Key points:

- The Greens’ commitments are projected to decrease all budget balances over the forward estimates period and the medium term, relative to the PEFO baseline. Due to large volumes of loans and equity in some commitments, the projected decline in the headline cash balance is much larger than the other budget balances.

- While large increases in receipts exceed the large increases in payments in 2022–23 itself, across both the forward estimates and medium-term periods, increases in payments are only partially offset by increases in receipts. If fully delivered, the Greens’ platform would decrease the underlying cash balance by an average of 0.5% of GDP per year over the medium term, relative to PEFO.

- The impacts in this report are in line with those published by the Greens prior to polling day for the same commitments, after adjusting for differences in economic parameters.

- Additional commitments identified by the PBO further decrease each of the budget balances, with increases in payments of $12.4 billion over the forward estimates, partially offset by a $2.7 billion increase to receipts. The net impact of these additional commitments is small compared to the total impact of the Greens’ platform, which increases payments by $376.6 billion over the same period.

Budget impacts over the forward estimates

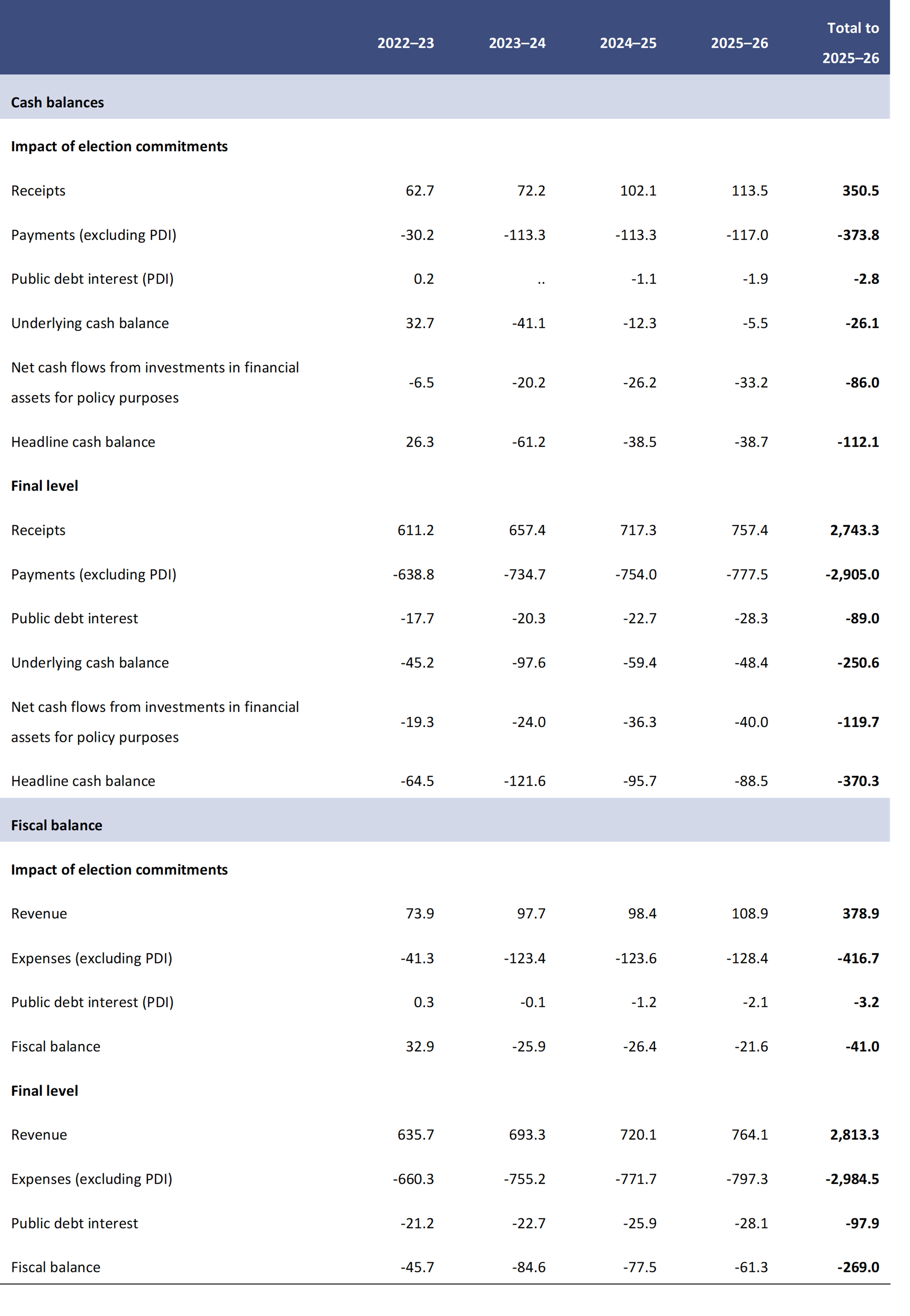

The combined impact of the Greens’ election commitments is estimated to decrease all 3 budget balances over the 2022–23 Budget forward estimates period (Table 7). For the underlying cash balance, this reflects a net increase in payments (including public debt interest) of $376.6 billion, partially offset by a net increase in receipts of $350.5 billion. The impacts on the fiscal balance are similar. The decrease in the headline cash balance results in an increase of $2.8 billion in public debt interest (PDI) payments over the forward estimates. The difference between the headline and underlying cash balances primarily reflects increases in loans and equity investments as part of the commitments Building One Million Homes (ECR524) and Finally Building High Speed Rail (ECR512), partially offset by decreases in loan commitments in Free TAFE and University (ECR528).

While the Greens did not publish a consolidated fiscal plan prior to polling day, their announcements included estimated budget impacts and these are in line with the impacts in this report.22 Differences in the estimates predominantly arose because the Greens’ announced estimates were costed before the release of the 2022–23 Budget and therefore used slightly different economic parameters and a different forward estimates period.

The Greens announced commitments to significantly increase receipts and decrease payments. The commitment that makes the largest contribution to the increase in the underlying cash balance is “Tycoon” Super Profits Tax (ECR534), which would introduce a tax of 40% on company profits that exceed a specified threshold. This is expected to increase the underlying cash balance by $87.0 billion over the forward estimates period. The commitment with the largest reduction in payments is Peace Disarmament and Demilitarisation (ECR565), which would reduce defence payments to 1.5% of GDP by 2025–26. This commitment is expected to increase the underlying cash balance by $51.1 billion over the forward estimates period.

Table 7: Financial implications of the Greens’ election commitments, 2022–23 forward estimates, underlying cash, headline cash and fiscal balance basis ($billion)

Note: A positive impact on the budget balance indicates an increase in receipts or a decrease in payments. A negative impact on the budget balance indicates a decrease in receipts or an increase in payments. Figures may not sum to totals due to rounding.

Increases to receipts and reductions in payments announced by the Greens are more than offset by commitments to increase payments. The largest spending commitment is No One in Poverty (ECR558), which increases the maximum payment rate and removes some compliance measures for social welfare payments. This commitment is expected to decrease the underlying cash balance by $134.5 billion over the forward estimates period. The next largest spending commitments are Free TAFE and University (ECR528) and Quality Aged Care for All (ECR563), which are expected to decrease the underlying cash balance by $44.2 billion and $25.0 billion respectively over the forward estimates period.

Further discussion of major election commitments is provided in the Medium‑term budget impacts section below. A detailed table outlining the source and budget impacts of each of the Greens’ election commitments is provided at Appendix C. Costing documentation for the Greens’ election commitments is provided at Appendix G.

Interactions between election commitments

The PBO has identified and costed material interactions between 12 commitments:

- End handouts for coal, oil and gas companies (ECR502)

- Make Gas Exporters Pay Taxes and Royalties (ECR503)

- Coal Export Levies (ECR504)

- Make Polluters Pay for the Damage they are doing (ECR506)

- End Tax Breaks for Property Investors (ECR525)

- Billionaires Tax (ECR533)

- “Tycoon” Super Profits Tax (ECR534)

- Mining Super Profits Tax (ECR535)

- Banking for People, Not Profit (ECR537)

- A Fair and Progressive Income Tax System (ECR539)

- No one in Poverty (ECR558)

- Paid Parental Leave (ECR581).

While some of these commitments primarily affect payments, the interactions between them only affect receipts.

These overall interactions lower receipts relative to the impact of the commitments if these interactions were not taken into account. Receipts are lower in each year and decrease by $10.3 billion over the forward estimates and $27.4 billion over the medium term. The magnitude of the estimated interactions grows significantly in 2024–25 as the reversal of the Stage 3 tax cuts in A Fair and Progressive Income Tax System (ECR539) takes effect. The interactions then decline over the medium term as the changes to negative gearing and the capital gains tax discount in End Tax Breaks for Property Investors (ECR525) approach maturity.

Further detail on these interactions, including the profile over the medium term, is set out in Budget analysis of interactions between the Australian Greens’ election commitments(ECR589).

Medium‑term budget impacts

Tables 2 and 3 in the Summary of major party budget impacts section show the net impacts of the Greens’ election commitments over the medium term, which are generally consistent with those over the forward estimates period.

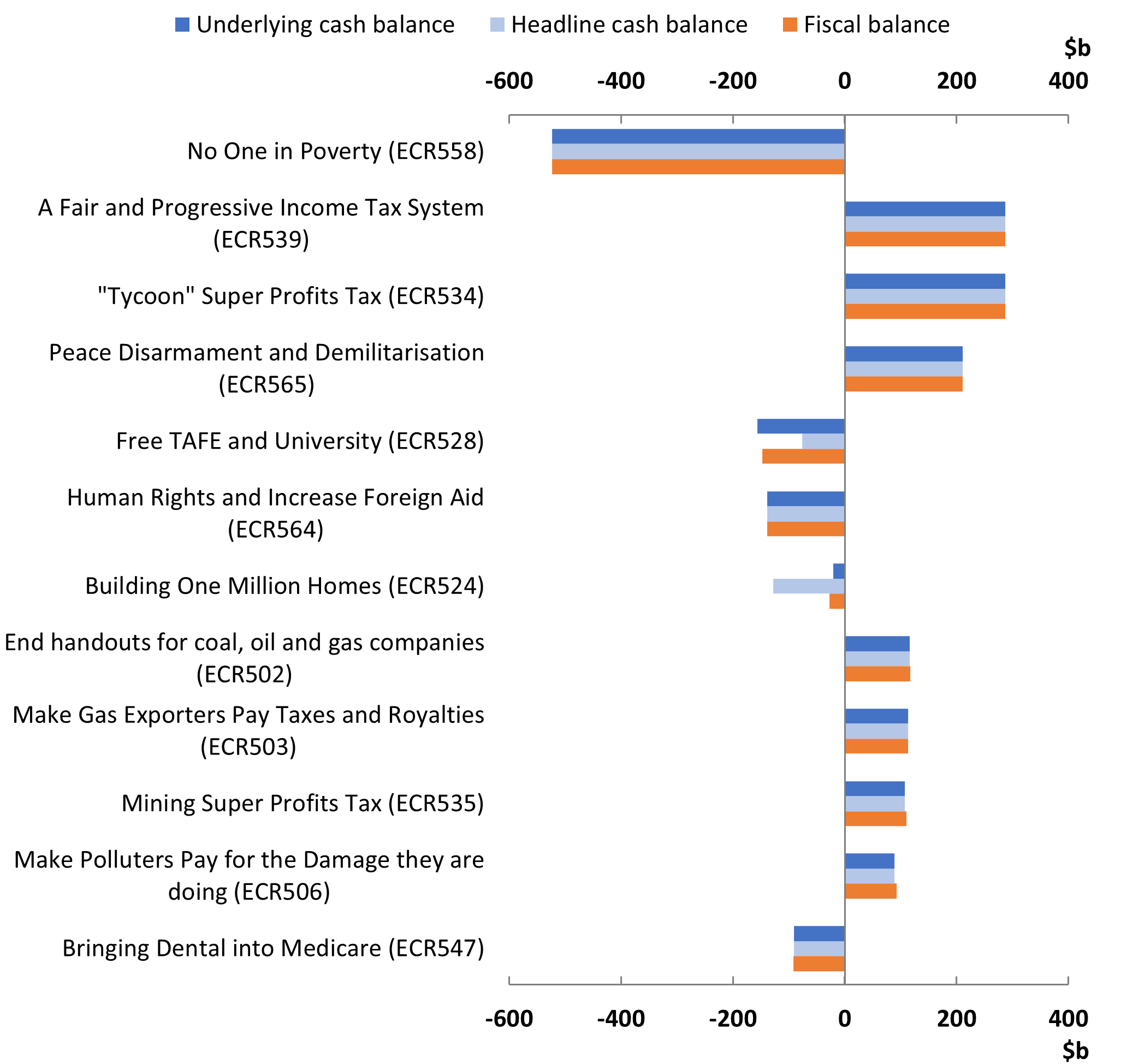

Figure 7 shows the major commitments driving these impacts and summarises the Greens’ largest election commitments over the medium term. The full list of medium-term impacts for each commitment is provided in Appendix C.

Figure 7: The Greens’ largest election commitments over the medium term

Cumulative impact on the underlying cash, headline cash and fiscal balance

Note: Shows the largest 10 commitments on each budget balance, resulting in more than 10 total commitments because the largest 10 commitments differ across budget balances. A positive impact indicates an increase in the budget balance. A negative impact indicates a reduction in the budget balance.

The following 2 large commitments have differing impacts across the budget balances.

- The commitment Free TAFE and University (ECR528) increases payments by $155.2 billion over the medium term. This commitment would replace loan schemes with grants for eligible student tuition fees and increase ongoing funding to public universities. However, this commitment only decreases the headline cash balance by $76.2 billion over the same period, as the principal paid under loan schemes is already captured in the headline cash balance under the baseline.

- The commitment with the largest difference between its impacts on different budget balances is Building One Million Homes (ECR524), which would build houses for rent and shared equity arrangements operated by the Australian Government. This commitment provides large amounts of equity and concessional loans. As these are only included in the headline cash balance, the commitment decreases the headline and underlying cash balances by $128.3 billion and $20.2 billion over the medium term, respectively.

Interaction with the tax cap

The Greens do not support capping tax receipts as a share of GDP.23 As such, the PBO’s calculation of the Greens’ fiscal impacts does not incorporate a tax cap. Due to the removal of this limit, the estimates of the Greens’ fiscal impacts in this report incorporate the reversal of unspecified tax cuts of $9.1 billion (0.2% of GDP in 2032–33), relative to the PEFO baseline (Table 8).

Table 8: Reversal of unspecified tax cuts (% of GDP)

- Indicates nil.

.. Not zero but rounded to zero.

Additional Greens’ commitments identified by the PBO

This report includes all election commitments identified by the Greens in the list provided to the Parliamentary Budget Officer on the day before polling day.

The Parliamentary Budget Officer has included 26 additional commitments in this report, relative to the list of commitments that was provided by the Greens. Of these additional commitments, 24 have either individual costing minutes or line items in Various capped costings – Australian Greens (ECR600). The commitments Impose penalties for the unlicensed sale of cannabis and End intensive factory farming were incorporated into Safer Drug Use (ECR552) and No More Animal Cruelty (ECR522), respectively.

In total, these additional commitments would decrease the underlying cash balance by $9.3 billion over the forward estimates period and $33.5 billion over the medium term. This is only a small decrease compared to the total impact of the Greens’ platform, which increases payments by $376.6 billion over the forward estimates and $1.5 trillion over the medium term. Eighteen of these additional commitments are payments measures and 2 are receipts measures. The remaining 4 are unquantifiable and are identified below.

The additional Greens’ commitment with the largest fiscal impact is Paid Parental Leave (ECR581), which would increase the maximum Parental Leave Pay entitlement to 26 weeks, increase the payment rate to the parent’s wage up to $100,000 per year, and include superannuation contributions on Parental Leave Pay. This commitment is expected to decrease the underlying cash balance by $6.4 billion over the forward estimates period and $26.8 billion over the medium term.

The additional commitments Ban the import and export of shark fins (ECR570), Cover funeral expenses for members of Youpla Group (ECR571), Legislate the minimum wage at 60% of the full time median wage (ECR580), and Stop companies claiming tax deductions for travel to tax havens (ECR588) are expected to have financial implications but were determined to be unquantifiable by the PBO. The commitment Ban live export of livestock (ECR569) also has an unquantifiable impact in some years.

The Leader of the Greens, Mr Adam Bandt MP, noted the party’s satisfaction with the additional commitments identified by the PBO.

Footnotes

- These announcements are available in the Greens platform.

- See ‘Paying for the Greens’ plans’.