, these are either offsetting or unquantifiable, so no additional financial implications have been outlined in this report. More detail on these interactions is set out in Budget analysis of interactions between the Australian Labor Party’s election commitments (ECR178).

Medium‑term budget impacts

Tables 2 and 3 in the Summary of major party budget impacts section show the net impacts of Labor’s election commitments over the medium term, which are broadly consistent with those over the forward estimates period.

Figure 6 summarises Labor’s largest election commitments over the medium term. The full list of medium-term impacts for each commitment is provided in Appendix B.

Figure 6: Labor’s largest election commitments over the medium term

Cumulative impact on the underlying cash, headline cash and fiscal balance

Note: * Denotes commitments assumed to be ongoing by the PBO, in line with PBO guidance. All commitments assumed to be ongoing for any party or independent are identified in Appendices A to D. Shows the largest 10 commitments on each budget balance, resulting in more than 10 total commitments because the largest 10 commitments differ across budget balances. A positive impact indicates an increase in the budget balance. A negative impact indicates a reduction in the budget balance.

Labor’s largest spending commitments over the medium term are largely consistent with those over the forward estimates. The following large commitments have differing impacts across the budget balances.

- The commitment with the most significantly different fiscal balance impact is Extend and boost existing ATO programs (ECR161), which differs due to the timing of when revenues and expenses are recognised. Also notable is National Reconstruction Fund (ECR157), which varies primarily due to the accounting treatment of concessional loans across the fiscal and underlying cash balances.

- Commitments with notably differing headline cash balance impacts include Powering Australia – Rewiring the Nation (ECR125), Help to Buy (ECR163), National Reconstruction Fund (ECR157) and Housing Australia Future Fund (ECR165). These commitments all differ due to the treatment of equity and concessional loan transactions, where the equity injections or loan principal and repayments appear in the headline cash balance only.

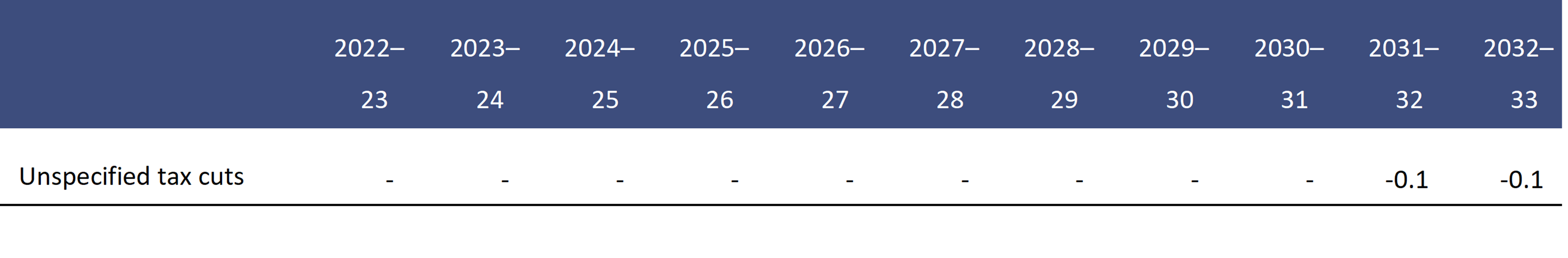

Interaction with the tax cap

The Statement on Labor’s Economic Plan and Budget Strategy outlined that ‘Labor is not attracted to the current [23.9% tax-to-GDP] cap and does not believe it needs to be revisited, given that both [the Coalition and Labor] will not approach it in the forward estimates’.21 As such, the PBO has incorporated the tax cap in calculating Labor’s fiscal aggregates. The PBO estimates that unspecified tax cuts of $9.2 billion over the medium term (0.1% of GDP in 2031–32 and 2032–33) would be required to satisfy this limit (Table 6).

Table 6: Net impact of unspecified tax cuts due to tax cap (% of GDP)

- Indicates nil.

Additional Labor commitments identified by the PBO

This report considered all election commitments identified by Labor in the list provided to the Parliamentary Budget Officer on the day before polling day. A number have been excluded from this report as they were deemed to not be material, or were matching Coalition commitments for which funding has already been provided for in the budget baseline. Appendix I provides further information on how the PBO assesses the materiality of election commitments for the purposes of this report.

The Parliamentary Budget Officer has included 4 additional commitments to the list provided by Labor. These are Powering the Regions Fund and direct financial support measures (ECR175), Restore the role of the Climate Change Authority (ECR176), Roll Creative Partnerships Australia into the Australia Council (ECR177) and Hunter Super Hydrogen Hub (ECR500). No additional costs associated with these commitments have been included in this report.

Powering the Regions fund and direct financial support measures (ECR175) would be funded by redirecting funds from the Emissions Reduction Fund. While the expenditure for this commitment is fully offset, the mandate, function and operation of the Powering the Regions Fund remain to be specified. The PBO has therefore assessed the overall budget impact of this commitment as unquantifiable.

The remaining 3 commitments would have no net cost, as they would all be funded by redirecting budgeted expenditure from other activities.

The largest quantifiable additional commitment is the creation of a Hunter Super Hydrogen Hub (ECR500), which would provide $82 million to establish a single hydrogen hub in the Hunter region of New South Wales. Funding for this commitment is to be drawn from existing allocated but not yet contracted funding for the Clean Hydrogen Industrial Hubs program.

The Minister for Finance, Senator the Hon Katy Gallagher, noted agreement with the additional commitments included by the PBO, and that these items would have no net cost.

Footnotes