This Budget Bite updates key trends in JobSeeker Payment outlays and recipients, based on data to November 2022. It builds on our 2020 report on the JobSeeker Payment. That report noted how policy changes to other income support payments, such as parenting, disability support and Age Pension payments have contributed to long-run changes to the demographics of payment recipients, particularly women.

The JobSeeker Payment provides financial help to individuals who are unemployed, looking for work, and between 22 years and Age Pension age. It also covers individuals who are sick, injured or unable to do their usual work or study for a short time. It is targeted through income and assets tests and residence rules.

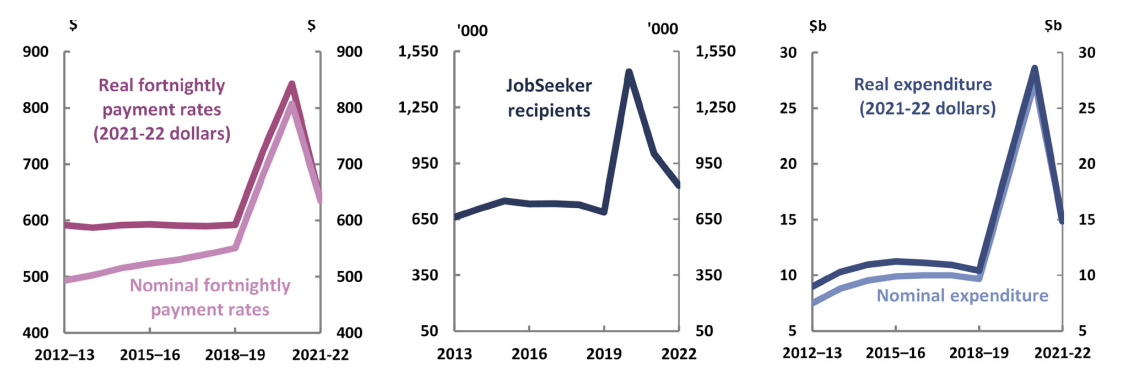

The JobSeeker Payment is an ‘automatic stabiliser’, with outlays increasing as economic conditions deteriorate, and reducing as they improve. This effect, as well as temporary discretionary policy responses, was visible throughout the COVID-19 pandemic. Early in the pandemic, JobSeeker Payment outlays spiked, and subsequently reduced as employment conditions improved and temporary measures lapsed (Figure 1).

Some recipient cohorts were more affected than others at the height of the pandemic (Figure 2). Following a brief divergence, the composition of ‘jobseekers’ has now resumed its long-run structural shift towards older women recipients, whereas younger males had historically been the largest group (Figures 3 and 5).

Expenditure increased significantly in 2020-21 driven by the COVID-19 pandemic and policy responses

JobSeeker Payment expenditure almost tripled during the pandemic, rising from $9.7 billion in 2018-19 to $27.4 billion in 2020-21, before easing to $14.8 billion in 2021-22 (Figure 1). This reflected changes in payment rates and recipient numbers, with recipients doubling from 728,400 in December 2019 to 1,463,900 in May 2020, before falling to 760,400 in November 2022. Budget Bites provide insights into fiscal policy issues and updates to previously published PBO analysis.

Figure 1: JobSeeker Payment rates, expenditure and recipients, 2012-13 to 2021-22

Source: Department of Social Services (DSS) Annual report 2021-22, ABS Consumer Price Index

(cat no.6401.0), DSS Social Security Guide, DSS Payment Demographic Data (June data) and PBO analysis

The COVID-19 pandemic impact was temporary and felt most among the youngest recipient cohorts

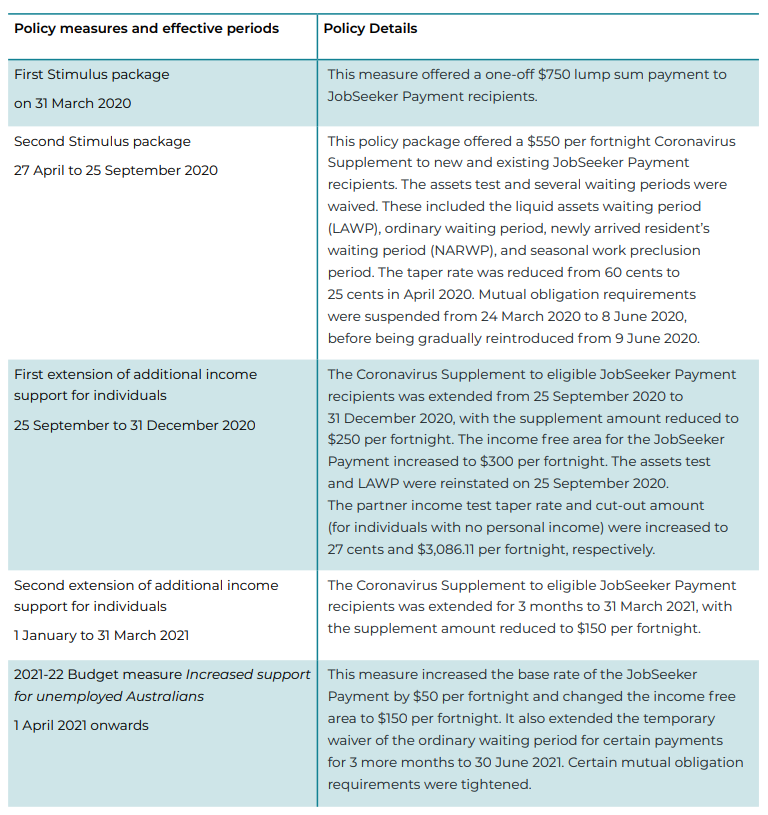

As shown in Figure 2, there was a significant increase in recipients in all age cohorts during the initial lockdown in early 2020. The temporary policy responses to challenging labour market conditions during this period included relaxing eligibility requirements around asset tests, waiting periods, mutual obligations, and partner income tests (Appendix A) and contributed to the rapid increase in recipient numbers. This effect was partly unwound as eligibility requirements gradually returned to pre-COVID settings from late 2020 and labour market conditions improved. By November 2022, recipient numbers for all age cohorts, except for those aged 65 and above, had broadly returned to pre-COVID levels.

The scale of the initial impact differed for each cohort. Initially the strongest increase was observed amongst recipients aged 25 to 34 years, particularly women, a cohort generally accounting for less than 10% of total recipients. These youngest recipients often have the largest shares of casual employment in sectors that were most affected by border closures and lockdowns (such as retail,

hospitality, and tourism). These groups also have higher job switching rates than older workers1. With lockdown restrictions removed and borders reopened, recipient numbers have generally returned to the pre-COVID-19 levels2.

Figure 2: The young were most affected by COVID-19 while Age Pension changes impacted over 65s

Source: DSS JobSeeker Payment and Youth Allowance (other)3

recipients monthly data and government announcements.

During the peak of the pandemic, at an aggregate level, male recipients were more affected than their female counterparts (Figure 3). However, this appears to have been a temporary effect as the share has returned to the long-run trend, with women increasing as a share of total recipients (Figures 3 and 5).

Figure 3: JobSeeker Payment recipients by gender

Source: DSS Payment Demographic Data, ABS Year Book Australia 2002

(ABS Cat. No. 1301.0), and PBO analysis.

Policy decisions have driven an increase in older recipients More recently, there has been a significant uplift in older JobSeeker Payment recipients (Figure 2). This does not appear to be related to the pandemic, but rather to changes in the Age Pension age. This is consistent with patterns observed as a result of previous Age Pension age changes (Figure 4).

Figure 4: JobSeeker Payment recipients aged 65 and above

Source: DSS Payment Demographic Data, September 2022.

Note: The number of JobSeeker Payment recipients aged 65 and above in June 2017 was less than 5.

From July 2021, JobSeeker Payment recipients who would have otherwise transitioned to the Age Pension at age 66 remained on the JobSeeker Payment for 6 more months, adding to the size of the 65+ cohort. Similar impacts resulting from earlier increases to the Age Pension age appear to have contributed to the shift in the share of JobSeeker Payment recipients away from younger men towards older people, especially women (Figure 5).

Figure 5: Share of JobSeeker Payment recipients by gender and age group

Source: PBO analysis of DSS data.

Note: The ‘60+’ category comprises women aged 60 to under 62 years and men aged 60 to under 65 years in 2001. For 2022, it comprises both genders aged 60 to under 66. The Age Pension age was 61.5 years for females and 65 years for males in June 2001 and 65.5 years for both genders in June 2022. On 1 July 2012, the eligibility age for the Newstart Allowance was increased from 21 to 22 years of age. Figures are as at 30 June.

- According to the Australian Bureau of Statistics, 18% of employment for this age cohort was casual in August 2021, as compared to 12% for the older cohorts. According to a 2019 Treasury working paper, younger workers, particularly women, have much higher job switching rates than older workers. As such, they would have been less likely to qualify for the JobKeeper Payment but were eligible for the JobSeeker Payment.

- The number of aggregate recipients would be expected to remain slightly higher than the level observed in late 2019 as the policy scope was expanded in March 2020 to progressively include a range of satellite payments, such as partner, sickness and widow allowances and wife pension.

- These monthly series available on the DSS website start from March 2020. The age cohort below 25 was excluded to remove the impact from the Youth Allowance (other) payment to maintain the focus on the JobSeeker Payment. Nevertheless, DSS data show that the age cohort below 25 tracked relatively closely with the 25 to 34 age cohort.

- A new JobKeeper Payment was introduced in 2020 to assist businesses that were affected by the pandemic, by supporting them to retain their employees. Unlike the JobSeeker Payment, which was provided directly to individuals, the JobKeeper Payments were claimed by employers. To qualify for the payment, both the business’ aggregate turnover and employees’ working hours were assessed.

- Working paper 11/2022 from the Tax and Transfer Policy Institute summarises the changes to Australian income support settings during the COVID-19 pandemic.

Source: Australian Government announcements and the 2021-22 Budget.