Budget Explainer, 21 September 2022

Attachment A: A brief history of fuel excise in Australia [Download PDF 209 KB]

Attachment B: International comparison of fuel taxation [Download PDF 174 KB]

Attachment C: Petroleum products and recent movements in fuel excise rates [Download PDF 165 KB]

Attachment D: Estimating fuel excise and fuel tax credits over the medium term [Download PDF 181KB]

Attachment E: The relationship between the Road User Charge (RUC) and Fuel Tax Credits (FTCs) [Download PDF 238KB]

Attachment F: Glossary of fuel taxation terminology [Download PDF 235KB]

Executive summary

- In Australia fuel tax is collected as a tax on the production or importation of fuel, offset by a system of fuel tax credits for business users of fuel. This explainer sets out the key features of what is a complex system of taxation and tax credits that impacts both the revenue and expenditure sides of the budget.

- The excise and customs duty on petroleum fuel (referred to here as fuel tax) is one of the oldest taxes in Australia, applying since Federation in 1901. For some of that time there has been a link between the amount of excise raised and road funding. The formal link to road funding most recently ceased in 1992. Since then, fuel tax has been a general revenue-raising tax with only a minor link with the Australian Government’s overall level of road funding.

- Australia has a relatively low fuel tax rate compared with most other OECD countries.

- There are two main parts to the fuel tax system. First, fuel tax is collected from the producers or importers of fuel when fuel leaves their depot or terminal (the terminal gate); currently charged at a rate of 46 cents per litre (CPL); and second, a system of fuel tax credits (FTCs), which refund fuel tax to eligible businesses so they are not taxed on fuel used as a business input.

- FTCs are worth around 39% of the total tax collected

- Three quarters of FTCs are paid to businesses in the mining industry; the transport, postal and warehousing industry; and the agriculture, forestry and fishing industry.

- The fuel tax and FTC systems are used together as a means of charging heavy vehicle operators for their share of the cost of road infrastructure. This is done by reducing the FTCs they receive so that they ultimately pay a net amount of fuel tax that represents a Road User Charge (RUC).

- The FTC system means that fuel tax is mostly paid by household users of fuel.

- Adjustments to the fuel tax arrangements have been used to address cost of living pressures associated with rising fuel prices. The most recent instance was the 2022‑23 Budget measure Addressing Cost of Living Pressures – temporary reduction in fuel excise, which halved excise rates for the six-month period from 30 March 2022 to 28 September 2022.

- this measure provided temporary relief from high fuel prices for households, but the operation of the FTC system means that it provided limited relief to businesses.

Basic features of the fuel tax system

The fuel tax system covers all petroleum fuels, with a range of rates and exemptions. For simplicity, the analysis in this explainer looks principally at petrol and diesel, which account for around 90% of fuel excise collections and share a common excise rate per litre.

The fuel tax system has two main parts:

- Excise and excise equivalent customs duty, which is a tax imposed on producers and importers of fuel, where the tax is collected at the point where fuel leaves the refinery or storage depot. Excise is indexed every six months to movements in the CPI with adjustments made in February and August.

- Fuel tax credits (FTCs), which are an expenditure that refunds some or all of the excise included in the price of fuel purchased by eligible businesses and which are used for a creditable purpose. Fuel tax credits refund over one third of the total fuel tax collected to businesses.

The rate of FTC paid to eligible businesses depends upon whether the fuel is used on a public road by a heavy vehicle or used for another creditable purpose:

- Fuel used on public roads in heavy vehicles receives a partial FTC with the portion of the excise that is not refunded being a notional road user charge (RUC) that aims to ensure that heavy transport users of fuel pay for the cost of providing public road infrastructure to them.

- Businesses using fuel for other purposes receive a full refund of the fuel tax they have paid.

The RUC is set independently of the excise rate and is based on advice to the Minister for Transport from the National Transport Commission.

A key factor in the operation of the RUC is that the fuel excise rate needs to be higher than the RUC. This is because the RUC is imposed by reducing the FTCs payable to heavy transport operators, and once FTCs are reduced to zero there is no mechanism for imposing further increases in the fuel-based RUC.

More information on particular terms is provided through links to the glossary throughout this explainer denoted by the clickable links.

Introduction

Petroleum fuel sold in Australia is taxed under both the petroleum fuel excise and the goods and services tax (GST). Fuel excise included in the price of fuel purchased by business users for creditable purposes is refunded through a system of FTCs, with the result that fuel taxes are mainly a tax on household consumption of fuel. This explainer explains what the various parts of the Australian fuel taxation system are and how they impact on the budget. The explainer is relatively technical because it aims to provide a comprehensive description of a system that is often described only in part.

Fuel excise – quick facts

Excise revenue:

2021-22 revenue $18.2 billion (3.2% of total 2021-22 Budget revenue).1

Fuel tax credits:

2021-22 expense $6.89 billion (1.1% of total 2021-22 Budget expenses).2

Trends in fuel tax revenue

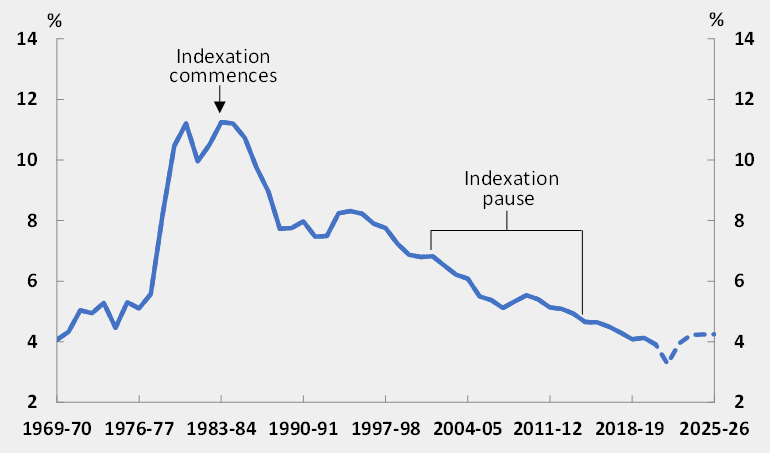

Fuel excise has declined as a proportion of Australian Government revenue over the last 40 years (see Figure 1 below), under pressure from increasing fuel efficiency and higher fuel prices (as well as the rise and fall of Australian crude oil production in the 1970s and 1980s). Revenue is expected to recover to pre-pandemic levels over the next few years following the end of the temporary 6 month halving of excise rates. Beyond that, it is likely that excise will continue to be eroded by factors such more fuel-efficient vehicles and increasing take up of electric vehicles (on and off public roads).

Figure 1: Fuel excise as a proportion of total receipts

Source: Reserve Bank of Australia, Occasional Paper No. 8, 2004-05 Budget, and 2022-23 Budget.

The excise and customs duty on petroleum fuel is one of the oldest tax bases of the Australian Government, applying since Federation in 1901. There have been numerous changes to petroleum taxation since Federation, involving changes in fuels covered, rates, exemptions, credits and indexation arrangements. A short history of petroleum taxation based on material from the 2001 Fuel Tax Inquiry – updated for more recent developments – is provided in Attachment A.

Internationally, most countries impose some form of tax on fuel. In some countries, taxes on fuel include an explicit carbon tax component (this is not the case in Australia). Analysis by the OECD in Attachment B shows that Australia has a relatively low rate of fuel excise compared to most countries.3

For some periods in the history of petroleum excise collection, the revenue has been earmarked for funding roads and the rate of the excise was set with this in mind. This has involved arrangements at various times to either exempt off-road fuel use (particularly for agricultural use), or to refund the excise collected, in full or part, to certain users.

The formal link between petroleum fuel excise and roads funding most recently ended in 1992. Since then, the overall Australian Government spending on roads has been set independently of excise revenue, and the role of petroleum excise has been to contribute to the broader budget. Figure 2 shows that Australian Government road spending has not followed movements in fuel tax over the last 15 years. In this period, while the ratio of Australian Government road spending to fuel tax revenue has averaged around 30%, it has varied substantially, mainly due to changes in road spending.

Figure 2: Australian Government road spending as a proportion of total fuel tax

Source: PBO analysis of Bureau of Infrastructure, Transport and Regional Economics (BITRE) Yearbook 2021: Australian Infrastructure and Transport Statistics, Statistical Report and 2022-23 Budget.

Partial hypothecation was re-introduced in 2014 with the re-introduction of fuel excise indexation.4 This involved the Australian Government paying an amount equal to the net revenue from reintroducing fuel excise indexation to a special account for payment to the States and Territories for road infrastructure.5 Since 2012, the amount hypothecated under this arrangement has grown reaching more than $1 billion (about 5.5% of fuel excise) in the 2021-22 financial year.6

The FTC system that refunds the excise included in the price of fuel to eligible business users has different levels of credit depending upon whether fuel is used on or off-road. Details of this system are outlined further below.

What elements make up Australia’s fuel tax system?

Excise

Excise is collected at the point where fuel leaves a designated storage depot, with the excise paid by the manufacturer or importer and remitted to the Australian Taxation Office, mostly on a weekly basis.7 As at 29 September 2022, the excise is charged at a rate of 46 cents per litre (CPL). The principal purpose of fuel excise is to raise revenue for the budget.

Fuel excise is indexed every 6 months, in February and August, to upwards movements in the consumer price index (CPI).8

Fuel tax credits

Fuel tax credits (FTCs) refund this excise, in part or in full, to eligible business users of fuel.

The economic rationale for refunding fuel excise to businesses is that imposing general revenue raising taxes on business inputs is economically inefficient.9

- The full FTCs paid to businesses for fuel used for a creditable off-road use fully refunds the excise included in the price of fuel and ensure that no excise applies.

- The partial-FTC for fuel used on public roads by heavy vehicles is an example of a tax being used to recover particular regulatory costs or as a charge for the provision of public goods or services. Use of taxes and tax offsets in this way can be an economically efficient way of implementing a user pays regime.

Excise and FTCs are used together to charge for the use of public roads by heavy vehicles. This is because fuel use increases with both vehicle mass and distance travelled on roads, which affect the impact heavy vehicles have on roads. Excise is an effective mechanism for collecting tax as it has only a few taxpayers and a clear taxing point, while FTCs adjust the impact on business to reflect a level of cost recovery. This approach can be a simpler and more effective system of cost recovery than a separate direct user charge, particularly if the system can be administered as part of general tax compliance. To this end, FTCs are claimed by businesses in their business activity statement (BAS).

There are 2 areas where the fuel tax system is used to recover particular costs from businesses.

- The FTCs available for on-road use of petroleum fuels is reduced by an amount so that the net excise paid by heavy vehicle operators covers their share of the cost of road construction and maintenance. The net excise payable as a result of the combination of excise and reduced FTCs is part of a national scheme of road user charging.

- The excise on aviation fuels (currently 3.556 cents per litre (CPL)) is used to fund the regulation of aviation safety, with all the excise revenue collected provided to the Civil Aviation Safety Authority.

Using fuel tax to fund the cost of providing roads or aviation safety works as a way of collecting revenue for those purposes as long as the fuel use varies in proportion to the activity being funded. If that ceases to be the case, for instance with the development of electrically powered trucks or aircraft, the fuel tax would no longer be an efficient funding mechanism because fuel tax would no longer recover the cost of the regulation or public goods from all users concerned.

Road user charge

The reduction in the FTCs for heavy vehicles on a public road is a road user charge (RUC). This charge aims to ensure that the operators of heavy vehicles pay their share of the cost of constructing and maintaining roads.

The RUC is set independently of the fuel excise rate. To ensure national consistency, any change in the RUC rate is considered alongside state and territory heavy vehicle registration fees as part of the annual pay-as-you-go (PAYGO) heavy vehicle charge setting process. The calculation of the heavy vehicle share of government road expenditure costs and charge rates is performed by the National Transport Commission (NTC) who apply pricing principles designed to efficiently recover the cost of providing road infrastructure for heavy vehicles. Ultimately it is the Transport Minister that determines the RUC charge rate.

The RUC is sometimes referred to as ‘notional’ because it is collected through the excise included in the price of fuel rather than by directly charging heavy vehicle operators. The RUC is equal to the amount of the fuel excise that is not refunded to the business through FTCs. A consequence of collecting the RUC in this way is that the fuel-tax-based RUC cannot exceed the excise rate. If the RUC is set at a level higher than the excise rate, the FTC is reduced to zero and the notional RUC paid is limited to the excise paid.

A key advantage of governments recovering costs of heavy vehicle road use through the fuel tax system is that it is paid progressively through the year on a PAYGO basis rather than as a large annual fee.

How much does the fuel tax system contribute to the budget?

Fuel excise contributes to tax revenue, with that contribution partly offset by expenditure on FTCs. Overall, the fuel tax system improves the budget position.

Figure 3 shows the relationship between fuel excise and FTCs, using the example of petrol and diesel fuel for the 2020-21 year.10 The vertical axis is the excise rate in CPL and the horizonal axis is the volume of fuel subject to the excise in megalitres (ML). The total area of the box represents the total gross excise collected from manufacturers and importers of petrol and diesel in the year.

Figure 3: Excise and fuel tax credits (petrol and diesel), 2020-21

Note: Petrol and diesel include excise tariff items 1005 and 1010.

Figure 3 shows there is a significant difference between the gross excise collected from manufacturers and importers at the terminal gate and final net excise collections once FTCs are deducted. The total coloured area represents the value of excise collections from fuel importers and manufacturers (gross excise). Fuel tax credits are represented as the green shaded area. Excise collections net of FTCs are represented by the brown shaded area. Figure 3 shows that FTCs reduce the value of net fuel excise collections from petrol and diesel by around 39% compared with the amount of excise paid at the taxing point.

In 2020-21:

- Gross excise collected from manufacturers or importers on petrol and diesel was around $18.8 billion.

- Of fuel that was taxed at the ‘terminal gate’, 49% (by volume) received a FTC for part or all of the excise collected. Of this:

- 17% of petrol and diesel was used on road and qualified for a partial FTC of 16.7 CPL.

- 32% of petrol and diesel was used off public roads for creditable purposes and qualified for a full FTC averaging 42.5 CPL.

- In total, fuel tax credits for petrol and diesel were an expense to the budget of $7.3 billion.

- 51% of petrol and diesel was ineligible for any FTC and was subject to the full fuel excise with excise collected on this fuel contributing $9.6 billion to the budget. This fuel was mainly consumed by households with the balance of non-household use attributable to light vehicles used on-road by businesses (the split between household and business use is not available).

- Overall, net excise collections (excise less FTC) on petrol and diesel were around $11.5 billion.

Table 1 provides further details of the excise and FTCs on diesel and petrol.

Table 1: Petrol and diesel 2020-21 – Excise and FTCs

Source: PBO analysis of ATO data.

Note: Petrol and diesel include excise tariff items 1005 and 1010.

Other impacts on the budget

Timing of revenues and expenses

Fuel excise is payable by manufacturers and importers when fuel leaves their storage facility with most remitting the excise payable on a weekly basis. Businesses that consume fuel claim FTCs through their BAS, which they lodge monthly, quarterly or annually depending upon business size.

The fiscal balance impacts arise when the transactions that give rise to revenue or expenses occur, whereas the underlying cash balance impacts arise when payments of tax or credits are made. In practice, there is little or no difference between the fiscal balance and the underlying cash balance for fuel excise or FTCs as the liability and payment generally occur in the same accounting period.

In modelling the fuel tax system, it is important to consider that there are timing impacts that arise because of the differences between when fuel leaves the terminal gate, when it is sold to a business user and when that business claims a FTC for the fuel. Excise is payable when the fuel passes the terminal gate whereas FTCs are payable when a business user claims the credits in their BAS. This means that there will be a lag between fuel entering the marketplace, its use by a business and FTCs being claimed.

Revenue or expense, tax or non-tax?

Fuel excise is a tax and contributes to the revenue side of the budget.

FTCs are refundable tax offsets, which means that they can either be used to reduce the amount owed by a business in their BAS or, if the offset exceeds the amount owed, the business will receive a cash refund of the excess.

FTCs are treated as a budget expense rather than a reduction in revenue because they do not relate to tax actually paid by the taxpayer (the excise was paid by the importer or manufacturer of the fuel), and because the amount of the credits can be paid as a cash refund.11

The revenue and expenditure components of the fuel tax system are reported in Budget Paper No.1, Budget Strategy and Outlook each year. In the 2022-23 Budget, excise revenue is reported as a revenue item in Statement 4: Revenue. FTC expenditure is reported in Statement 5: Expenses and Net Capital Investment under the ‘fuel and energy’ sub-function.

FTC cannot be reduced below zero by the Road User Charge

The part FTC for fuel used on-road in heavy vehicles is calculated as equal to the excise paid per litre of fuel, reduced by the RUC.

This raises the question of what would happen if the RUC were to exceed the excise rate payable (either because of an increase in the RUC or a decrease in the excise rate). If this occurs the on-road FTC rate would be zero.

Examples of situations where excise has either been reduced to a level lower than the RUC, or where the policy settings made this a possibility, are:

- The 2022-23 Budget measure Addressing Cost of Living Pressures – temporary reduction in fuel excise, temporarily halved fuel excise for 6 months – from 30 March 2022 to 28 September 2022. As a consequence, the excise rate for petrol and diesel fell to 22.1 CPL, below the prevailing RUC of 26.4 CPL. As the RUC exceeded the excise duty paid, this change meant that the partial FTC for heavy vehicles used on public roads fell to zero for the period of the excise reduction. This reduced the RUC that could be collected from 26.4 CPL to 22.1 CPL, providing heavy vehicle operators with a net benefit of 4.3 CPL compared with settings prior to the change.12 Attachment E provides details of how this outcome came about.

- From 2001 to 2014 the twice-yearly indexation of the fuel excise rate was suspended at 38.14 CPL with the result that the difference between the RUC and fuel excise narrowed as the RUC was increased. As the RUC is set independently of the excise rate it was possible that the RUC could have been increased to the point where it exceeded the excise rate if the excise freeze had continued.

- The excise rates on LPG, CNG and LNG powered vehicles are below the RUC (even without the temporary halving of excise rates), meaning heavy vehicles using these fuels receive no FTCs. As excise rates are indexed, operators of such vehicles will pay the full increase in the excise rate. This compares with the FTC paid to operators of petrol or diesel powered heavy vehicles where, as long as excise is greater than the RUC, the FTC rate increases to offset excise indexation and leave the RUC unchanged.

A consequence of the interaction between the RUC and the excise rate is that businesses operating heavy vehicles on road are shielded from the effect of changes in the excise rate as long as the net excise rate (which is equal to the RUC) is greater than zero.

Tax treatment of excise and FTC

Excise and fuel tax credits affect the income tax (personal income tax and company tax) calculations of businesses. Fuel purchases are a deductible business expense. Excise on fuel adds to this expense, while FTCs (and GST input tax credits) reduce it. The cost of fuel included in businesses’ taxable income will equal the excise and GST inclusive pump price of the fuel less any FTC and GST input tax credits received. This means that the budget impact of changes in excise and FTC will be offset in part by changes in income tax (personal income tax and company tax) payable by businesses.

Figure 4 shows the determinants of the cost of fuel to households and different business users of fuel. Fuel is a private expense for households, so their cost of fuel is the full pump price (i.e. including excise and GST). The cost of fuel for businesses that use fuel for an eligible income producing purpose is the pump price less GST and FTCs, which is tax deductible. Decomposing the determinants of the FTC payable, this means that:

- for households the cost of fuel is the full GST-inclusive pump price

- for businesses that use fuel for an eligible off-road use, the cost of fuel is equal to the pump price less the full excise paid less the GST input tax credit, and this cost reduces their taxable income13

- for businesses that use fuel in a heavy vehicle on road, the cost of fuel is equal to the pump price less excise plus the RUC less the GST input tax credit, and this cost reduces their taxable income

- for businesses that use fuel in a light vehicle, the cost of fuel is equal to the pump price less the GST input tax credit, and this cost reduces their taxable income.

Figure 4: Excise, fuel tax credits and the cost of fuel to users

Goods and services tax (GST)

Fuel is also taxable under the GST with the GST charged on the excise inclusive price of the fuel.

GST registered businesses can claim an input tax credit for the GST on the excise inclusive price in their BAS. GST nets out to zero for most businesses due to input tax credits which mean that there is generally no GST on business-to-business transactions.

Final consumers will be affected by the GST on fuel in two ways. Changes in the pump price of fuel will have a direct impact on final consumers through the GST payable on the fuel, and an indirect effect through the cost of GST taxable goods and services that use fuel as an input. The indirect impact arises because the final consumer pays GST on the full price of the goods or services supplied, including on the value of business inputs used (such as fuel). In this context, final consumers are households and businesses that make input-taxed supplies (supplies where the business does not remit GST but cannot claim input tax credits: mainly financial supplies, rental housing and some long term accommodation).

GST collections have no significant impact on the Australian Government Budget because all GST revenue (less administration costs) is paid to the states and territories. These payments are based on cash collections, with GST remitted 21 days after the end of each accounting period (monthly, quarterly or annually). This timing of remittances creates a timing difference between GST accounted for on a fiscal balance basis and that accounted for on an underlying cash balance basis.

Impact of excise changes on consumer prices and the budget

Automotive fuel is a component of the basket of goods used to measure CPI in Australia. Historically, the main short-term influence on the price of automotive fuel comes from factors such as global oil prices, with only a minor impact coming from the regular 6-monthly indexation of the excise rate.

The indexation of fuel excise is cumulative and has a greater impact over longer periods. This can be seen from Figure 5 which shows that the freeze in the fuel excise indexation from March 2001 to November 2014 reduced the excise rate by around one third compared with what would have been had there been no 1.5 CPL cut in excise and indexation pause.

Figure 5: Excise rates for petrol since 2000 – effect of policy decisions

Source: PBO analysis of ATO excise data and ABS Consumer Price Index.

The temporary 6-month halving of fuel excise in the 2022-23 Budget has had a substantial impact on the CPI, which in turn impacts on the budget through CPI indexed payment rates, tax rates and thresholds.

The temporary halving of fuel excise in the 2022-23 Budget meant that fuel prices in the June quarter 2022 were up to 24.3 CPL lower than otherwise would have been the case.14,15 This amounts to a roughly 11% reduction in prices for automotive fuel which would have reduced the CPI by around 0.6 percentage points (all else being equal). Without the excise reduction, the June quarter CPI increase could have been as high as 2.4% in the June quarter 2022 instead of the 1.8% outcome.

When the temporary reduction in excise rates ends on 29 September 2022 the excise rate will increase to 46 CPL, increasing GST-inclusive fuel prices by 25.3 CPL. We can expect the CPI impact of the excise reduction will be unwound, increasing consumer prices (all else being unchanged) and reversing the budget impacts of the initial halving of excise.

How have past policy decisions impacted on the excise rate?

Figure 5 also shows the effect of policy decisions on the excise rate for petrol since 2000.16

The most significant policy was the decision on 2 March 2001 to cut excise by 1.5 CPL and pause indexation indefinitely. This decision significantly reduced real fuel excise rates over the period it operated and has resulted in an ongoing reduction in fuel excise of around 24 CPL with this amount growing in line with indexation increases.

Figure 5 also shows that the ongoing cumulative impact on excise rates from the 2001 to 2014 indexation pause is of about the same magnitude as the temporary reduction in the excise rate provided by the 2022-23 Budget measure, Temporary reduction in fuel excise.

The benefit of the lower excise rate under these measures mainly went to households and to business users of vehicles under 4.5 tonnes Gross Vehicle Mass (which do not qualify for FTCs).

Attachment D provides an illustration of the trends in excise collections, the impact of potential policy options and an analysis of how the system may be impacted by changes in demand for fuel.

Who gets the fuel tax credits?

Table 2 summarises FTC claims paid from the Australian Taxation Office, by broad industry group as well as the number of claimants and average claim value.

Table 2 shows that the largest proportion of FTCs are paid to businesses in the mining industry, followed by the transport, postal and warehousing industry and then agriculture, forestry and fishing. Collectively, these top three broad industry groups account for around three quarters of FTC payments. The mining industry has a high average claim value per claimant but relatively few claimants, whereas agriculture, forestry and fishing industry and the transport, postal and warehousing industry have lower average claims but much larger numbers of claimants.

Table 2: Fuel tax credits by broad industry group, 2020-21

Numbers may not sum due to rounding.

.. not zero but rounded to zero

Source: PBO analysis of ATO data.

Table 3 provides detail of FTC claims by businesses in the top 20 fine industry groups which gives an insight into which business activities claim the most credits and use the most fuel. The table shows the largest fuel tax credit claims are by the metal ore mining industry, followed by coal mining and road freight transport.

While FTC claims provide a general indication of the distribution of fuel use by industry, the claims data will significantly understate fuel used by businesses like those in the road freight transport and road passenger transport industries that are subject to the RUC. This is because the RUC more than halves the FTC claims of these businesses.

Table 3: Top 20 fuel tax claiming industries by fine industry, 2020-21

Numbers may not sum due to rounding.

Source: PBO analysis of ATO data.

Footnotes

- Estimate, Budget 2022-23 Paper No. 1. Page 129. This figure was affected by the 2022-23 Budget measure Temporarily reducing fuel excise.

- Estimate, Budget 2022-23 Budget Paper No. 1. Page 144.

- Taxing Energy Use 2019: Using Taxes for Climate Action | OECD iLibrary (oecd-ilibrary.org)

- Hypothecation’ refers to the formal quarantining of particular revenue streams to fund particular programs.

- As part of the reintroduction of fuel excise indexation, the 2014-15 Budget included a measure to establish a Fuel Excise (Road Funding) Special Account under which amounts equal to the net revenue from reintroducing indexation on customs and excise duties on fuel are transferred to the COAG Reform Fund to provide funding to the States and Territories for expenditure in relation to Australian road infrastructure investment.

- Fuel Indexation (Road Funding) Special Account Determination 2022, Federal Register of Legislation, www.comlaw.gov.au (accessed 9 September 2022)

- Most fuel excise is reported and paid on a weekly basis. However, small businesses with aggregated turnover less than $10 million ($50 million from 1 July 2021) can report and pay their excise obligations monthly.

- The excise rate is held constant in the event of negative growth in the CPI (section 6A of the Excise Tariff Act 1921)

- A tax on goods or services can be argued to be efficient if household demand does not vary much in response to the impact of the tax, that is the tax does not distort consumer choices. On the other hand, the same tax on business inputs may distort the consumption choices of final household consumers because the tax impacts in varying degrees on a wide range of goods and services that are consumed by households, many of which may have demand that is much more price sensitive.

- Figure 3 uses 2020-21 estimates because more recent data are affected by the temporary 6 month halving of fuel excise rates announced in the 2022-23 Budget, which affects 2021‑22 and 2022-23. For simplicity, the diagram is based on petrol and diesel only (excise tariff items 1005, 1010) as these account for around 90% of excise collections and are subject to the same excise rate per litre. The full range of excisable fuels is listed in Attachment C.

- See ABS 5514.0 Australian System of Government Finance Statistics: Concepts, Sources and Methods, 2015, Box 13.6, Chapter 13, Part L

- From 30 March to 31 July, with the rate indexed on 1 August to 23 CPL. See Budget 2022-23 – Fuel excise fact sheet, Treasury 2022

- Reducing the tax deduction has the same effect as including the FTC in assessable income (as depicted in Figure 4)

- The 22.1 CPL excise reduction, combined with 10% GST. 24.3 CPL = 22.1 CPL x 1.1.

- The ACCC has monitored fuel prices following the halving of the excise rate. Their report can be found here. The ACCC concluded: “After 6 weeks, the influence of the lag between changes in wholesale prices and changes in retail prices had been incorporated into retail price movements, and the cuts to fuel excise had clearly been passed on to a large extent.”

- The excise rate for diesel was temporarily affected by increases in excise associated with the transition to ultra-low sulphur diesel fuels.

References

Fuel Taxation Inquiry Committee (2002) Fuel Taxation Inquiry, Australian Government.

Webb R (2012) Fuel tax credits: are they a subsidy to fuel use?, Parliamentary Library, Australian Government.

Webb R (2000) Commonwealth Road Funding Since 1990, Research Paper 13 1999-2000, Parliamentary Library, Australian Government.

Department of Infrastructure (2022) Portfolio Budget Statements, Budget 2022-23 – Civil Aviation Safety Authority, Department of Infrastructure, Australian Government.

Organisation for Economic Co-operation and Development (OECD) (2019), Taxing Energy Use 2019: Using Taxes for Climate Action, OECD Publishing.

National Transport Commission (NTC) (2022) Heavy vehicle charges consultation report, NTC Australian Government.

Australian Government (2022) Budget 2022-23, Australian Government.

Australian Taxation Office (ATO) (2022) Excise data, ATO, Australian Government, accessed 29 August 2022.

Australian Taxation Office (ATO) (2022) Taxation statistics, ATO, Australian Government, accessed 13 September 2022.

Australian Bureau of Statistics (ABS) (June 2022) Consumer Price Index, ABS, Australian Government, accessed 29 August 2022.

Australian Competition and Consumer Commission (ACCC) (2022) Monitoring fuel prices following the excise cut, ACCC, Australian Government, accessed 1 September 2022.

Parliament of Australia (2015), Fuel Indexation (Road Funding) Special Account Act 2015, Australian Government.

Parliamentary Library (1997), Federalism Up in Smoke? The High Court Decision on State Tobacco Tax, Australian Government.

Federal Register of Legislation (2022), Fuel Indexation (Road Funding) Special Account Determination 2022, Federal Register of Legislation, Australian Government.

Bureau of Infrastructure, Transport and Regional Economics (BITRE) (2021) Yearbook 2021: Australian Infrastructure and Transport Statistics, BITRE, Australian Government.

Reserve Bank of Australia (RBA) (1996) Australian Economic Statistics 1949-50 to 1994-95, RBA, Australian Government.